After tough results from Zoom Video on Monday, another big software-as-a-service provider was on the skids after hours on Tuesday.

Key Points

- Markets were modestly lower on Tuesday to close a strong month.

- CrowdStrike Holdings became the second cloud stock in two days to fall after earnings.

- However, CrowdStrike's business condition differs from that of Zoom Video Communications.

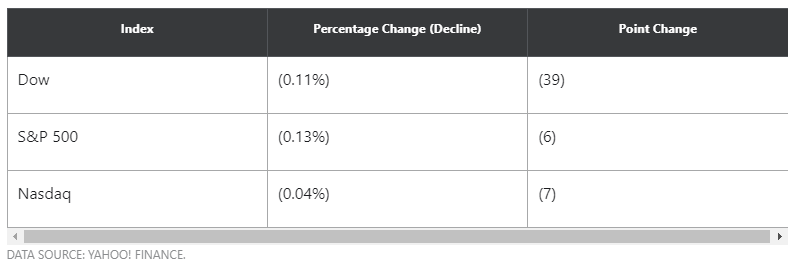

Wall Street ended the month of August on a quiet note, with major market benchmarks easing lower. Nevertheless, gains for the month were substantial, as theDow Jones Industrial Average(DJINDICES:^DJI)picked up 1%, theS&P 500(SNPINDEX:^GSPC)rose 3%, and theNasdaq Composite(NASDAQINDEX:^IXIC)led with a 4% gain for August. Below are the daily moves for the major indexes.

Securing the future

CrowdStrike's stock fell almost 2% in the regular session, but it added to its losses in the late session, falling another 4.5% as of just before 6 p.m. EDT today. The cybersecurity specialist's second-quarter financial results showed sustained growth, but apparently not enough to satisfy investors, who had been bidding theshare price higher for most of the past week.

From the stock's decline, you might be surprised by the magnitude of some of CrowdStrike's growth numbers. Revenue for the second quarter climbed 70% to $338 million, on a 71% rise in subscription-based sales. The annual recurring-revenue run rate also rose 70% to $1.34 billion. More than $150 million of that figure was from new business generated during the period. Adjusted gross margin held steady at an impressive rate of 78%. Adjusted net income more than tripled year over year, resulting in $0.11 per share of earnings. Free cash flow more than doubled to $74 million.

Fundamentally, CrowdStrike's business metrics also looked solid. The company added 1,660 new subscription customers in the past three months, bringing its total count to more than 13,000. That was up more than 80% from the same time last year. Moreover, it has done well at cross-selling new modules to existing customers, as fully two-thirds of its subscription customers now have four or more modules running on their platforms.

Nor does CrowdStrike anticipate any meaningful slowdown in its future. The company increased its full-year guidance for revenue, which now centers on the $1.4 billion mark, which would represent roughly 60% growth from its previous fiscal year's sales. Adjusted earnings of $0.43 to $0.49 per share might seem inconsequential, but it still represents a profit.

Don't panic

It's easy to see CrowdStrike's after-hours drop as a sign that investors are losing confidence in cloud stocks. But it's still important to draw distinctions between different companies.

Zoom has had to deal with a huge slowdown in its growth, largely because of the extremely fast expansion it experienced during the pandemic. That's left some investors wondering where future growth at Zoom is going to come from.

For CrowdStrike, on the other hand, steadily rising demand for cybersecurity services isn't going to end even if the pandemic fades. As businesses adopt the latest technology, they'll increasingly need thetop-end protection CrowdStrike can provide.

It's therefore far too early to declare that the strong run for all cloud stocks is over. A single day's drop for CrowdStrike might end up being a buying opportunity for those who believe in its long-term promise.