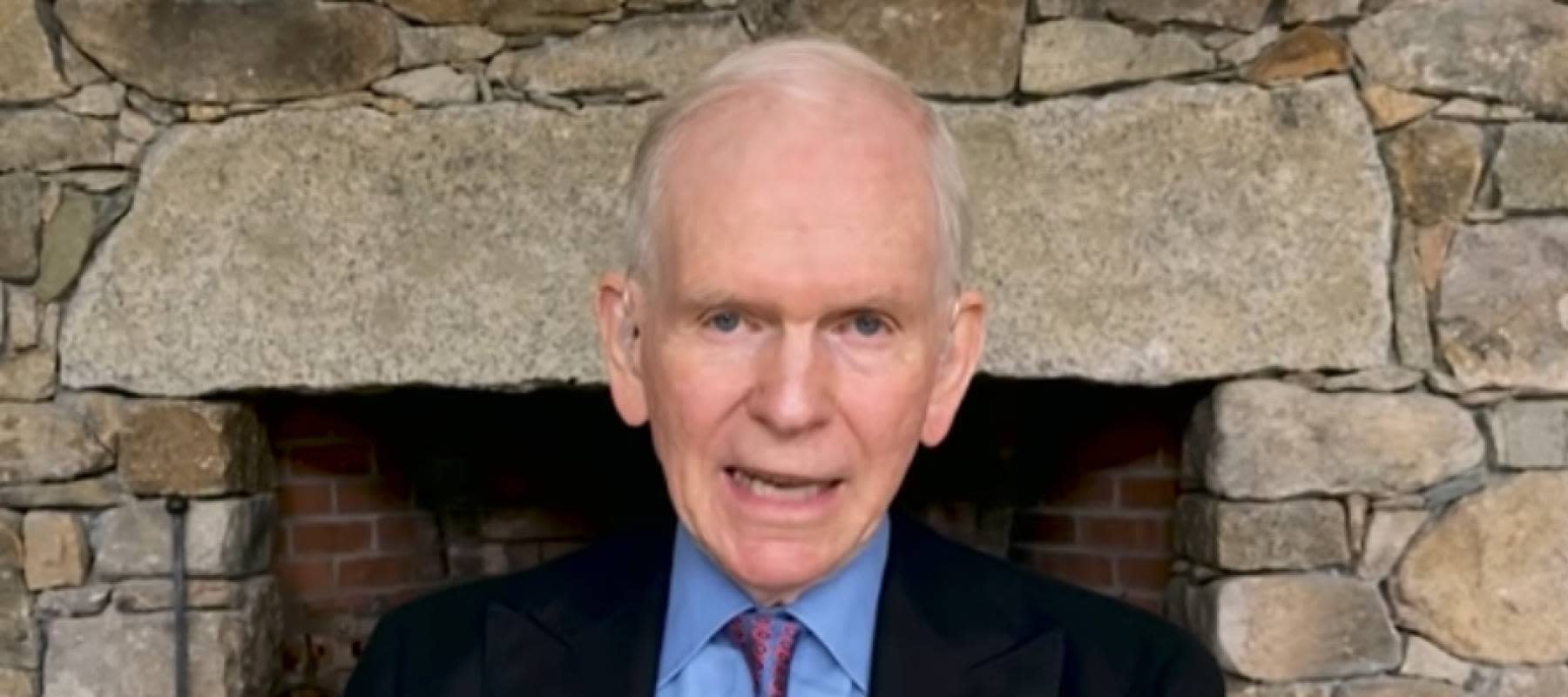

Jeremy Grantham, legendary investor and a pioneer of index fund investing, has added his voice to the chorus of financial wizards who expect today’s runaway stock market to soon hit the wall.

Grantham recently told CNBC that equities in the U.S. are in a “magnificent bubble,” larger even than those in 1929 and 2000, which kicked off the Great Depression and signaled the end of the dotcom bubble, respectively.

Grantham’s worth listening to.

He predicted the dotcom collapse and the 2008 meltdown of the real estate market. He’s also in charge of about $60 billion as the investment chief at asset management firm Grantham, Mayo, & Otterloo.

Even though the market has surged further since Grantham’s comments, let’s look at a few safe haven stocks in GMO’s portfolio. One of them might be worth buying with some of your spare pennies.

UnitedHealth (UNH)

UnitedHealth’s dividend payout, currently $1.45 per share, and the performance of its shares, which are up almost 30% this year, make the company an attractive buy right now.

But the insurance and healthcare leader is well positioned to weather any long-term financial tumult as well.

Regardless of what happens to the economy, Americans are still going to need healthcare, and millions of them are already UnitedHealth customers.

UnitedHealth is a diversified company. In addition to its thriving insurance business, it also provides software and information technology to a number of clinics and hospitals.

As the medical tech space continues to grow, so should UnitedHealth’s profits.

U.S. Bancorp (USB)

U.S. Bancorp is the parent company of U.S. Bank, one of the country’s largest banking institutions.

Betting on bank stock might seem counterintuitive when a stock market correction is expected to hammer investors’ finances. But banks tend to do well in rising interest rate environments: As rates increase, the profit margin, or spread, earned by banks widens.

Rather than turning itself into a casino through the kinds of risky derivative plays that tanked some of its competitors in 2007-2008, U.S. Bancorp has instead been focused on innovating and providing digital service for its customers.

The increased efficiency and lower operating costs that result should be music to investors’ ears.

Since the beginning of 2021, U.S. Bancorp stock has risen by almost 32%. Of course, if you’re on the fence about jumping in at the current level, some apps might give you a free share of U.S. Bancorp just for signing up.

Coca-Cola (KO)

There may no longer be any actual coke in Coke, but the company’s shares are still pretty addictive.

Despite the push for more healthy food and beverage consumption, Coca-Cola’s dominance of the soft drink market remains unmatched.

But the company’s offerings extend far beyond liquid sugar.

Coke also sells popular bottled water brands Dasani and Smartwater, big-name juices like Minute Maid and Simply, and international coffee products Costa and Georgia.

What makes Coca-Cola an interesting defensive play is the company’s consistently impressive profit margin, which has averaged 23.6% over the last decade. That’s largely the result of Coke’s ability to tinker with portion sizes and prices and having the capital to invest in greater productivity.

A faltering stock market shouldn’t change any of those dynamics.

This year, Coke’s quarterly dividend payout hit $0.42, almost double what it was in 2011.