Amazon’s subscriptions do not amount to much revenue – probably even less so to profits. But the success of the company and the upside to Amazon stock may depend greatly on this business.

Amazon (AMZN) -Get Report is well known for its e-commerce and cloud services. But the company has been diversifying its business model in the past several years and gaining scale. For example, the 200 million Prime accountsmeanthat Amazon’s Prime Video has become one of the most widely available streaming services in the world.

But if potential investors were to consider buying Amazon stock today, should they focus their due diligence on Amazon’s “side gigs”, particularly subscriptions? Amazon Prime, Prime Video and others: could they be an important piece of the investment thesis?

A snapshot of Amazon’s businesses

Around 70% of Amazon’s revenues come from e-commerce, broken into two major categories: 1P and 3P. The first consists of sales made by Amazon itself, while the latter pertains to thirty-party vendors that sell their products through Amazon’s marketplace.

Another 12% of Amazon’s revenues come from AWS, the acronym for Amazon Web Service. The segment provides cloud infrastructure services primarily to enterprises and competes with the likes of Microsoft’s Azure.

Aside from physical stores and other minor activities, subscriptions account for only around 7% of Amazon’s total revenues – a drop in the bucket.

Does it matter?

At first glance, even if all of Amazon’s sub revenues were to vanish overnight (not practical, only a thought exercise), the company would still be left with a giant retail and cloud business that grew sales ata dizzying rate of around 40% last quarter. Without subscriptions, Amazon’s Q1 sales would have still increased by a respectable 34% year-over-year -- more so than in any quarter of 2019.

From a number’s perspective, Amazon would probably be fine deemphasizing its subscription businesses to become a pure-play e-commerce and cloud giant. US e-commerce isforecastedto grow 20% by 2025, and Amazon is likely to control a large piece of this expanding market. Worldwide, e-commerce is expected to grow an even better 30%, and Amazon’s footprint expansion opportunities outside North America are substantial.

Think bigger picture

The catch is that subscriptions serve as a hook to attract and retain Amazon customers into its retail ecosystem.

For instance, a Prime subscription brings in no more than $120 per year to Amazon’s coffers. Considering the costly benefits of a Prime account (i.e. fast delivery, access to audio and video content that is expensive to produce), the Seattle-based company probably sees little of the revenue trickling down to earnings.

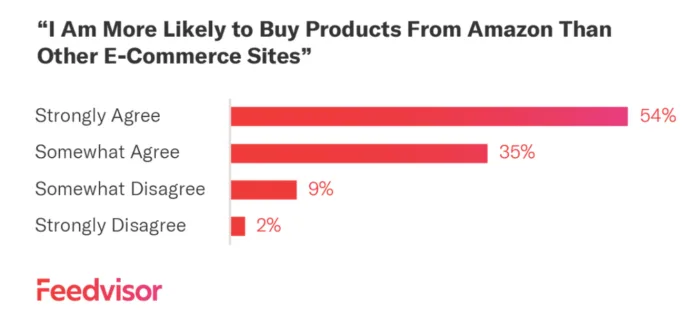

However, a Prime member is a much better Amazon customer compared to those who do not have a membership. According toForbes, a staggering 96% of all Prime members agree that they are more likely to buy from Amazon than from other e-commerce vendors. See below.