Summary

- GE’s Power and Renewables segments have a history of negative free cash flow.

- However, against fierce headwinds, the Aviation segment broke even in 2020, and the Healthcare segment provided billions in FCF.

- Despite significant progress, GE still has a heavy debt load.

There are few stocks that have as wide a gap in terms of analysts’ expectations as that of General Electric Company (GE). Forexample, a bearish Steve Tusa has a price target of $5 while UBS gives $17 as a target, with upside potential of $21.

Looking at my stock broker’s grades, Schwab gives GE an overall score of D while TD Ameritrade rates the company as a perfect 10.

So where does the truth lie?

On one hand, we have a much improved debt profile, the prospect of a revived airline industry to drive revenues in the Aviation business, and a Healthcaresegment that proved profitable, to the tune of $2.9 billion in FCF in FY 2020, despite pandemic induced headwinds.

The flip side has two of the four segments, Power and Renewable Energy, that have consistently provided negative returns. Furthermore, the all clear has not yet sounded for the pandemic.

The Power(less) Segment

The Power segment is essentially two businesses in one. Gas power provides 72% of segment revenue. The remainder of the segment consists of power conversion, steam power and nuclear related projects.

It seems a bit counterintuitive, but gas turbine orders have fallen markedly over the years. In 2015, large gas turbine orders totaled 58 GW. However, Morningstar predicts annual orders will remain in the 25 GW to 30 GW range for the foreseeable future. GE execs concur with Morningstar’s assessment.

The new unit gas market is substantially smaller today, stabilizing at 25 to 30 gigawatts a year.

GE Gas Power CEO Scott Strazik

This decline in demand is one reason Power’s operating margin fell from 6.41% in 2017 to 1.6% in 2020. The poor performance is a bit of a conundrum to me, considering GE operates in an oligopoly in this space, Siemens (OTCPK:SIEGY) and Mitsubishi-Hitachi are the only true competitors, and 62% of the segment revenues flow from services. After all, service contracts provide reliable revenues in most industries.

The problem with power is industry overcapacity is resulting in pricing pressure, not something one normally witnesses among oligopolies. Look no further than Siemens reorganization efforts as that firm copes with headwinds confronting its Power and Gas Division. The following is an excerpt from a document outlining Siemens Project 2020.

These measures are being taken in response to the persistently difficult environment in the global power generation market. The Power and Gas Division is having to cope, among other things, with regulatory changes, massive price erosion, aggressive competitors and regional overcapacities.

However, there is another concern when one attempts to evaluate prospects for the Power segment: an argument can be made that Power is in direct competition with GE's Renewables segment.

Renewing Renewables

Like the Power segment, the Renewable Energy segment has been a net loser. Renewables reported a $1 billion loss in 2019 followed by $641 million in negative FCF in 2020. However, management is predicting FY 21 will bring positive FCF.

Like Power, the Renewable segment consists of several businesses under one umbrella: offshore wind, onshore wind, grid solutions, and hydro power. If that segment is to provide outsized growth, it will most likely come from the offshore wind business.

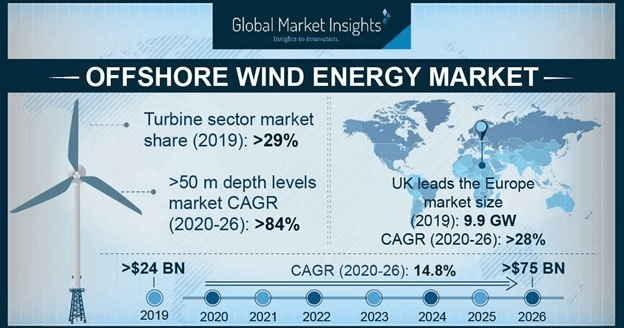

The offshore wind market, which stood at $24 billion in 2019, is expected to witness a CAGR of 14.8% through 2026.

A report released in late 2019 by the International Energy Agency [IEA] states offshore wind could easily generate enough electricity to meet global demand. Furthermore, the IEA claims the need to increase offshore capacity could attract $1 trillion in investment by 2040.

Ironically, the path to success for Renewables is the opposite of the hurdle facing the Power segment. The list of “key players” is literally one name shorter than the alphabet.

Fortunately for those invested in the stock, it appears as if GE could have an inside track on the competition. For one, winners are beginning to emerge. GE, Goldwind (OTCPK:XJNGF), Vestas (OTCPK:VWDRY) (OTCPK:VWSYF) and Envision now account for half of global sales.

Secondly, GE ranked as the number one wind turbine manufacturer in 2020.

The third note of importance is that GE is a major supplier for all three phases of the Dogger Bank wind farm. Since the UK currently leads the world in terms of offshore power production, and Dogger Bank is the world's largest offshore wind farm, this speaks well of GE’s efforts in this industry.

Despite these positives, I ask readers to peruse the above chart. It provides a good perspective on the “lumpiness” of orders, and therefore revenues, related to wind turbines. In 2020, installations of offshore wind turbines dropped by 19%.

This isn’t a result of a lack of long term demand. Wind farms are major projects involving enormous expenditures. More often than not, the funds for these projects rely in one way or another on government largesse. Read a half dozen GE earnings reports, and you will find management providing frequent commentary regarding this issue.

Even so, the long term outlook seems good. Management guides for positive free cash flow for the segment in 2021. This prospective development is welcomed following years of losses suffered by Renewables.

The Health Of The Healthcare Segment

The Healthcare segment, providing a quarter of company revenues, is the one business that seems to prevail no matter the circumstances.

Healthcare primarily manufactures and services a variety of medical imaging devices. Equipment sales comprise 55% of segment revenues while 45% flows from services. Although the segment took a bit of a hit from pandemic related headwinds, operating profits fell from 19.5% in 2019 to 18.8% in FY20, Healthcare contributed $2.9 billion in free cash flow in FY 2020.

GE operates as a member of a duopoly in this space, with Siemens as its primary competitor. According to Morningstar, GE and Siemens are the only companies considered by large hospital networks when seeking imaging devices. Although there are notable exceptions, hospitals have reputations as being “GE hospitals” or “Siemens hospitals,” and many medical professionals choose their residencies according to the imaging devices with which they are familiar.

Consequently, investors can expect a reliable income stream from this segment for the foreseeable future.

The Crown Jewel: Aviation

Much of the battle between bulls and bears revolves around the prospects of the Aviation segment. Bulls will argue that GE would be long down its road to recovery were it not for the near paralysis induced by COVID on the airline industry.

Bears will counter that “it ain’t over till it’s over,” and predict the rejuvenation of the Aviation segment will take longer than many suspect.

While my best guess is that Aviation will witness a reasonably sharp rebound, recent events lend some credence to the bearish perspective.

The World Health Organization’s is encouraging the fully vaccinated to wear masks, and there are those in the medical community urging the CDC to follow suit.

Meanwhile, officials in Israel are reporting half of all adults infected by the Delta variant of the virus are fully vaccinated, while ten million Australians are under lockdown, and South Africa recently imposed at least two more weeks of additional lockdowns.

It’s (possibly) deja vu all over again.

So where does the airline industry stand? In May, US airports reported 50 million passengers, an increase of 19% over April. Even so, that’s a far cry from the daily average of 77 million in 2019.

Include the fact that corporate travel is off to a slow start, and international flights are still largely closed.

This does not bode well for Aviation. GE’s jet engine orders are closely related to commercial air travel demand, but perhaps of greater importance is that 63% of the segment’s revenue is derived from services. Simply put, aircraft that are not in the air require less maintenance.

However, although there is less wear and tear on aircraft of late, and cash strapped airlines can defer shop visits, service deferrals add 20% to 30% to costs over the long term.

On average, GE services its engines five to seven years after an aircraft goes online. Additional visits are normally conducted every five years thereafter, and the service contracts are typically 25 years in length. Now consider that GE has an installed base of approximately 38,000 engines, and only 40% of those have undergone the first scheduled shop visit.

A reasonable conclusion is that even with a slow return to air travel, the revenue stream associated with engine services will simply be deferred.

Now digest the recent win GE scored with its joint venture with Safran (OTCPK:SAFRY). The partners inked their largest single order to date, a deal to supply engines for 310 Airbus A320 aircraft for IndiGo Airlines. Considering IndiGo is the largest commercial airliner in India, this could bode well for GE moving forward.

To place this in perspective, the new deal will likely result in an order of approximately 700 engines. In all of 2020, GE reported a total of only 351 LEAP engine orders.

Add to that last week’s news that United Airlines (UAL) placed the largest order for aircraft in its history, and the biggest by a single carrier in the last ten years. The order was for 200 Boeing 737 MAX and 70 Airbus A320 NEO aircraft. GE/Safran manufactures the CFM engines used on all of the MAX jets, and airlines have the option of equipping the A320 NEO jets with GE engines.

We must entertain the possibility that the airline recovery could be hampered short term, but at the same time, long term demand for the Aviation segment should be robust.

A Look At GE’s Debt

GE’s current credit ratings are in the BBB+ range. That ranks the company in the lower end of investment grade ratings.

As 2018 dawned, GE had a debt load of $134.6 billion. The company finished the most recent quarter with $71.4 billion in debt, not including the firm’s pension deficit.

Last March, management announced a deal to sell its GECAS leasing unit to AerCap (AER). Using existing cash and $24 billion in proceeds from that divestiture, GE plans to reduce debt by another $30 billion upon closing of the deal.

However, factoring in GE’s $20 billion pension deficit, the company’s net debt to EBITDA ratio will still be around 6 times, well above the management’s goal of 2.5 times EBITDA.

To further reduce debt, management has plans to sell its stake in Baker Hughes (BKR), currently valued at about $6 billion, and use those proceeds to pay down debt. Plus, GE will still own nearly half of the AerCap shares, currently worth another $6 billion. Once the sale of those shares is permitted, CFO Carolina Dybeck Happe has stated the proceeds will be dedicated to debt reduction.

GE Stock Price

GE currently trades for $13.09 a share. The 12 month target price of 15 analysts is $14.64. The target of the 4 analysts rating the company since the last quarterly report is $15.75.

Using Schwab, Seeking Alpha and Yahoo! Finance, the lowest forward P/E ratio provided is by the first source: 48.83x.

None of those report a current P/E.

Seeking Alpha has a PEG of nearly 13x, Schwab does not provide a PEG ratio, and Yahoo calculates a 5 year PEG of 10.53.

The consensus EPS estimate of 16 analysts for 2021 is $0.25. The 2022 EPS estimate of 15 analysts is $0.51. With a P/E ratio of 20x, that would give us a fair valuation well below the current share price.

Will GE Stock Ever Recover?

Prior to the pandemic, the Aviation segment was projected to garner at least $4.4 billion in FCF in FY 2020. Although there were few industries hit as hard as the airlines, GE Aviation recorded a break even year.

The Healthcare segment also suffered moderate headwinds, yet it contributed $2.9 billion in FCF.

Like Aviation, GE Power was roughly breakeven in FY 2020 ($300 million FCF), while the Renewables segment suffered a $640 million loss.

There is every reason to believe the Healthcare segment will provide steady FCF for the foreseeable future. While the Aviation segment presents a more opaque picture, the short term prospects for the airline industry are unclear, there is no question that longer term this segment will provide a strong, recurring revenue stream. In fact, in terms of revenues derived from service contracts, any short term pain results in greater future demand.

The Renewables segment will likely contribute increased revenues and FCF in the future. Offshore wind projects should provide the segment with reasonable growth; however, I believe the prospects for the Power segment are rather poor, and I can find no reason to believe that business will generate significant FCF in the foreseeable future.

Of course, GE still has a heavy debt load, and there could be lingering effects associated with the pandemic.

Therefore, the most reasonable answer to the question posed by the header is that GE stock will return to a valuation that is a norm for the industry, but the road to recovery is a long one.

Adding the stock’s current valuation to the above, I rate GE a HOLD.

I will add that I began my investigations for this article believing I would rate GE as a speculative buy. For some reason, I’m rooting for the company, and I have a somewhat quizzical desire to witness GE’s revival while also profiting through an investment in the stock.

Unfortunately, I think it is likely that before GE recovers some event, including a potential downturn in the market, will allow a better entry point.

However, I’m pulling for current investors, and hope my assessment errs on the side of caution.