The S&P 500 is approaching bear market territory. Is Apple stock a good place to hide, should the broad market dip further from here?

The stock markets have decisively turned south. As of the writing of this sentence, both the S&P 500 and Apple stock have corrected around 15% from their respective peaks reached early in January 2022.

As the S&P 500 approaches bear territory (i.e., a 20%-plus decline, something that has happened only once in the past decade), I ask the question: can AAPL endure the upcoming selloff better than other stocks?

AAPL: outperformer in distressed times?

From a business perspective, Apple seems to be performing well, regardless of unfavorable macroeconomic forces and despite supply chain issues.

Some even argue that the Cupertino company can do better than the average company in times like these. This is because of world-class supply chain management, along with peak demand and brand appreciation that should help to protect Apple’s pricing power.

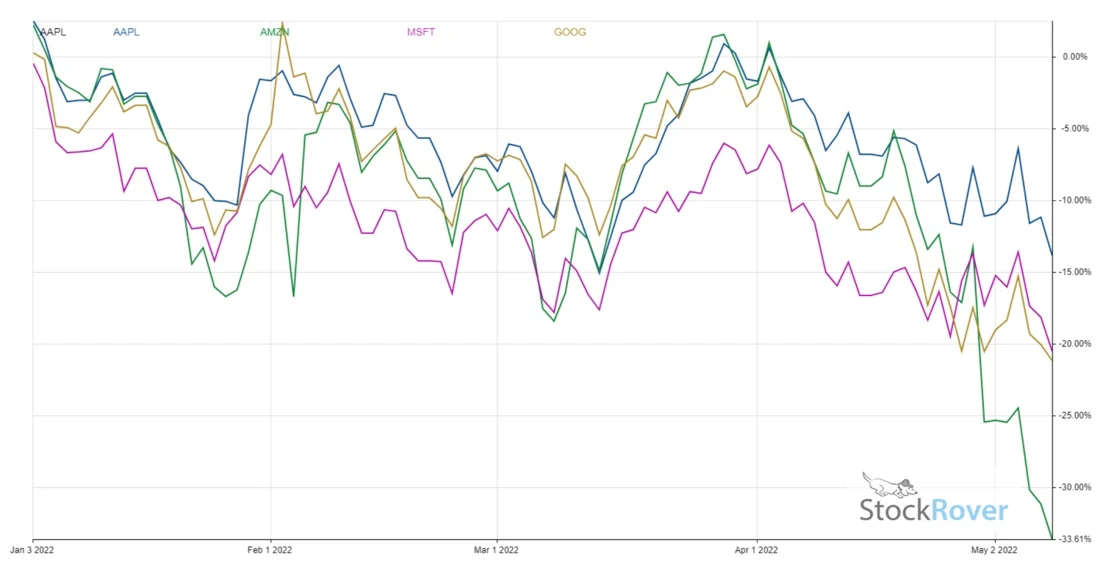

This may help to explain why Apple has not lost too much of its market value since reaching a January 2022 peak — at least compared to other stocks. While Amazon, Alphabet and Microsoft have been down at least 20% so far this year, Apple has declined “only” 15%.

The apple does not fall far from the tree

The above is the more qualitative, bullish take on Apple stock. But there is also the more quantitative and less upbeat perspective.

First, Apple’s valuations remain fairly rich. The current-year P/E of nearly 26 times is quite high compared to the S&P 500’s multiple of 17.5 times — historically, Apple’s earnings ratio has been consistently lower than the broad market’s.

Most high-valuation stocks have fallen off a cliff lately. Many of the uber-growth, richly valued names that would be natural candidates for one of Cathie Wood’s ARK portfolio, for example, have already lost at least half of their peak market values. Could AAPL be next?

Second, Apple stock has historically been pretty sensitive to broad market movements. AAPL’s beta is +1.2,which means that the share price should be reasonably expected to move 20% (or 0.2 times) more than the S&P 500 in either direction.

Therefore, should the broad index tank, history suggests that Apple may also sell off, except even more sharply — that is, the apple does not usually fall far from the tree. Take the four bear and quasi-bear markets since 2000:

- Early 2000s: the S&P 500 dipped as much as 47%, while AAPL sank 82%.

- 2008-09 financial crisis: the S&P 500 dipped 55%, while AAPL dropped 61%.

- Quasi-bear of Q4’18: the S&P 500 dipped 19.8%, while AAPL shrunk 38%.

- 2020 COVID bear: the S&P 500 dipped 34%, and AAPL did better at 31%.