Summary

- Apple missed revenue estimates for FQ4'21 and faces major headwinds to growth going forward.

- The tech giant expects supply chain issues to lead to a greater than $6 billion impact to December quarter revenues.

- Analysts forecast minimal revenue growth over the next 3 years, as Apple faces the typical weak Product cycles combined with massive sales pulled forward into FY21.

- The stock trades at a stretched forward PE ratio of 26x while even very bullish analysts only forecast 13% upside leading to a mismatched risk/reward scenario.

After reporting a highly disappointing September quarter,Apple(AAPL) investors now have to reset their view on the tech giant. The company benefitted substantially from the COVID lockdowns pushing workers and students into buying technology gadgets for the home. My investment thesis remains Neutral on the stock until the market has reset exceptions on Apple to the reality of a slow growth behemoth.

Normalization Reset

Despite wide knowledge that revenues were pulled forward during the last FY, 5G iPhones were pushed into the year and supply chain issues will constrain current results, the average analyst is still very bullish on Apple. Even with all of these acknowledged headwinds, the stock still trades near all-time highs around $150.

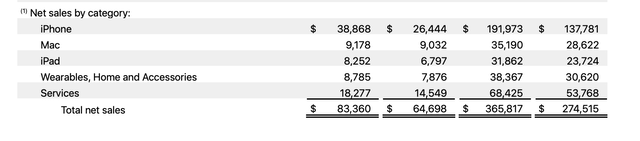

For FQ4'21, Apple missed analyst revenue targets by a wide $1.6 billion for the first quarterly miss since 2017. The tech giant saw most Product categories miss estimates, but the main issue with iPhone revenues missing the consensus $68.7 billion target by a large $3.6 billion. Most important, the quarter was already the last one with massive pulled forward revenues combined with the 5G iPhone benefit, as the big miss still corresponded with revenue growing 29%.

The quarterly revenues were even impacted by supply constraints hitting the September quarter numbers. Per CFO Luca Maestri on the FQ4'21 earnings call, the impact will be far higher in the current quarter:

As we mentioned earlier, during the September quarter, supply constraints impacted our revenue by around $6 billion. We estimate the impact from supply constraints will be larger during the December quarter. Despite this challenge, we are seeing high demands for our products and expect to achieve very solid year-over-year revenue growth and to set a new revenue record during the December quarter.

Now, this revenue pushed out into FY22 does help results going forward. Apple would've had a far higher hurdle this year with the September quarter results being a massive blowout number reaching topping $89 billion. The company would've reported FY21 sales of $372 billion and those $6 billion in sales wouldn't help the FY22 results. The actual results for the year would be much closer to breakeven at $373 billion compared to the forecasts for nearly 4% growth.

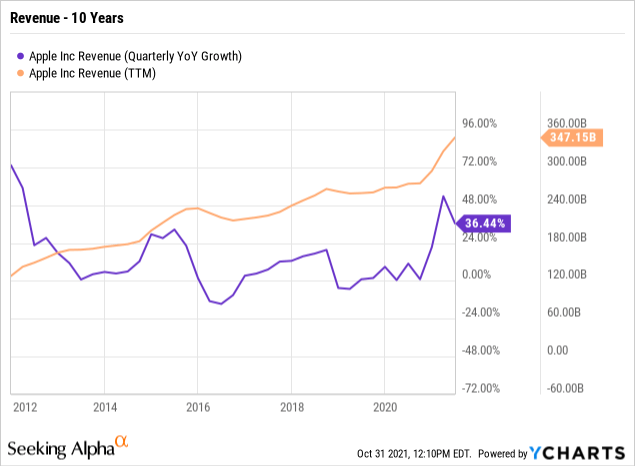

Even still, the forecast is for a strong December quarter followed my miserable quarterly numbers in at least the March and June quarters. Anyone looking at a 10-year revenue chart for Apple will quickly recognize the massive revenue pulled froward. Apple already has a history of volatile revenues due iPhone product cycles with a period of 25% growth around the FY15 iPhone launch followed by negative growth in FY16. The pattern was again repeated in FY19 where Apple reported limited growth the year after the FY18 iPhone boost.

The 5G iPhone cycle was already expected to boost FY21 revenues and the COVID revenue pulled forward just exacerbated the normal cycles. The tech giant has shifted to Services in order to cut out the volatility from Product sales, but COVID actually made services somewhat volatile as well.

Apple just reported a quarter where Services revenues grew a surprisingly strong 26%. Unfortunately though, Services revenues were the second largest bucket, but the amount was only 22% of total sales. And this was a quarter when supply constraints held back Product revenues by $6 billion, yet Services still didn't dictate the business path.

The recent App Store court ruling on payments is even forecast to impact Services growth going forward. Apple faces lower growth for App Store revenue with the inclusion of alternative payment methods in apps and the company already reducing fees for some apps.

Wildly Bullish

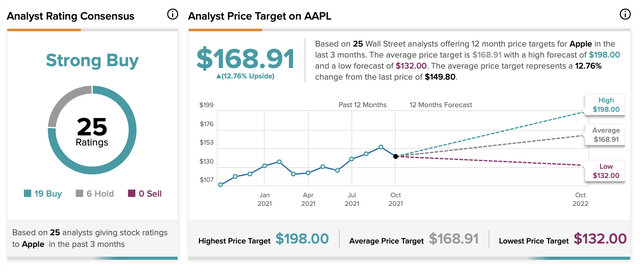

Despite all of these issues with the reset of the business, analysts are uniformly bullish on the stock. According toTipRanksdata where only analyst ratings updated in the last 3 months are included, 19 analysts have Buy ratings and only 6 analysts have Hold ratings. No analysts have maintained a Sell rating on Apple during this period.

Now that Apple has missed quarterly revenue targets and reset the strong holiday quarter to include sizable supply disruptions, analysts are wildly bullish with the stock still trading at 26x FY22 EPS estimates at $5.67. Even the analyst community hasn't outlined a scenario where Apple generates premium growth rates going forward, so the disconnect is odd.

The average analyst target of nearly $169 would offer 13% upside and leave the stock at nearly 30x FY22 EPS targets. An investor shouldn't take accept this limited return forecast considering the weak revenue growth picture could reset the stock multiple 20% lower or more. The risk/reward scenario isn't very rewarding for Apple at $150 when a 20% dip leaves the stock still trading at 21x FY22 EPS forecasts and the upside is predicted at only 13%.

Takeaway

The key investor takeaway is that while Apple remains a market leader, the company is now going through the normal cyclical revenue dips from a Product focused business. The COVID lockdowns pulled forward revenues more than normal leading to what amounts as a great reset in FY22. Investors should avoid the stock at $150 with the downside risk larger than any upside potential in the next year or more.