Initial Report(Part 1): Sisram Medical (1696.HK), 62% 3-yr Potential Upside (EIP, Wu MeiMei)

1. Sisram Medical

2. Executive summary

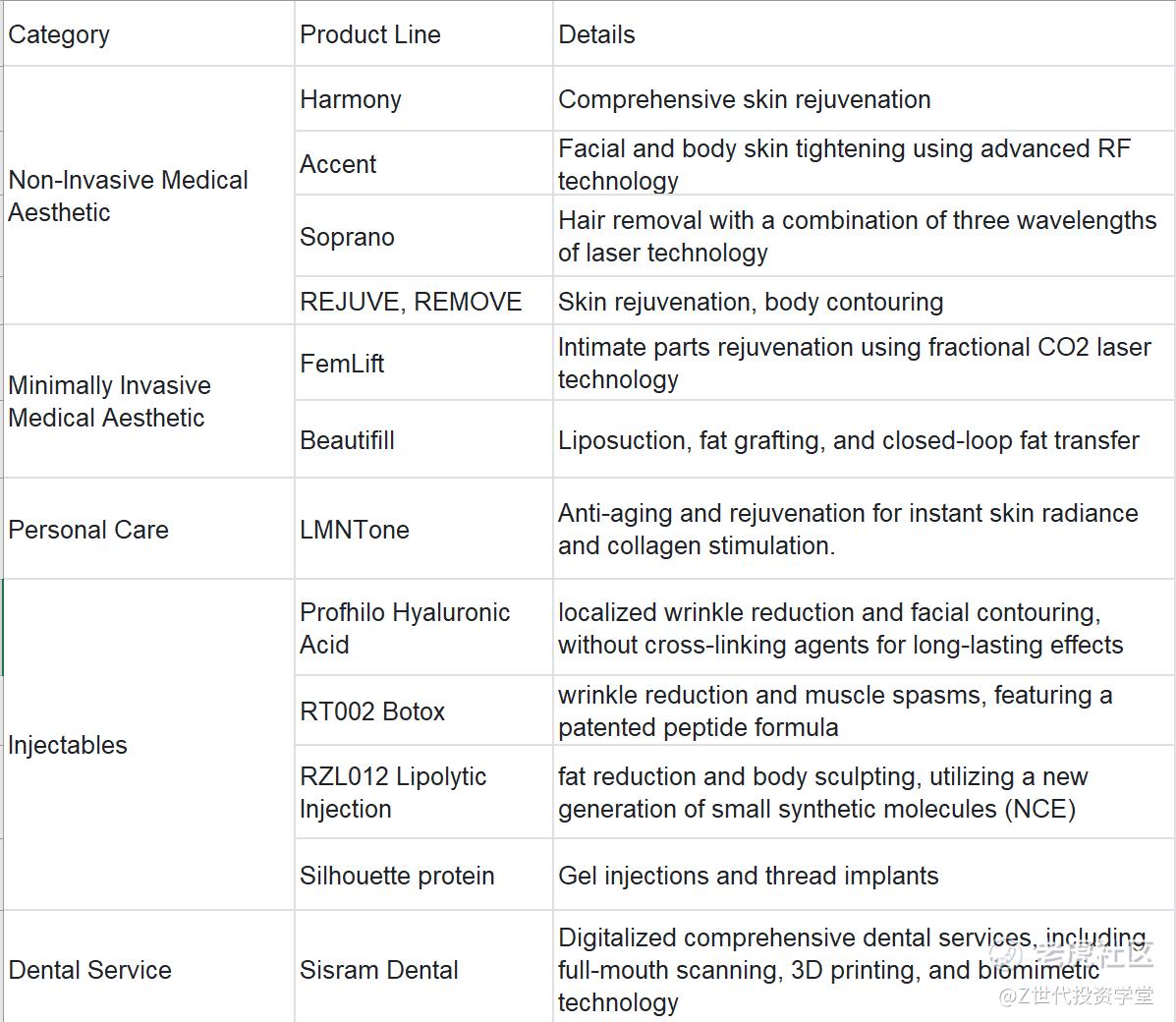

Sisram Medical is a leading international aesthetic medical company that designs, develops, manufactures, and distributes optoelectronic aesthetic medical device and aesthetic beauty equipment to medical institutions and retail customers. Sisram’s aesthetic medical devices utilize laser and RF technologies to achieve skin rejuvenation, hair removal, anti-aging, and various other beauty effects. It also produces injectables and provides dental services.

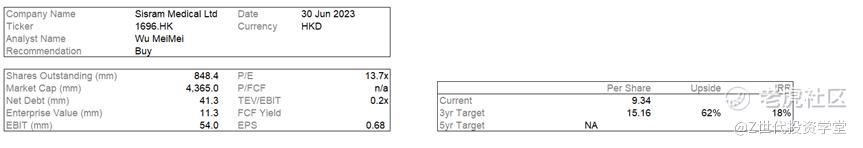

This report initiates a BUY recommendation on Sisram Medical (1696.HK) on the basis of the following theses: (a) Organic growth of aesthetic cosmetic market in the US and Asia, (b) Expanding product matrix, and (c) Stronger customer engagement through direct sales expansion. We believe that Sisram’s product advantage in providing stronger treatment effects with painless experience renders a strong economic moat for the company. Sisram has a moderately strong ESG proposition with an emphasis on product stewardship, but aspects including data privacy and information disclosure can be improved.

3. Company overview

Founded in Israel in 2013, Sisram Medical is committed to building a global ecosystem for beauty and health. The company's aesthetic product portfolio encompasses light energy-based medical devices, injectables and fillers, as well as beauty and digital dentistry. Its business spans over 90 countries and regions worldwide, enjoying a high level of brand recognition and reputation. One of its subsidiaries, Alma Lasers, is a global leader in energy-based devices, deeply involved in energy-based medical aesthetics such as comprehensive skin rejuvenation and body and facial contouring through a combination of in-house development and strategic acquisitions. In 2020 and 2021, its brand Fotona ranked first and second, respectively, in the market share of laser/intense pulsed light medical aesthetic products in China. In 2022, the company's annual revenue increased by 20.45% to $35.4 million, and its net profit increased by 28.56% to $4.017 million.

Sisram’s growth can be divided into three stages:

Founding Stage (2013-2017): Sisram Medical Technology was established in April 2013 and acquired 95.2% of Alma Lasers, a leading global energy-based medical aesthetic device supplier. In June 2016, it completed the full acquisition. During this period, the company focused on Alma Lasers as its core business, continuously enriching its Harmony and Accent series, and launching multiple energy-based products such as Beauty Fill, Opus, and Remove. In 2017, Sisram Medical Technology listed on the Hong Kong Stock Exchange, becoming the first Israeli company to be listed in Hong Kong.

Entering Injectable Market (2018-2020): Deepening global channels and expanding the injectables market. In 2018, Sisram Medical acquired a 60% stake in Nova Medical Israel, a major Israeli distributor of medical aesthetic products, to accumulate channel capabilities and lay a solid foundation for global market sales. In the same year, it signed an agency agreement for the hyaluronic acid product Profhilo with Swiss company IBSA, and officially entered the injectables and fillers business the following year. It also obtained exclusive distribution rights for the Israeli product Raziel RZL012 lipolytic injection.

Building Ecosystem (2021-Present): Expanding the product portfolio and creating an ecosystem for medical aesthetics. Since 2021, the company has successively expanded into two new business lines: dental and personal care, moving towards a comprehensive medical aesthetics framework. This includes the acquisition of full ownership of Fosun Dental and the establishment of the innovative digital dentistry service platform Copulla. The company also launched the LMNT, a home beauty device brand based on light-wave energy. Products in the injectables business line such as skin boosters, subcutaneous facial fillers, new long-lasting botulinum toxin, and lipolytic injections are all in the R&D stage. While building a diversified product portfolio, Sisram Medical actively creates a medical aesthetics platform that spans the entire industry chain, deploying direct sales channels. In April 2023, it acquired the exclusive distributor Feidun in China to accelerate channel integration and continue its global business expansion.

3.1Business segments

3.2 Revenue drivers

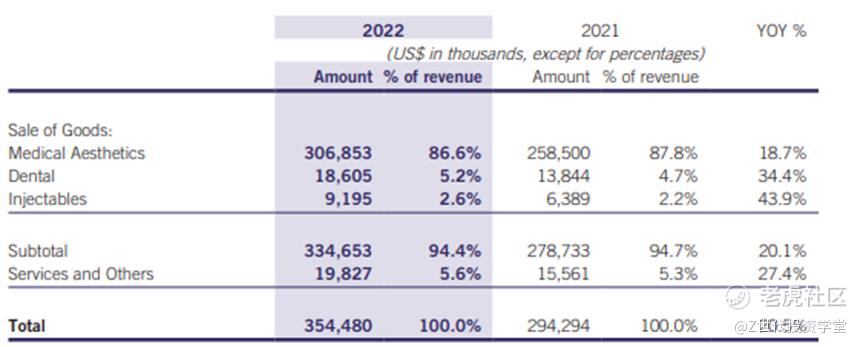

• By Product Lines

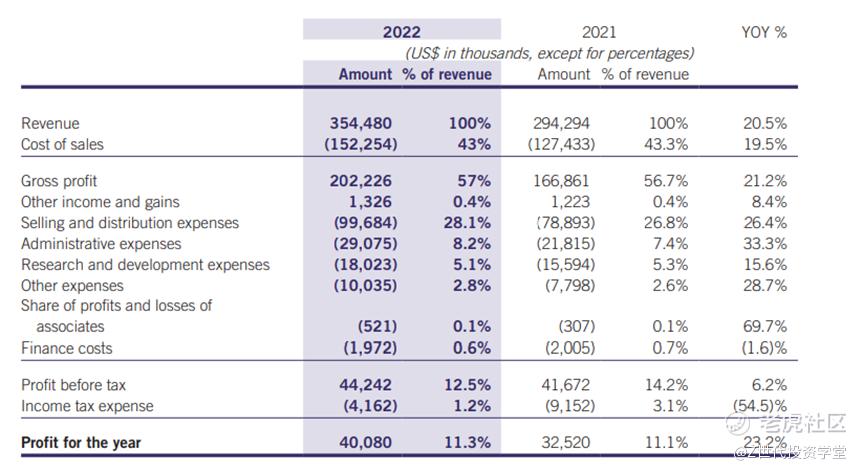

86.6% of Sisram’s revenue was from medical aesthetic equipment sales. The revenue of the group increased by 20.5% compared to 2021, and 18.7% was driven by MA equipment sales. The increase was primarily attributable to the continuous growth of Sisram’s existing leading products alongside successful introduction of Alma Ted™, LMNTOne™ and CBD+ Professional Skincare Solution™.

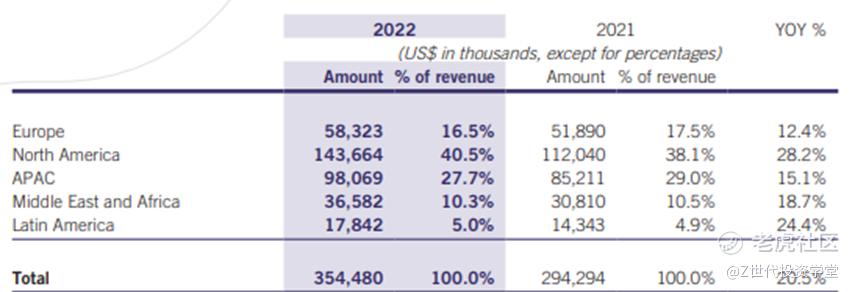

• By Geographic Regions

North America, APAC and Europe were the most important markets. The revenue derived from North America increased by 28.2%, primarily attributed to the strong position of Alma’s brand and sales operation and the successful launch of Alma Ted™. The revenue derived from APAC increased by 15.1%. The increase was mainly attributed to the integration of Foshion dental and successful launch of LMNT One™ alongside direct operation expansion (Australia, Korea, and India).

3.3 Cost drivers

43% of Sisram’s costs are attributed to the cost of material, rendering service and renumeration. The cost of sales increased by 19.5% , rising slower than the group’s revenue. R&D expenses comprise 5.1% of total sales, higher than the industry average of 2-3%, and increased by 15.6% compared to 2021, indicating more research efforts in improving the existing products and developing new lines. Selling and distribution expenses rose by 26.4% primarily due to rising sales commission and marketing expenses. The fastest growing cost is administrative cost, explained by information system investments and the creation of new corporate functions. In overall, the increase in cost is consistent with the revenue growth.

3.4 ESG considerations

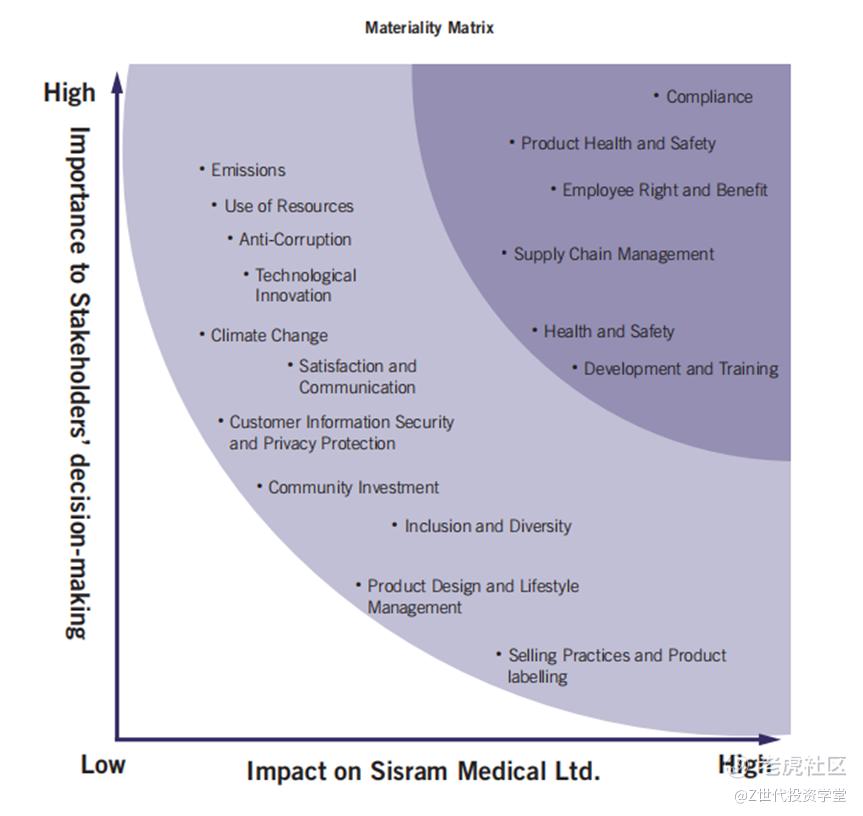

Sisram identified 17 material ESG issues that are important to its stakeholders, and devised strategies to address issues starting with the ones with more immediate and higher risk exposure. In 2022, It has included new issues including selling practices & product labelling and product design& life cycle management, which are urgently demanded by medical aesthetic companies in the environment of tightening regulation on marketing information accuracy & appropriateness and waste management. However, critical social issues regarding customer privacy and data security were not considered in the company’s ESG strategy. Information privacy is at high stake to consumers of medical aesthetic as the company are in possession of private data including photos, body measurements, medical conditions, bioinformation as well as purchase histories that they do not wish to reveal. Therefore, data leak incidents could develop into critical incident risk which damages brand value and company reputation. Sisram should address the issues immediately by including prevention features systems in the current development of its information system infrastructure.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。