The stock market has been on fire since it bottomed out in March 2020, following a downturn fueled by coronavirus-related concern. That's despite the fact that we are still dealing with the pandemic and the economy is far from having recovered to its pre-COVID strength. One reason for this discrepancy is that the market is forward-looking.

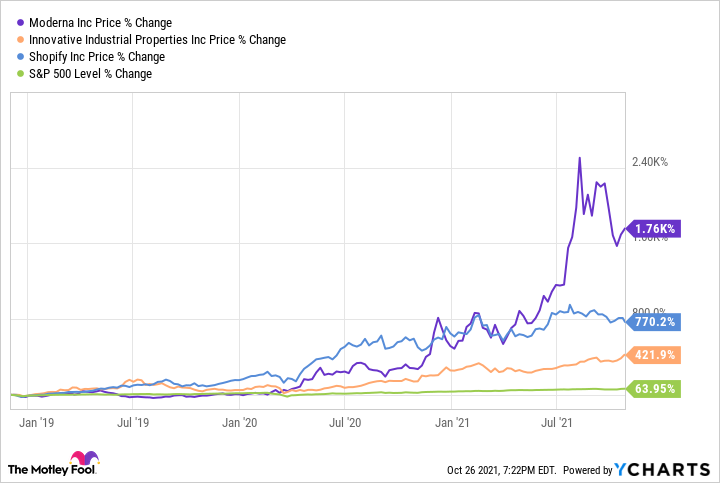

That's why companies with lofty expectations will tend to perform very well. Each of these stocks has surpassed the market significantly over the past couple of years. Let's look at three market-beating companies with sky-high expectations: Moderna (NASDAQ:MRNA), Innovative Industrial Properties (NYSE:IIPR), and Shopify (NYSE:SHOP). Here's why these stocks can continue beating the market.

1. Moderna

Moderna is currently one of the leaders in the COVID-19 vaccine market. It expects to generate $20 billion in sales next year from its crown jewel, mRNA-1273. The company has already reported revenue of $7 billion trailing 12 months. That's not bad for a company that, until about 10 months ago, didn't have any product sales to its name. And there are excellent reasons to think this windfall will persist. Weekly COVID-19 cases, hospitalizations, and deaths still number in the thousands, primarily due to the more contagious delta variant.

The U.S. Food and Drug Administration (FDA) recently granted emergency use authorization (EUA) of a booster dose of mRNA-1273 to certain at-risk populations. This will help fuel more sales of Moderna's flagship product. It's important to note that the company has already signed advanced purchase agreements (APAs) worth $12 billion for next year, with additional options of roughly $8 billion.

Given the current trajectory of the pandemic, these options will likely be activated. And beyond COVID-19, Moderna boasts a rich lineup of potential mRNA vaccines for various viruses and infectious diseases.

It is also looking to jump into the promising gene-editing space. Valuation is an issue for Moderna, which currently boasts a market cap of $139.5 billion. Making Moderna a lot larger than both Gilead Sciences ($81 billion) and Vertex Pharmaceuticals ($47.8 billion), two biotechs with long track records of success. Moderna's stock will likely be volatile moving forward and will almost certainly struggle once the pandemic subsides. But I expect the biotech to deliver enough clinical and regulatory wins to outperform the market in the next decade.

2. Innovative Industrial Properties

Innovative Industrial Properties is a real estate investment trust (REIT) that focuses on the medical cannabis industry. It buys real estate assets from cannabis growers and leases them back to these companies. To what end? Since cannabis remains illegal at the federal level in the U.S., pot companies have trouble accessing typical banking services such as loans. Innovative Industrial Properties' business model helps marijuana growers free up capital.

The company currently operates in 18 states and boasts 73 properties. Its revenue and earnings have generally increased, which explains why it has easily outpaced the market over the past few years. The REIT is reporting revenue growth of nearly 40% over that past year. And there are plenty of opportunities ahead. Medical uses of marijuana are legal in 36 states, twice as many as the number of states in which the company does business. Expanding its operations into these territories will help the company improve its financial results.

According to some estimates, the cannabis industry is projected to increase at a compound annual growth rate of 26.7% between 2021 and 2028. That's a terrific pace, and Innovative Industrial Properties is well-positioned to benefit. If cannabis becomes legal in the U.S. soon -- which is far from a sure bet -- some investors may be worried that it will disrupt the company's business.

But even in this environment, Innovative Industrial Properties will thrive. Cannabis legalization would significantly expand the number of potential business partners for Innovative Industrial Properties. And while some would probably turn to traditional banks, the company's services wouldn't become obsolete. After all, doing business with banks has its downside, too, including high-interest rates and stringent lending standards. In short, whatever happens in the foreseeable future, Innovative Industrial Properties looks equipped to continue its market-beating ways.

3. Shopify

Shopify has been riding the e-commerce wave better than most, and in the years since its 2015 IPO, it has soundly beat the market. The tech giant is positioning itself as the go-to option for merchants looking to build an online storefront. Shopify has generated nearly $4 billion over the past 12 months. Despite the success it has already had, there is still a long runway for growth. Shopify is currently pursuing various initiatives, one of which is international expansion.

Picture this: During the second quarter ending June 30, e-commerce sales accounted for just 12.5% of total retail sales in the U.S. E-commerce penetration is much lower in many international locations. With the world increasingly going digital, we can expect the e-commerce space to continue growing. Shopify is looking to pounce on these opportunities, which is why it made international expansion one of its key investment areas.

Another priority for Shopify is its fulfillment network. Back in 2019, the company pledged to invest $1 billion into this initiative "over the next five years." In 2019, Shopify acquired 6 River Systems -- a provider of warehouse fulfillment solutions -- in a cash-and-stock transaction valued at $450 million. The company's goal is to increase the efficiency and productivity of its customer fulfillment operations, which will help attract even more merchants onto the platform.

Combine these growth opportunities with Shopify's strong competitive edge -- namely, high switching costs -- and the future looks bright for this tech company. Investors looking for market-beating stocks likely can't go wrong with Shopify.