After a year of disappointing revenue and sluggish growth, Disney is ready for a comeback in 2022. Here's why investors may want to consider buying shares now.

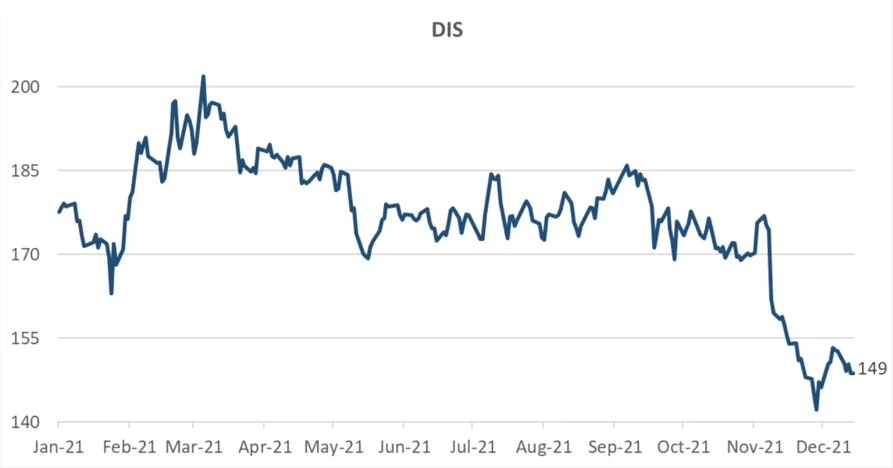

In 2021, Disney stock disappointed investors with a roughly 15% loss. This poor performance was due largely to underwhelming revenue and Disney+'s sluggish subscriber growth.

However, we think a stock rally is possible in 2022.

Let's dig into three factors that could lift DIS shares over the next year and why investors may want to consider buying Disney stock even before the end of this month.

1. Increased Revenue From Movie Theaters and Theme Parks

Before the COVID-19 pandemic began, Disney's largest segment by revenue was its theme parks and resorts. However, since 2020, the company has had to cut capacity at most of its properties.

As the number of COVID-19 cases worldwide begins to decrease and Disney parks, resorts, and cruises return to full capacity, this segment should become a top-earner again.

In addition, the virus put a dent in Disney's box office earnings. As movie fans return to cinemas around the globe, the company's entertainment business will pick up too.

In fact, if parks and movie theaters return to pre-COVID attendance levels, the company could add $26 billion in revenue in those segments alone (based on the last quarter before the pandemic began). That would positively impact DIS's valuation.

2. Better Performance From Disney+

Since its launch in 2019, Disney's streaming service, Disney+, has been a success. In just two short years, it has grabbed a huge market share and competed with industry giants such as Netflix and Amazon Prime Video.

However, Disney+'s new subscriber growth slowed in 2021, even falling short of the company's own projections. That has caused shares to depreciate significantly since Disney's latest earnings reports.

But subscriber growth can often be tied to new available content. Because of the pandemic, Disney was unable to keep up a steady pace of production. It's likely that negatively impacted the service's performance.

With production studios returning to normal, Disney+ should see a growing number of new subscribers. And we may not have to wait until New Year's for new subscribers to start signing up.

In fact, during the third-quarter earnings call, Disney CFO Christine McCarthy said, "[The fourth quarter of fiscal 2021] will be the first time in Disney+ history that we plan to release original content… from Disney, Marvel, Star Wars, Pixar, and Nat Geo, all in one quarter."

3. It's Relatively Cheap Right Now

Since the start of 2021, Disney shares have dropped roughly 15%. And since this year's peak in March, the stock has plunged more than 25%.

However, Disney is still a global company with many revenue segments. Just as all of these segments suffered during the pandemic, they all should experience a turnaround in the coming years… or even months.

Our Take

Although this year has been a lousy one for Disney bulls, there's light at the end of the tunnel. By buying DIS shares before 2022 begins, investors can take advantage of potential price increases in the new year.