A key measure of lending continued to decline at the biggest U.S. banks, according to the latest Federal Reserve data.

A key measure of lending continued to decline at the biggest U.S. banks, according to the latest Federal Reserve data.

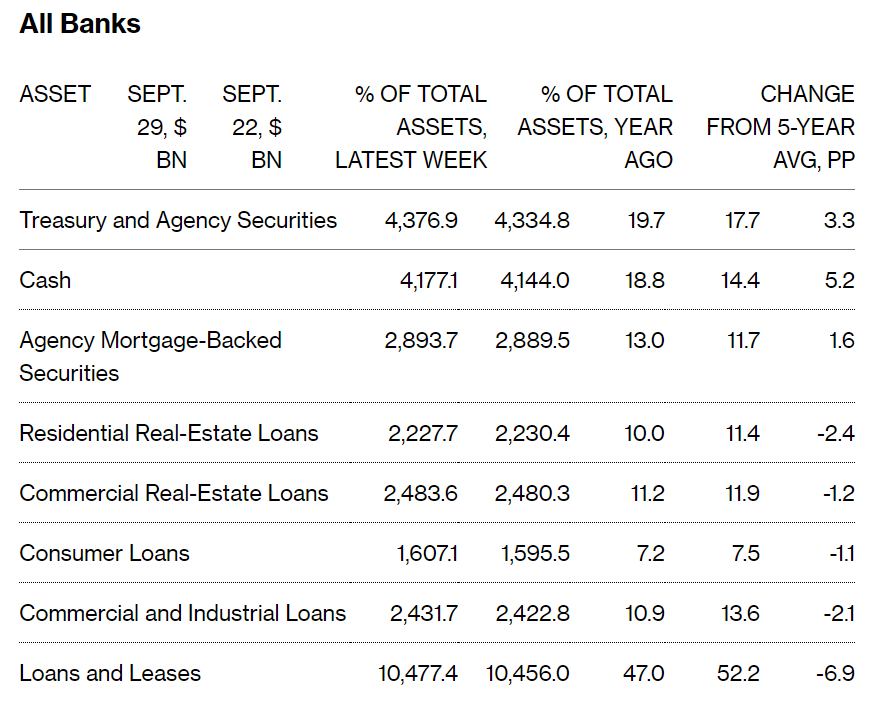

Loans as a percentage of total assets fell to 47.05% in the week ended Sept. 29 from 47.11% the prior period, the Fed data show. Banks’ cash piles rose.

- Total assets increased to $22.27 trillion from $22.19 trillion

- The share of safe assets — virtually riskless investments such as cash, Treasuries, and securities effectively guaranteed by the U.S. government — increased to 51.4% of total assets from 51.2%

- Loans and leases as a percentage of deposits increased to 59.7% from 59.6%

- Treasury and agency securities were the highest as a percentage of total assets since September 1994

- Residential real-estate loans hit a historic low as a percentage of total assets at 10.0%

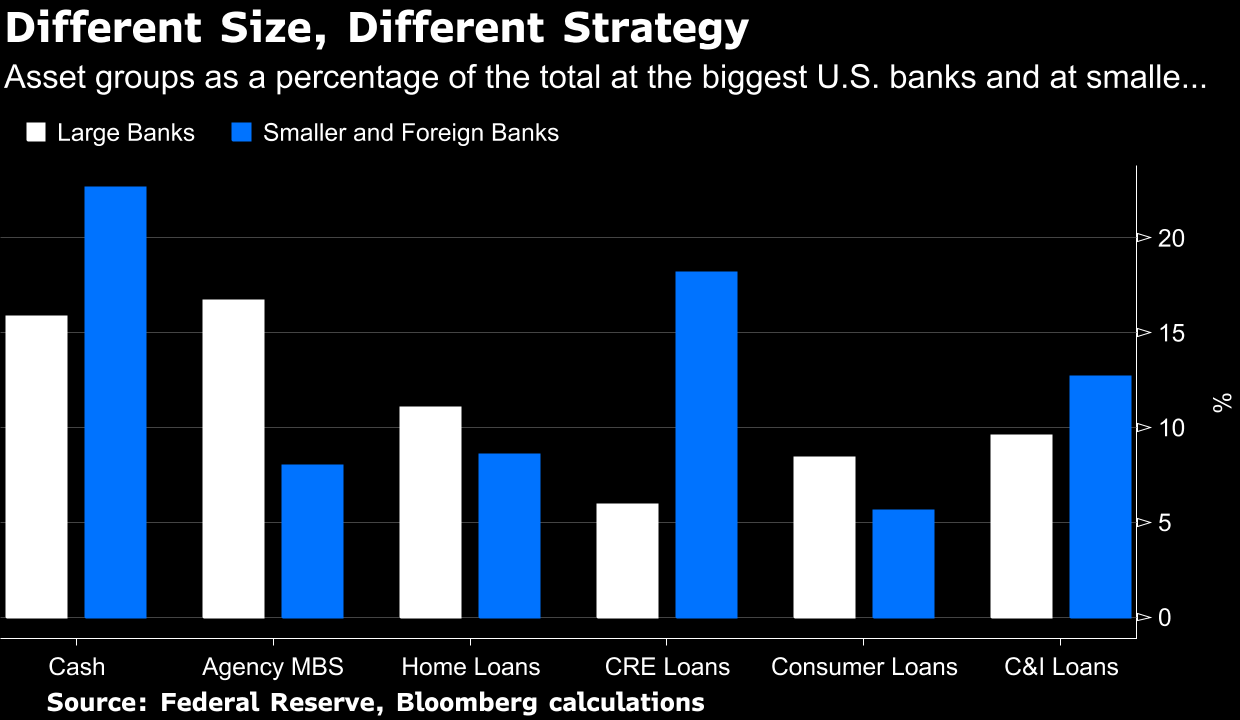

The Fed also reported the assets of the large, small and foreign-related U.S. lenders. Here’s how their balance sheets compare on selected parameters:

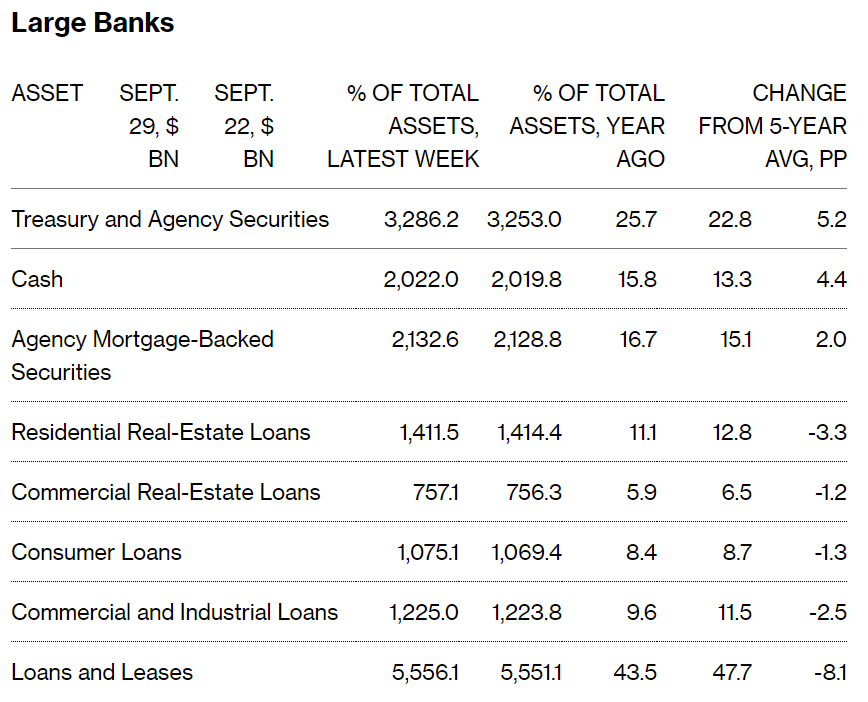

- At the 25 largest banks, total assets rose to $12.77 trillion from $12.76 trillion the week before

- Treasury and agency securities hit a historic high as a percentage of total assets at 25.7%

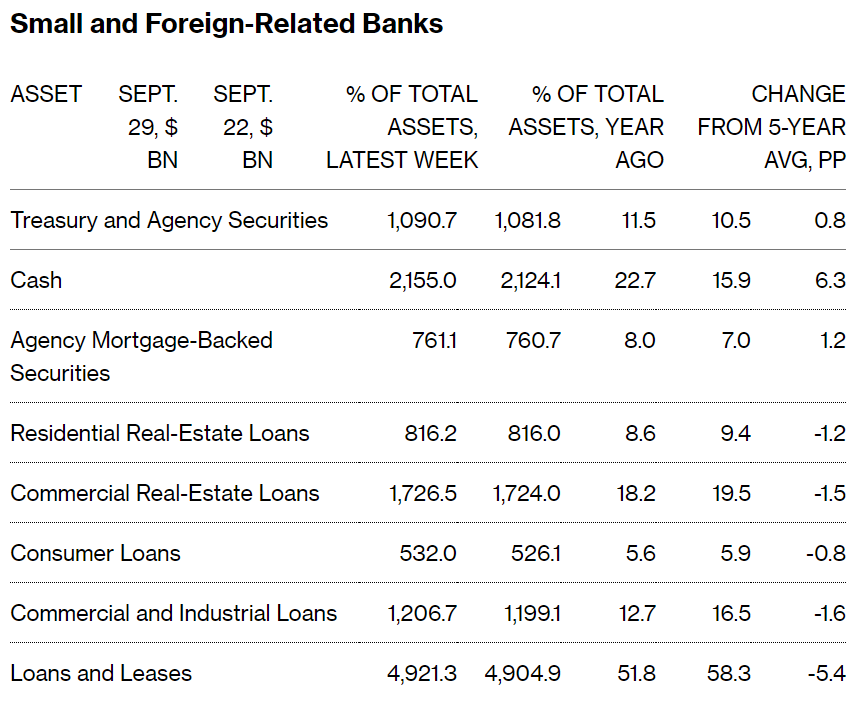

- At the smaller and foreign banks, total assets increased to $9.50 trillion from $9.43 trillion the previous week

- Treasury and agency securities were the highest as a percentage of total assets since June

- Cash was the highest as a percentage of total assets since December 2015

- Residential real-estate loans reached an all-time low as a percentage of total assets at 8.6%

- Commercial real-estate loans were the lowest as a percentage of total assets since August 2016

- Commercial and industrial loans were the lowest as a percentage of total assets since January 2015

- Loans and leases were the lowest as a percentage of total assets since November 2015