Summary

- U.S. based Marathon Digital continues to benefit from strong production growth despite the correction in the price of bitcoin.

- Chinese ban on bitcoin mining means Marathon has gained market share within the global network hash rate from existing capacity as a boost to revenue.

- We go through our 2021 and 2022 revenue forecast models.

Marathon Digital Holdings, Inc.(NASDAQ:MARA)has emerged as one of the most exciting stocks in the market with an industry-leading crypto mining strategy. Indeed, even considering the recent volatility in Bitcoin (BTC-USD), shares of MARA are still up nearly 200% year-to-date, highlighted by its strong growth outlook. June was a milestone month for the company which reported mining 227 bitcoins in May, implying an annual revenue run rate approaching $100 million, which is set to accelerate towards $500 million by the end of the year as more mining capacity comes online. We are bullish on the stock which is well-positioned to continue generating strong returns with a positive long-term outlook.

A Massive Growth Story

The key to understanding Marathon Digital is to put aside the recent financial statements and last annual report which are simply ancient history at this point. The attraction here is the company's evolution over the next several months in 2022. Marathon is on track to be the largest publicly-traded mining company in terms of production capacity, which offers several advantages from scale and strategic opportunities.

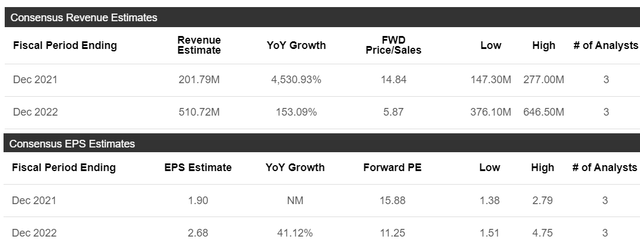

There are a lot of misconceptions regarding bitcoin miners but the reality is that the business is profitable and generates real cash flows. The current consensus estimates for MARA suggest an outlook for $202 million in revenue and an EPS of $1.90 this year. For 2022, the outlook is for revenue to reach $511 million with EPS climbing towards $2.68. We believe these estimates are too low even assuming a constant bitcoin price of $35,000 through next year which we discuss in our model below.

Either way, there are a few stocks in the market trading at a 1-year forward P/E multiple of 11.3x with this type of growth visibility. It's also worth noting, Marathon has no debt and over $350 million in cash and bitcoin on its balance sheet. Getting past the regulatory concerns and environmental pushback against bitcoin mining that has pressured sentiment towards the industry, there's a lot of reasons to be bullish here.

How Does Marathon Digital Make Money?

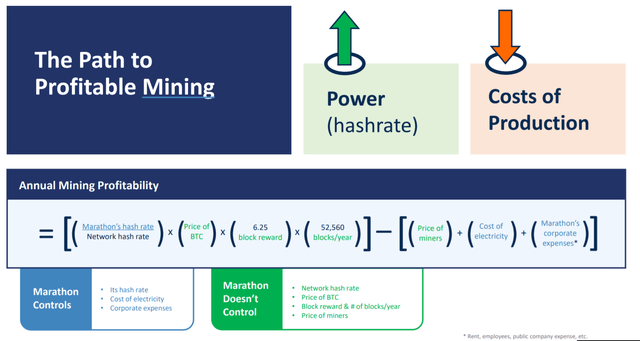

As a recap, the business model here is relatively simple. Marathon Digital acquires specialized computer hardware equipment built for mining bitcoin. The setup is installed in a data center and integrated into a system that continuously works to solve the bitcoin blockchain code to earn the network reward as the core mining process.

Approximately every 10 minutes, the global bitcoin network awards a block of 6.25 BTC as a protocol to the decentralized system. Over the course of a year, approximately 52,560 blocks are awarded on the network meaning 328,500 BTC are mined. At a current market price of $35,000, the "addressable market" bitcoin miners are attempting to capture is $11.5 billion in newly minted bitcoins per year.

Over the past year, Marathon has invested over $257 million in orders for mining rigs including what was a game-changing $170 million purchase in late December of 2002 for 70,000 'Antminer S19' machines from 'Bitmain Technologies Inc'. These are recognized as top-of-the-line with specifications that show they can generate a market-leading hash rate to power consumption ratio which means they are more profitable to run than nearly any other existing equipment on the market.

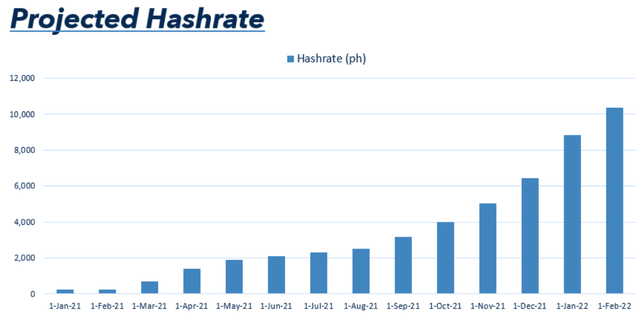

The advantage here from Marathon is that the company stepped into the front of the line for the industry as Bitmain's largest customer selling out production through 2021. Other bitcoin miners are having to wait or acquire less efficient models from other manufacturers. Once fully deployed by Q1 2022, the expectation is that MARA's full mining fleet will consist of 103,120 miners, generating 10.37 EH/s (or 10,370 PH/s as a different denomination of standard hashing computation power). Mara reports and updates on its schedule of mining machine deployments with the projected hash rate increase over time.

The hash rate is an important metric which we use to extrapolate the company's future revenue potential as a function of the market price of bitcoin against the company's share of the global network. So when we look at that 10.37 EH/s hash rate number, this translates into a production capacity in terms of the number of bitcoins the company is expected to generate on a daily and monthly basis.

A Windfall As Chinese Mining Goes Offline

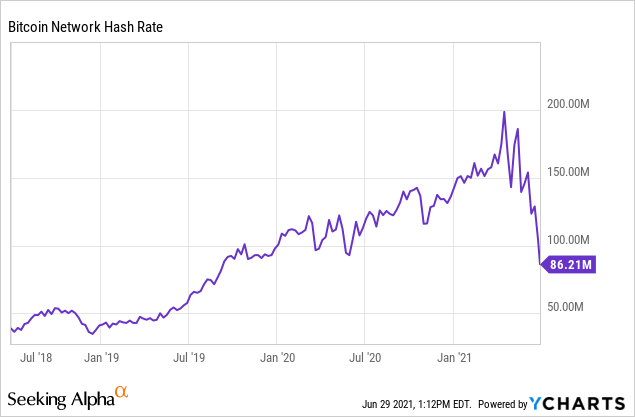

The trend over the last decade since the inception of bitcoin has been a steady climb higher in the network hash rate or difficult with more resources and equipment allocated towards mining considering the profitability potential. This means that each company's mining capacity is expected to be diluted over time as more processing power works to solve the blockchain code.

That said, a curious development has emerged which we see as a windfall of Marathon Digital. In June, China took a hard line towards bitcoin mining, with an outright ban in several regions including Xinjiang, Inner Mongolia, Sichuan, and Yunnan citing the excess electrical power consumption on the country's infrastructure. It was previously estimated that Chinese miners represented upwards of 75% of the global bitcoin mining production which had been attracted by low electricity rates.

The result of the ban has been a collapse of the network hash rate which has now declined to the lowest level going back to 2019. Compared to a peak bitcoin network hash rate of 198.5 EH/s, the current level as of June 28th at 86.2 EH/s is down nearly 60%. Again, this is independent of the bitcoin price and simply reflects the Chinese miners going offline and thus no longer contributing to the network processing power.

The upside for Marathon and other bitcoin miners outside of China is that their existing hash rate capacity captures a higher share of the network reward. Compared to the 1.9 EH/s Marathon reported at the end of May which represented approximately 1.2% of the global total, that same hash rate now totals 2.2% based on the latest network figure. In other words, Marathon is mining nearly double the number of bitcoins without the Chinese miners on the network based on current hash rate figures.

The implication here is huge. Even as the price of bitcoin has declined from an average of $47,200 in May to the current $35,000, the company is actually generating more revenue. With a concrete example, the company reported mining 227 bitcoins in May representing approximately $10.7 million in revenue. Based on the latest network hash rate and using Marathon's May capacity at 1.9 EH/s, the company can now mine upwards of 600 bitcoin over the entire month. This translates into $21.1 million in revenue, up nearly 100% from May at the current market price of bitcoin.

To be clear, the lost Chinese capacity is not necessarily removed permanently, but simply that there is an expectation that the production will have to shift into other countries that maintain a more neutral regulatory approach towards bitcoin mining including the U.S. We expect the network hash rate level to begin stabilizing from the current low but not return to peak levels through at least 2022 considering the logistical challenges of Chinese miners moving their operations and securing the necessary data centers and power supplies.

Our Updated Revenue Model For Marathon

In a previous article, we presented a revenue model for Marathon using a constant bitcoin price of $55,000 and a network hash rate projection that continuously climbed through 2022. The bitcoin correction since May along with the decline in the network difficulty now warrants an update.

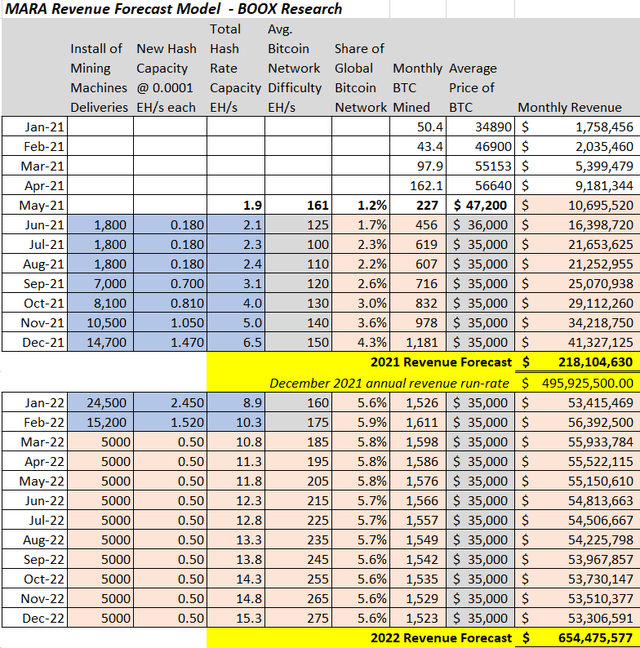

Using the company's schedule of mining machine deliveries, we are assuming a flat BTC price of $35,000 through 2022 as a base case while forecasting the bitcoin network difficulty climbs back towards 150 EH/s by year-end 2021 and ends 2022 around 275 EH/s. This is down from our previous estimate of 220 EH/s and 310 EH/s each year respectively given the disruption to global mining out of China.

We forecast Marathon Digital to reach $218.1 million in revenue this year by mining 5,968 bitcoins. Considering the company's current market cap of $3.2 billion, our revenue forecast implies a forward P/S ratio of 14.7x. The number to really focus on is going to be 2022 when Marathon expects to have fully deployed all its announced purchases by February. At that point, with our network hash rate projection, Marathon may be mining upwards of 1,611 bitcoin that month, generating $56.4 million in revenue, representing an annual run rate of $677 million. By this measure, the stock's current 1-year forward price to sales multiple of just 4.7x appears very reasonable.

The reason we are estimating a higher revenue number for 2022 compared to the market consensus of $511 million is because of our expectation that Marathon will continue to add mining capacity beyond what has already been announced. Adding 5,000 new machines per month on average between March and December of 2022 would allow the company to maintain its global hash rate share above 5.5%. Longer-term, the company just needs to stay ahead of the global network hash rate increases by adding new equipment.

The framework above here allows different scenarios to be modeled. Playing around with the numbers, a more bearish forecast with a BTC price of $20,000 would lead to at least $375 million in annual revenue by next year. To the upside, $1 billion in annual revenue by next year is on the table if BTC climbs back to $55,000.

In terms of earnings, Marathon has previously offered an expected average all-in mining cost of approximately $4,541 per bitcoin. By this measure, at a bitcoin price of $35,000, the gross mining profit is $30,459 with the margin scale as bitcoin appreciates. Compared to the 2022 consensus EPS of $2.68, which represents approximately $270 million in adjusted net income, we are forecasting 2022 EPS closer to $3.50 per share based on our higher revenue outlook considering. Overall, while there are still some questions as to how expenses will evolve over the coming quarters as the operation scales, the path to profitability is clear with positive cash flows this year.

Is MARA a Buy?

There is a good case to be made that Marathon has a very positive outlook based on its production growth. The expectation of reaching 10.3 EH/s is the largest hash rate capacity any publicly traded miner has announced.

For context, Riot Blockchain, Inc.(NASDAQ:RIOT)only anticipates having 7.7 EH/s capacity by the end of 2022, even as the company with a market cap of $3.6 billion trades at a premium to MARA at $3.2 billion. Separately, while MARA currently holds 5,518 BTC on its balance sheet, RIOT's holding is smaller at 2,000. One explanation for RIOT's higher valuation is the company's recent acquisition of "Whinstone US", the largest Bitcoin hosting facility in North America, which diversifies RIOT's business beyond mining into data services supporting other miners. We still believe the advantage on the production side from MARA is more attractive. We'll cover RIOT in more detail in a future article.

The other side to the equation comes down to the uncertainty over the price of bitcoin. At the end of the day, Marathon and other bitcoin miners are going to need the price of bitcoin to rally higher and sustain positive long-term momentum as part of the bullish case. If you believe bitcoin is going to crash lower and head to zero, then certainly Marathon Digital would not succeed.

While the trading action in bitcoin has been difficult in recent months, investors should be encouraged that the price has a positive gain year to date, and holding the $30,000 level which appears to be a strong level of technical support. Amid all the negative headlines regarding bitcoin's environmental concerns and higher regulatory scrutiny around the world, the market appears to be resilient with a potential bottom forming with bulls stepping in.

This consolidation pattern sets up a rebound higher as sentiment slowly improves over time. In our view, the long-term thesis for cryptocurrencies in general as a new asset class and alternative to fiat currencies remains in place. The appeal of its potential as a payment method and store of value will continue to support demand.

Final Thoughts

We rate shares of MARA as a buy with a price target for the year ahead at $50 representing a market cap of $5 billion and a 7.6x price to sales multiple on our 2022 revenue forecast. The insight we offer is that the recent decline in the network hash rate from Chinese miners going offline has helped balance out the 55% drop in the price of BTC from the all-time high. Marathon Digital is mining an increasing amount of bitcoin which translates into significant revenue and earnings potential even at the current market price. The upside can be significantly higher in a scenario where the price of bitcoin regains positive momentum and rebounds higher.

Considering the ongoing extreme volatility in the price of bitcoin, we have to keep Marathon in a high-risk and otherwise speculative category. This won't be a straight line higher or lower. Investors interested in Mara should only consider a small position in the context of a diversified portfolio and we always recommend averaging into trades over days and weeks to secure a lower cost basis.

Recognizing the company will remain cash flow positive even at a significantly lower market price of bitcoin from current levels, any downside from here would pressure sentiment and force a reassessment of the long-term earnings outlook. Furthermore, any type of concerted government effort to limit bitcoin mining operations in the U.S. or delegitimize its use as a financial instrument would be bearish and pressure the market value lower. These are important risks to be aware of.