Summary

- Paysafe rallied to $12 based on inclusion in the Russell 3000 and Reddit mentions.

- The payments company is stuck with 10% growth despite the growth in the U.S. iGaming market.

- The stock trades at 23x '21 EV/EBITDA targets due to a $2 billion debt load.

The fintech space remains red hot, but Paysafe Limited (PSFE) is one such company lacking the growth typical of the sector. The company is focused on payments in the iGaming space, but Paysafe just reported underwhelming Q1 results. My investment thesis is Neutral on the stock, but the iGaming sector keeps us interested in watching the story here for the long term.

Underwhelming Q1

Paysafe completed the business combination with the Foley Trasimene Acquisition Corp. II SPAC back on March 30. The stock originally traded as high as $19 on excitement over the growth potential of payments in the iGaming sector, but the company had meager guidance. Recently, Paysafe fell as low as $10 following weak numbers with the Q1 report.

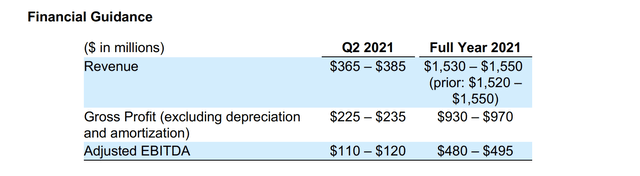

For Q1, the fintech reported revenues beat estimates by $11 million, but Paysafe only reported 4.9% revenue growth. The adjusted EBITDA number was flat at $113 million while payments volume did grow by 8% to $28 billion.

The company reaffirmed guidance for 2021, but the market likely expected a number hike. Paysafe forecasts revenue of $1,540 million for only 10% growth over last year.

The company has set a goal for 10%+ annualized organic revenue growth, but the market likely hoped this number was very conservative rather than actual results confirming this reality. The stock already has a market cap of ~$9 billion and an enterprise value of nearly $11 billion based on $2 billion in debt with Paysafe trading up at $12. The stock trades at an EV of nearly 23x the adjusted EBITDA target for 2021.

Considering Paysafe already has 32% EBITDA margins, the story is far more mature than most SPAC stocks and maybe not what one expected of a payments company targeting the hot iGaming space with a digital wallet involved in the crypto space. The stock got a nice rally over the last few weeks due to the inclusion in the Russell 3000 and some mentions from the Reddit crowd, so investors should steer clear here above $12 outside of short-term trade reasons.

iGaming Payments Growth

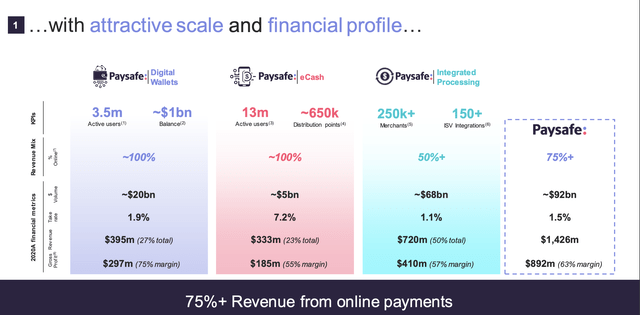

The company plays in all of the hot sectors with a payments platform focused on sports betting, online casinos, eSports and fantasy sports. Paysafe has a digital wallet that works withDraftKings(NASDAQ:DKNG)and bet365 while the eCash network works with Fortnite and Twitch, but most of the business is in the Integrated Processing payments segment where the take rate was only 1.1% last year.

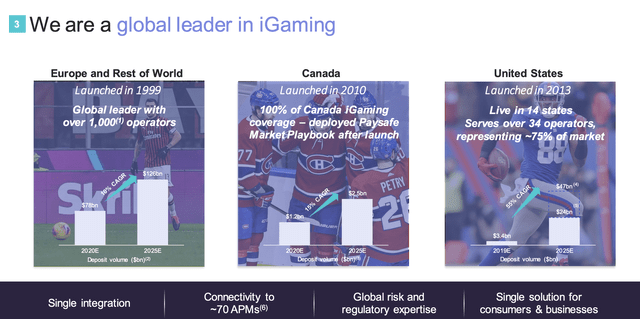

The U.S. iGaming market is growing at a 55% clip, but Paysafe is involved more in the online commerce market with growth closer to a 10% rate. Right now, the Europe and ROW segments have payments volumes up to 10x the U.S. market, but this segment is far more mature having launched all the way back in 1999.

The iGaming payment network is already live in 14 states in the U.S. with ~75% of the operators in those states, but the size of the market is swamped by Europe and such. Even if the U.S. iGaming payments market reaches 2025 targets of $24 billion in payment volumes, Europe and ROW is already a $78 billion payments market and will still reach nearly 3x the U.S. levels in 2025.

Ultimately, the story just doesn't have the sizzle as some of the other payments stocks recently going public. Paysafe has solid 10% revenue growth ahead, but the company will have to find another catalyst to move the needle for investors in the payments space to really get excited by the story.

Otherwise, Paysafe is a solid buy once the stock dips back to $10 following the recent Reddit and index inclusion rally. As the market better understands the $2 billion load, a lot of the upside could be limited.

Takeaway

The key investor takeaway is that Paysafe is a solid company in a growing market. Investors have to recognize the company is a 10% grower, not the 50% grower of the U.S. iGaming market due to other business operations outside of the U.S.

Any more involvement in the crypto space could boost the growth story and make the stock more appealing. Investors interested in the fintech and payments space should keep Paysafe on a watch list to see how the story develops over time and possibly buy the stock on dips.