G-7 tax deal, Yellen positive on higher rates, and Bitcoin gets a country.

15%

The Group of Seven nations reached a deal backing the U.S. call for a minimum corporate tax rate of “at least 15%” on foreign earnings. While key details still need to be nailed down and more nations need to sign on, the agreement is beinghailed as an unprecedented stepwith Treasury Secretary Janet Yellen calling it a “revival of multilateralism.” Places that offer beneficial tax arrangements for global corporations such as Ireland,SwitzerlandandHong Kong have commented on the changes and how they intend to defend their positions.

Plus

Yellen said that President Joe Biden’s $4 trillion spending plans should be pushed through, even if they triggerhigher inflation and interest rates. Speaking to Bloomberg News during her return from the tax meeting in London, the Treasury secretary said that ending up in a “slightly higher interest rate environment would actuallybe a plus from society’s point of view.” Not everyone shares Yellen’s view onhow benign inflation may be, with even Roger Bootle, who literally wrote the book on the death of inflation, now thinking it lives again.

Legal tender

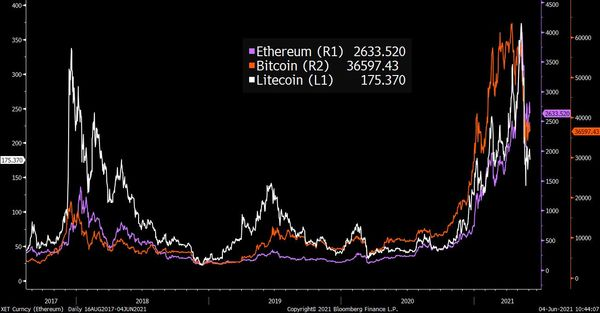

El Salvador’s young, and extremely popular, President Nayib Bukele said that his country wouldmake Bitcoin legal tender as he spoke at a video broadcast at the Bitcoin 2021 conferencein Miami. The largest cryptocurrency did not rally much on the news, and remains close to $36,000 this morning amid fears offurther crackdowns in Chinaand a Goldman Sachs Group Inc. report which suggested institutional adoption may be a long way off.

Markets quiet

Global equities remain in the doldrums this morning as investors remain uninspired by any of the political developments over the weekend. Overnight the MSCI Asia Pacific Index was unchanged, while Japan’s Topix index closed less than 0.1% higher. In Europe, the Stoxx 600 Index was little changed at 5:50 a.m. Eastern Time with miners the biggest losers. S&P 500 futures pointed to asmall move lower at the open, the 10-year Treasury yield was at 1.579%, oil retreated afterbriefly topping $70 a barreland gold was lower.

Coming up...

It is also a quiet day on the data front, with consumer credit for April at 3:00 p.m. the only release of note. The board of the International Atomic Energy Agencymeets today as Iran talks are set to resume later this week. Apple Inc.’sdevelopers conferencebegins and runs through Friday. The Commodity Trading Week virtual summit begins.

And finally, here’s what Joe’s interested in this morning

This should be the last crypto bull market. That's basically the gist of along new piece I have out this morning.

As everyone knows, cryptocurrencies tend to have a pretty high degree of correlation to each other. If you go to a site likeCoinGeckoand look at all the names listed, they tend to be doing the same thing on any given day. Usually they're all rising or falling at once. Not only it this true in the short term, it seems to hold over the longer term. Numerous coins saw massive surges in 2017, then multiple years of doldrums, and then a revival last year and this year.

Right now it seems the marginal flows into the space are coming from investors that just want to be on "crypto" who then put their chips down on a bunch of different squares and leave it at that. But as there's now enough diversity in the space we should see distinctly different performance among different kinds of assets.