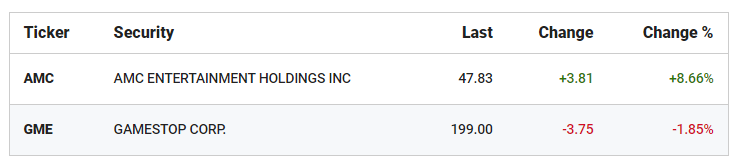

GameStop shares have gained 956% in '21 with earnings on tap Wednesday.

GameStopand AMC are loved by retail investors and the Reddit trading community, and now theexchange-traded fund industrywants in on the action.

An application forThe Roundhill Meme ETF is sitting with the Securities and Exchange Commission after being filed late last month and aims to track the performance of the so-called "meme stocks."

- Meme stocks are equity securities, including American depositary receipts

- Exhibit a combination of elevated social media activity (i.e., the number of times a company or its ticker is mentioned on specific social media platforms)

- High short interest (i.e., the number of an issuer’s shares that have been sold short but which have not yet been covered or closed out), both of which are indicators of market sentiment

Source: SEC Filing

Roundhill is a "registered investment adviser and ETF sponsor focused on thematic and sector-specific investing," according to the firm. Due to the quiet period, Roundhill told FOX Business it is restricted from commenting until the fund is live on Nov. 21, 2021, pending SEC approval.

AMC, which is among the more high-profile meme names, has seen its shares rise over 2,156% this year, often experiencing volatile sessions.

Still, the idea of an ETF connecting to these heavily traded retail investor favorites is not new.

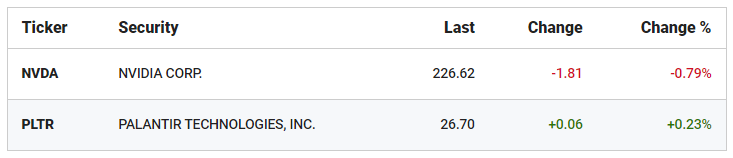

Along with AMC and GameStop, its largest holdingsinclude Nvidia and Palantir Technologies, according to the company.