- Strategists say market concentration doesn’t indicate peak

- U.S. rally may become broader in January, according to note

There’s no reason to fear that the rally that catapulted U.S. stocks to successive records this year will end anytime soon, according to JPMorgan Chase & Co. strategists. In fact, more investors may soon join.

“Conditions for a large selloff are not in place right now given already low investor positioning, record buybacks, limited systematic amplifiers, and positive January seasonals,” the strategists led by Dubravko Lakos-Bujas wrote in a note to clients. “Investor positioning is too bearish -- the market has taken the hawkish central bank and bearish omicron narratives too far.”

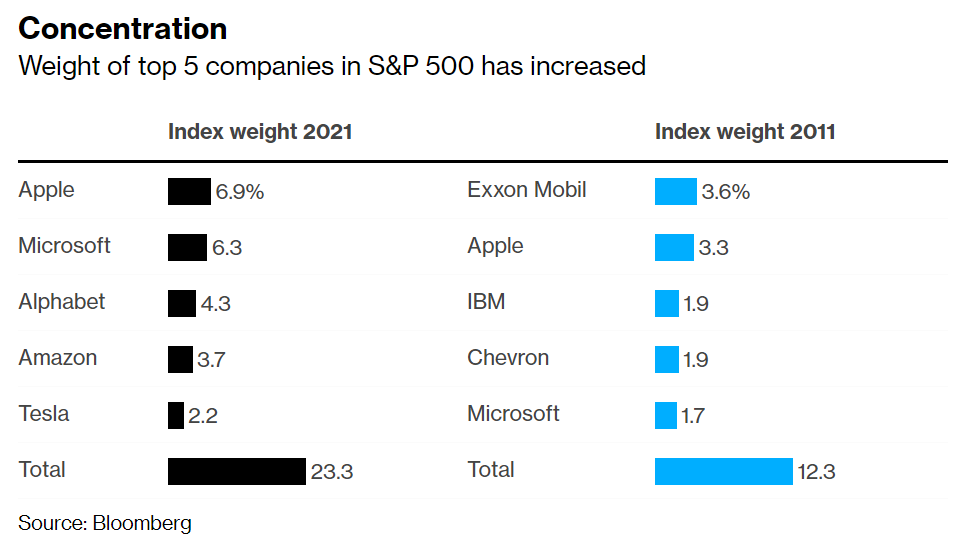

While the S&P 500 climbed to yet another record high last week, the rally has been increasingly driven by a narrow group of mega-cap companies, which is reminiscent of the bubble in tech stocks at the turn of the century. With the economic rebound following the pandemic-induced slump now past its peak, some fund managers have warned that the next stage in the cycle is a correction, as central banks and governments wind down stimulus measures to tame surging inflation.

For JPMorgan strategists, however, the “extreme stock dispersion and record concentration within equities” is an indicator of an abundance of caution, not a looming selloff. Investors have been treating mega caps as safe-havens, or “pseudo-bonds,” the strategists wrote.

If anything, the drawdown in smaller companies offers investors attractive entry points for “reopening stocks”, such as travel and hospitality, as well as energy and e-commerce, as inflation normalizes and concerns over the Fed’s hawkishness abate, the strategists said.

The bullish outlook echoes the one of Goldman Sachs Group Inc. strategists, who also said earlier this month that the narrowing rally doesn’t point to an imminent major drawdown.

“Rising concentration is not a reliable indicator for market peaks,” JPMorgan strategists said.