Summary

- Shares of AMC surged 23% on news of a private share placement.

- Private share placements dilute shareholders and AMC's price should have gone down, not surged.

- It looks as if this hedge fund just monetized the Reddit army.

Shares of AMC Entertainment (AMC) surged another 23% on Tuesday after the movie theater chain announced a private placement of shares to an investment fund. Normally, capital raises cause stock prices to fall, not increase. The hedge fund looks to have turned the tables on the Reddit army.

Reason for AMC's price reaction

Movie theater company AMC just did what a lot of companies do that have a lot of debt to service and need to confront an uncertain future… they offer new shares to investors and use the funds as a life line to survive.

AMC issued 8,500,000 shares for $230,500,000 to an investment firm named Mudrick Capital Management, LP. The investment firm has a focus on event-driven investing and distressed debt.

AMC said that it will use the proceeds from the capital raise for the "pursuit of value creating acquisitions of theater assets and leases, as well as investments to enhance the consumer appeal of its theaters".

Fresh capital is much needed. AMC's revenues cratered during the pandemic and the theater chain is still suffering from COVID-19 shutdown restrictions and social distancing regulations.

Although AMC's revenues are expected to bounce back this year as the pandemic seemingly comes to an end, COVID-19 may have changed movie viewing habits permanently.

One big challenge for AMC will be to get viewers back into its movie theaters. Streaming already was a competitive threat to the industry before COVID-19 and the pandemic may have accelerated this trend. A lot of people seem to have serious anxiety regarding a lockdown exit, so there is a valid question to be asked if movie theaters can really return to normal once the pandemic ends.

But back to AMC's announcement.

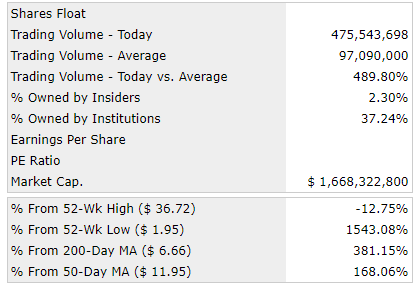

Shares of AMC surged 23% on Tuesday, which brings the total year-to-date return to more than 1,500%.

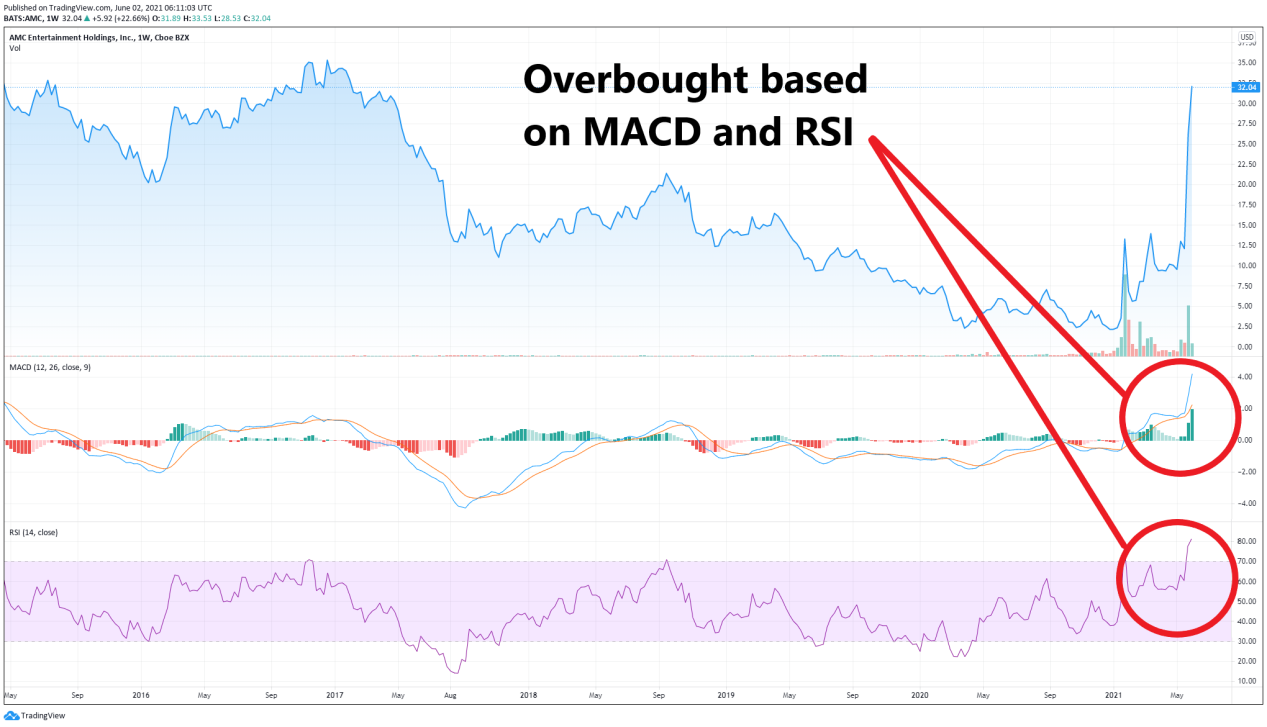

Looking at the technical situation of AMC… shares are now very, very much overbought...

AMC's trading volume on Tuesday was almost 500% the average trading volume with almost half a billion shares being bought and sold…

However, the price reaction literally makes no sense given that the firm announced a capital raise, which increases the number of shares. As more shares are issued, the firms EPS is poised to decline as earnings are distributed over a larger amount of outstanding shares. The reaction to a capital raise is typically for the share price to fall, not to increase.

AMC now has a market capitalization of $14.4b compared to less than $1b in January...

A hedge fund is turning the tables on the Reddit army…

Mudrick Capital Management is said to have already exited its position in AMC after making a quick 20% on Tuesday. So Mudrick Capital Management is not a long term investor that is bringing its distressed debt and special situation expertise to AMC… the whole thing was really just a quick flip as the investment firm offloaded overpriced shares to retail investors that continue to buy into the frenzy because they hope for a short squeeze. The firm itself brazenly called AMC "massively overvalued." If the firm made a 20% return on its invested capital, it secured $46m in profits yesterday… not bad for a day's work!

While AMC was likely happy to get an equity raise done at this valuation, the hedge fund sold its stake faster than AMC could get the filing about its unregistered sale of equity securities out...

Extreme volatility and risks...

AMC's valuation has become even more ludicrous on Tuesday than it already was before. The movie theater chain, which was close to bankruptcy just a few months ago, now trades at a P-S ratio of 3.

Cinemark Holdings (CNK), a theater rival which may itself be overvalued, trades at a P-S ratio of 1.0.

The risk here is immeasurable because neither the price action nor the valuation makes any sense for AMC.

AMC's price should have gone down yesterday, not up because a capital raise is dilutive... but nothing makes sense anymore when it comes to AMC.

AMC is trading independently of its business numbers and growth prospects and the risk of losing everything in this "investment" is extremely high.

Closing thoughts

A hedge fund just had a big victory and nobody seems to notice or care.

You literally had a hedge fund flipping its stake in AMC to the Reddit army at a massively overpriced valuation and explicitly calling AMC "overvalued." It can't get any more brazen than this. Please be careful.