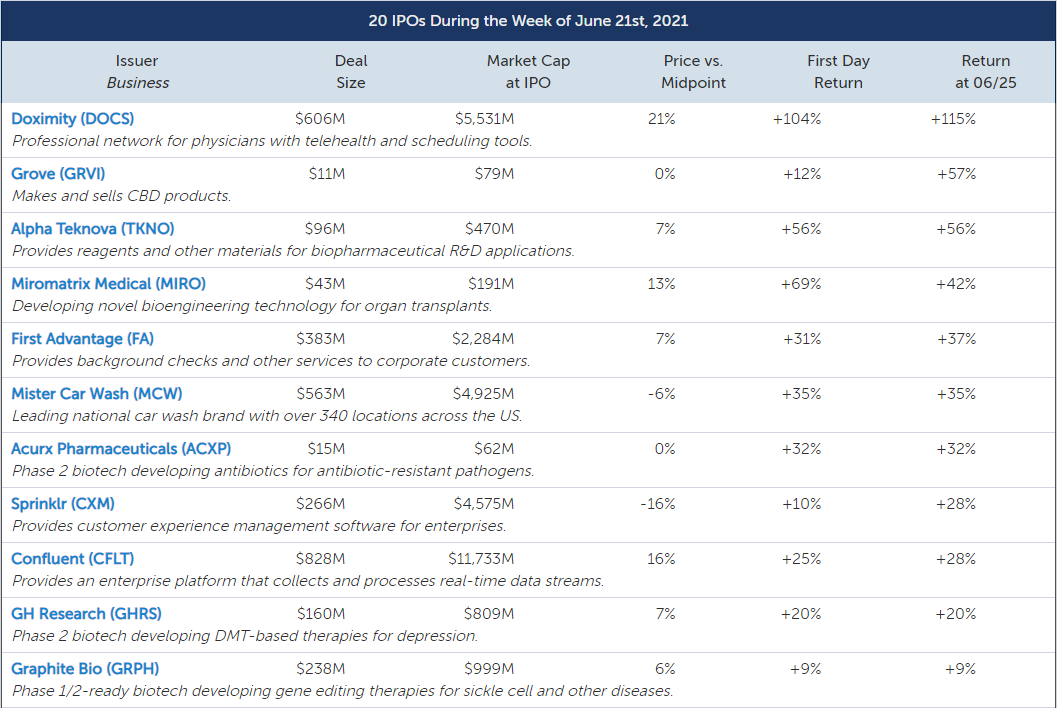

16 IPOs went public in another active week for the IPO market, led by digital physicians network Doximity(DOCS), which soared 104% in its debut. The week’s IPOs were joined by four SPACs, as well as one postponement, Chinese social networking platform Soulgate(SSR).

Doximity (DOCS) priced above the range to raise $606 million at a $5.5 billion market cap. Doximity claims that it is the leading digital platform for US medical professionals, allowing collaboration with colleagues and secure coordination of patient care, among other features. While growth may slow as conditions normalize post-pandemic, the company has a sticky customer base and strong track record of profitability. Doximity finished up 115%.

The largest deal of the week, Chinese freight platform Full Truck Alliance(YMM) priced at the high end to raise $1.6 billion at a $20.8 billion market cap. Full Truck states that it is the world's largest digital freight platform by gross transaction value (GTV), facilitating 22+ million fulfilled orders with GTV of nearly $8 billion in the 1Q21. The company is unprofitable though free cash flow turned positive in 2020. Full Truck finished up 4%.

Integrated insurer Bright Health Group(BHG) downsized and priced below the range to raise $924 million at a $12.7 billion market cap. Through a multi-pronged organic and inorganic growth strategy, the company’s core business has grown to serve roughly 623,000 patients in 14 states since its founding. However, the company is unprofitable, and its medical cost ratio has increased over the last several years. Bright Health finished down 4%.

Confluent(CFLT) priced above the range to raise $828 million at an $11.7 billion market cap. Founded by the original creators of Apache Kafka, Confluent’s data infrastructure offering is designed to connect all the applications, systems, and data layers of a company around a real-time central nervous system. The company has demonstrated growth but S&M spending has widened losses. Confluent finished up 28%.

Car wash brand Mister Car Wash(MCW) priced at the low end to raise $563 million at a $4.9 billion market cap. Profitable with strong margins and solid cash flow, Mister Car Wash is the largest national car wash brand in the US, with 344 locations in 21 states. The company is slightly concentrated in certain states, and it is leveraged post-IPO. Mister Car Wash finished up 35%.

HR services provider First Advantage(FA) upsized and priced at the high end to raise $383 million at a $2.3 billion market cap. Profitable with positive cash flow, First Advantage provides solutions for screening, verifications, safety, and compliance related to human capital. The company operates in a highly competitive market, and revenue depends on hiring rates. First Advantage finished up 37%.

Chinese grocery delivery platform Missfresh(MF) priced at the low end to raise $273 million at a $3.2 billion market cap. Missfresh’s mobile app and Mini Program allow consumers to purchase groceries from their phone, which are then delivered to their door by a delivery driver. The company is a leader in its market, though it is unprofitable, and revenue declined in the 1Q21. Missfresh finished down 26%.

Customer experience software provider Sprinklr(CXM) downsized and priced below the range to raise $266 million at a $4.6 billion market cap. Sprinklr provides a software platform that helps enterprises create a persistent, unified view of each customer at scale. The company has improved its gross margins, though it is historically unprofitable due to high S&M costs. Sprinklr finished up 28%.

Gene editing biotech Graphite Bio(GRPH) upsized and priced at the high end to raise $238 million at a $999 million market cap. Graphite's lead candidate aims to correct the mutation that causes sickle cell disease and restore normal adult hemoglobin expression. The company has received IND clearance and intends to enroll a Phase 1/2 trial in the 2H21, with initial data expected by the end of 2022. Graphite finished up 9%.

Oncology biotech Monte Rosa Therapeutics(GLUE) upsized and priced at the high end to raise $222 million at a $911 million market cap. The company plans to select one of its selective, orally bioavailable GSPT1-directed MGD molecules for use in a genetically-defined subset of non-small cell lung cancer patients by the 2H21, and submit an IND in the 1H22. Monte Rosa finished down 1%.

Irish DMT biotech GH Research(GHRS) upsized and priced at the high end to raise $160 million at an $809 million market cap. The company is developing its proprietary 5-MeO-DMT compound in a Phase 2 trial in the Netherlands for patients with Treatment-Resistant Depression. GH Research finished up 20%.

Oncology biotech Elevation Oncology(ELEV) priced at the midpoint to raise $100 million at a $403 million market cap. Elevation's lead program is focused on neuregulin-1, or NRG1, fusions. It has initiated a Phase 2 trial of seribantumab, an anti-HER3 monoclonal antibody, in advanced solid tumors harboring an NRG1 fusion. Elevation finished down 29%.

Biopharmaceutical reagents provider Alpha Teknova(TKNO) upsized and priced at the high end to raise $96 million at a $470 million market cap. Alpha Teknova provides critical reagents that enable the discovery, research, development and production of biopharmaceutical products. As of March 31, 2021, Alpha Teknova had over 3,000 active customers. Alpha Teknova finished up 56%.

Miromatrix Medical (MIRO) upsized and priced at the high end to raise $43 million at a $191 million market cap. Miromatrix is developing a novel technology for bioengineering fully transplantable organs, initially focused on livers and kidneys. The company has demonstrated functional vasculature and important organ function in preclinical studies, and hopes to initiate a Phase 1 trial in late 2022 with its External Liver Assist Product. Miromatrix finished up 42%.

Antibiotic biotech Acurx Pharmaceuticals(ACXP) priced at the midpoint to raise $15 million at a $62 million market cap. The company is developing a new class of antibiotics for infections caused by bacteria listed as priority pathogens by the WHO, CDC, and USDA. Its lead candidate recently completed a Phase 2a trial in patients with C. difficile infections, and is expected to begin a Phase 2b trial this year. Acurx finished up 32%.

CBD products maker Grove(GRVI) priced at the midpoint to raise $11 million at a $79 million market cap. Fast growing and profitable in the 9mo FY21, Grove develops, produces, markets, and sells raw materials, white label products, and end consumer products containing the industrial hemp plant extract, Cannabidiol (CBD). Grove finished up 57%.

Four SPACs raised $520 million led by FinTech Acquisition VI(FTVIU), which raised $220 million.

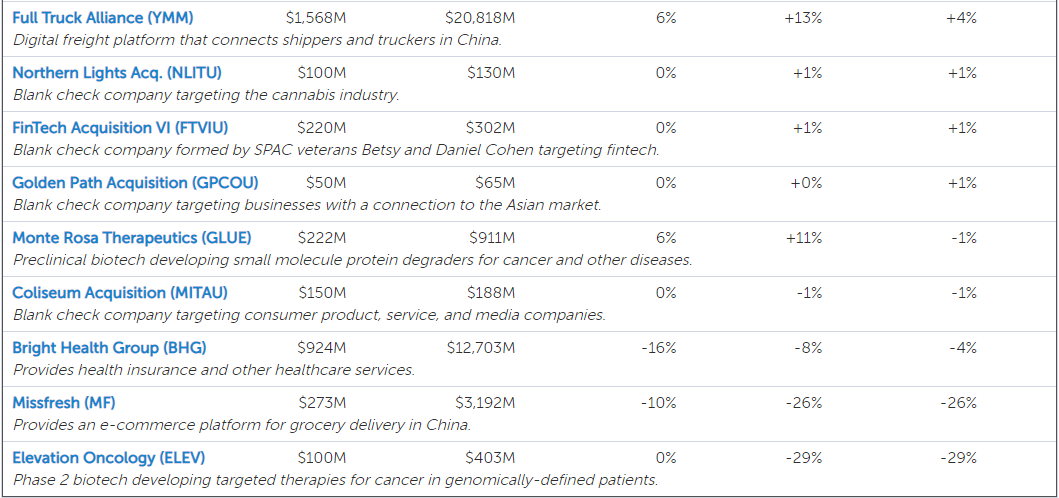

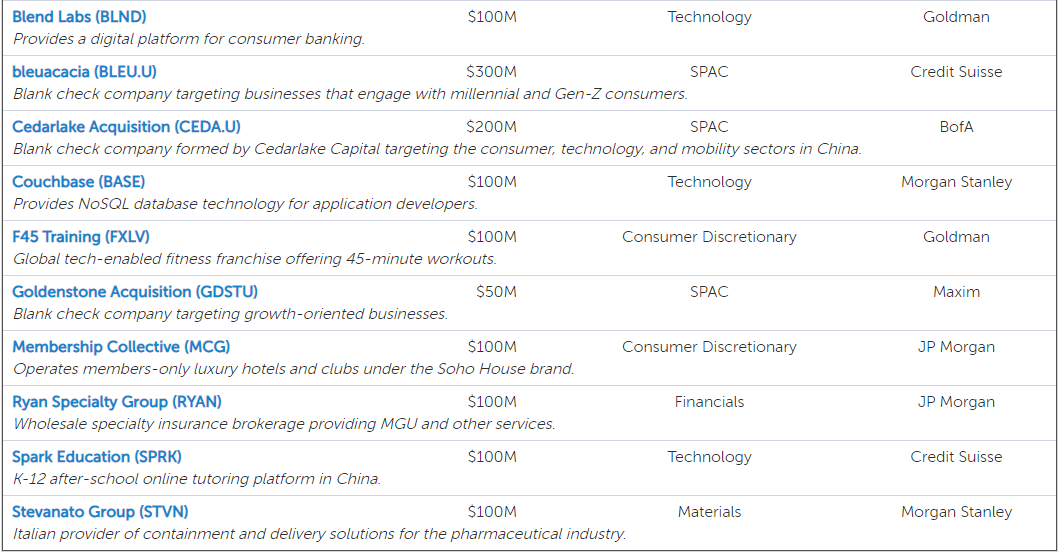

23 IPOs submitted initial filings. Chinese vaping brand Aspire Global(ASPG) plans to raise $161 million. Fitness franchise F45 Training(FXLV), luxury social club operator Membership Collective(MCG), soft drink maker Zevia(ZVIA), specialty insurer Ryan Specialty Group(RYAN), ocular medical device maker Sight Sciences(SGHT), Italy-basedStevanato Group(STVN), real estate manager Bridge Investment Group(BRDG), consumer banking platform Blend Labs(BLND), database developerCouchbase(BASE), interior design software provider Manycore Tech(KOOL), Chinese tutoring platform Spark Education(SPRK), oncology biotech Vividion Therapeutics(VVID), e-commerce platform VTEX(VTEX), digital marketing services provider Gambling.com Group(GAMB), bone marrow disease biotech Imago BioSciences(IMGO), French biotech Dynacure(DYCU), microbial testing device provider Rapid Micro Biosystems(RPID), legal software provider CS Disco(LAW), oncology biotechs Erasca(ERAS) and Candel Therapeutics(CADL), and fitness franchisor Xponential Fitness(XPOF) all filed to raise $100 million. Medical imaging software provider Perspectum Group(SCAN) filed to raise $75 million.

10 SPACs submitted initial filings led by Sagansky and Sloan’s Spinning Eagle Acquisition(SPNGU), which plans to raise $2 billion.

This past week, Renaissance Capital released its2Q 2021 US IPO Market Review, exploring the second quarter’s record-breaking activity, best and worst performers, and outlook for the 3Q.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 6/24/21, the Renaissance IPO Index was up 2.7% year-to-date, while the S&P 500 was up 13.6%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Snowflake (SNOW) and Palantir Technologies (PLTR). The Renaissance International IPO Index was down 1.5% year-to-date, while the ACWX was up 10.3%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Smoore International and EQT Partners.