Despite Wall Street’s overall bearishness, there are a few good reasons to be optimistic about BlackBerry stock. Wall Street Memes lists three of them.

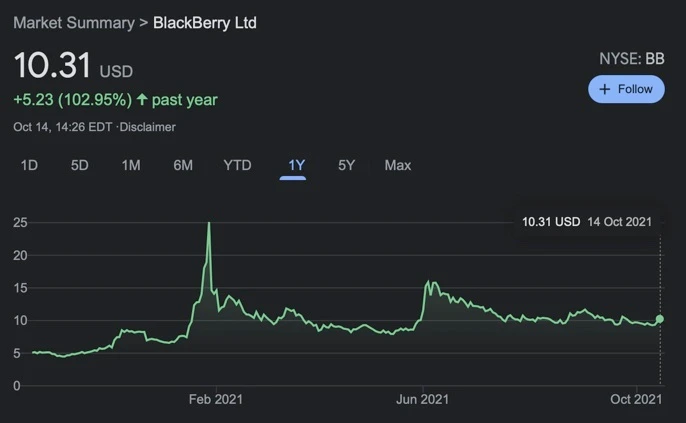

BlackBerry stock has been trading sideways since mid-July. Shares of the Canadian cybersecurity company are among retail investors’ favorites. But beyond the stock’s meme status, many might consider the investment opportunity compelling.

Despite analysts’ bearishness on BB, Wall Street Memes sees reasons to be optimistic about a long bet on the stock. We list three reasons why investors might want to consider the opportunity.

Promising industry

BlackBerry has gone through a deep transformation of its business in the past several years: from a market-leading (then failing) smartphone maker to a cybersecurity company. Today, BlackBerry is viewed as a top security provider, as its solutions are claimed to address more than 96% of cyberthreats.

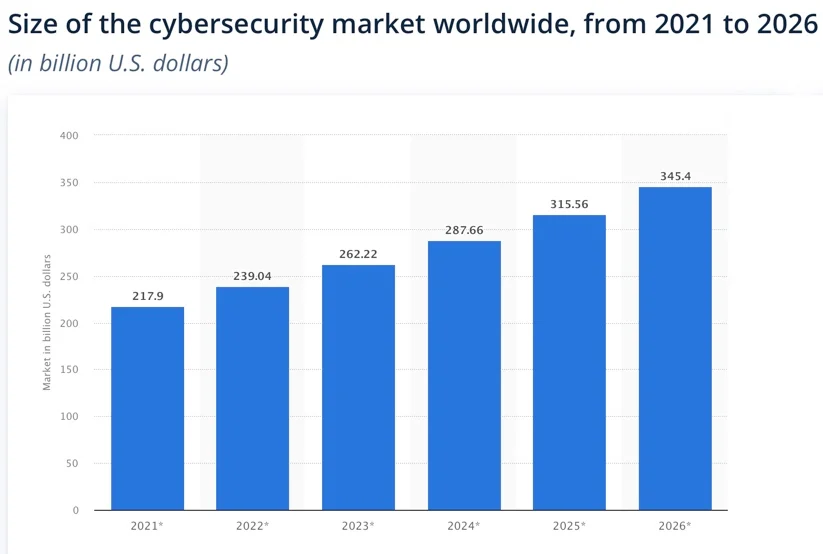

Starting from the top down, the global cybersecurity market isforecastedto rise to $345 billion by 2026, representing nearly 10% CAGR, according to Statista (see below). Should BlackBerry remain a relevant player in the space, it stands to benefit from industry-wide growth tailwinds.

BlackBerry seems to be already well positioned in the industry, particularly within the government vertical. The company reports to have several security certificates from the US government, as well as access to seven of the G7 and 18 of the G20 members.

Lastly, 19 of the top 25 electric vehicle OEMs (original equipment manufacturer) use BlackBerry's QNX operating system design. Together, they account for 61% of the EV market.

Contracts are inked

BlackBerry’s solutions, including QNX, IVY and others, seem to be gaining traction with the company’s clients. BlackBerry has reported several deals that could help it to drive increased revenue in the future.

It can be tricky to quantify the value of these partnerships, as they tend to merely suggest a pipeline of future (sometimes multi-year) revenue. This is not to mention that these contract announcements are often short on details for investors and analysts to properly understand the revenue opportunity.

But this could help to explain why, to an extent, BB stock lacks the market appreciation that (some may argue) it deserves. If or once BlackBerry’s commercial deals start to bear fruit and show up in the financial statements, the stock may finally gain traction.

Meme factor

Some analysts may see BB’s meme status as a risk. However, the stock can also benefit from a combination of increased popularity among retail investors and elevated short interest (the ratio was still around 8% as of the end of Q3, which is neither low nor too high).

BB stock seems to have gone through a gamma squeeze in early January and June, and the stock skyrocketed for a moment. Similar price moves could happen once again, for as long as BlackBerry stock has a sizable community on Reddit and its ticker continues to trend among the most popular on discussion boards.