- Results season for conglomerate’s listed firms is under way

- Company is trying to slash debt under stricter policies

Five months after billionaire Hui Ka Yan navigated a liquidity scareat his China Evergrande Group, investors are about to get a fresh read on the financial health of the conglomerate.

Evergrande’s four main listed units will report earnings this month, starting with its services arm on Tuesday, followed by its electric-vehiclestartupon March 25. Dates for the debt-saddled developer and cultural business unit are yet to be announced.

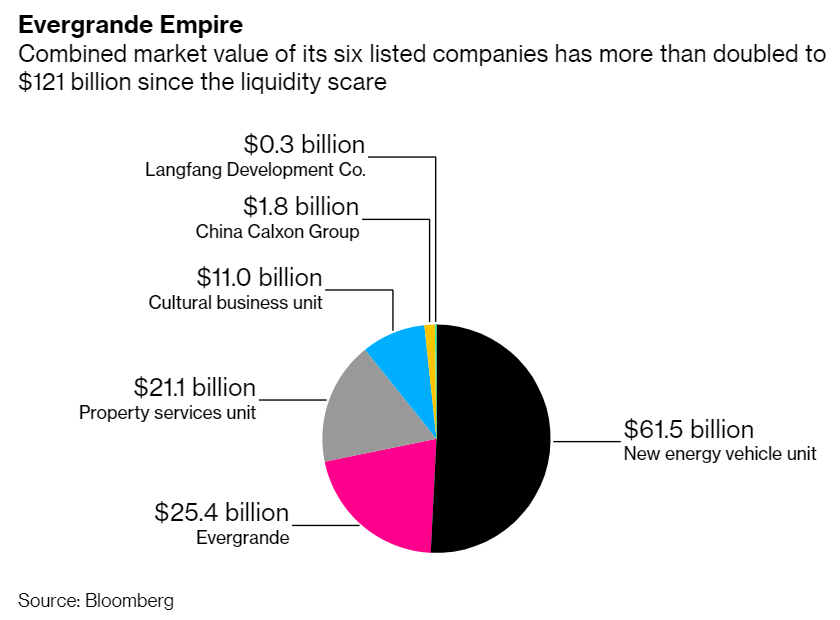

The results will offer the biggest clues on how the group is doing since its cash crunch in September sent investors running for the exit and spooked China’s top financial officials. Since the crisis, Hui’s empire has won more shareholder support, more than doubling its combined market size to $121 billion.

“For Evergrande, especially due to its high gearing, we believe that they will work even harder to make sure that banks will continue to support them,” said Raymond Cheng, a property analyst at CGS-CIMB Securities.

The policy environment has swiftly changed since the saga. In the third quarter, officials drafted what state-run media have called“three red lines”-- debt metrics that developers will have to meet if they want to borrow more. Evergrande breached all three, meaning it may not be allowed to increase its debt in the following year.

Meanwhile, authorities arereportedly wary on EV investments by developers, as latecomers like Evergrande jockey for a slice of the market. And China has tightened rules for firms outside the traditional financial industry that are designated as financial holding companies, a label given to Evergrande in 2018.

Here are key things to watch during the earnings season:

1. Deleveraging Target

One critical element is Evergrande’s deleveraging progress. The company said it pared debt by 158 billion yuan ($24 billion) in the nine months ended Dec. 31, reaching a milestone in its goal to cut borrowings by about 150 billion yuan each year from 2020 to 2022. That was the first meaningful progress after years of a poor track record on deleveraging. Meeting the target would mean Evergrande will cut total borrowings by about half in three years.

Particularly worth watching is whether the company will reveal a clearer timeline to meet certain debt criteria. Smaller rival Greenland Holdings Corp., which also breached all three metrics, was able to reach one debt requirement in February, according to a company statement.Sunac China Holdings Ltd. aims to comply with all three by 2022.

2. EV Launches

While the EV startup has swelled to about $62 billion in market value, further gains in share price may hinge on investors’ response to its product launches. In a delayed timetable, it aims to start mass production in the second half of 2021, the vehicle unit said in August. The company has unveiled a range of six new-energy cars covering sedans and SUVs, but they haven’t been officially launched.

The EV unit in September proposed a listing on the Shanghai stock exchange’s Science and Technology Innovation Board, an important move for the conglomerate’s deleveraging. No progress has been announced since then.

3. Margin Pressure

Earnings of the main developer business are particularly important for Evergrande because its new ventures are either losing money or making only small profits. But the developer’s margin faces a potential decline under heavy discounts. Evergrande’s gross margin may remain 25%, around the same level as end-June, according to a survey of seven analysts. That would be the lowest for a full year since 2004, data compiled by Bloomberg show.

Cash flow through property sales remains an important way for Evergrande to boost liquidity and income, but has been met with skepticism.

UBS Group AG analysts have expected Evergrande’s contract sales to decline 2% from 2020 to 707 billion yuan this year, while the developer has flagged it can reach 3.6% growth to 750 billion yuan. A drop in February sales raised concerns that large discounts may not be enough to drive sales in smaller cities, according to Bloomberg Intelligence analysts.