Summary

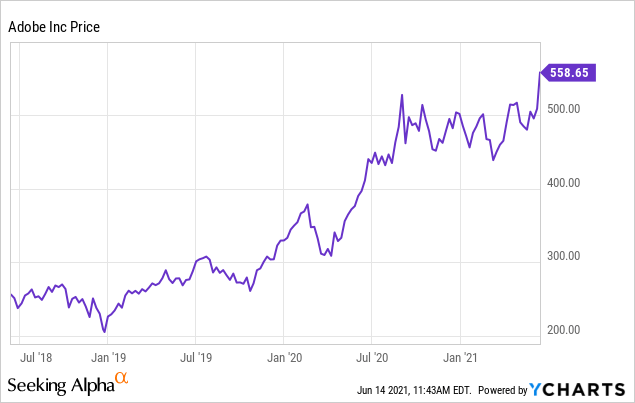

- Despite rising over 8% in the past week ahead of earnings, there is still room for upside in Adobe stock.

- The firm is well-positioned to benefit from trends in the immediate future and beyond.

- Adobe’s scale and dominance will allow it to continue to thrive and benefit from rapid growth in its total addressable market across its diverse products.

- Strong Q2 earnings could be the catalyst to push the stock over $600.

I. Investment Thesis

Despite rallying well over 8% in the past week ahead of earnings, there is still room for upside in Adobe Inc. (NASDAQ:ADBE) stock.

Adobe's historical success with execution of a transition to a cloud-based subscription model will continue to drive strong revenue growth.

The firm is also well-positioned to benefit from trends in the immediate future and beyond, however, many of these trends and growth opportunities are unrecognized.

Adobe's scale and dominance will allow it to continue to thrive and benefit from rapid growth in its total addressable market across its diverse products.

Lastly, strong Q2 earnings could be the catalyst to push the stock over $600 in a bull scenario.

II. Company Overview

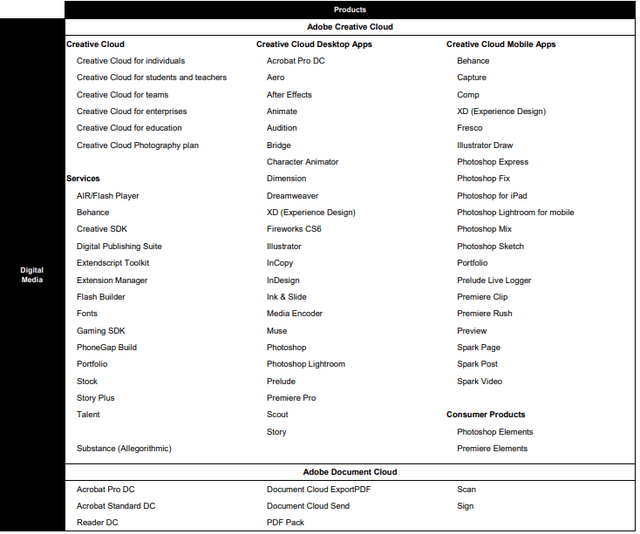

Adobe operates worldwide, offering software and services used by professionals, marketers, students, and more for creating, managing, measuring, and engaging with compelling content and experiences. As of Q1 FY 2021, the firm generates their revenue from three main segments: Digital Media (~73% of revenues), Digital Experience (~24%), and Publishing & Advertising (~3%).

The digital media segment includes their most well-known product, Creative Cloud, as well as Document Cloud. Creative Cloud is a diverse toolkit built for creating, publishing, and promoting digital content. Some of the most well-known applications include Photoshop and Illustrator. Adobe Document Cloud is gaining momentum against pure-play firms like DocuSign and is becoming a fierce competitor, especially with regard to small and medium-sized businesses.

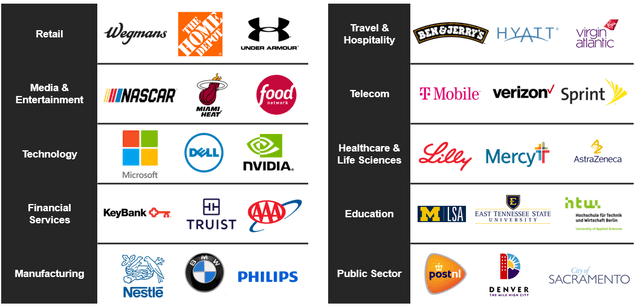

The Digital Experience Cloud is designed to help users manage, measure, automate, and optimize customer experiences and customer engagement. Adobe has done a great job expanding into various industries through this segment, including retail, media, financial services, technology, education, and more. The segment has been slowly increasing in size and can be expected to provide long-term support to Adobe's strong revenue growth.

The third segment, formerly known as Print & Publishing, was renamed last quarter to "Publishing & Advertising", as Adobe shifted the revenues from their advertising portion of Digital Experience to this new segment. With the demand of print on the decline, this reclassification allows for a more accurate balance of product divisions. With data from only one quarter of this new classification, it's hard to evaluate the performance of advertising, but there should be more clarity over the next few quarters.

III. Growth Drivers1) Digital Business Transformation

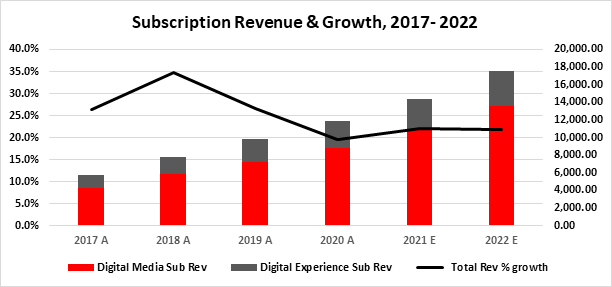

Historically, Adobe has been one of the most successful firms in migrating a user base from a traditional one-time license-based model to a cloud-based subscription revenue model. A cloud-based subscription model is extremely crucial as it allows technology firms to see more stability in future revenue streams. As of last quarter, Adobe generates approximately 83% of revenues through a recurring stream. For analysts and investors, this gives confidence and a much clearer indication as to the quality and consistency of cash flows. It also allows cloud firms to strengthen margins and benefit from scale, which we already see with Adobe. Subscription revenues are derived from the Digital Media and Digital Experience segments, and the new Publishing & Advertising Segment (not accounted for below).

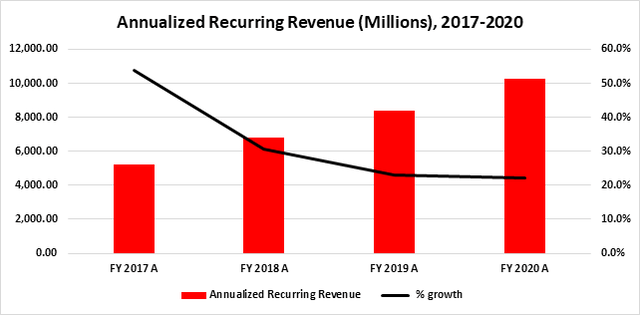

Annualized recurring revenue, a more software industry-specific metric, sheds light on how much revenue the firm generates over the course of a year that is guaranteed to occur again. This value doesn't just tell us how much revenue is generated from subscriptions and contracts, but also roughly the net value of expansions and churn. As ARR growth continues to be positive, we see that a) more customers are paying for services each year, and b) customers are on average spending more with Adobe. Essentially, net expansions are outweighing churn, which could mean either a) or b) above, or a mix of both. Since the quantifiable values of net expansion and churn are not readily available in public filings, it is too difficult to explore this avenue further.

Even with a plateau of subscription and ARR growth, we are seeing >20% YoY revenue growth for a large-cap firm that has been a leader in the industry for well over a decade. The customer transition to the new revenue model is essentially complete and has consistently outperformed expectations, with stronger comparable margins across the board as Adobe continues to dominate in scale.

2) Advertising, Analytics, & New Tech

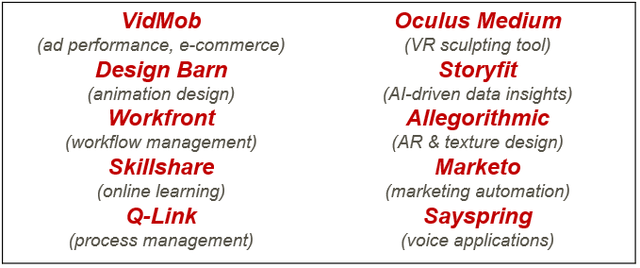

Various profitable digital and marketing-related trends of 2021 and into the future include e-commerce, analytics, AI & automation, augmented reality, and virtual reality. We typically see large software firms position themselves to benefit from tailwinds through R&D to strengthen innovation, or M&A to expand market share and product diversification.

Adobe has recently completed over a dozen strategic acquisitions and investments that revolve around these key areas. The firm is taking care to ensure their most recent acquisitions will be effectively integrated into their respective platforms to set up strong market positioning. At the end of last year, we heard from management that the team was most likely not planning any large acquisitions in 2021, mainly because 1) speculative software is trading at high multiples and is overvalued, and 2) so they can focus on working with what they currently have.

Spending about 17% of revenues on R&D as of last quarter, the firm has utilized their capital efficiently to foster innovation and a competitive edge. Adobe most recently has worked to expand the breadth of their Creative Cloud tools - especially ones designed for mobile devices - to increase the appeal of their products to different user groups in new or unique markets.

Effective use of capital towards R&D and M&A initiatives led by strong margins and cash flows should allow the company to gain traction in new verticals and continue to accelerate revenue growth in the subscription segment.

3) Market and Global Opportunity

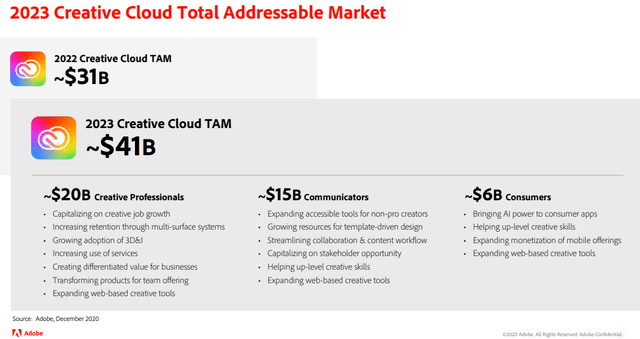

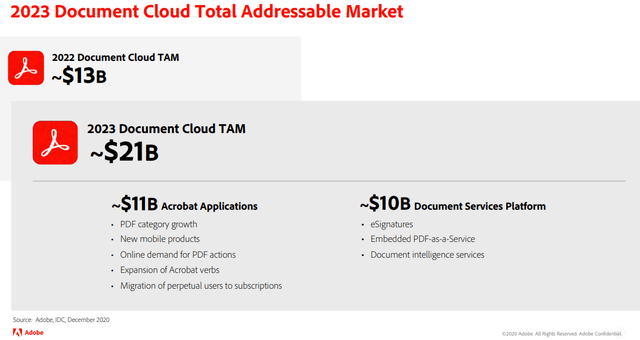

As the firm shed light on its Total Addressable Market [TAM] for the next few years in its financial analyst meeting of 2020, Adobe has huge plans to capture diverse user groups to an expanding TAM in Creative Cloud, Document Cloud, and Experience Cloud by 2023 - their largest areas for growth. The projected TAM in these segments from 2021 to 2023 has grown 40.4%*, 180.0%*, and 19.4%*, respectively. We see Adobe has the largest potential in its Digital Media segment through Creative Cloud and Document Cloud, although the market for its Experience Cloud has still grown modestly. In the figures below, we take a look at some of these numbers, and some of the plans outlined by Adobe.

(* - numbers calculated from financial analyst meeting slides from2018,2019, and2020, respectively)

Adobe's product depth, market share, customer loyalty, and high brand recognition for their flagship creative software over the past two decades make a strong case as to why the firm can be expected to successfully execute its intermediate-term growth strategies. Adobe is positioned well to benefit from growth in the total addressable market for all three segments and specific products.

We have seen from earlier mentions of Adobe's expansion into key areas that they have already been successful in penetrating markets with web and mobile-based tools, and increased adoption of 3D development. This reinforces my view of Adobe's ability to continue to capture a larger share of the total addressable market for its Creative Cloud.

The firm's deep customer loyalty and brand recognition will allow the firm to continue to grab larger shares of the CRM market with their Experience Cloud platform as the company continues to expand further into unique industries like healthcare and education.

In this section, I'd also like to explore the importance of strong margins a bit further. According to Bloomberg data, Adobe's subscription revenue (which is generated from its cloud-based business) achieved a gross margin of 91% last quarter. If we look back to 2009, before Adobe began their transition to a cloud-based model, gross margin from subscription revenue was ~35%. For Salesforce (NYSE:CRM), another large-cap application software firm, gross margin last quarter from subscription was ~80%. Previously to their cloud model, in 2008, Salesforce's gross margin for the segment was ~87%.

My conclusion is that a company like Salesforce has struggled to execute a long-term cloud strategy that would allow them to truly benefit from scale. With the growth in gross margin for Adobe from 35% to 91% (a 160% increase) from 2009 to 2021, this means that cost of revenue for subscription and cloud-based services has been decreasing proportionally, which makes sense for a strategy that has been executed successfully. Essentially, this gives firms like Adobe the upper hand with the ability to reinvest more capital into the business to achieve its strategic initiatives, such as those outlined in their financial analyst meeting slides above.

Next is global opportunity. As consumer confidence continues to increase, Global IT Spending is already on the rebound, benefitting Adobe nicely. Results for Q1 FY2021 gave insight toward how enterprises are increasing software spending again post-pandemic, with total revenue up about 26% over the previous quarter. This, along with Adobe's solid performance during the pandemic, prove how strong the company's fundamentals really are.

Furthermore, Adobe currently generates ~58% of revenues from the Americas, which means that they already have proven success in other areas globally. If Adobe can increase exposure specifically in EMEA it can be lucrative as emerging markets are expected to outperform and benefit from increased foreign investment. There is more to be explored in this area of expansion.

IV. Major Risks

Although subscription growth is beginning to plateau at about 20% YoY, in the next few years, it may begin to decline. This means Adobe must work harder in gaining a competitive edge, most likely through M&A and R&D. If Adobe does not effectively integrate its acquisitions into its platforms, it can impact margins short-term and prove to be inefficient use of capital. With a strong cash flow and relatively small debt load, even in this scenario, I don't believe it would impact Adobe's ability to generate cash flows intermediate to long term.

According to an analysis of Porter's Five Forces, the application software subsector has a high degree of competition and a medium threat of substitutes. Currently, Salesforce dominates the relationship management space. Adobe is gaining traction, but due to the long enterprise sales cycle nature of the industry, there may be a lag in a shift to an environment that is more favorable for Adobe's Experience Cloud growth. Therefore, stock price may not accurately reflect the success of this segment immediately.

Software products are reliant on the same enterprise IT budget of a given firm. Adobe and other large-cap application software firms may have to develop a strategy to reduce costs and pricing short-term. However, with strong roots in the industry, a successful business model, and a long sales cycle, I don't see this having a huge impact on Adobe's market share.

Although consumer confidence has continued to increase post-pandemic, there are still unprecedented effects that are unexpected and cannot be measured. If Global IT Spending does not rebound as quickly as expected, Adobe may continue to see quarters of unexpectedly slow growth. This is most damaging for companies that rely on large enterprise spending. However, the technology firms that seem to be benefitting the most from the pandemic and lockdown orders are cloud-based software.

V. Valuation

1) Comparative Valuation

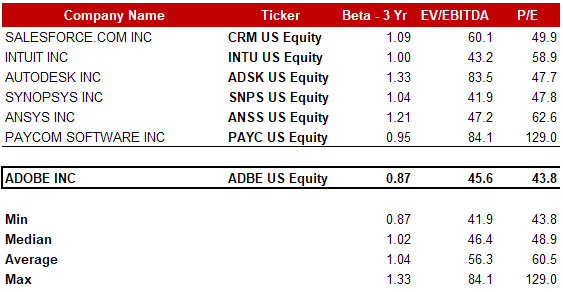

Starting with a quick comparative analysis, we see that Adobe is trading at a slight discount to its peers. In an industry that is highly speculative, Adobe provides an investment in a stock with less risk and solid returns.

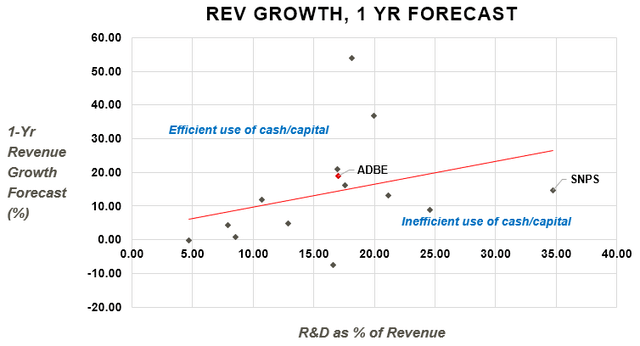

An interesting analysis I conducted was a comparison of R&D expenditures to future projected revenue growth to get insight as to how efficient software firms are at utilizing their profits to focus on firm growth. In an industry where differentiation and innovation are key, I thought this concept would be interesting to observe. The graph below displays the top 25 application software firms, by market cap. Essentially, any firm above the line is currently using their capital efficiently towards greater growth, while those below the line are not using their capital efficiently. Comparing the findings of this graph with the risk vs. return of stocks above the line, we further see that Adobe is a solid long-term pick.

2) Intrinsic Valuation

The first set of calculations was forecasting future revenue streams of the business segments. Based on my research and assumptions, I used a weighted moving average to calculate growth rates, then used a regression of historical market and industry growth expectations to adjust the top-line revenue estimates. The rest of the model was built upon a mix of more industry expectations, as well as assumptions, estimates, and long-term goals set forth by management.

I calculated a discount rate of 6.87%, which was used to discount the projected cash flows until 2025. To calculate the present value of the cash flows of 2026-beyond, I used the perpetual growth rate method, and based on my concluding research, assumed a perpetual growth rate of 3.5%. This brought me to a 12-month PT of ~$590.

In a bull case scenario where revenue growth exceeds 20% YoY from 2022-2025, or where the perpetual growth rate assumed in the model is changed to 4.0%, we see the price target soaring above $600.

When initially developing my model and report, Adobe stock was ~$485. However, we've seen a run up of the price over the past few days, from about $515 to surpassing $550. It is typical to see a rally in tech stocks before their earnings, which deflates the potential return. This means that there may be a solid entry point immediately post-earnings, depending on if the price drops or not.

Furthermore, this does not consider Adobe's share buyback plan that was authorized, which would increase the value of shares and earnings. I think that Q2 earnings should provide more clarity.

VI. Conclusion

Adobe has seen major success in growth and scale, which will support its strategic initiatives. The firm has proven to be a leader in 2021 macroeconomic and software industry trends, which will provide tailwinds for growth of its subscription-based segments.

With inflation fears, right now is the time to shift investments diversified across technology to more fundamentally stable large-cap firms, like Adobe, to combat uncertainty. I think there should be an optimal entry point immediately post-earnings, unless earnings drive the price higher after-hours. Regardless, as a growth prospect with proven cash flows and healthy margins, I see any entry in Adobe as a solid-long term pick that is less speculative of a play.