Summary

- First, I explain the principle of selling puts.

- Second, I briefly discuss PLTR's price action and a great buy price.

- Third, I spell out an exact PLTR put trade.

The Puzzle

We are in a bull market. Therefore, getting a good price on a great company can be tricky. For example, Palantir (PLTR) is a wonderful company but maybe you're not too excited about buying shares for $24 right now.

That all said, perhaps you'd be interested in a set up that allows you to either buy PLTR for $19.47 in about two months or you make nearly 16% annualized on your money if that deal doesn't work out.Heads or tails, you win.

In this article, I'm going to show you how this trade is structured. First, I explain the principle of selling puts. Second, I briefly discuss PLTR's price action and a great buy price. Third, I spell out an exact PLTR put trade.

As a quick disclaimer, I strongly encourage you to perform your own due diligence about this trade. Do not simply copy and paste anything. Although I'm using the best possible data I can find, markets are very fluid and it's likely this exact set-up is has already changed - perhaps substantially. Further, options trading inherently carries additional risk.You've been warned.

Selling Puts: Big Picture

I enjoy selling puts when I like a company but I want a better price. It's a way to lower my buying price, or get paid for taking the risk if the stock price drops in a big way. Here's how Investopedia says it:

Selling (also called writing) a put option allows an investor to potentially own the underlying security at a future date and at a much more favorable price. In other words, the sale of put options allows market players to gain bullish exposure, with the added benefit of potentially owning the underlying security at a future date and at a price below the current market price.

When you sell a put on PLTR, for example, you have the obligation to buy PLTR at a predetermined price from the option buyer if they exercise the option. Very importantly, you should only sell put options if you're very comfortable owning PLTR, or whatever security is underlying the trade. PLTR passes this test for me.

There are several factors that matter when setting up your put selling trade: stock symbol, price of the put, strike price, and the number of contracts. In this case, we'll focus on PLTR, of course. We'll soon look at put prices, the strike price and contracts. But I do want to point out that the most important factor is yourpatience. You've got to run some simple math, then you've got to be patient as the trade works out over time.

Good Price for PLTR

PLTR has mostly been trading between $21 and $25 this year. It has obviously reached much higher, and even recently went over $28. However, it only went down below $21 for a short while in July and May. It also reached down below $20 but not for long. That's a lot to take in so here's a simple view.

What I'm really showing here is that PLTR has only spent a little time below $20 and getting it at that price would be great if you believe in the company. For the record,Growth Stock Renegademembers are keen on PLTR, even well above $20. Many of us believe that anything below $20 would be a jackpot.

In any case, many investors would be more interested in PLTR below $20, instead of $24, because that'd be like getting an instant 17% discount.Spicy!

Selling PLTR Puts

The trade set up is pretty simple. Here's how things look:

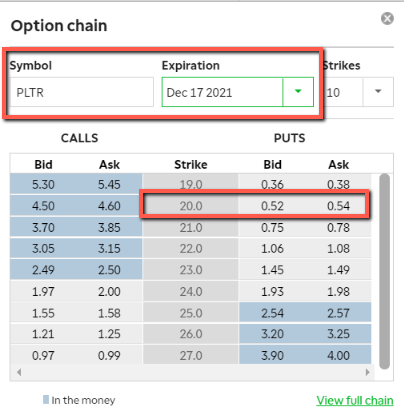

You can see that we're looking at PLTR. Also, the expiration date is December 17th, 2021. That's about two months from now, of course. And, we've got a strike price of $20, with a bid of $0.52 and ask of $0.54, as I'm writing this. I'm going to assume that we could split the difference and sell at $0.53 per PLTR contract, for this trade.

As another quick sidebar, and warning, the bid and ask are very likely going to change between right now, and when you look. Options tend to be quite fluid.

In any case, if you sell one PLTR put at $0.53 you'd collect $53, since each option contract is for 100 shares. You're also agreeing to buy PLTR for $20 on December 17th.

If PLTR is trading above $20, then the buyer isn't going to ask you buy the shares. They'd be losing money. As long as PLTR stays above $20, you'll be in good shape. Of course, if PLTR falls below $20, then you're obligated to buy those shares, even if the price is $19, $18, or less.That's the risk.Otherwise, you've collected your premium, and if the option expires worthless, you keep your $53. Not too shabby.

Doing more simple math, when you're selling the December 17th PLTR $20 put, you're making 2.65% profit. That's in just two months. Therefore, annualized, that's about 15.9% for your trouble.

Furthermore, your breakeven price is $19.47, since you've collected $0.53 and the strike price for this PLTR put option is $20. In other words, worse case you'd be buying PLTR for $19.47 in two months, which is nearly 19% below today's price of $24. I consider this is rather substantial margin of safety.

Wrap-Up

Please keep in mind a few more things. First, you aren't forced to hold onto options that you've sold. That is, you can always buy your options back, which effectively closes out your trade. This can lock in gains or remove risk faster.

Second, it's important to remember that one contract is 100 shares, and you're on the hook for those shares, so to speak. Your gain is $53 on this trade, but at the same time, your obligation is 100 shares at $20, which translates to $2,000. This isn't a free lunch. You're eating some risk.

All of that said, getting PLTR for $19.47 or making 15.9% is a pretty good deal. I already own a good amount of PLTR, or I'd immediately consider this trade because I'm bullish on the company. I can also imagine running this trade many times until I owned shares.

This is a lower risk type of options trade, especially if you're interested in owning the stock for the long term. And, it can be good for both traders and long-term stock owners. Whatever the case, I think this is a rational set-up. Just don't make it blindly.I remain long and bullish on PLTR.