Summary

- ETSY has been a multi-bagger over the last 2 years, but the future remains as bright as ever.

- Growth has slowed as the company laps pandemic quarters.

- ETSY trades at only 12.9x sales and 55x earnings.

- I explain why ETSY is a strong buy for long term investors.

Etsy(NASDAQ:ETSY)is one of those stocks that has sold off due to hopes of a pandemic recovery. Yet Wall Street may be underestimating the long term tailwinds brought upon by the pandemic, as ETSY has benefited from a dramatic boost to its name brand unlike no other. In spite of the post-earnings drop, ETSY is still producing gobs of cash and has strategically positioned itself to take on the global e-commerce market. I rate shares a strong buy for long term investors.

Etsy Stock Price

ETSY was a huge beneficiary of the pandemic as the country not only increased its appetite for face masks but also customized goods in general:

Yet the stock has struggled since reaching all time highs earlier in the year. With concerns regarding the pandemic in large part in the rear view mirror, is ETSY still a buy?

What is the target price for ETSY?

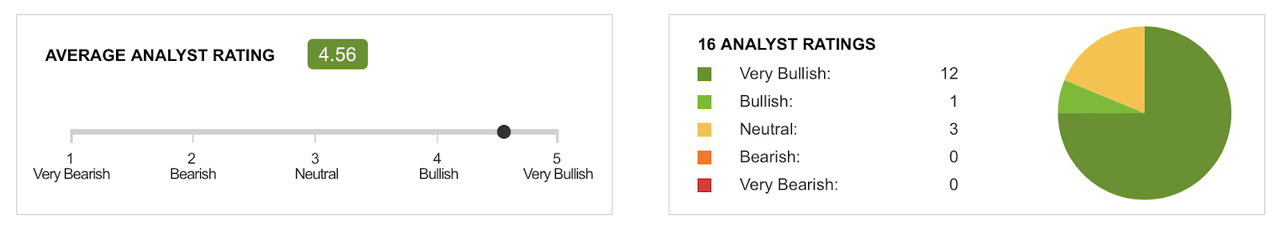

Wall Street analysts remain quite bullish on the company’s prospects, with an average analyst rating of 4.56 out of 5:

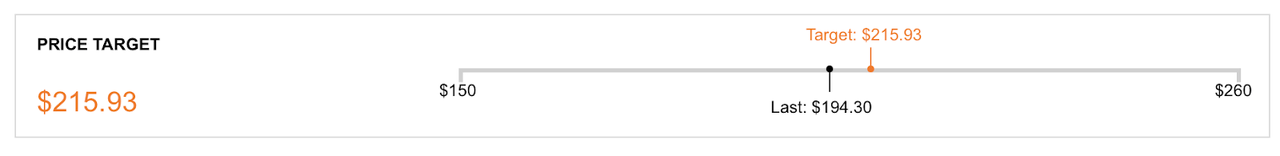

The average price target of $215.93 suggests around 13% upside:

Is Etsy Stock Overvalued?

Even though ETSY fell double-digits after reporting earnings, there’s an argument that the stock is still undervalued.

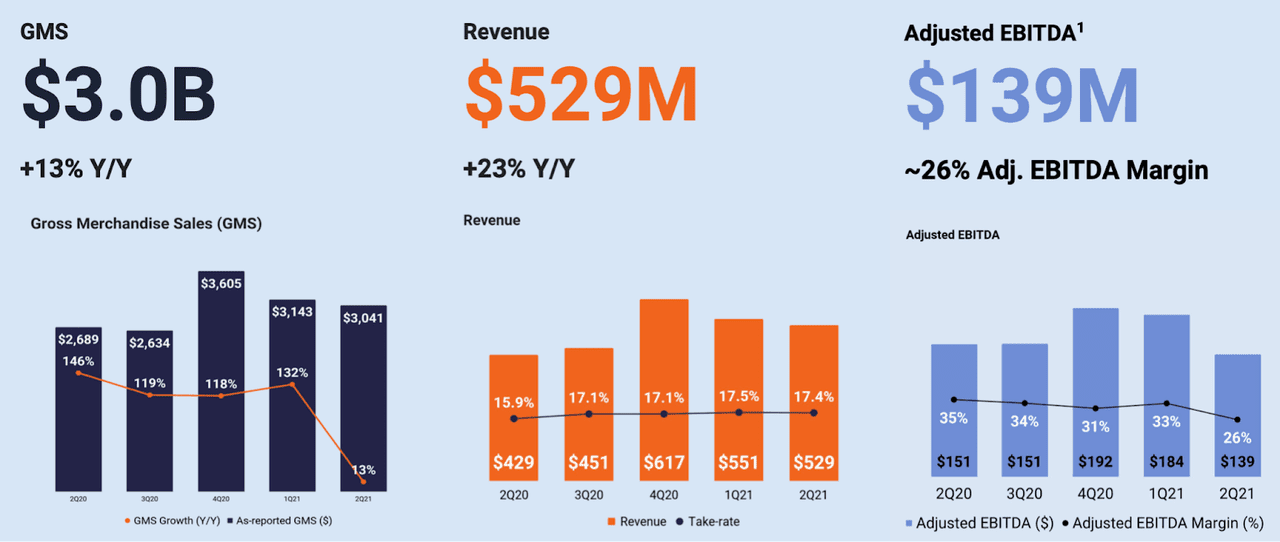

Revenue grew 23% year over year - a solid growth rate but a huge deceleration from the 141% growth rate of the prior quarter.

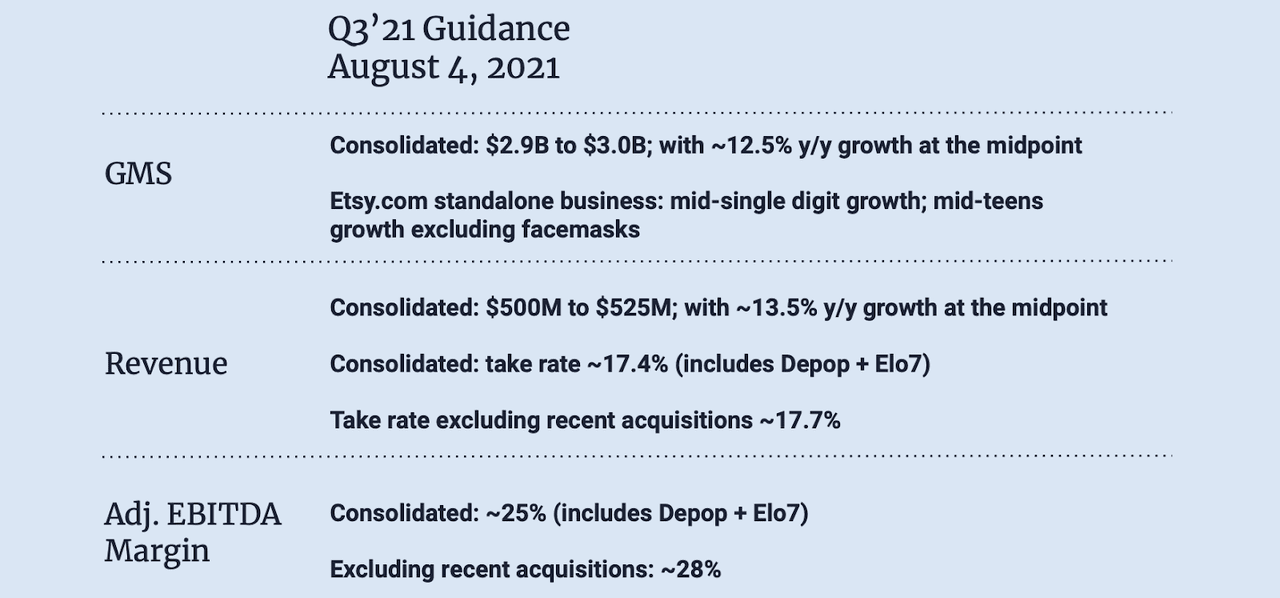

The slowdown was to be expected. It appears that the stock fell due to what appears to be conservative guidance of just 13.5% YOY revenue growth for the next quarter:

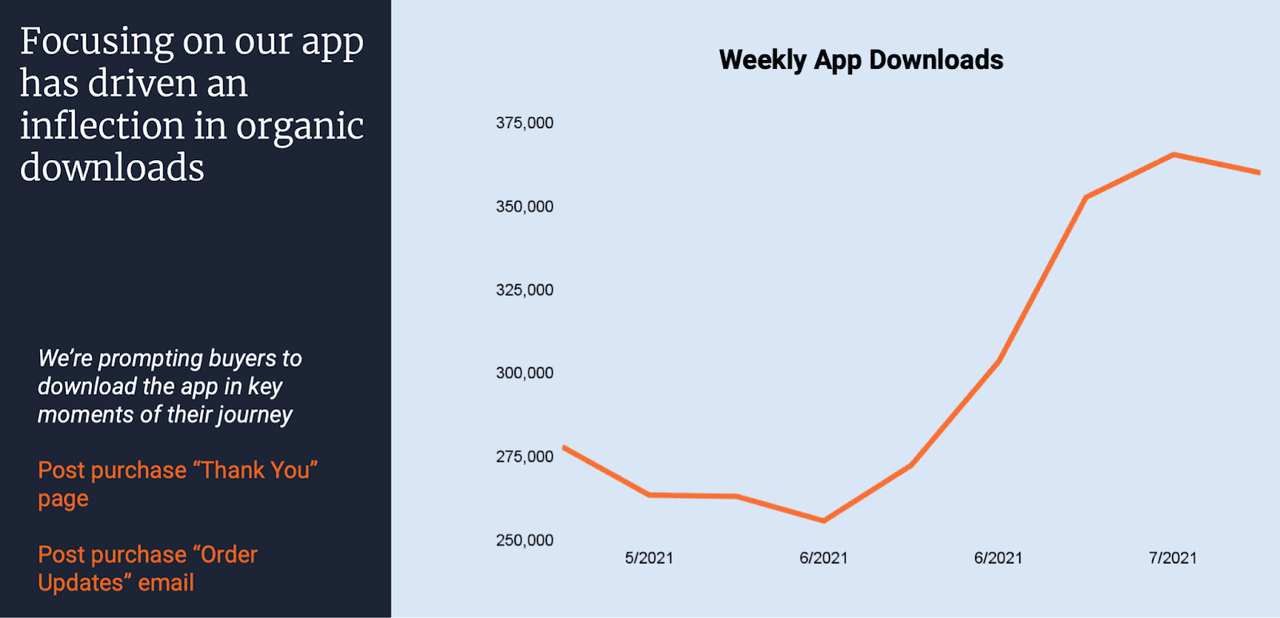

Wall Street, as you no doubt know, often focuses too much on near term earnings numbers. If one zooms out and takes a longer term lens, they might find that stocks can experience great volatility around earnings even if they are still trending up longer term. We can see below that weekly app downloads have been getting stronger in recent months:

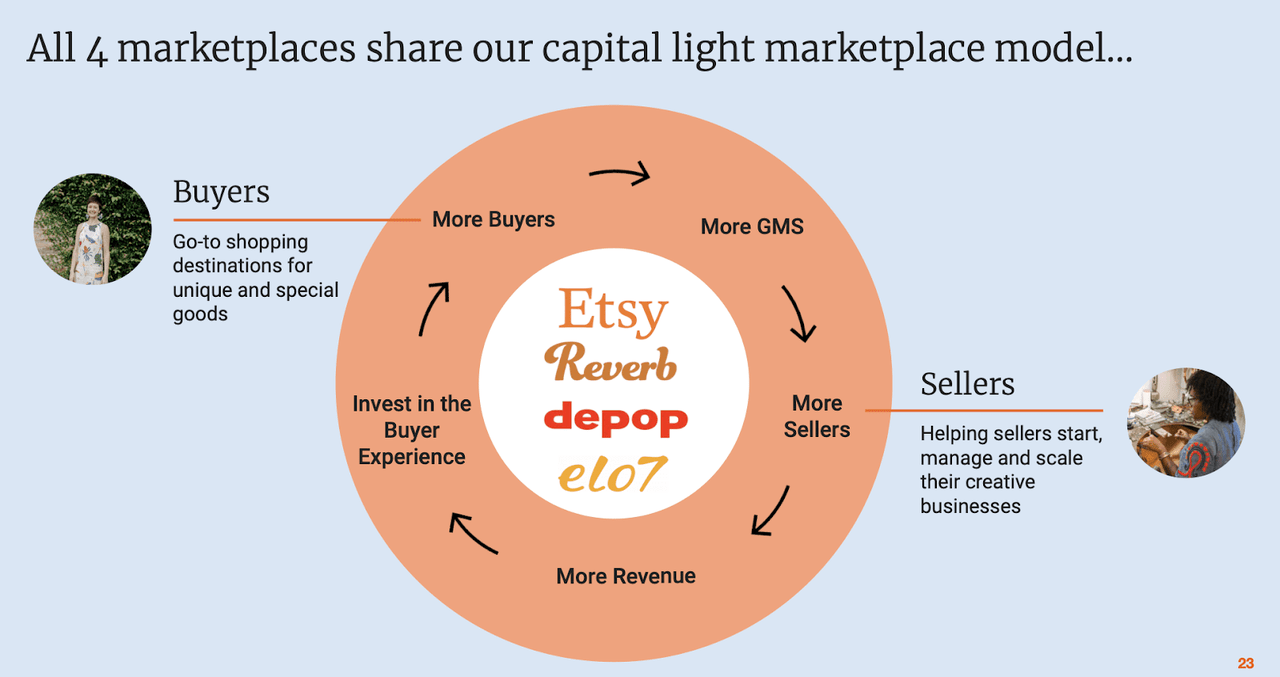

ETSY has been trying to emerge as an e-commerce powerhouse that can rival Amazon(NASDAQ:AMZN). Part of that strategy is dominating the resale space, an area it entered through its acquisition of Depop.

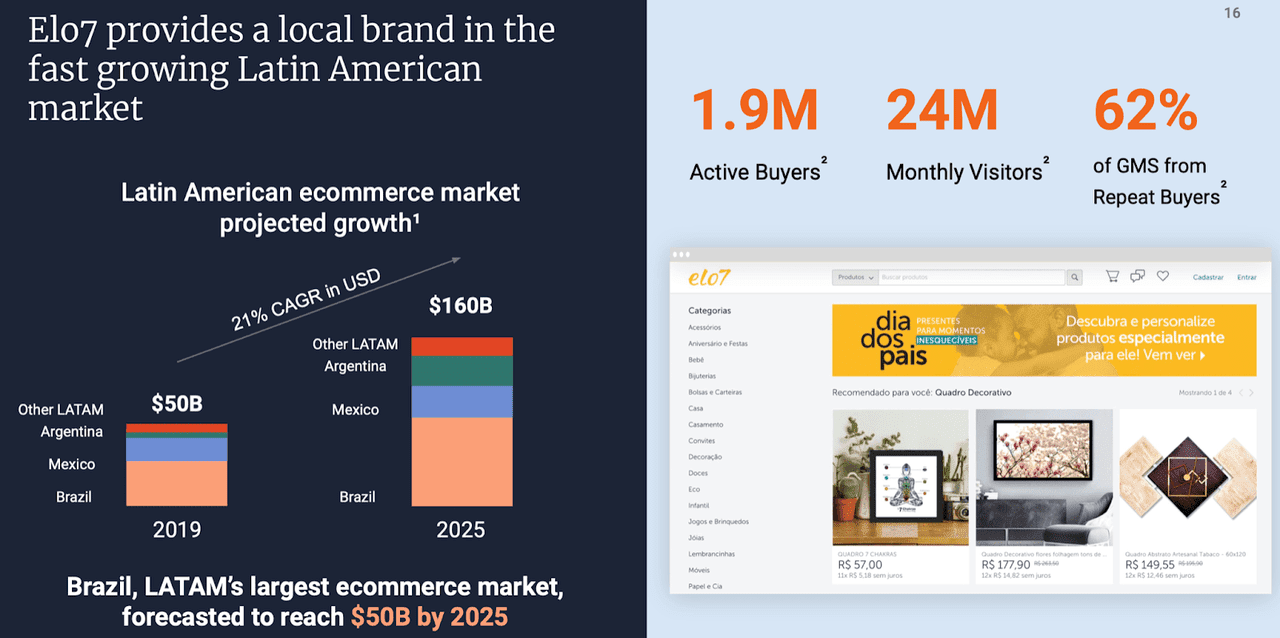

ETSY has also acquired Elo7 - the “Etsy of Brazil.”

I expect this acquisition to prove to be an important growth driver in the future. ETSY was able to become an incredible marketplace on its own. Elo7 will benefit from ETSY’s investment.

Together, these platforms position ETSY to become more than just a niche e-commerce marketplace: ETSY is set to become a legitimate e-commerce challenger to the likes of Amazon and Shopify(NYSE:SHOP).

Is ETSY Stock A Buy, Sell, Or Hold?

As of recent prices, ETSY is trading at 12.9x trailing sales and 55x earnings. Net income is likely held back due to accelerated investment in sales & marketing. When one wants to buy something on Etsy.com, the search results are much better on that website itself, as opposed to Google. That’s why it makes sense for ETSY to invest so aggressively in sales & marketing so people know about Etsy in the first place. At some point, I expect ETSY to scale back sales & marketing and just let the cash flow to the bottomline.

The stock might not look so cheap right now, but this is a cash cow which I can see returning to 20+% growth next year and beyond. For what it’s worth, Wall Street analysts expect ETSY to maintain robust growth rates through 2025:

I expect ETSY to be able to drive strong operating leverage as it eventually scales back its reliance on sales & marketing spend. I expect the company to be able to eventually earn 35% net margins. I anticipate a 30x 2025 earnings multiple, which based on 35% long term margins, suggests a 10.5x price to sales multiple. That represents roughly 110% upside through 2025 - a compounded annual return of around 20%. There may be substantial upside surprise potential to that projection, as ETSY is already earning 20+% net margins and may be able to sustain elevated growth rates for a longer period of time. I rate shares a strong buy with a high likelihood of outperforming the market for many years.

Risks

The e-commerce market is highly competitive. While ETSY appears to have a niche in customized goods, it is possible that other platforms try to compete in the space. For now, I find this to not be so likely due to the network effects provided by the ETSY platform.

ETSY sellers may try to sell on their own website in order to avoid commission fees. Through services like Shopify, sellers may be able to host their own e-commerce stores. I expect overall sales to remain reliant on ETSY’s sales funnel, and ETSY’s diverse list of stores helps mitigate the risk of any one seller moving off the platform.

ETSY might not be able to show the operating leverage that I anticipate. I see two main scenarios that this might occur. ETSY might have to compete on commission fees if another e-commerce platform poses competition. ETSY might also have to continually increase its sales & marketing expense to third-party advertisements like Google if it is unable to build strong enough name brand recognition.

Conclusion

While ETSY has run up dramatically since only several years ago, much of that outperformance appears to have been due to the absurd undervaluation at which the shares had traded before. The pandemic has boosted ETSY’s business and brand recognition, positioning it nicely to continuing taking market share in the overall e-commerce market. While the current valuation might not make undervaluation immediately apparent, the high profitability and potential for operating leverage suggests that if ETSY can keep up robust growth rates, then it should produce returns far outpacing the broader market. I rate shares a strong buy for long term investors.