Focus on NIO vehicle deliveries

KEY TAKEAWAYS

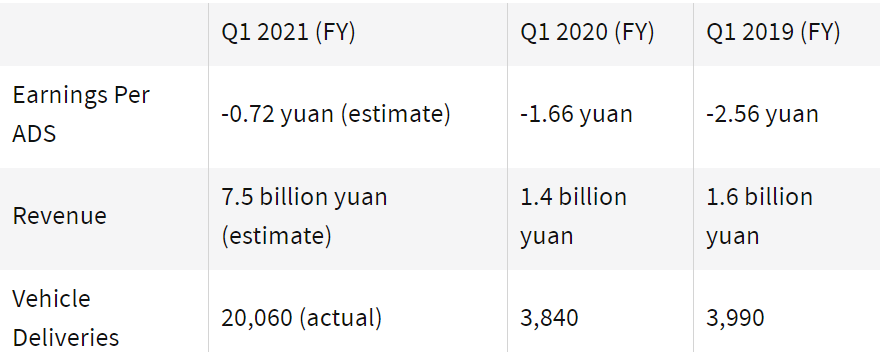

- Analysts estimate earnings per ADS of -0.72 yuan vs. -1.66 yuan in Q1 FY 2020.

- Vehicle deliveries, already announced, rose dramatically YOY.

- Revenue is expected to soar on expanding vehicle sales.

NIO Inc. (NIO), like many other automakers, was forced to halt production this year due to the global semiconductor shortage. Semiconductor chips, widely used in smartphones, computers, and other electronic devices, are especially important to NIO, a maker of premium electric vehicles (EVs). NIO's production stoppage in late March had little impact on the company's record vehicle deliveries in Q1, but it could affect future production numbers.

Investors will focus on how these forces affect NIO's immediate results, as well as its financial outlook, when the company reports earnings on April 29, 2021 for Q1 FY 2021.Analysts are expecting the company's loss per American depositary share (ADS) to narrow significantly as revenue expands at a rapid pace.

Vehicle deliveries are another key metric investors watch in order to gauge the company's productive capacity. NIO already reported vehicle deliveries for the first quarter earlier this month, achieving a new quarterly record despite total deliveries coming in slightly below expectations.

Shares of NIO have dramatically outperformed the broader market over the past year. But after reaching all-time highs earlier this year, the stock has fallen considerably and has been trading mostly sideways since early March. NIO's shares have provided investors with an astronomic total return of 1,171.9% over the past year, well above the S&P 500's total return of 45.5%.

NIO Earnings History

The stock, which had been gathering downward momentum after peaking around mid-February, plunged following NIO's Q4 FY 2020 earnings report released at the beginning of March. The company reported a much larger loss per ADS than analysts expected and revenue also missed estimates. However, NIO's loss narrowed considerably compared to the year-ago quarter and revenue was still up 133.2%.The company was optimistic about its performance, noting that its gross margin rose to 17.2% compared to negative 8.9% in the year-ago quarter.

In Q3 FY 2020, NIO posted a loss per ADS of 0.98 yuan ($0.15 as of the CNY/USD exchange rate on April 27, 2021).It was the smallest loss in at least 11 quarters. Revenue rose 146.4%, maintaining the pace of growth achieved in the second quarter.NIO said it delivered a record number of vehicles and saw improvements in its average selling price. The company also said that it was the second straight quarter of positive cash flow from operating activities.

Analysts expect continued improvement in NIO's financial results in Q1 FY 2021. While NIO is still expected to post another loss per ADS, it is estimated to be the lowest in at least 14 quarters. Revenue for the quarter is forecast to rise 446.1%, which would be the fastest pace since Q2 FY 2019. For full-year FY 2021, analysts are currently expecting NIO to achieve a loss of 2.72 yuan per ADS, which would be the smallest loss in at least five years. Revenue is expected to rise 109.7%, a faster pace than in each of the last two years.

The Key Metric

As mentioned above, investors are also watching the number of vehicles NIO delivers each quarter. NIO generates some revenue from various services it provides, but the majority of revenue is derived from vehicle sales.Currently, the company makes deliveries of three types of vehicles: the ES8, the company's 6-seater and 7-seater flagship premium smart electric SUV; the ES6, the company’s 5-seater high-performance premium smart electric SUV; and the EC6, the company’s 5-seater premium electric coupe SUV.The number of vehicle deliveries provides an indication of the demand for NIO's vehicles as well as the company's ability to scale production.

NIO has significantly ramped up its production over the past few years. The company delivered 11,350 vehicles in FY 2018. In FY 2020, it had nearly quadrupled that figure, delivering 43,730 vehicles. Despite a slowdown in Q1 FY 2020 amid the COVID-19 pandemic, NIO quickly made up for the Q1 drop in deliveries with a 190.8% year-over-year increase in Q2 FY 2020. Total vehicle delivery growth decelerated to 154.3% in Q3 and then to 111.0% in Q4. However, vehicle deliveries rose 423.0% in Q1 FY 2021, hitting a new quarterly record, as mentioned above. For full-year FY 2021, analysts are forecasting NIO to deliver 88,280 vehicles, which would be more than double last year's total deliveries. However, NIO warned investors in early March that the global chip shortage is likely to cut its production capacity, at least in the second quarter.