MoMo Productions/DigitalVision via Getty Images

Thesis

The title could have been 'Avoid Avoid Avoid' when retail investors are concerned. There are some financial instruments that regular retail investors should never touch, and we believe 2x Long VIX Futures ETF (BATS:UVIX) is one of them. With the recent bout of volatility seen in the beginning of August, certain market participants have started to believe volatility as an asset class is attractive again. While certain instruments could provide for a hedge, or a long-term holding, other instruments are not only loss-generating long-term, but specifically set up for day trading, especially when analyzed in depth.

In this article we are going to have a closer look at UVIX, its composition and structure, and articulate why buy-and-hold retail investors should avoid this name which is only suitable in our view for day trading.

Composition - a leveraged ETF

As per its own literature, UVIX is a leveraged exchange traded fund:

The 2x Long VIX Futures ETF is a leveraged VIX-linked ETF that seeks to provide daily investment results, before fees and expenses, that correspond generally to twice the performance of the Long VIX Futures Index (Ticker: LONGVOL).

Kindly keep in mind that leveraged products as a whole are much more risky, and generally not suitable for long-term holders, but rather for people with a shorter time horizon in mind as FINRA highlights:

The objective of a geared ETP with a daily reset is to provide that degree of leveraged or inverse exposure for that single period and, importantly, not over longer (or shorter) periods. (Similarly, a geared ETP with a monthly objective is designed to provide that leveraged or inverse exposure for a specified monthly period.) Holding a geared ETP for a period that is shorter or longer than its objective can lead to performance that may deviate significantly from the daily objective.

Now that we have established the leveraged nature of the fund, let us look at the fundamentals and understand what the Long VIX Futures Index actually does:

The Long VIX Futures Index expresses the daily performance of a theoretical portfolio of first and second month VIX futures contracts that are rolled daily. The Index determines its daily settlement price from the Time Weighted Average Price (TWAP) of its theoretical portfolio over the last 15 minutes of the regular equity trading session.

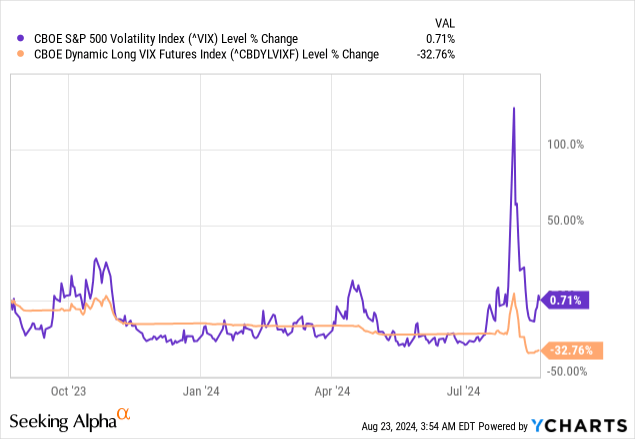

So an investor long this index would be long volatility via the first and second months futures contracts on the VIX. As we have seen from the recent VIX performance, VIX futures tend to 'smooth-out' extreme spikes since they represent a longer-term take on the market:

In the above graph, we have plotted the VIX index against the CBOE Dynamic Long VIX Futures Index, and we can clearly see how futures are much less volatile than the VIX itself.

The 'roll' effect compounded

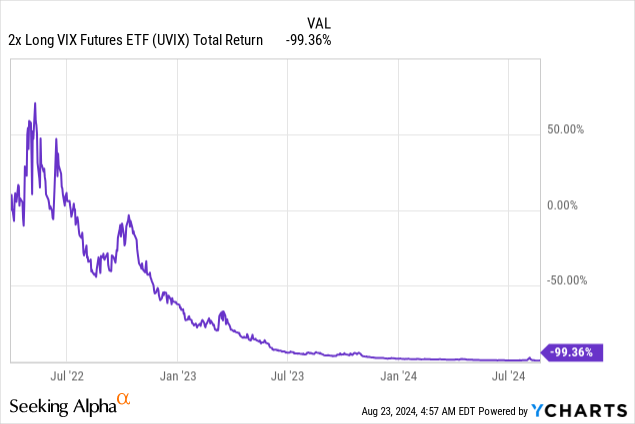

In a market that does not change, rolling futures (i.e. moving to the next futures contract as the current one expires) has a negative effect on profits. The higher the 'roll cost', the more negative the long-term performance. When you use leverage like UVIX does, the effect is astounding:

The fund has lost -99% in the past three years. Yes, you read that correctly. If you would have bought this name as a 'portfolio hedge' in the beginning of 2022, you would be almost completely wiped-out.

There is no clearer chart on why a retail investor should stay away from this name from a buy-and-hold perspective. At the end of the day UVIX is a leveraged expression of a trade which has a significant negative roll cost.

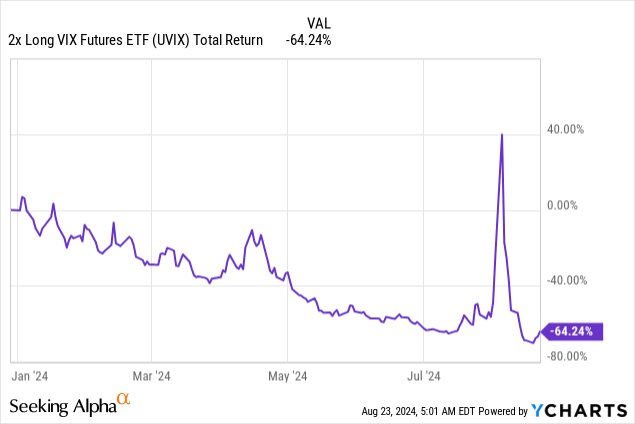

While the August 5, 2024 VIX spike moved the name to positive territory for the year, it has now re-traced the entire move and is down -64% for the year:

The above chart shows the day-trading or short-term trading possibilities embedded in this name, but also the need to hold the name for only very short time-frames with tight targets and stop-losses.

An instrument for day-traders only

From a day-trading perspective, the fund offers significant upside on overall down days in the equity market when volatility moves higher. As an example, on August 22, 2024 the S&P 500 was down -0.78%, while UVIX was up +8% as volatility moved higher.

This ETF can be very profitable for day traders as it represents a very volatile instrument via its return profile and leveraged nature. However, that is where the benefits stop. When trading this name investors have to set-up clear targets for the VIX futures they are following, and exit the name within a pre-defined time-frame. As we saw from its 2024 total return graph, the name is a value destroyer if held long term.

An investor can find the risk metrics for the name under the 'Risk' tab on the Seeking Alpha platform, and the ETF comes with a 149% annualized volatility versus a 12% one for the S&P 500.

Conclusion

UVIX is an exchange traded fund that represents a 2x take on VIX futures. The instrument is meant to replicate the front month VIX futures on a daily basis only, and represents a long-term value destroyer, being down -99% in the past three years. The name is not a buy-and-hold instrument, but a security to be used by day traders and sophisticated investors only. The fund can provide substantial daily returns if the market is timed correctly and the name exited. With an annualized volatility of 149%, UVIX squarely positions itself in the speculative instruments category, and regular retail investors should avoid this name completely. In our mind the name is only palatable for sophisticated day-traders who look for high beta securities in down markets.