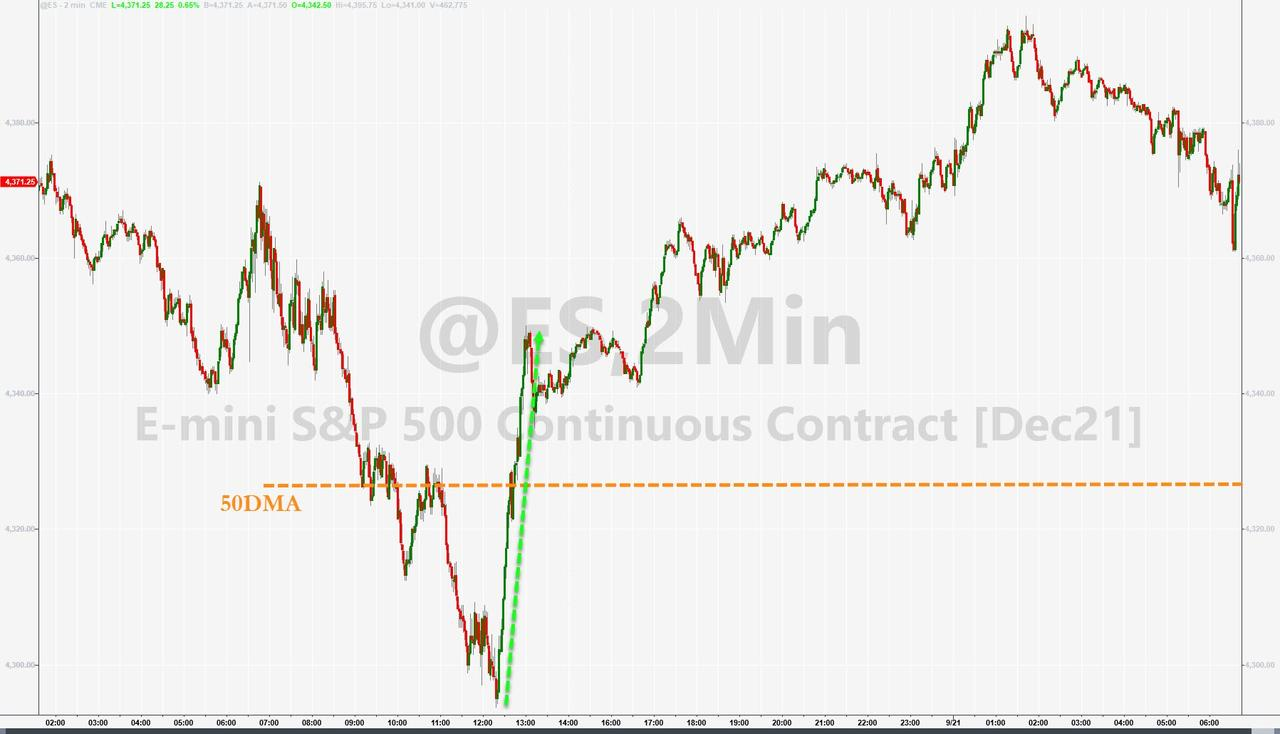

A dramatic rebound in stocks - off the S&P's 100DMA - has prompted many commission-rakers and asset-gatherers today to call the end of the Evergrande event and signal the all-clear to new highs.

Nomura's Charlie McElligott explains thatthere is simply no way to overstate the power of the “reflexive vol sellers” into another spike, as this “sell the rip (in vol)” = “buy the dip (in stocks),”particularly as it related Put sellers either directionally shorting “rich” vols yday…and “long sellers” who monetized their downside hedges by the close (a lot of that being 1d SPY Puts from Retail “day traders” which doesn’t show in OI), creating $Delta to buy and again self-fulfilling yet another “turnaround Tuesday”

Critically, that Delta buying in the late day was hugely important then in reducing the absolute $ of systematic deleveraging “accelerant” flows,because only closing down -170bps in SPX then meant a much more manageable -$24.7B of Vol Control de-allocation in coming days, as opposed to what would have been a much more challenging -$62.9B to digest which we estimate would have been triggered off of a “-3% close”…while similarly, Leveraged ETFs only needed to rebalance -$5.9B at EOD, as opposed to a hypothetical -$8.9B assumed at the low of the day

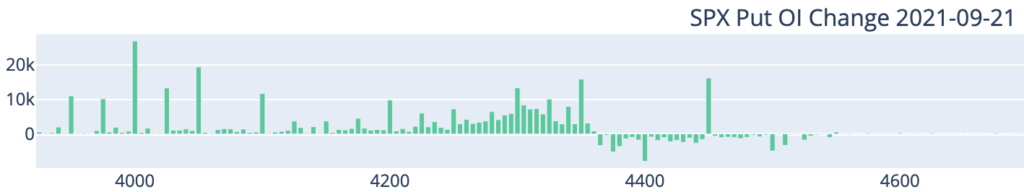

Specifically,as SpotGamma details, the chart below shows that puts were net closed at all strikes above 4365 SPX (and 435 SPY) but there were fairly substantial positions added to lower strikes.

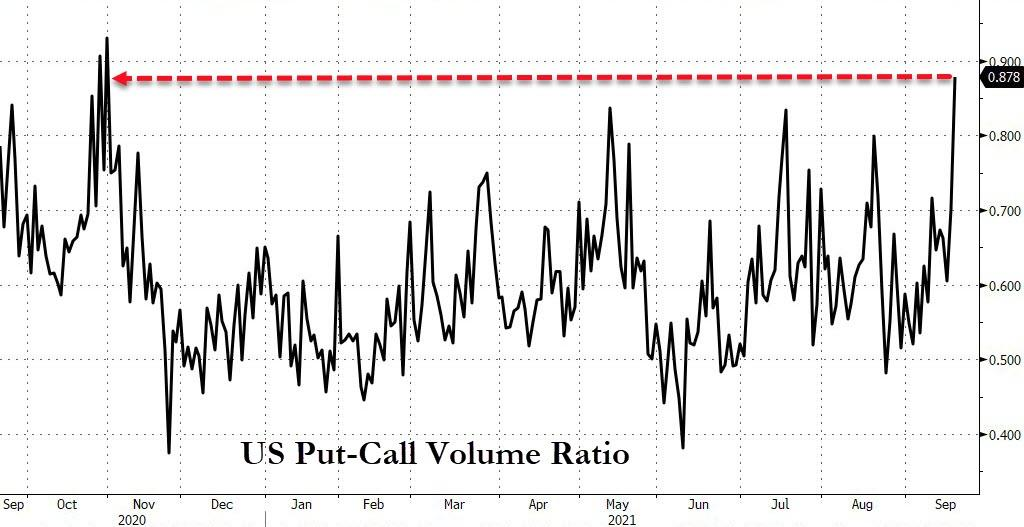

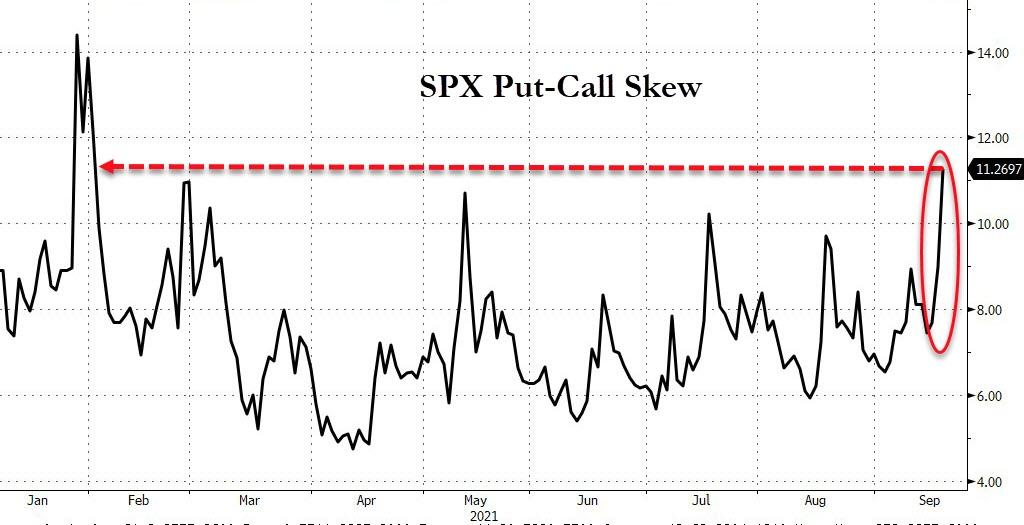

Put volume surged relative to calls yesterday...

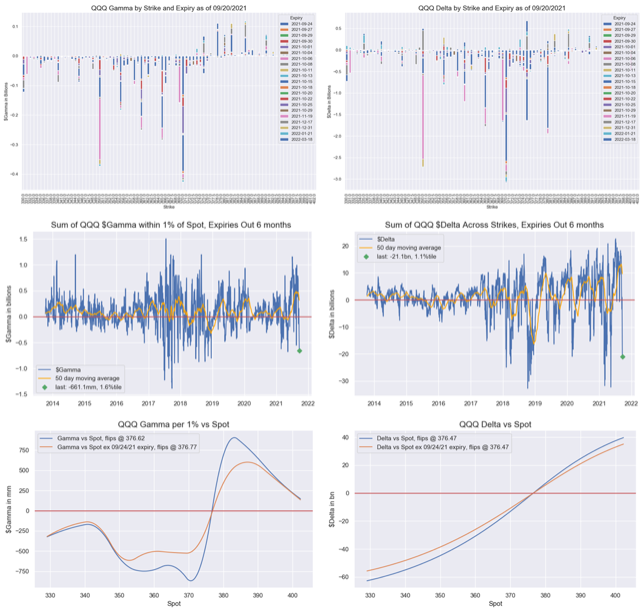

To Nomura's Charlie McElligott's amazement yesterday, we saw confirmation of our repeated point made stating that “the only things that clears out all that “crash” pricing in vol metrics is a crash”... yet it isVERY worth noting then that we actually saw Skew still steepen further yday despite incredibly high levels of both ATM Vol and Skew(SPX 1m 25delta Put Call Skew steepened 70bps, same gig for others: QQQ 64bps, IWM 37bps)...

SpotGammaconcludes that its up to Powell tomorrow to set the next price move, which should be rather substantial due to the options positioning.Negative gamma could strongly influence any selling to the downside.