- Dollars gains versus most major peers; bond yields are steady.

- Market on high alert to hints on taper timetable from Fed.

U.S. stocks declined from all-time highs as data suggested consumers are starting to shift more of their spending to services ahead of a key Federal Reserve meeting. Crude oil traded at the highest level since 2018.

Real estate, materials and health care sectors pushed the benchmark S&P 500 index lower, while energy shares were in the green. The 10-year Treasury yield was little changed after Commerce Department figures showed retail sales declined in May.

“There’s a lot of moving pieces with the deluge of data out this morning,” said Mike Loewengart, managing director of investment strategy at E*Trade Financial. “Keep in mind there are unique circumstances related to our economic comeback that are putting pressure on these numbers.”

The prevailing mood was calm the day before the Fed’s next policy decision -- and possible hints about when the central bank will slow the pace of emergency asset purchases. The statement is set to include updated forecasts, and expectations are that officials would broadcast any taper plans well in advance.

“We think that market could remain relatively complacent in a low conviction environment ahead of the Fed meeting tomorrow,” according to Xavier Chapard, global macro strategist at Credit Agricole SA. “We continue to think that starting tomorrow the Fed could be slightly less ultra-dovish than it has been. While it will try not to trigger a significant market reaction, the question is whether it will succeed.”

Economists expect the so-called dot plot to point to aninterest-rate increasein 2023, while the bank is unlikely to signal a scaling back of bond purchases until later this year.

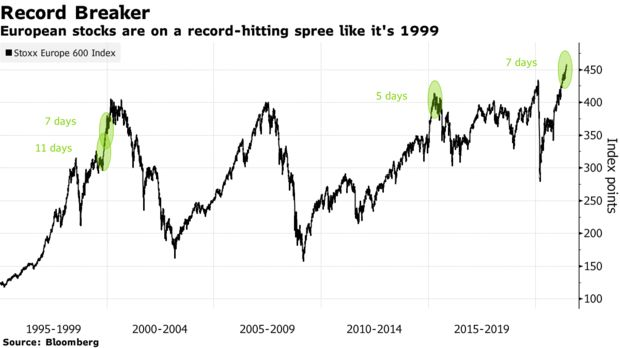

Elsewhere, European equities were led higher by chemical firms, while Asian stocks were mixed. West Texas Intermediate crude traded around $71 a barrel as investors weighed the outlook for rising demand against extended anti-virus curbs in some economies.

Bitcoin continued to gyrate amid a barrage of comments, brieflyclimbingabove $41,000 only to pull back. The digital currency got a boost after veteran hedge fund manager Paul Tudor Jones re-endorsed the coin in a television interview.

For more market commentary, follow the MLIV blog.

Here are some key events to watch this week:

- The Federal Open Market Committee rate decision comes on Wednesday, with a news conference from Jerome Powell after

- U.S. President Joe Biden and Russia’s Vladimir Putin meet Wednesday in Geneva

- U.S. Treasury Secretary Janet Yellen testifies before a House panel Thursday on the federal budget

- Rate decisions come from Switzerland and Norway on Thursday

- The Bank of Japan’s monetary policy decision is on Friday

These are some of the main moves in markets:

Stocks

- The S&P 500 fell 0.2%, more than any closing loss since June 3 as of 10:12 a.m. New York time

- The Nasdaq 100 fell 0.3%, more than any closing loss since June 3

- The Dow Jones Industrial Average fell 0.4%, more than any closing loss since June 9

- The Stoxx Europe 600 rose 0.2% to a record high

- The MSCI World index fell 0.1%, more than any closing loss since June 9

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%, climbing for the third straight day, the longest winning streak since March 25

- The euro was little changed at $1.2127

- The British pound fell 0.2% to $1.4080

- The Japanese yen was little changed at 110.13 per dollar

Bonds

- The yield on 10-year Treasuries advanced one

- basis point to 1.50%

- Germany’s 10-year yield advanced two basis points to -0.23%

- Britain’s 10-year yield advanced one basis point to 0.75%

Commodities

- West Texas Intermediate crude rose 1.3% to $71.78 a barrel

- Gold futures fell 0.1% to $1,863.40 an ounce