'European equities surged to first place in areas to invest,' Citi finds in market outlook study

With the stock market near record highs, the threat of a pullback is outweighing investor optimism for a big rally from current levels, according to a Citigroup survey of its clients.

"In some ways, clients seemed willing to take a step back," a Citi analyst said in a research report published just before the weekend. They upped their median cash holdings "modestly" and signaled that a 20% correction remained more likely than a rally of the same size in stocks.

Investors worry most about Federal Reserve policy and inflation , said the Citi report, which collected insights over the past two weeks from pension funds, mutual funds and hedge funds. More than half of respondents indicated that inflation will be "sticky," or persisting 9 to 12 months, with the largest block of those surveyed expecting the Fed to raise short-term rates in the second half of 2021.

The S&P 500 index has kept climbing past all-time highs this year, even after the Fed meeting earlier this month initially rattled markets with a more hawkish leaning than expected. The S&P 500 was up 0.2% to a new high on Monday, at about 4,292, after finishing at another record high Friday .

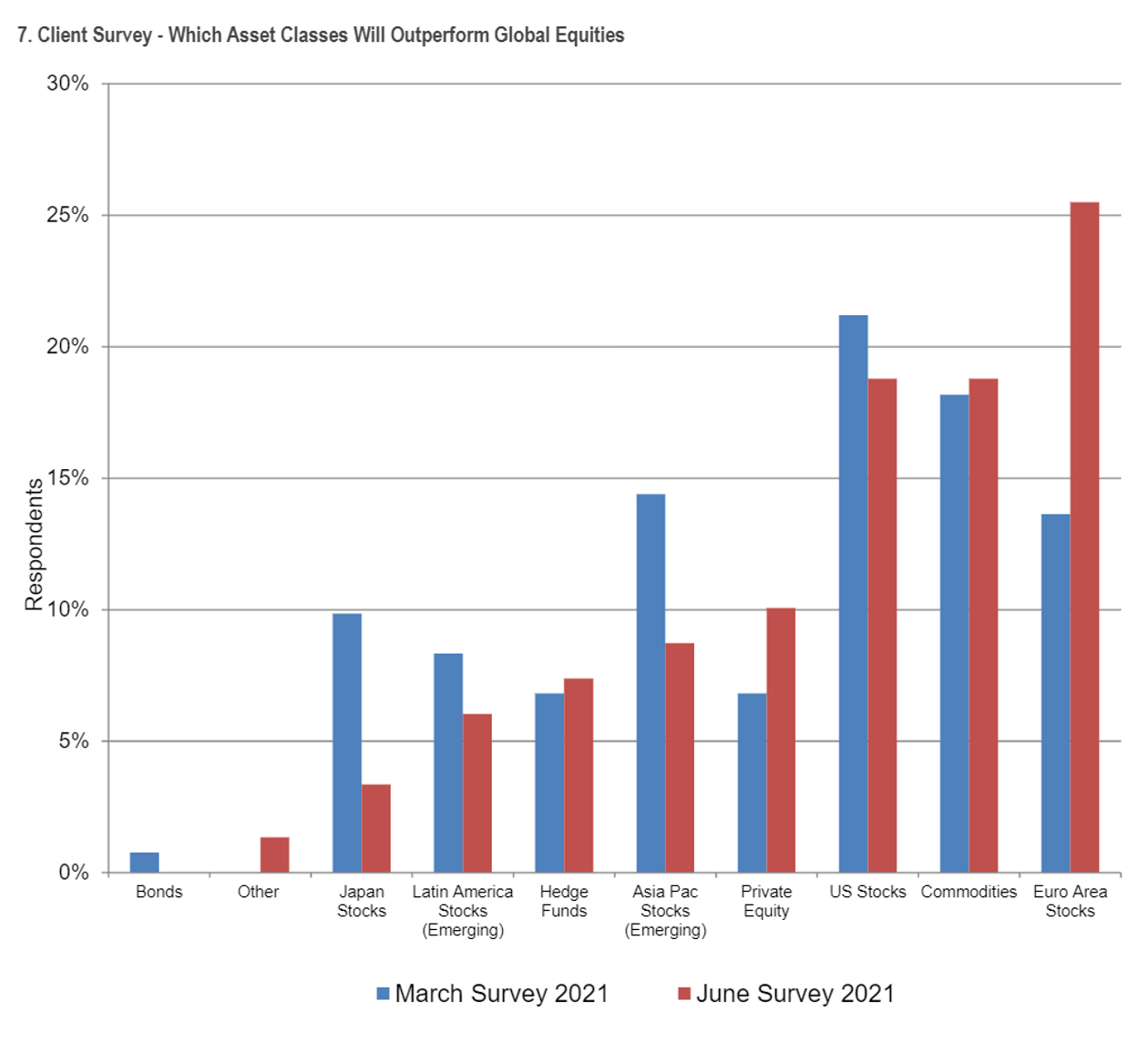

With the U.S. stock market hovering around peaks, Citi's survey found its clients preferring opportunities on the other side of the Atlantic.

"Europe has become the most favored equity market," the report said. "European equities surged to first place in areas to invest," overtaking U.S. stocks, which had been the most popular asset class in Citi's March survey. Commodities now rank second for asset classes expected to outperform global equities, followed by U.S. stocks as a close third, the report shows.

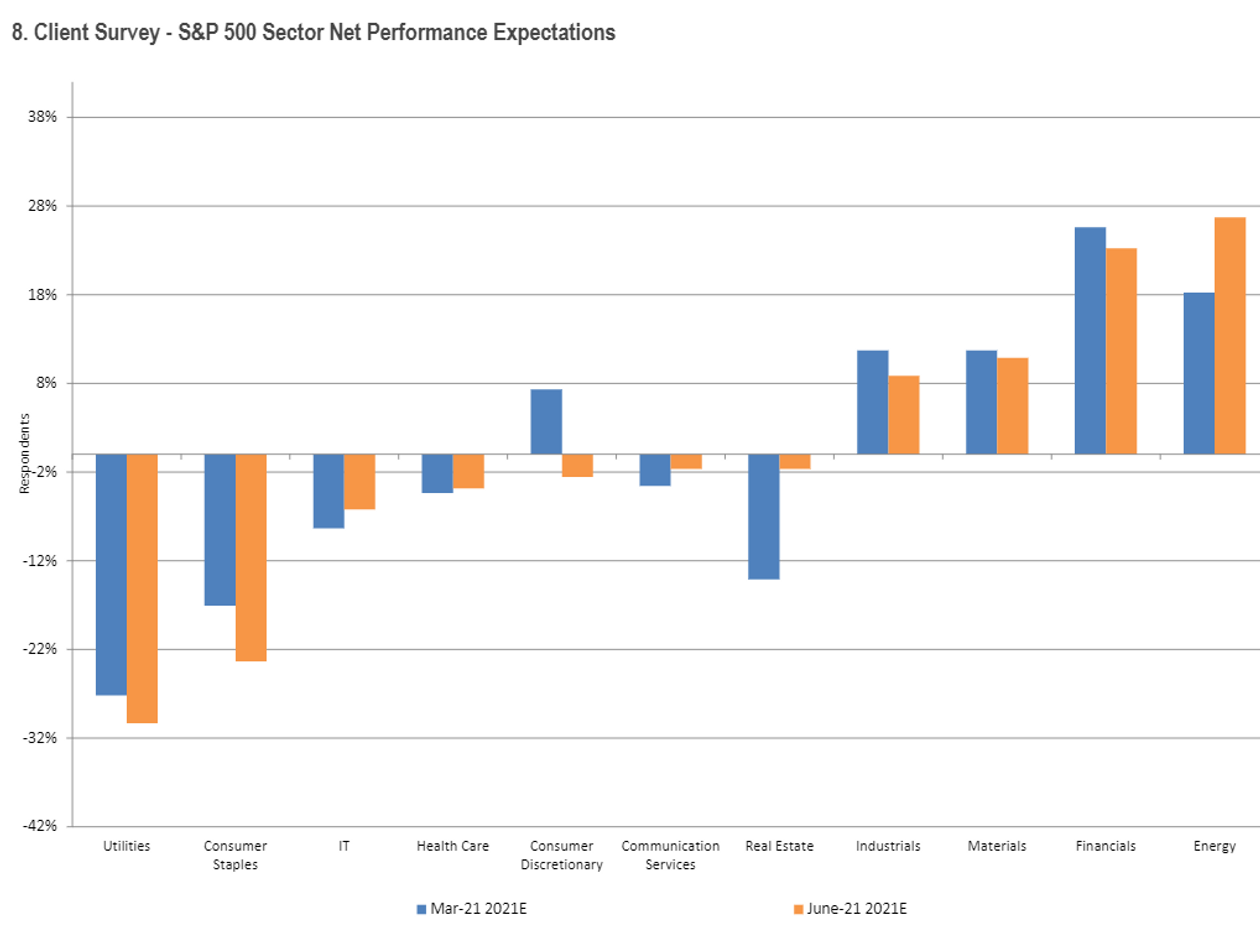

Almost half of Citi's clients expect that S&P 500 will end this year between 4200 and 4400, with a weighted average target of 4,269, the survey found. "The buy-side chose energy to be the best performer, wrestling the lead from financials, while tech is anticipated to underperform and utilities remain the most unloved," the analyst said.

"We cannot necessarily explain why investors seem so unenthused on utilities and consumer staples," the Citi report said. "But they have been the worst performers of the S&P 500 sectors year to date and thus there could be some trend-following being reflected."