The growth of interactive entertainment is an attractive area to look for long-term investments. The millions of new players who started gaming during the pandemic, along with the console launches from Sony and Microsoft, are catalysts for the big game companies to sell more content into a wider installed base.

Activision Blizzard (NASDAQ:ATVI) and Take-Two Interactive (NASDAQ:TTWO) are two market leaders that operate some of the best-selling game franchises in the industry. Activision is known for Call of Duty and World of Warcraft and generates over $8 billion a year in bookings (a non-GAAP measure of revenue). Take-Two's Grand Theft Auto V has sold a staggering 145 million copies, which has pushed the company's bookings to over $3 billion.

I'll say up front that I believe Take-Two is well-positioned to deliver much better returns than Activision Blizzard over the next five years. Here's why.

The margin gap

Activision has many good qualities investors look for in an investment. It has eight franchises that have generated $1 billion in lifetime bookings. It has a large player base of over 400 million monthly active users, and management has a great record of allocating capital through acquisitions that create shareholder returns. Over the last year, the company generated a healthy free cash flow margin of 33% compared to revenue and paid $316 million in dividends to shareholders.

While Take-Two is smaller and is more dependent on a few franchises, CEO Strauss Zelnick, who took over in 2011, is gradually turning Take-Two into a bigger and more profitable leader in the industry. Since Grand Theft Auto V launched in 2013, Take-Two's free cash flow has increased by 347% to $843 million. The digital distribution of games has brought more-consistent profits for management to reinvest in expanding its game library, with the long-term goal to build greater scale, reach more players, and improve operating margin.

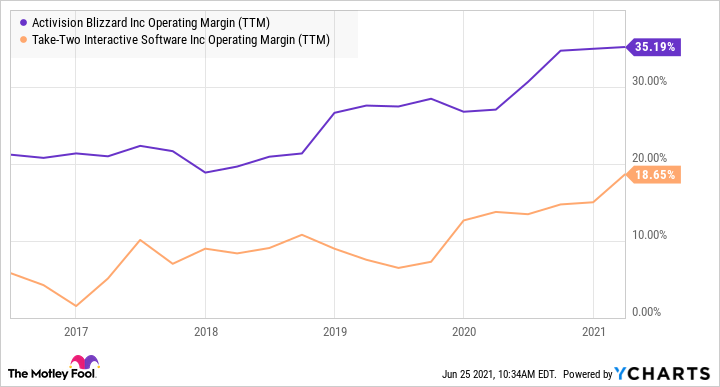

Compared to Activision's stellar operating margin of 35.2%, Take-Two's operating margin is currently at 18.7% on a trailing-12-month basis, but that's exactly why Take-Two offers more upside to investors. It has made major strides to squeeze more profits out of its business, and its operating margin is still trending up.

If Take-Two's operating margin improves to over 20%, it will drive much faster growth in earnings per share and fuel a rising share price.

Here are the consensus analyst estimates for Activision's adjusted operating margin and EPS growth through 2023.

| Metric | 2021 | 2022 | 2023 |

|---|---|---|---|

| Adjusted operating margin | 42.8% | 44.1% | 45% |

| Adjusted EPS | 8.4% | 18% | 4.6% |

Data source: Atom Finance.

Here are the same estimates for Take-Two.

| Metric | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|

| Adjusted operating margin | 19% | 23.2% | 24.6% |

| Adjusted EPS (loss) | (28.5%) | 49.9% | 30.8% |

Data source: Atom Finance. Take-Two's fiscal year ends in March.

Take-Two's EPS is expected to decline this year due to the investments in marketing, personnel, and IT that management is spending to launch the new game pipeline over the next few years. It's hiring more game developers ahead of its deepest upcoming release slate in history, with a grand total of 62 releases across existing and new titles.

Beyond the near term, the continued decline in distribution costs for games remains a catalyst to grow profits for both companies. Still, analysts expect Take-Two to expand its margin by a greater amount, which could lead to better returns for investors.

Take-Two stock is cheaper with more upside

Activision should remain a good long-term investment. Management believes it can reach 1 billion monthly active users, as the company expands its mobile game business. But investors are paying a higher price for Activision's greater game diversity, and perceived lower business risk.

Activision stock trades at a price-to-sales ratio of 8.5, which is much higher than Take-Two's sales multiple of 6. But as Take-Two expands its game catalog, this relatively lower sales multiple won't be justified.

Take-Two's Grand Theft Auto V and Red Dead Redemption 2 have sold a combined 182 million copies, establishing a large player base to build on with future releases. Take-Two has almost endless opportunities with these top franchises to grow higher-margin digital sales with more expansion updates.

Because of its higher ceiling for margin expansion and earnings growth, I would buy Take-Two over Activision right now.