Stocks are set for a poor performance on Thursday, as markets absorb the Federal Reserve's indication that interest rate increases are coming sooner than expected, while the central bank remains alert to inflation risks.

"There is probably no bigger macro issue, both tactically and strategically, than inflation and what this means for portfolios," said strategists led by Inigo Fraser Jenkins at Bernstein Research on Thursday.

Fraser Jenkins and his team have our call of the day: that investors should look to buy shares in companies with a long maturity of debt as an effective hedge against inflation.

Companies issued debt at an astounding rate through the COVID-19 pandemic. Much of it was a necessary move to meet funding needs, but for some groups it was an opportunity to take advantage of the Fed's measures supporting credit markets, which provided an ability to increase the maturity of debt, the strategists said.

According to the team at Bernstein, for companies that have long maturity of debt, have issued fixed-rate debt, and are going concerns -- i.e. can continue operating while meeting financial obligations -- inflation could be a positive thing. "Inflation would erode the real value of the debt relative to earnings (which are tied to the real economy)," the strategists said.

"There is no one solution" to finding suitable hedges for inflation, Fraser Jenkins' group said, noting that a good response may involve more equities, real assets, gold, and even crypto assets like bitcoin . But "another possible string to the inflation-hedging bow" is companies that emerge from the pandemic with a long maturity of debt.

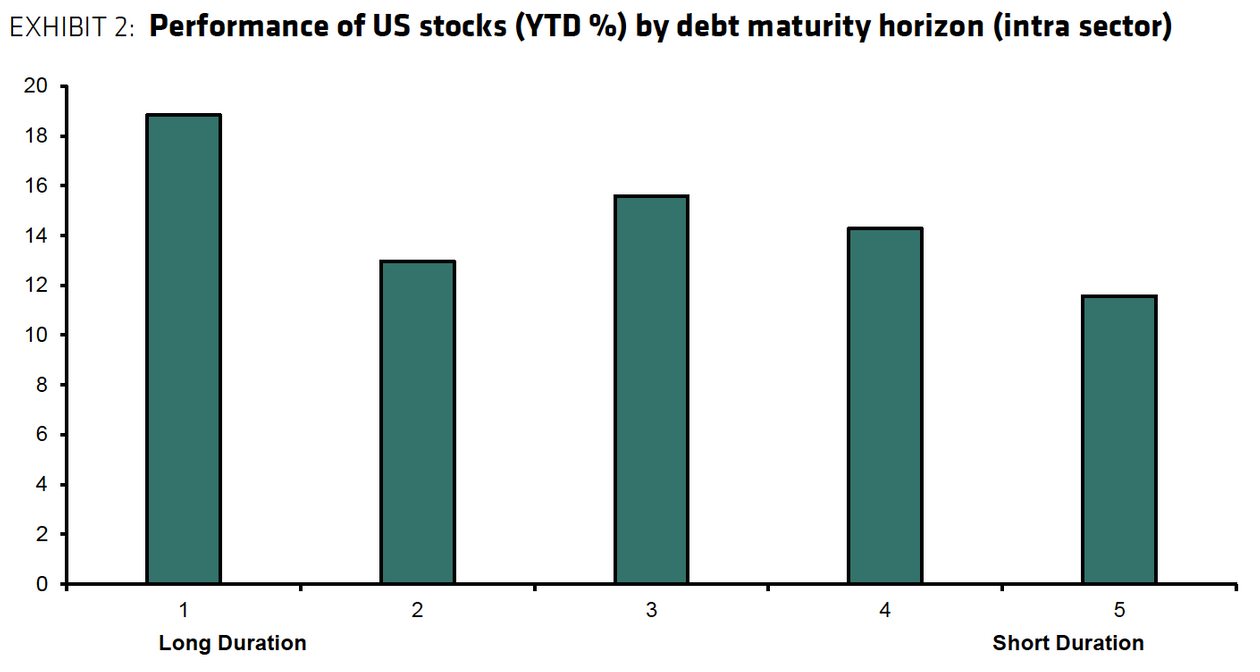

"A basket of U.S. long debt maturity stocks has outperformed a basket of short debt maturity stocks by 7% this year and trades at more attractive valuations than their short debt maturity peers," Fraser Jenkins and his team added.

There are a lot of these stocks: the strategists at Bernstein have a list of more than 80. Some of those picks include Big Tech names Apple $(AAPL)$, Alphabet $(GOOGL)$(GOOGL), Amazon $(AMZN)$, and Microsoft $(MSFT)$, as well as other technology companies like videogame developer Electronic Arts $(EA)$ and semiconductor groups Nvidia $(NVDA)$, Texas Instruments $(TXN)$, and Qualcomm $(QCOM)$.

Telecom giants AT&T $(T)$ and Verizon $(VZ)$ are also on the list, as are retailers and consumer-products groups such as Home Depot $(HD)$, Target $(TGT)$, McDonalds $(MCD)$, Starbucks $(SBUX)$, Nike $(NKE)$, Kraft Heinz $(KHC)$, Estée Lauder $(EL)$, and Coca-Cola $(KO)$.

Health and biotechnology stocks like Johnson & Johnson $(JNJ)$, Pfizer $(PFE)$, Gilead Sciences $(GILD)$, Regeneron $(REGN)$, and Biogen $(BIIB)$ also make the cut, as do railroad operators Kansas City Southern $(KSU)$ and Union Pacific $(UNP)$. Defense companies Lockheed Martin $(LMT)$, Northrop Grumman $(NOC)$, and Raytheon Technologies $(RTX)$ also qualify.