- Asian-Pacific shares trade lower following U.S. equities’ drop

- Investors fear Beijing’s clampdown could further hit sector

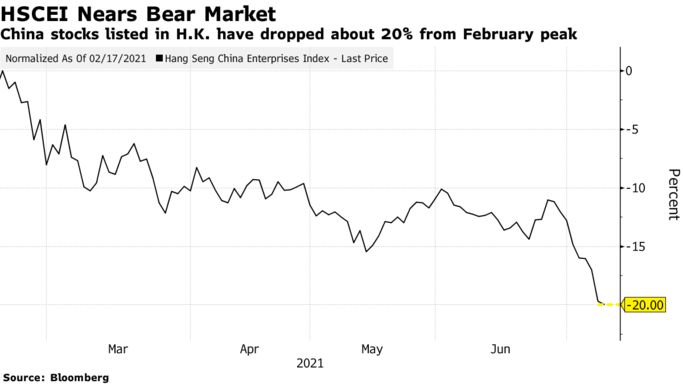

A gauge of Chinese stocks listed in Hong Kong is on track to enter a bear market on Friday as a selloff of tech shares continued amid Beijing’s latest crackdown on the country’s tech sector.

The Hang Seng China Enterprises Index fell as much as 1.1%, extending its loss since a February high to over 20%. The gauge was dragged lower by Alibaba Group Holding Ltd., Meituan and Tencent Holdings Ltd. Hong Kong’s benchmark Hang Seng Index edged 0.9% lower as of 10:01 a.m. local time, taking its weekly loss to 4.9%, which is set for the worst since late February.

The broader Asia Pacific region traded lower on Friday morning, following weaker U.S. equities on growing anxiety that the spread of the Covid-19 variants could hamper the global economic recovery. Treasuries trimmed a rally.

Tech Stocks Drag Key China Index in Hong Kong Toward Bear Market

China’s tech sector saw renewed selling pressure this week, as the country’s regulators announced acrackdownonDidi Global Inc.just days after the ride-hailing giant pulled off one of the biggest U.S. initial public offerings of the past decade. Investors worry that more troubles may be ahead for other companies as Beijingmullsfurther rule changes that would allow them to block Chinese firms from listing overseas.

(Updates with quote, chart and prices throughout)