Summary

- Nvidia's stock price reaches a new historical high, but analysts' target prices and historical & peer valuation comparisons suggest that NVDA's future upside could be limited.

- NVDA's record-high stock price and premium valuations are justified to a large extent by its above-expectations quarterly results and the strong performance of its gaming & data center businesses.

- Nvidia Corporation is not a good buy now, as expectations are relatively high now as evidenced by its valuations and there are considerable risks relating to earnings disappointment.

- I think that a Neutral rating for Nvidia is fair; the company's long-term growth prospects are good, but it will be challenging for the stock to meet the market's near-term growth expectations.

Elevator Pitch

I have a Neutral rating assigned to Nvidia Corporation (NVDA).

Nvidia's stock price reached a new historical high, but analysts' target prices and historical & peer valuation comparisons suggest that NVDA's future upside could be limited. NVDA's record-high stock price and premium valuations are justified to a large extent by its above-expectations quarterly results and the strong performance of its gaming & data center businesses.

Nvidia Corporation is not a good buy now, in my view, as expectations are relatively high now as evidenced by its valuations and there are considerable risks relating to earnings disappointment. I think that a Neutral rating for Nvidia is fair; the company's long-term growth prospects are good, but it will be challenging for the stock to meet the market's near-term growth expectations.

Company Description

On its investor relations website, Nvidia Corporation calls itself "the pioneer of GPU (Graphics Processing Unit)-accelerated computing", a company focused on "products and platforms for the large, growing markets of gaming, professional visualization, data center, and automotive." NVDA was started in 1993 and listed on Nasdaq in 1999.

Nvidia generated 47% and 40% of the company's FY 2021 (YE January 31) revenue from its gaming and data center markets, respectively. The professional visualization, automotive, and OEM & others markets accounted for the remaining 6%, 3% and 4% of NVDA's sales, respectively in the most recent fiscal year.

The company also derived 27%, 23%, 19% and 7% of its top line from Taiwan, China, the US and Europe (based on where its direct customers are located), respectively in FY 2021. The rest of Asia Pacific and other countries contributed the other 19% and 5% of NVDA's revenue in the last fiscal year, respectively.

Nvidia Stock Price

It has been a great one year and five months for Nvidia's shareholders, with respect to the company's stock price performance. Nvidia's share price rose by +186% from $234.83 as of December 31, 2019 to $671.13 as of June 2, 2021.

The majority of Wall Street seem to be positive on Nvidia, with 65% and 20% of the sell-side analysts covering the stock having "Very Bullish" and "Bullish" ratings for the stock, respectively. But the analysts' target prices tell a different story. Based on S&P Capital data, the mean sell-side target price for Nvidia Corporation is $709.26, while the median target price set by analysts is $720. In other words, the market on average only expects a +5%-6% upside for Nvidia's stock price of $671.13 as of June 2, 2021.

While it is possible that some of the sell-side analysts might have yet to publish new research reports updating their target prices, the relatively limited upside implied by Wall Street analysts' target prices does suggest Nvidia's stock price and valuations are not particularly attractive.

As per the valuation comparison tables below, the market currently values Nvidia Corporation at a significant premium to its historical valuation averages and peer comparables.

Historical Valuation Comparison For Nvidia Corporation

| Nvidia's Valuation Multiple | Consensus Forward Next Twelve Months' Enterprise Value-To-Revenue | Consensus Forward Next Twelve Months' EV/EBITDA | Consensus Forward Next Twelve Months' Normalized P/E |

| Latest Valuation Multiple As Of June 2, 2021 | 16.3 | 42.0 | 41.9 |

| Historical Three-Year Average Valuation Multiple | 12.1 | 39.1 | 36.6 |

| Historical Five-Year Average Valuation Multiple | 10.7 | 34.0 | 35.9 |

| Historical 10-Year Average Valuation Multiple | 6.1 | 20.9 | 25.5 |

Source: S&P Capital IQ

Peer Valuation Comparison For Nvidia Corporation

| Stock | Consensus Current Fiscal Year Enterprise Value-To-Revenue | Consensus Forward One Fiscal Year Enterprise Value-To-Revenue | Consensus Current Fiscal Year EV/EBITDA | Consensus Forward One Fiscal Year EV/EBITDA | Consensus Current Fiscal Year Normalized P/E | Consensus Forward One Fiscal Year Normalized P/E |

| Nvidia Corporation | 16.4 | 14.8 | 41.4 | 40.9 | 42.3 | 39.1 |

| Advanced Micro Devices, Inc (AMD) | 6.4 | 5.4 | 26.9 | 21.7 | 37.9 | 30.6 |

| Intel Corporation (INTC) | 3.4 | 3.3 | 7.6 | 7.3 | 12.4 | 12.6 |

Source: S&P Capital IQ

In the next section of this article, I examine Nvidia Corporation's recent financial performance to see if the stock's high stock price and valuations are justified.

Why Is Nvidia Stock So High?

Nvidia reported the company's 1Q FY 2022 (February 1, 2021 to April 30, 2021) financial results last week on May 26, 2021. Nvidia Corporation's most recent quarterly financial performance beat market expectations, and specifically, its core gaming and data center businesses did very well. This justifies NVDA's strong year-to-date 2021 share price performance as highlighted in the preceding section.

The company's total revenue expanded by +84% YoY and +13% QoQ to $5,661 million in the first quarter of fiscal 2022. This was the highest quarterly revenue in Nvidia's history, and NVDA's top line came in +5% better than what Wall Street analysts were forecasting. Nvidia Corporation's 1Q FY 2022 diluted non-GAAP (mainly adjusted for stock compensation and M&A-related expenses) earnings per share of $3.66 also represented impressive QoQ and YoY growth rates of +18% and +103%, respectively. The company's bottom line was +12% higher than market consensus' quarterly earnings per share forecasts.

Notably, NVDA's key gaming and data center businesses drove the company's better-than-expected financial performance in the most recent quarter.

The gaming business' revenue grew by +11% QoQ and +106% YoY to $2,760 million in 1Q FY 2022. The robust growth for the gaming business was mainly attributable to higher gaming demand as a result of Work-From-Home or WFH tailwinds brought about by COVID-19, and the good performance of the company's new GeForce RTX 30 Series GPUs since its introduction to the market in September 2020. Cryptocurrency mining was also another tailwind for NVDA in 1Q FY 2022, which is detailed in the next section of this article.

Looking ahead, a key growth driver for Nvidia's gaming business in the coming quarters is the recent launch of "new GeForce RTX 3050 and GeForce RTX 3050 Ti laptops" with more than 140 "mass-market" models available priced as low as $799, as per the company's May 11, 2021 media release.

Separately, sales for Nvidia Corporation's data center business increased by +79% YoY and +8% QoQ to $2,048 million in the first quarter of the current fiscal year, which was also a new historical high. It is also noteworthy that this is the sixth consecutive quarter that the data center business has set a new historical record in terms of quarterly revenue, which is indicative of the business' strong growth momentum.

Specifically, the completion of the acquisition of Mellanox Technologies in April 2020 has been the key driving force behind the excellent growth of Nvidia Corporation's data center business. According to Mellanox Technologies' corporate profile that is available on its website, the company is a "supplier of end-to-end Ethernet and InfiniBand intelligent interconnect solutions and services for servers, storage, and hyper-converged infrastructure", and Nvidia's hyperscale data center clients had strong demand for Mellanox Technologies' products. At the company's recent 1Q FY 2022 results briefing, NVDA also disclosed that it "achieved key design wins and proof-of-concept trials for the NVIDIA BlueField-2 DPU (Data Processing Unit) with cloud service providers and consumer Internet companies."

Moving forward, the increased adoption of the NVIDIA BlueField-2 A100 ("a converged card that combines GPUs and DPUs" based onmedia release) and the recent launch of the NVIDIA BlueField-3 DPU (referred to the "first DPU built for AI and accelerated computing" at company's recent earnings call) in April 2021, are expected to boost the future revenue growth prospects of the data center business.

Given that Nvidia Corporation benefited from WFH tailwinds to a large extent in FY 2021, it is no surprise that the market expects the company's top line and bottom line growth to slow in FY 2022 as per S&P Capital IQ estimates. Market consensus sees Nvidia Corporation's revenue growth moderating from +53% in FY 2021 to 49% in FY 2022, while sell-side analysts anticipate that NVDA's normalized earnings growth will go from +75% in the most recent fiscal year to +59% in the current fiscal year.

More importantly, I think that there could be downside to Nvidia Corporation's FY 2022 financial forecasts, which I elaborate on in the subsequent section.

Is Nvidia A Good Buy Now?

I don't think that Nvidia is a good buy now. As highlighted in an earlier section of the article, Nvidia Corporation's stock price is high and its valuations are rich. More significantly, I see downside risks for NVDA's FY 2022 earnings, which I explain below.

Nvidia's strong gaming business performance in 1Q FY 2022 was partly driven by cryptocurrency mining. The company acknowledged at its recent 1Q FY 2022 earnings call that its "gaming (business) also benefited from crypto mining demand", while emphasizing that "it's hard to estimate exactly how much and where crypto mining is being done." Assuming that the price of cryptocurrencies drop significantly, demand for Nvidia's gaming GPUs could be adversely impacted. Notably, Nvidia's stock price fell to a "16-month low" in late-November 2018, after the price of bitcoin dropped by -30% in a week, according to a November 26, 2018PC Gamer article. The possibility of a repeat of such volatility in the price of cryptocurrencies and Nvidia's share price can't be ruled out.

For NVDA's other key data center business, the current semiconductor chip shortage situation is one to watch. Charlie Boyle, who is the general manager of the Nvidia DGX division,mentioned in a recent April 2021 interview with The Data Center Podcast that the data center business "hasn't been short on CPUs or GPUs" although "it's taken a lot of extra work by the company's operations team to source other components." The chip shortage represents another potential downside risk to Nvidia Corporation's FY 2022 revenue & earnings, although it does not seem to be an issue for now.

A stock is a good buy when its share price and valuation reflect relatively modest expectations, and there is a good chance of upside surprises. The reverse is true for Nvidia now i.e. lofty expectations and a high probability of downside surprises.

Is Nvidia A Good Stock To Buy Now?

I like Nvidia as a company and I am positive on its long-term growth trajectory. However, I don't see Nvidia as a good stock to buy now.

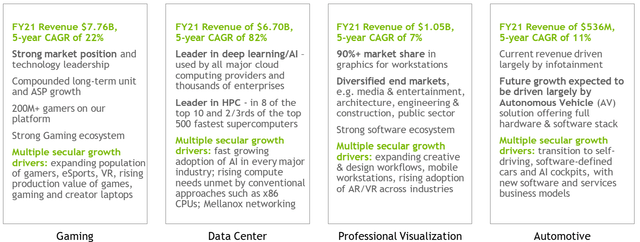

As per the chart below, Nvidia operates in fast-growing markets with lots of potential in the future. Things like virtual reality, augmented reality and artificial intelligence are important future trends, and Nvidia Corporation is a key beneficiary of such growth tailwinds. Separately, Nvidia's proposed acquisition of ARM Limited expected to conclude in early-2022, will help to address any semiconductor chip shortage issues in the medium term. Also, paying for the majority of ARM Limited acquisition consideration with its own shares (as opposed) is positive. From a capital allocation perspective, it is value-accretive to repurchase shares when one's shares are under-valued and issue shares (to drive future growth) when one's shares are over-valued.

An Overview Of Nvidia's Key Markets And Their Respective Growth Drivers

On the flip side, as explained in the prior section of this article, growth expectations for Nvidia Corporation are very high, which translate into a high probability of earnings disappointment and valuation de-rating as a result.

Nvidia Corporation's key risks are a larger-than-expected decline in the price of cryptocurrencies which depresses gaming GPU demand, and the semiconductor chip shortage situation worsening to the point that it affects the company's data center business.