Apple’s earnings day is around the corner. Here is what analysts expect of the Cupertino company, and what could move the needle for Apple stock.

Apple is only a few days away from reporting fiscal Q1 results. The earnings report will be released on Thursday, January 27, after the closing bell. As usual, the Apple Maven will cover the event in real time, via live blog. Don’t miss it!

Today, we look at how high Wall Street has set the bar for the Cupertino company ahead of earnings day. The following revenue and earnings benchmark may help to determine whether Apple stock rises or falls after the company announces the holiday quarter results.

AAPL: analyst expectations

According to Yahoo Finance, Apple is expected to deliver revenues of $118.2 billion in fiscal Q1, representing 6% growth YOY. Should this happen, the sales figure will be the largest of any quarter in Apple’s history, beating the 2020 holiday quarter for the top spot.

The most optimistic of analysts sees revenues reaching as high as $121.3 billion, for 9% growth. Meanwhile, the most pessimistic of them believes that sales will barely increase. Because Apple has not been offering revenue guidance since the start of the pandemic, either number is plausible.

On the earnings side, consensus calls for EPS of $1.88 that would be around 12% higher YOY. I estimate that, for this bottom-line number to be achieved, Apple would probably need to expand operating margin by about one percentage point, which is no easy feat.

AAPL: what could move the needle

We have recently talked about one segment that is likely to support Apple’s top line next week: the Mac. PC sales skyrocketed after the start of the pandemic, but the momentum does not seem to have slowed down much.

Apple has done even better than its competitors, according to Canalys. In the most recent holiday season, the Mac saw shipments grow 9% YOY, the best among the top 5 PC vendors. We believe that average selling price will be robust due to the M1 chip upgrades, which suggests that above-10% growth in the segment is not out of the question.

Then, of course, there is the iPhone. Representing around half of Apple’s total revenues, results from the smartphone segment will certainly be followed closely by investors and analysts.

Here, two opposing forces are likely to be at play.Strong demand for the iPhone 13 will probably be a positive for the Cupertino company. On the other hand,the supply chain crisis may have put a damper on sales, particularly if long lead times discouraged the less-patient consumers from buying the device during the quarter.

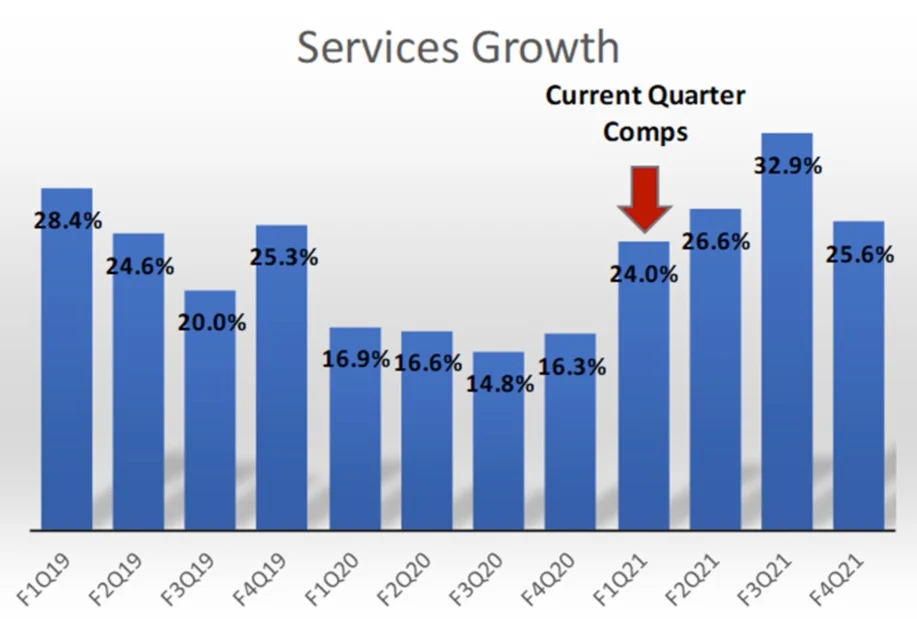

Lastly, I believe that services will be another front-and-center topic of discussion, as is usually the case. It is hard to find a bullish argument on AAPL stock that does not include secular growth in the services segment.

In our view, optimism can be triggered if Apple delivers growth rates above 20%. The chart below shows how comps will start to get tougher in fiscal Q1. Beating the strong growth cycle in fiscal 2021 by a decent margin should bode well for Apple stock and the investment thesis.