- Previous record for full calendar year overtaken in late July.

- SPY assets top $400 billion as investors seek broad exposure.

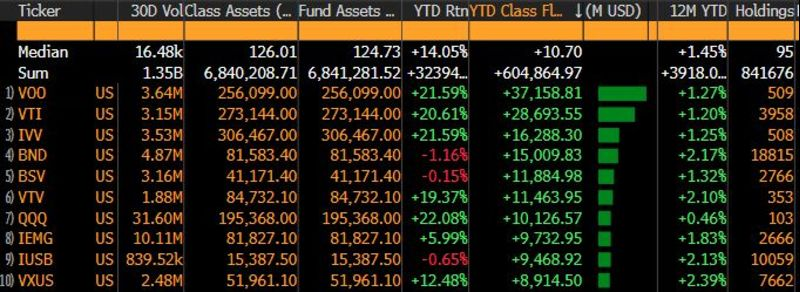

Investors have now poured $605 billion into the $6.8 trillion industry in 2021, according to data compiled by Bloomberg. The previous record for a full calendar year was $497 billion in 2020, which wasovertaken in late July.

The biggest winner is currently the Vanguard S&P 500 ETF (tickerVOO) -- with $37.2 billion in new cash -- while the second place is the Vanguard Total Stock Market ETF (VTI), with $28.7 billion.

The world’s largest ETF, the SPDR S&P 500 ETF Trust (SPY), is nowhere near top of the leader board with just $8 billion in money added this year. But thanks to that and the rallying S&P 500 index, its assets surpassed $400 billion for the first time in August.