In a recent blog post from DB's Francis Yared, the credit strategist looks at one of the lesser discussed drivers of inflation and points out that supply shocks to oil prices have historically been relevant for inflation expectations.

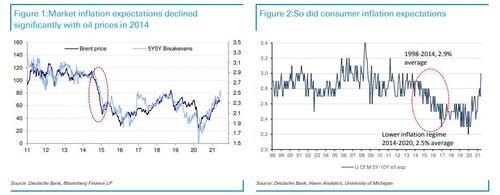

As Yared writes, "supply shock to oil prices have had a significant impact on inflation expectations on three occasions over the past half century: in the mid 70s, the mid 80s and the mid 10s." However, unlike the infamous price explosions of the 70s and 80s, in the latest episode the "shale oil revolution" resulted in a significantpositivesupply shock to oil markets which led OPEC in 2014 to defend its market share rather than oil prices. The downward pressure on oil prices, Yared writes,resulted in a shift to a lower inflation regime, which was reflected in both consumer and market inflation expectations (University of Michigan 5-10y and 5y5y breakevens) as well as monetary policy expectations and the term premium.

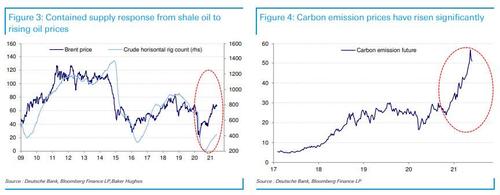

Well not anymore,because ESG is unwinding the shale oil revolution.As recent events at Exxon and Shell have shown, the pressure on oil companies to reduce oil and gas exploration and adapt their business models has increased significantly over the past few months. This is reflected in crude rig counts that have lagged the recovery in oil prices and stand at 1/3rd of the 2014 peak.

Similarly, carbon emission future prices in Europe have risen considerably: as theWSJ reported recently, the price of carbon credits traded in Europe has jumped 135% over the past 12 months and recently hit a series of records as economic activity rebounded from pandemic lockdowns. Only lumber, driven higher by the housing boom, has proved a better commodities investment.

As Yared summarizes, "ESG is a negative supply shock that internalizes the climate cost of the production of goods and services."This negative supply shock will be inflationary until technological progress absorbs these costs. That could take years. Moreover in Europe, it could garner enough of political support to justify a more aggressive fiscal policy despite the constraints at the German or EU levels.

To be sure, the global economy has still to contend with the disinflationary impact of ecommerce. However, as DB concludes, "ESG, the Fed's Average Inflation Targeting regime and a significantly more pro-active fiscal policy (at least until the US mid-term elections) constitute a new powerful combination that should be supportive of a higher inflation environment than experienced over the last 10 years."

Commenting on his colleague's observations, DB credit strategist Jim Reid agrees, and writes that "maybe in the fullness of time this surge in mining between 2010-2015 will be the exception rather than the norm and that, in a rapidly changing and ever more ESG sensitive world, it will be harder to get oil out of the ground.Pricing climate-change externalities more generally could make things more expensive over time. Are we on the verge of another change in inflation expectations due to oil and energy, one that is in large part due to ESG."

So in case there was still any confusion why the establishment has adopted ESG as gospel - and as a reminder, ESG is nothing new, and many years ago used to be called Corporate Social Responsibility, or CSR and even Nobel economist Milton Friedman warned against its subversive nature 50 years ago when he said that taking on externally dictated “social responsibilities” beyond those directly related to a company’s business opened the floodgates to endless pressure and interferenc - at a time when the same establishment is also desperate to inflate away thenearly $300 trillion in global debt, now you know: ESG looks like the catalyst that will unleash runaway inflation. And if central banks fail to contain it in time, the entire developed world may soon descend into hyperinflation.

Which in turn should also answer the other pressing question: why are central banks so desperate to issue their own digital, programmable currencies? Well, the ability to turn money on and off with the literal flip of a switch will come in extremely useful in a world where authorities have lost control over all other monetary pathways...