Some 85% of active U.S. stock funds were on pace to underperform the S&P 500 this year

It was supposed to be a stock picker’s market.

A late 2020 rally by smaller and cheaper stocks, culminating with the meme-stock craze that started in January, raised hopes that active investing would stage a comeback this year. But as 2021 draws to a close, most professional stock pickers find themselves in familiar territory: trailing the benchmark S&P 500 index.

That many money managers were brimming with optimism in January is nothing new, said Craig Lazzara, a managing director at S&P Dow Jones Indices. “Every year, there are a bunch of forecasts typically from active managers describing why this year is going to be a good year—this will be a stock picker’s market,” Mr. Lazzara said.

But many active stock funds struggle to beat the market in a given year, and 2021 fits the pattern. Some 85% of active U.S. stock funds were on pace to underperform the S&P 500 this year as of Nov. 30, according to Morningstar Direct. In the same period a year ago, 64% of such funds were running behind the S&P 500, according to Morningstar.

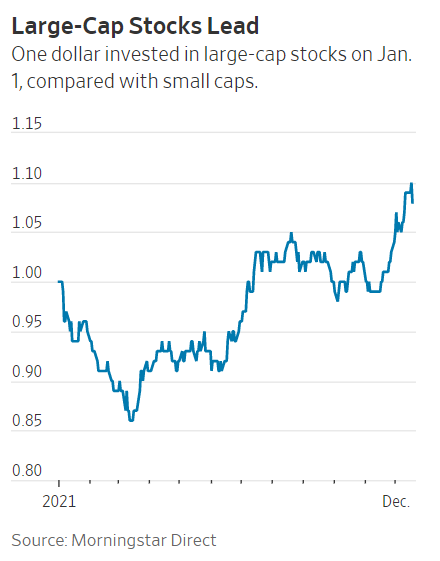

Some of those funds focus on small or midsize companies, and many were on track to beat the benchmark indexes that more closely resemble their investment style, said Robby Greengold, a Morningstar strategist. Small-cap funds, in particular, have had a strong year relative to their benchmarks.

Keeping pace with the S&P 500, though,was a different matter.

“Large-cap stocks this year have generally trounced the small-caps,” Mr. Greengold said.

Active managers had reason to believe this year might be different. Indeed, the U.S. economy’s recovery from the coronavirus slowdown had emboldened investors to snap up stocks they had previously ignored, Mr. Lazzara said. They went looking for bargains, reasoning that most companies would benefit from the economy’s growth—and not just the ones that proved most resilient earlier in the year.

Cheap stocks, small-caps and energy companies—categories that lagged behind the S&P 500 at the start of the health crisis—vaulted past the index’s performance in fall 2020, according to S&P Dow Jones Indices.

Their moment didn’t last. By spring 2021, big growth stocks had found their footing and kept it—helping power the S&P 500 to a 28% gain so far this year. The S&P MidCap 400 is up 23%, while the S&P SmallCap 600 has risen 26%.