ContextLogic stock (WISH) is one of the most discussed within the top forums on Reddit. The e-commerce platform probably gained popularity after a sudden share price recovery in early June.

This Thursday, August 12, the company will report its second quarter results. Could this be a catalyst for the share price to take off once again?

Q1 earnings results recap

The companybeatexpectations in the first quarter of 2021, reporting loss per share of $0.13 against consensus loss of $0.14. The company also beat revenue expectations by $29 million.

- Revenues in first quarter was $772 million, a 75% increase year-over-year.

- First quarter net loss was $128 million, compared to a loss of $66 million in Q1 2020.

- Adjusted EBITDA loss was $79 million, -10% margin, compared to a loss of $51 million in Q1 2020.

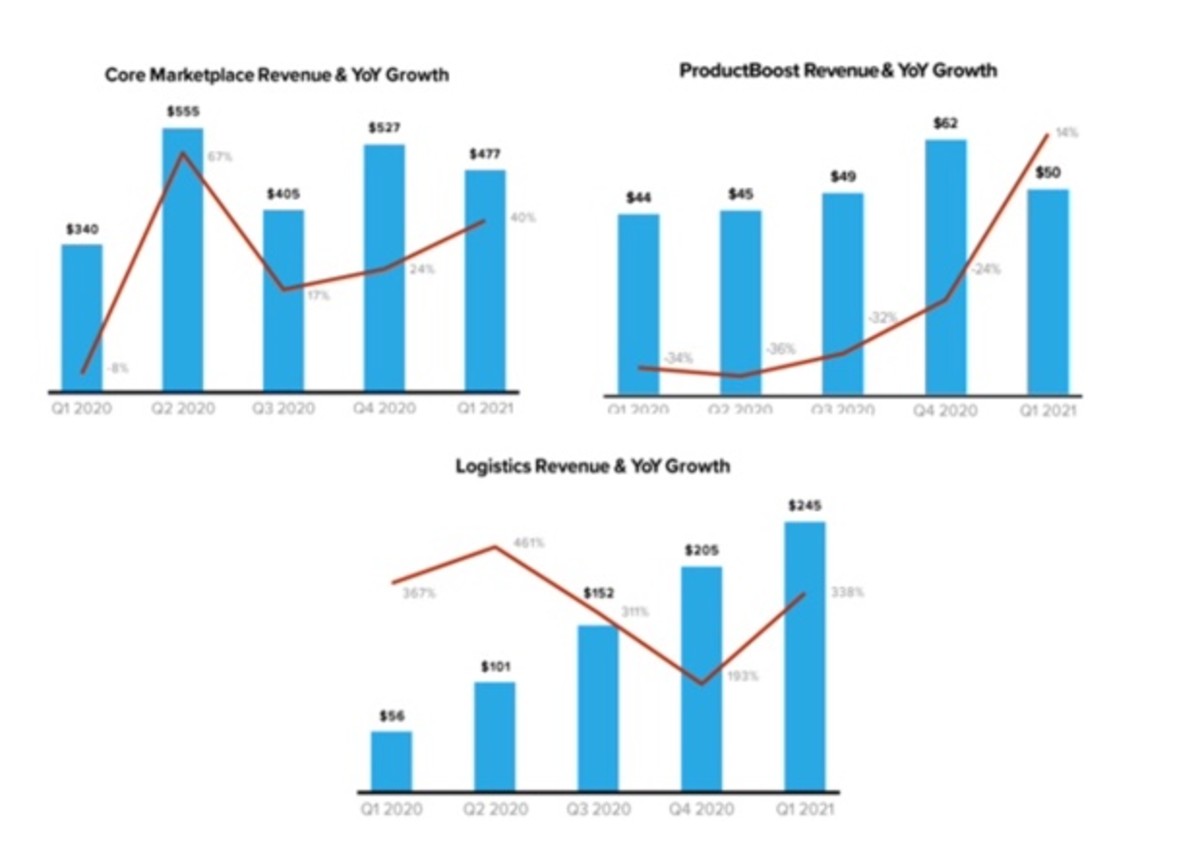

- Core marketplace revenue grew 40% to $477 million year-over-year, a boost from a 24% year-over-year growth in Q4 2020. See below. ProductBoost revenue grew 14% year-over-year to $50 million and Logistics revenue was $245 million, a whopping 338% higher year-over-year.

Founder and CEO Piotr Szulczewski said: “Wish started off 2021 strong with Q1 results that exceeded our expectations on both the top and bottom lines,”. He added that the company’s main focus is to drive continued long-term growth through efficient user acquisition, increased monetization and higher retention.

Lastly, the CEOsaidthat newer initiatives, including Wish Local expansion, as well as efforts to diversify product selection, were well executed according to the company’s plan.

However, despite the strong Q1 results, WISH stock fell sharply 31% right after reporting its earnings in the next trading day. The main culprit was probably the company’s revenue guidance, whose top end of the range fell below Wall Street’s estimate.

Previewing Wish’s Q2 earnings

Wall Street is expecting net loss per share of $0.10 in the second quarter. For reference, this number compares very favorably to the second quarter of 2020 when Wish became a publicly traded company amid the ongoing COVID-19 pandemic: net loss of $0.97 per share.

Consensus revenue of $722 million compares to a reported $772 million in the last quarter. Wall Street latest recommendation on the stock was cautiously bearish. Bank Of America and Evercore ISI both downgraded WISH to hold. The latter mentioned the departure of CFO Rajat Bahri as raising the risk on the company's operations.

For the second quarter, Wishexpectsrevenues of between $715 to $730 million, or a 2% to 4% year-over-year increase as the company had a very solid Q2 2020. In addition, an EBITDA loss of between $60 to $55 million or a loss of 8% to 7% of revenue is expected. Wish is looking at 2021 with caution, given the uncertainties behind the ongoing COVID-19 pandemic and new tax rollouts in Europe starting in July of this year.

To keep delivering solid results, the company believes that the opportunities are based on five core priorities: (1) Driving efficient customer acquisition, retention and monetization, (2) optimizing logistics infrastructure, (3) scaling Wish Local, (4) adding new product categories and (5) opening the platform to non-Wish merchants.

Wall Street Meme’s take

As seen in thelatest earnings reported by e-commerce giants like Amazon, growth in the sector decelerated quite a bit in a post-pandemic scenario. This was due to the gradual reopening of the economy causing stay-at-home trends to slow down. Therefore, it is feasible that Wish’s revenues will not surprise this time as they did in the last quarter.

However, on the bullish side, the company has been delivering results in line with its outlook, and it remains a promising e-commerce player. Even with the phasing out of the stay-at-home tailwinds, e-commerce is stilllikelyto flourish beyond the COVID-19 crisis.