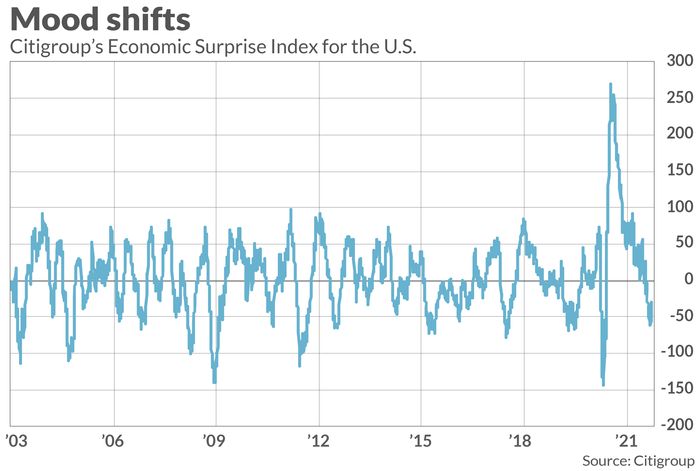

It’s an urgent question, since the Citigroup Economic Surprise Index (CESI) has been negative for two months now, following an unbroken positive stretch for more than a year. The CESI measures the extent to which the latest economic news deviates from the Wall Street consensus. The past two months of consistently negative CESI readings therefore mean that the economic news, on balance, has been worse than expected.

Is it good news or bad for stock investors that recent U.S. economic news releases have been significantly worse than expected?

The latest reading from the Citigroup Economic Surprise Index (CESI) is minus 29.2. Just 10 days ago it was even more negative, at minus 61.7. Its average over the last 18 years is 4.6.

There is no consensus among the advisers I monitor about what these latest readings mean. Some believe it’s good news, on the contrarian theory that the worse-than-expected news constitutes a“wall of worry”that the U.S. bull market can climb. Others argue that you can’t sugar-coat worse-than-expected economic news.

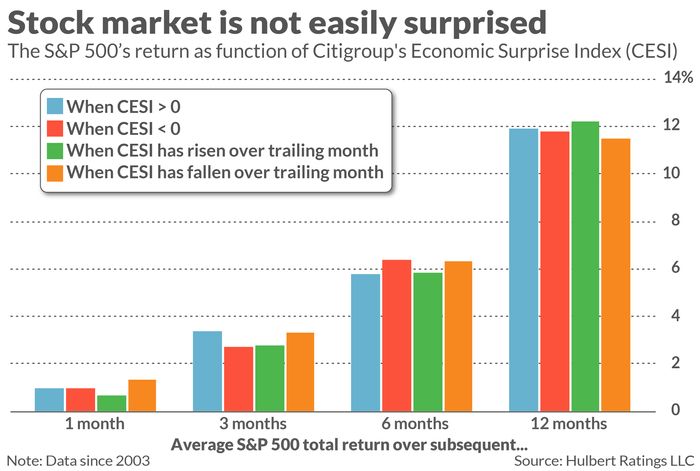

To help resolve their disagreement, I analyzed daily CESI data back to 2003. Specifically, I measured its correlation with the S&P 500’sSPX,+0.15%return over the subsequent month-, quarter-, six months, and one year. I came up with nothing that met traditional standards of statistical significance.

A summary of what I found is plotted in the chart below. Notice that the S&P 500’s average return is virtually the same regardless of whether the CESI is positive or negative, trending upward or downward.

These findings are not a criticism of the CESI itself. Citigroup created the index as a useful tool for foreign exchange traders.Citigroup has saidthat the CESI “is a perfect example of unique proprietary design which has almost no bearing on those who discuss it… It was not meant to be used for stock prices.”

There’s a broader lesson here for us to learn as well: We need to subject our intuitions to empirical reality checks. That’s especially important when our hunches seem so obviously true — as is the case when it comes to whether the economic news is coming in better or worse than expected. Stock market history is filled with expectations that were guaranteed to happen but which did not.

It can be tedious plowing through huge databases to see if a pattern really exists. But it’s worth the effort. Though being statistically rigorous does not guarantee that you will beat the market, you most assuredly will lose to the market if you’re statistically sloppy and inconsistent.