Some Robinhood traders looking for what to buy in May might be planning to sell by June. But among the favorite stocks of users of the app are some that should be good investments to hold for many years.

Owning the names on this list isn't for the faint of heart. But many Robinhood investors like aggressive investments, and the list of the most popular names on the app is crowded with risky stocks. The following companies -- on the list when I checked -- are in three different fast-growing sectors, and each could have a very promising road ahead.

Tilray: A transformative merger

Canadian cannabis companyTilray(NASDAQ:TLRY)is a top Robinhood name that is combining with another of the app users' favorites. Shareholders have approved a merger withAphria(NASDAQ:APHA)and the newly combined company will take the Tilray name. The new Tilray, which will be one of the largest global cannabis companies, will be led by Aphria CEO Irwin Simon.

The deal gives investors an opportunity to own a single cannabis company with strong growth prospects in markets outside of Canada. Tilray has been growing internationally in Europe and beyond. It announced a new distribution agreement with U.K. medical cannabis distributor Grow Pharma under which Tilray's pharmaceutical-grade medical cannabis products will be imported and distributed by Grow Pharma in the U.K. Separately, it announced it had exported its first medical cannabis shipment to Spain, and had received the first and only market authorization for medical cannabis products in Portugal. In March, it also received approval from authorities in New Zealand to launch its medical cannabis products across the country.

Aphria also has been working on plans to grow outside of Canada. Last year, it bought U.S.-based craft brewer SweetWater Brewing for $300 million as part of a strategy to prepare for potentialfederal marijuana legalizationin the U.S. At the time of the acquisition, Simon said the deal was done for the purposes of "expanding our addressable market and leveraging SweetWater's existing infrastructure to accelerate Aphria's entry into the U.S. ahead of federal legalization of cannabis." There's no guarantee that federal legalization will ever happen, but there has been growing momentum, with Virginia recently becoming the 16th state to legalize recreational marijuana, along with Washington D.C.

In its recentfiscal third-quarter earnings call, Aphria told investors that as of the period ended Feb. 28, it was the top licensed producer in Canada, with an overall national market share of 12.1%. Tilray's 2020 revenue grew 26% over 2019. Combining those businesses gives investors a well-rounded way to invest in the cannabis sector.

NIO: A massive market opportunity

There is huge potential for growth in theelectric vehicle(EV) sector. Chinese EV makerNIO(NYSE:NIO)is a leader in the world's largest automotive market. There will be plenty of competition, but the company's sales are growing quickly, and it has begun construction on a new manufacturing facility.

NIO delivered 20,060 vehiclesin a strong first quarter, a jump of over 400% from the prior-year period. Deliveries in April 2021 grew 125% over last year's April shipments and this speed bump in growing sales has been a factor in the recent decline in the stock price. In late March, the company told investors it is being affected by the global semiconductor shortage -- a headwind being felt by many automakers. It resulted in a five-day suspension in operations that resulted in several days of April production being lost. NIO founder, chairman, and CEO William Li expanded on that topic during the company'sfirst-quarter conference call last week. Li said the company now expects the supply chain problems will "continue to linger."

NIO has several things investors should be excited about. Its new ET7 luxury sedan that will be available early next year expands its offerings beyond its current SUV designs. It is also expanding anetwork of battery swap and recharging stationsthat should help demand grow throughout the country, and bring NIO a growing income stream from the service. And NIO plans to expand beyond China. It recntly announcedan upcoming news conferencewhere it will detail plans to enter the European market, beginning with Norway.

NIO is still growing toward profitability and is worth a look for investors comfortable with risk as the EV market is expected to soar. Only 1.7 million EVs were sold in 2020, but industry research provider BloombergNEF expects that will reach 26 million by 2030, and more than double from there over the following 10 years.

Peloton: Keeping up with demand

At-home exercise equipment makerPeloton Interactive(NASDAQ:PTON)reported its 2021 fiscal second-quarter financial results in February, with total quarterly revenue surpassing $1 billion for the first time. That was a 128% year-over-year jump. The company also updated investors on a big problem -- addressing long order-to-delivery times. For investors, that can be a good problem to have, highlighting the popularity of the company's bike and treadmill products.

One way Peloton responded was to acquire commercial fitness equipment provider Precor. In addition to bringing Peloton into the non-residential side of the market with customers including fitness clubs, hotels, and corporate facilities, it also brought what the company calls "a significant U.S. manufacturing presence." Peloton had already been growing its global manufacturing output, and is in the process of ramping up production at a new factory in Taiwan. The company believes that the combination of added production and easing of supply chain disruptions caused by the pandemic will allow it improve its delivery backlog in the coming months.

Recent negative publicity surrounding accidents involving the company's treadmills has contributed to a stock price decline. Investors should hear more about deliveries and the safety concern whenPeloton reports its fiscal third quarter2021 earnings on May 6. If the company continues to improve the delivery time frame and demand remains high, today'sprice-to-sales ratioof about 10 makes for a reasonable entry point for those willing to wait for the growth story to play out.

Why to buy now

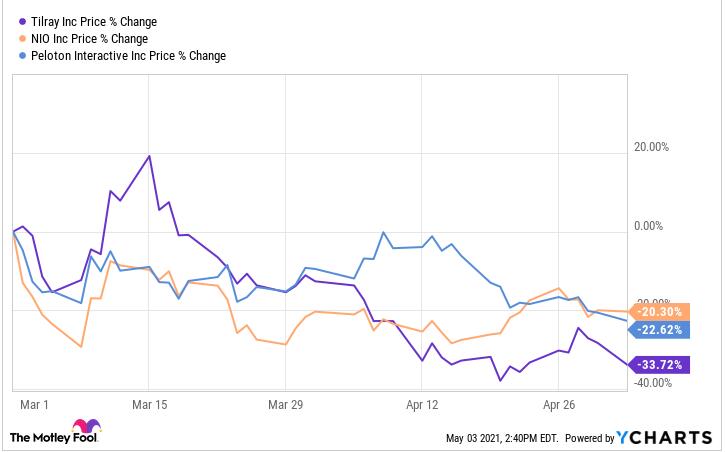

Each of these companies has a compelling growth story, but each also comes with notable risks. For various reasons, the stocks have all declined at least 20% over the past two months, which could make for an attractive buy-in price.

Should you invest $1,000 in NIO Inc. right now?

Before you consider NIO Inc., you'll want to hear this.

Investing legends and Motley Fool Co-founders David and Tom Gardner just revealed what they believe are the10 best stocksfor investors to buy right now... and NIO Inc. wasn't one of them.

The online investing service they've run for nearly two decades,Motley Fool Stock Advisor, has beaten the stock market by over 4X.* And right now, they think there are 10 stocks that are better buys.