In October, Tesla's (NASDAQ:TSLA) stock price rose above the $1,000 mark and its market capitalization zoomed past $1 trillion. It's a situation that likely had many Tesla investors rejoicing about the rise and many of those investors who have so far missed the bus wondering if it is now too late for them to benefit from this high-flying stock.

Let's discuss if buying Tesla stock at this point still makes long-term sense or not.

Tesla's stock price soars

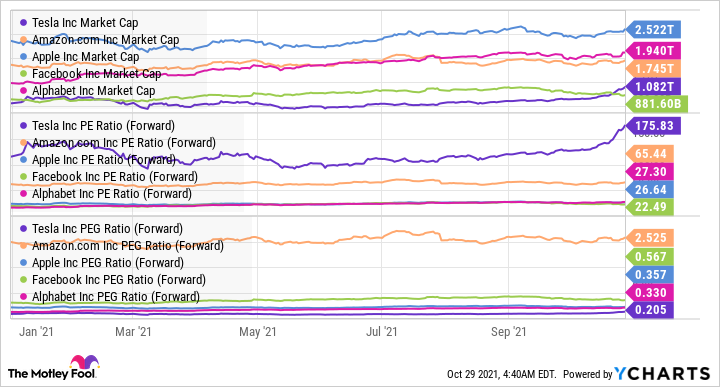

A lot of traditional market watchers find Tesla's valuation bewildering. At $1 trillion, the stock's market capitalization exceeds the combined valuation of the next half-dozen or so top auto stocks. In fact, it is more than 1.5 times the combined market capitalization of the next five automakers.

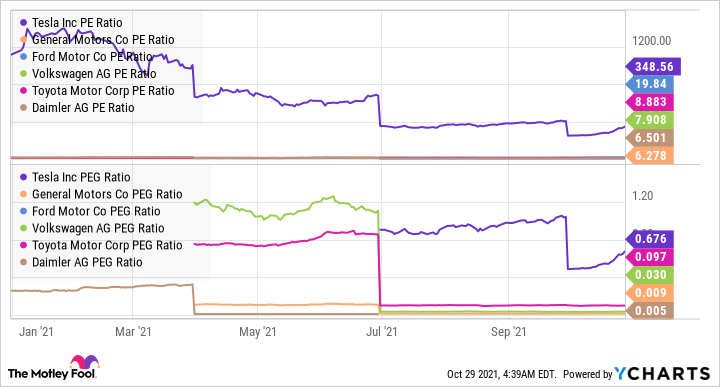

Tesla's P/E and price-earnings-to-growth (PEG) ratios look exorbitant compared to those of legacy automakers.

Add to this evaluation the fact that the five largest automakers together sold nearly 40 million vehicles in 2020 compared to the roughly 500,000 that Tesla sold, and the market analysts' bewilderment looks understandable. So, what should you as an investor take from Tesla stock's spectacular rise, and more importantly, how is Tesla's stock likely to perform going forward?

Image source: Getty Images.

Image source: Getty Images.

Why Tesla is different

One of the common arguments made to justify Tesla's valuation is that it is more of a technology company than an automaker and should thus be valued as such. This reasoning indeed holds some water. Electric vehicles (EVs) aren't new. They have been around for more than a century. But the abundance of gasoline and continued improvement in internal combustion engines hindered the commercialization of EVs. Electric cars are widely considered to have begun making a comeback in 1997 with Toyota's (NYSE:TM) Prius.

Yet, even after that, for nearly two decades, no major automaker was able to produce (or even interested in producing) EVs at scale. In 2003, as a start-up, Tesla took up this formidable task. The company can be credited for making EVs mainstream through its improved technology. If we look at Tesla as a technology stock, its valuation makes some sense.

Though Tesla's forward P/E ratio is higher than even the top technology stocks, its forward PEG ratio seems more reasonable. The forward PEG ratio considers a company's expected growth, in addition to earnings. So, it paints a better picture when comparing companies growing at different rates. That brings us to the next factor that is supporting Tesla stock's rise.

Tesla is growing at a faster pace than other automakers

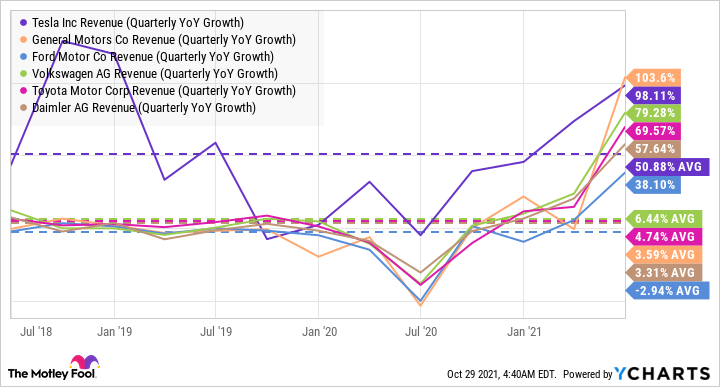

Tesla expects to continue growing its vehicle deliveries at an average annual rate of 50% over a "multi-year horizon." Indeed, Tesla's growth rate is achievable as it is starting at a much smaller base. In this latest quarter, it grew revenue by about 98%, which wasn't even the fastest growth last quarter. But in three years up to second-quarter 2021, it grew its quarterly revenue at an average year-over-year growth rate of more than 50%.

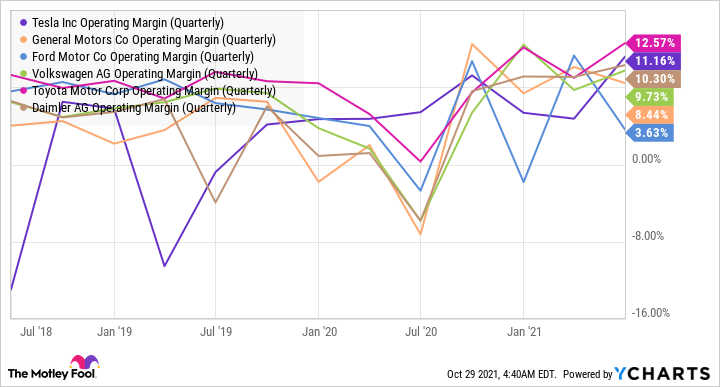

By comparison, over the same timeframe, the highest average growth rate among the top automakers is 6.4% for Volkswagen (OTC:VWAGY). Similarly, in the third quarter, Tesla's revenue grew 57% year over year. In comparison, Q3 revenue for Ford (NYSE:F), General Motors (NYSE:GM), and Volkswagen fell year over year. What's more, Tesla's operating margins in recent quarters are also higher than those of most of its rivals.

In Q3, Tesla's operating margin rose to 14.6%. Tesla looks well-placed to continue growing its revenue over the coming several quarters. It is expanding its production capacity to meet the increasing demand. That should, in turn, support its stock's price in the coming quarters.

In the long run, however, Tesla's stock price may depend on its ability to make money apart from selling cars. The biggest potential avenue, of course, is Full Self-Driving (FSD) software.

Not just another car company

Despite all that Tesla has achieved in car-making, its stock's valuation considers what the company can potentially accomplish, especially in the field of autonomous driving. Tesla enthusiasts see several other growth avenues -- auto insurance, battery and power supply, to name a few. But none seems to be potentially as big as FSD.

Tesla buyers can now join the beta test of the company's FSD software. The company plans to offer this only to selected buyers based on their past driving performance. It has a treasure trove of data on Tesla drivers, covering things like hard braking, aggressive turning, and so on. Tesla continues to improve its autopilot and FSD features incrementally. As it rolls out features to more customers, it gets more data that gets fed into its machine learning models, thereby further improving the software.

If Tesla can roll out self-driving features that are better than its competitors, its stock price may see further gains in the long term too. Looking at its track record so far, I'm inclined to believe that Tesla has a fair chance of accomplishing this feat.