- Cryptocurrency reached record high $64,870 earlier this month

- Token now hovers between 50-day and 100-day moving averages

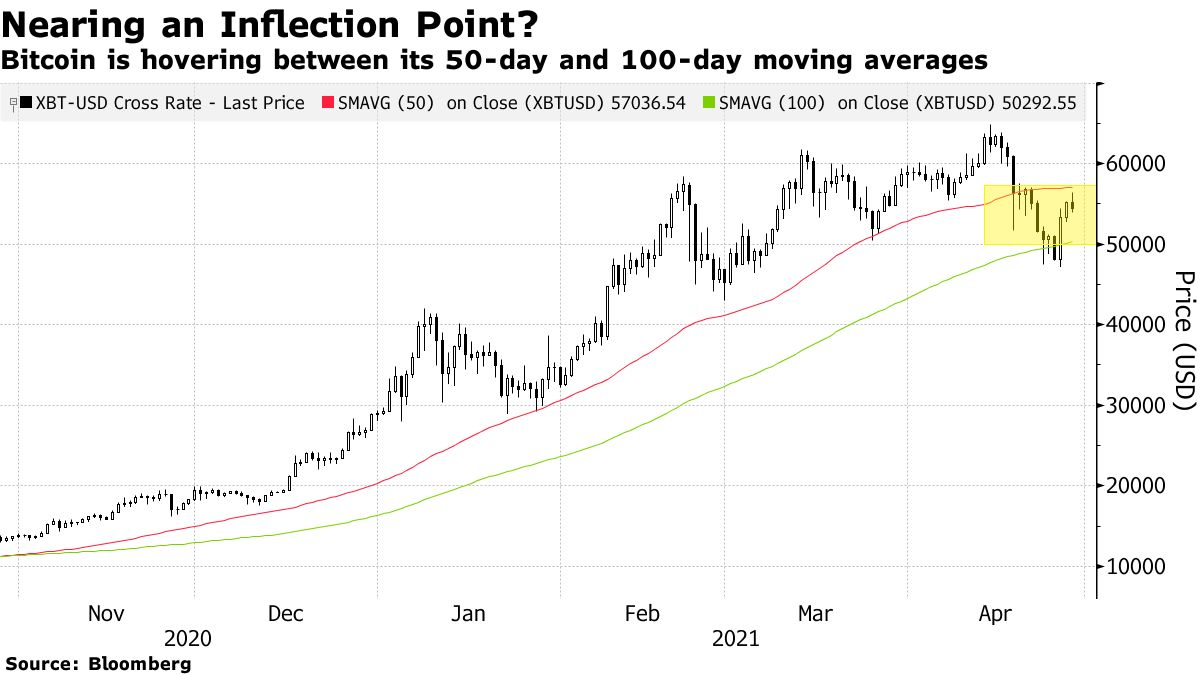

Bitcoin is facing a make-or-break moment following a recent bout of selling, according to technical analysis.

Though the cryptocurrency has rebounded above its average price over the past 100 days, it’s still trading below its 50-day moving average. Such a dynamic typically indicates an asset is nearing an inflection point.

If Bitcoin can’t overtake its 50-day mean -- which currently sits at about $57,000 -- then it might be in for a period of volatility as the gap between the two trend lines converges. Technical indicators suggest breaking out might not be an easy feat -- Bitcoin failed to do so on several occasions last week.

Trading in the world’s largest digital asset has been choppy in recent days after it hit a record high in mid-April above $64,000. It’s down more than 15% since then, though it rebounded earlier this week amid positive news, including comments from Tesla Inc.’s chief financial officer that reiterated the company’s commitment to the cryptocurrency.

“The drastic -- relative to what we’ve seen of late -- pullback certainly was a point of eyebrows being raised, but at the end of the day, I think the fact that things were able to rebound and stabilize is a good thing,” said David Tawil, president of ProChain Capital. “It shows real power to the token, the staying power to the asset class.”

The coin fell 1.4% on Wednesday following an announcement by the Securities and Exchange Commission that it will delay a decision on a Bitcoin exchange-traded fund. It was at about $54,586 as of 9:43 a.m. in Hong Kong Thursday.

Sam Stovall, chief investment strategist at CFRA Research, says that if the stock market continues its advance, he expected Bitcoin to follow.

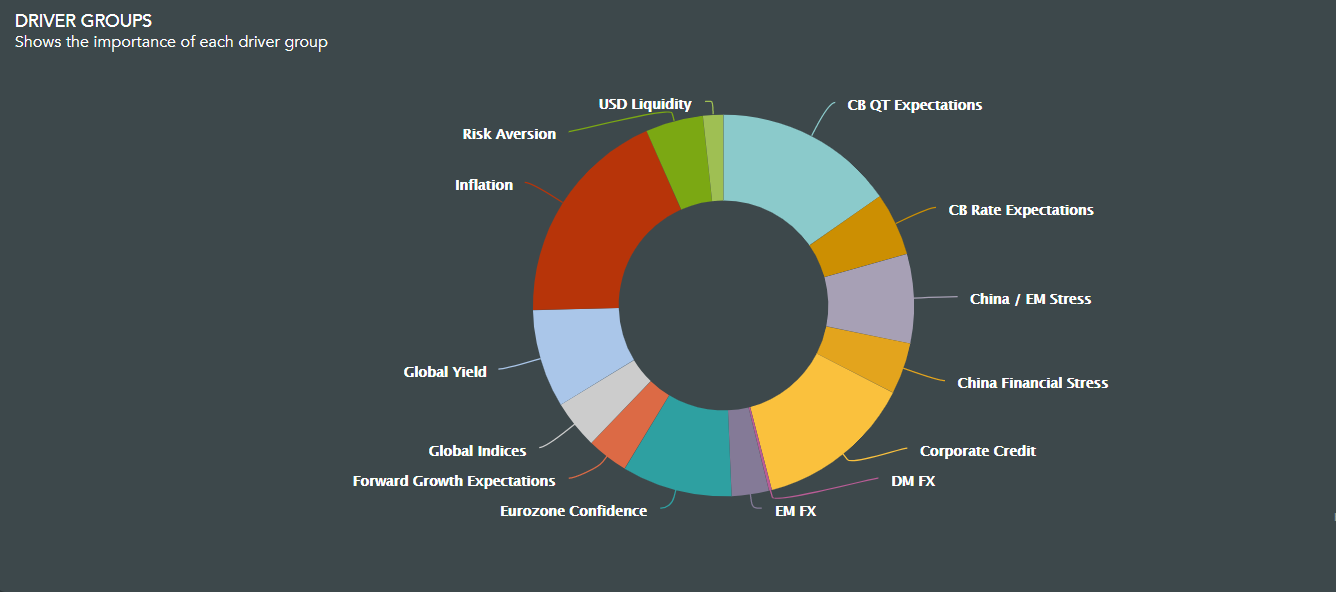

Despite its recent turbulence, Bitcoin is still up 511% over the past year. Inflation and central bank policies have been its biggest drivers during the past 12 months, according to Quant Insight, a London-based analytics research firm that studies the relationship between assets and macro factors.

While some dispute the idea that Bitcoin can act as an inflation hedge, the argument has been a key tenet for its bullish thesis and rings true for a lot of crypto fans. Proponents have seized on the money-printing narrative to promote the notion that Bitcoin is a store of wealth, an explanation that’s gained traction in recent months with economists expecting price pressures to pick up.

“No question about it -- what drives a big chunk of the interest in Bitcoin has been just the tremendous amount of money that has been printed and will be printed and really the fundamental thought that you cannot have that much money in the system and not have it be inflationary,” said Chuck Cumello, president and chief executive officer of Essex Financial Services.