Statistical scrutiny brings this high-flying ETF down to earth

You could have performed as well as the high-flying ARK Innovation ETF by investing in the Nasdaq 100 Index.

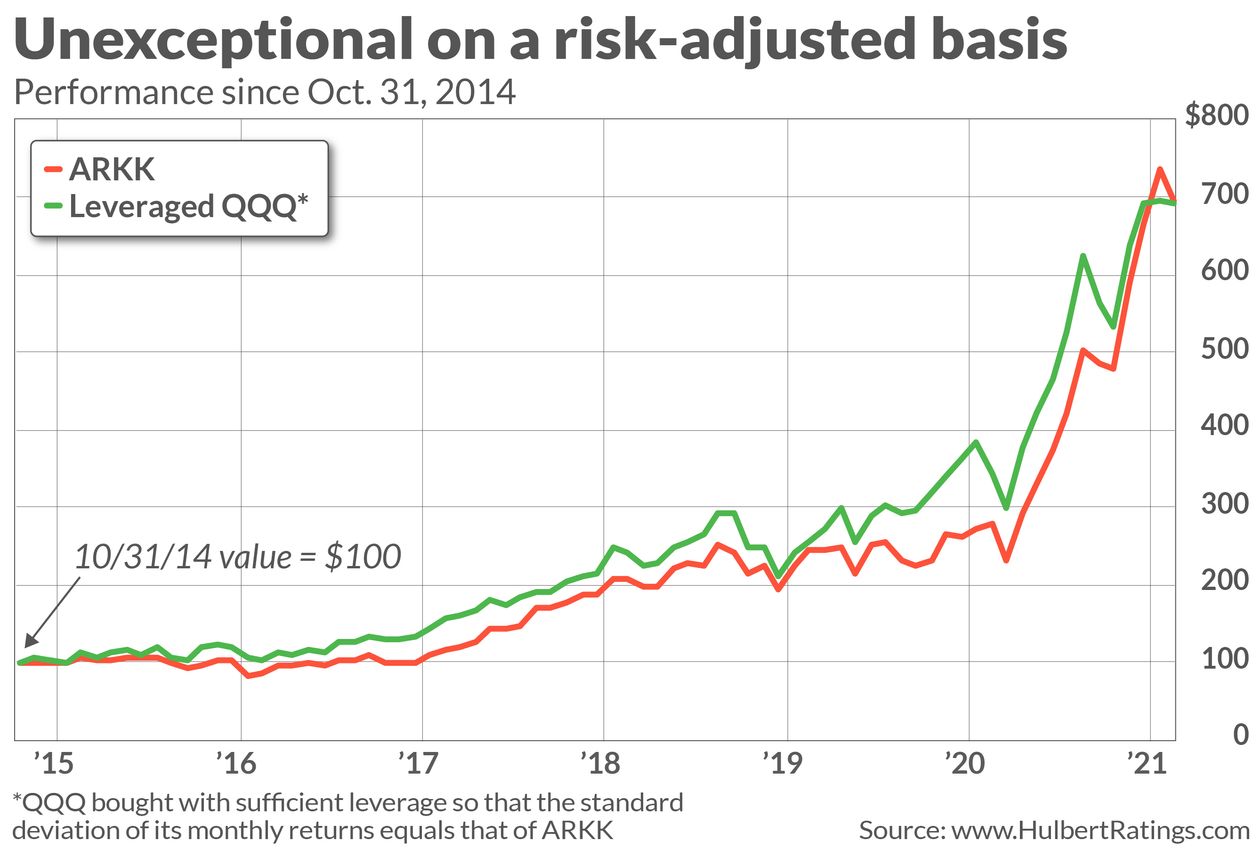

I know that seems hard to believe, given the stunning performance chief investment officer Cathie Wood has produced with ARK Innovation— a 229% gain over the past year, according to FactSet. Meanwhile, the Invesco QQQ Trust (which is benchmarked to the Nasdaq 100), gained 78%. Since its creation in October 2014, ARK Innovation has produced an annualized gain of 34.6%, versus 20.6% for the QQQ.

At the same time, ARK Innovation has been extremely volatile and risky, making an apples-to-apples comparison with the Nasdaq 100 misleading. As measured by the standard deviation of monthly returns, ARK Innovation has been 73% more volatile than QQQ. That’s really saying something, since QQQ is itself more volatile than broad market indices such as the S&P 500.

One approach statisticians use to create an apples-to-apples comparison is with a metric known as the Sharpe Ratio, invented by William Sharpe, the 1990 Nobel laureate in economics. It is the ratio of a fund’s average returns to the standard deviation of those returns. The Sharpe Ratio of ARK Innovation’s monthly returns since 2014 is almost precisely the same as the QQQ’s.

If you’re like some of my clients, your reaction is not to care about the Sharpe Ratio. “You can’t take the Sharpe Ratio to the bank,” you in effect tell me. It’s raw performance that counts, and on that basis there’s no doubt that the ARKK did far better.

This reaction is confused, however. In fact you can take the Sharpe Ratio to the bank. If you had been willing to incur the ARK Innovation’s increased volatility, you could have made just as much by leveraging an investment in the QQQ. That is, you would have made just as much by increasing your portfolio allocation to QQQ, or by buying it on sufficient margin. This is illustrated in the chart below:

The Sharpe Ratio is not the only method that statisticians employ for measuring adviser performance on a level playing field, but other widely used approaches reach the same conclusion. Perhaps the best known, at least in academic circles, is the Fama-French factor model, named for University of Chicago finance professor Eugene Fama (the 2013 Nobel laureate in economics) and Dartmouth College professor Ken French. Their model involves an econometric test to see if a mutual fund’s return is significantly better than a combination of index funds benchmarked to factors such as small-cap, growth, and momentum.

The answer for ARK Innovation is “no” — an overweight allocation to a small-cap growth fund would have produced the same overall return since November 2014.

Luck versus skill

Note carefully that these statistical tests do not prove that ARK Innovation’s performance is due solely to luck. Instead, those tests tell us that we cannot conclude that its performance was not due to luck. In this case, the double negative is not the same as the positive; this is a subtle, but important, difference.

This goes to show just how difficult it is to prove that an investment manager has genuine market-beating ability. If beating an index fund by more than 10 percentage points annualized over a 6-plus-year period is not enough, then what is? (An email to ARK Investment Management requesting comment was not immediately answered.)

The answer: Satisfying traditional standards of statistical significance requires beating the market by a larger amount over a much longer period.

An example of a fund that does jump over this much-higher hurdle is Renaissance Technologies’ Medallion Fund, a hedge fund that has produced an incredible 39% annualized return over the 33 calendar years through 2020, versus “just” 11% annualized for an index fund. Bradford Cornell, an emeritus finance professor at UCLA, told me in an interview that it is impossible to attribute that fund’s outperformance to mere luck. (Unfortunately, this fund is only available to current and former partners at Renaissance Technologies.)

In the meantime, it’s too early to render anything close to a final verdict on ARK Innovation’s stunning performance. Its performance over the next several years may prove to be good enough to eventually satisfy traditional standards of statistical significance. Until then we can’t be sure. This is yet another reason why index funds are the default investment of choice.