Initial Report Part 2: Kaspi.kz (NASDAQ: KSPI), 117%% 5-yr Potential Upside (EIP, Dean Tay)

Fintech Platform

Kaspi˖s Fintech segment is its consumer lending and deposit businesses. The platform enables consumers to access instantly and seamlessly, primarily through Kaspi.kz Super App, the Company’s digital finance products, including consumer finance and deposit. Fintech is Kaspi˖s largest, but slowest growing and least profitable (from a margin perspective) operating segment, accounting for 54% of revenue and 35% of net income, in 20˖23. It is notable that Kaspi originates 100% of loans from its own balance sheet (vs 2% for Ant/Alipay).

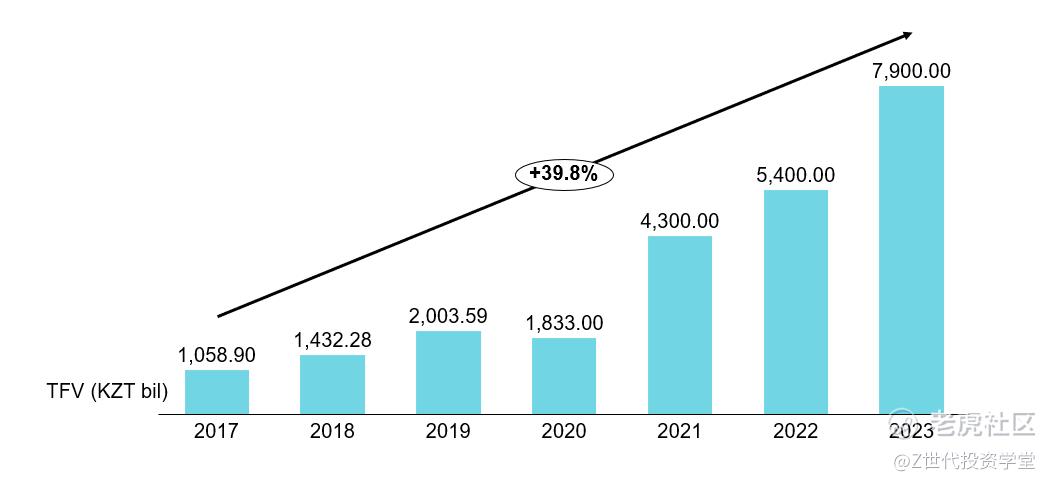

Kaspi's fintech platform has shown impressive growth, particularly in its Total Finance Volume (TFV), which serves as a key indicator of the platform's financial services adoption and usage. The TFV has exhibited strong year-over-year growth at 39.8% CAGR from 2017 to 2023, reflecting the increasing popularity and trust in Kaspi's lending and financial products.

Source: Kaspi

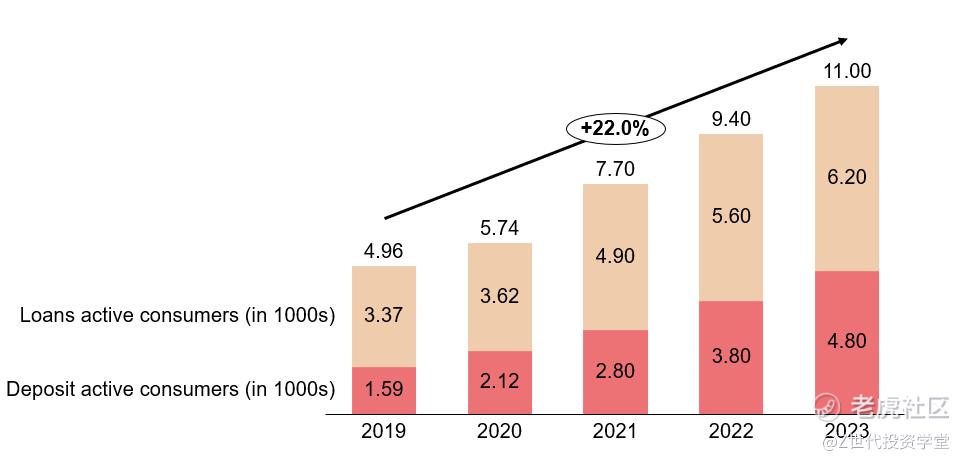

The trend of total active consumers parallels that of TFV, with a 22% CAGR from 2019 to 2023.

Source: Kaspi

Key products and services in the fintech segment include:

-

Car financing - online car loans for purchases through Kolesa.kz (a leading classified group that Kaspi acquired a majority stake in Jul 2023 - to be elaborated under "Marketplace")

In order to secure financing, a consumer can select a car on Kolesa.kz and seamlessly apply for a loan originated through the Fintech Platform for the maximum term of 60 months.

The loan approval process takes less than one minute, which then allows the consumer to complete the car purchase funded by Kaspi.kz via the Kolesa.kz website or the respective mobile application.

Kaspi then credits the purchase price to the seller’s account. Purchased cars act as security for the financing provided.

Consumers may prepay car loans without any penalty prior to contractual maturity.

-

General Purpose Loans - loans extended to consumers for day-to-day purchases outside of the Marketplace Platform

Source: Kaspi

3.Buy-now-pay-later - unsecured financing for Marketplace platform, provided for a period of up to 3 months, and from 6 to 24 months in specific promotion periods. Buy-now-pay-later products with a maturity of less than three months are provided to consumers interest free.

Kaspi Red Shopping Club

Kaspi Red Shopping Club is a subscription-based programme which allows consumers to have a pre-approved revolving shopping limit and make purchases on the Marketplace Platform free of any interest through a buy-now-pay-later product, for a period of up to three months.

Kaspi offers free membership for the first year. If the consumer uses the services of the Kaspi Red Shopping Club, for each subsequent year we will charge a membership fee which varies depending on the shopping limit chosen by the consumer (ranging from KZT50,000 to KZT150,000).

4.Kaspi deposits - customer deposit accounts available through the Kaspi.kz Super App.

Kaspi Deposit accounts are predominately denominated in tenge and U.S. dollars and are current and term accounts

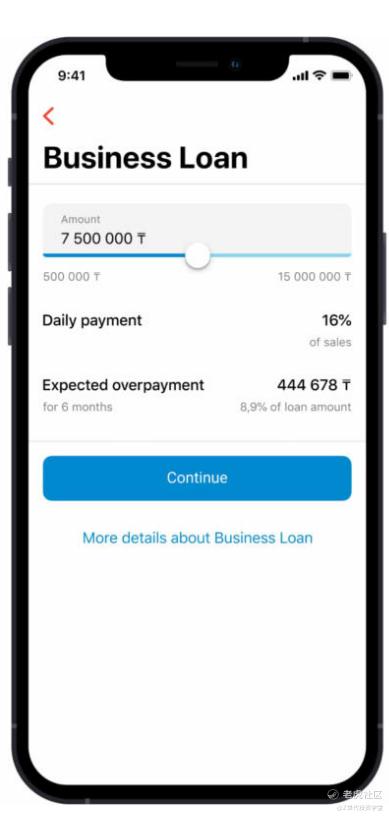

5.Merchant finance - a working capital finance product for merchants operating in the Payments and Marketplace Platform with a targeted yield of 15-20%.

The service enables merchants to drawdown a facility of up to 20% of GMV and TPV generated by the merchant through the Payments and Marketplace Platforms. The financing will be provided in local currency and we expect the average amount to be around U.S.$10,000 equivalent. The maturity of each drawdown is up to six months and is automatically repaid daily from the merchant’s GMV and TPV with Kaspi.kz. Online Merchant Finance is provided fully online through Kaspi Pay Mobile App.

Lending is linked to transaction activity through Kaspi's Super App, in this case a merchant’s turnover through Kaspi.kz Pay or Kaspi Marketplace. Merchant financing is also low risk, with repayments taken directly from the merchant’s sales transacted through Kaspi.kz.

Pricing and Monetization

The Fintech Platform primarily generates interest revenue, fees from consumer finance loans and Kaspi Red Shopping Club membership and other fees.

Marketplace Platform

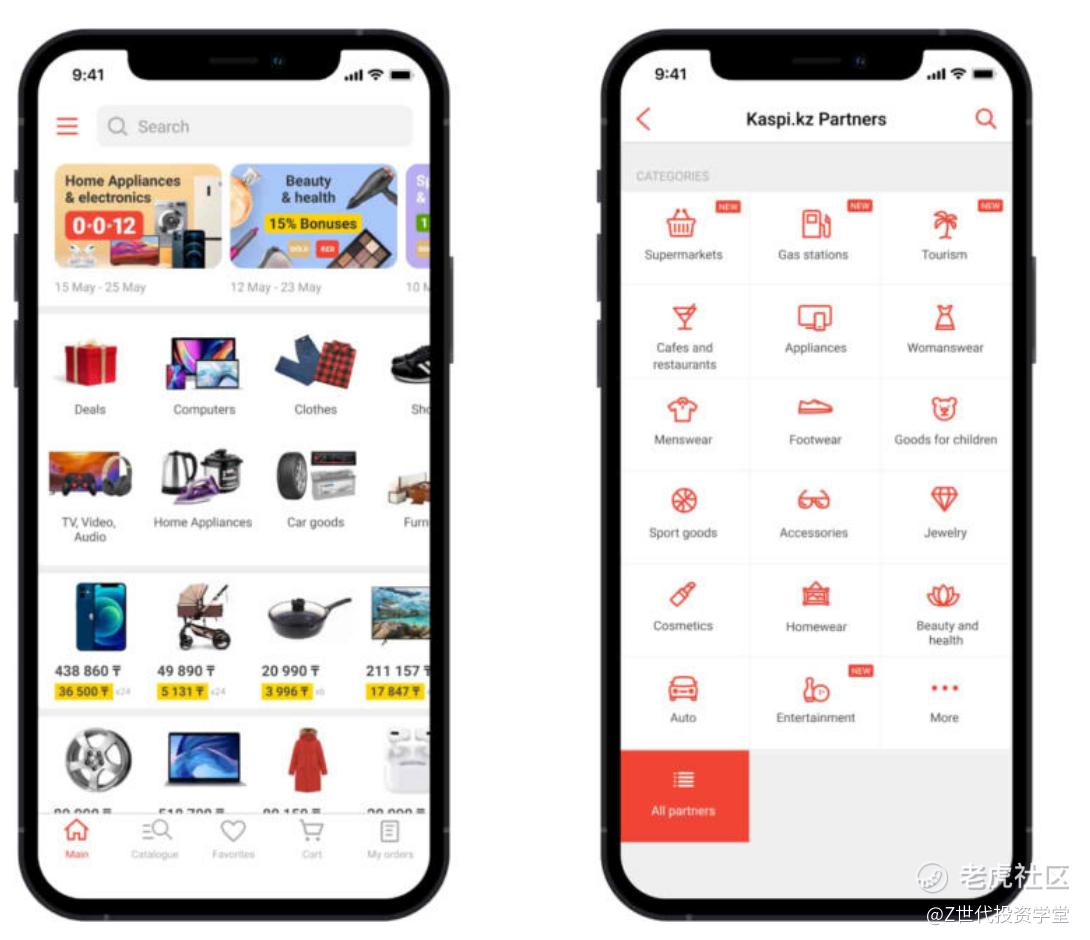

The platform allows consumers to buy a broad selection of products and services from a variety of online and offline merchants. Marketplace is Kaspi'˖s fastest growing segment. Kaspi reports four main businesses within Marketplace: m-commerce (in-store and services), e-commerce, Travel, and Grocery.

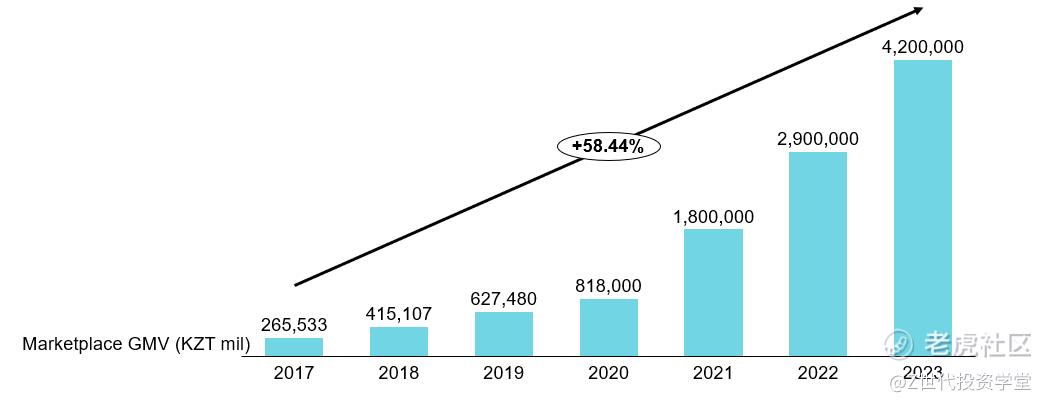

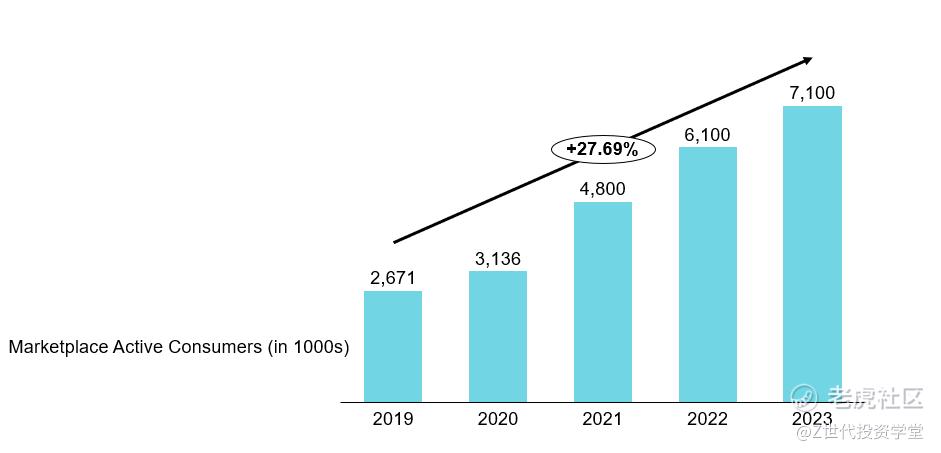

Kaspi's Marketplace segment has demonstrated remarkable growth, with its Gross Merchandise Value (GMV) serving as a key indicator of the platform's expanding reach and consumer adoption. The GMV has shown impressive 58.44 CAGR from 2017 to 2023, reflecting the platform's success in capturing a larger share of Kazakhstan's e-commerce market.

Source: Kaspi

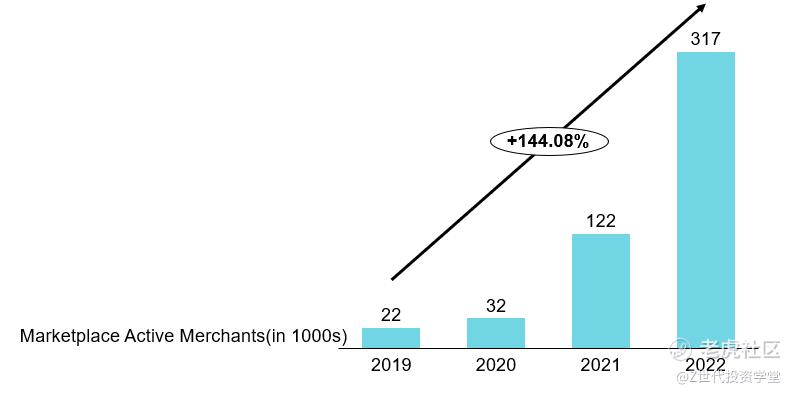

This growth is similar for the marketplace active consumers and merchants as seen below.

Source: Kaspi

Note: Kaspi did not report active merchants in the marketplace for 2023

Key products and services in the marketplace segment include:

1.1P marketplace

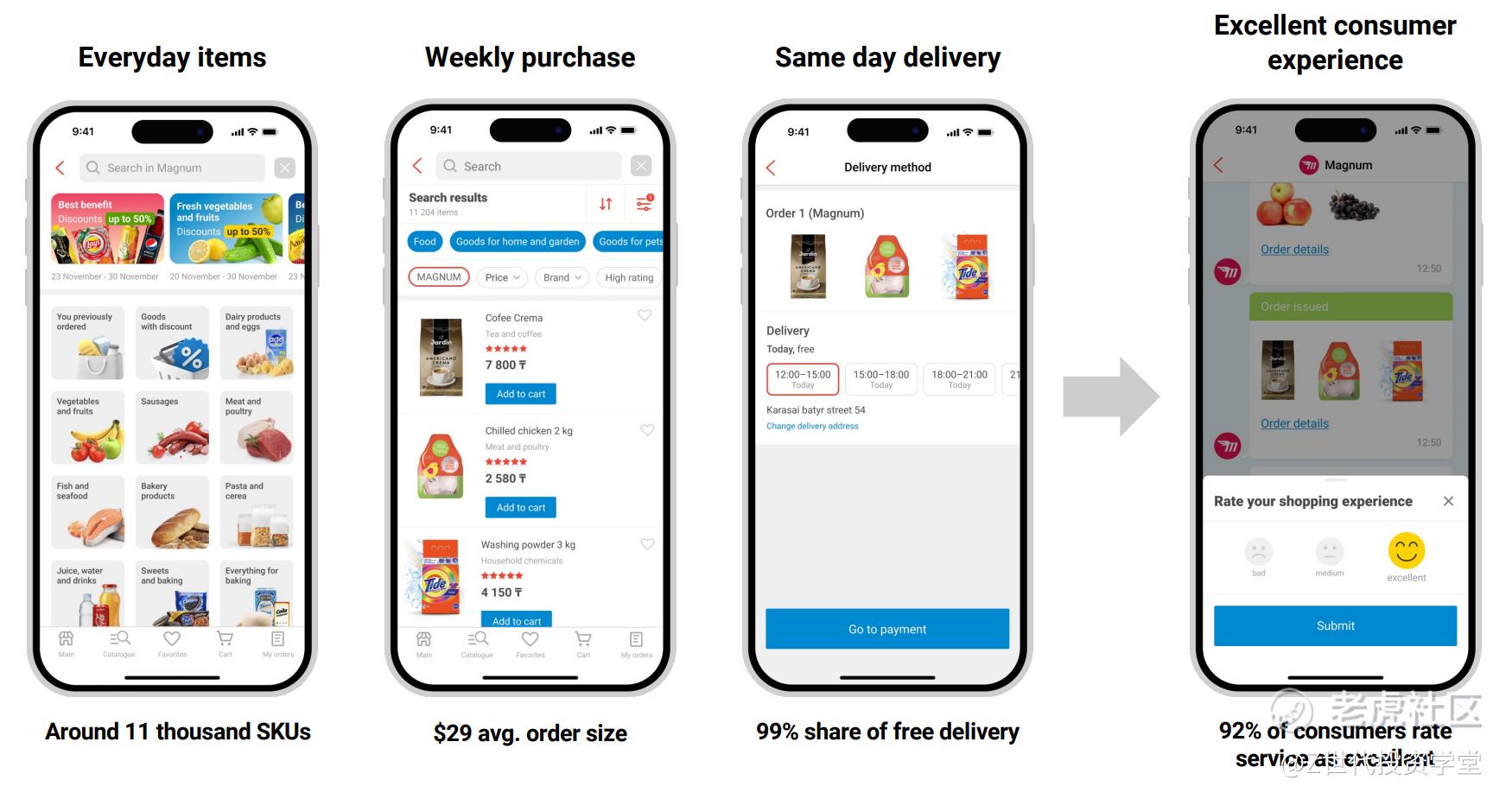

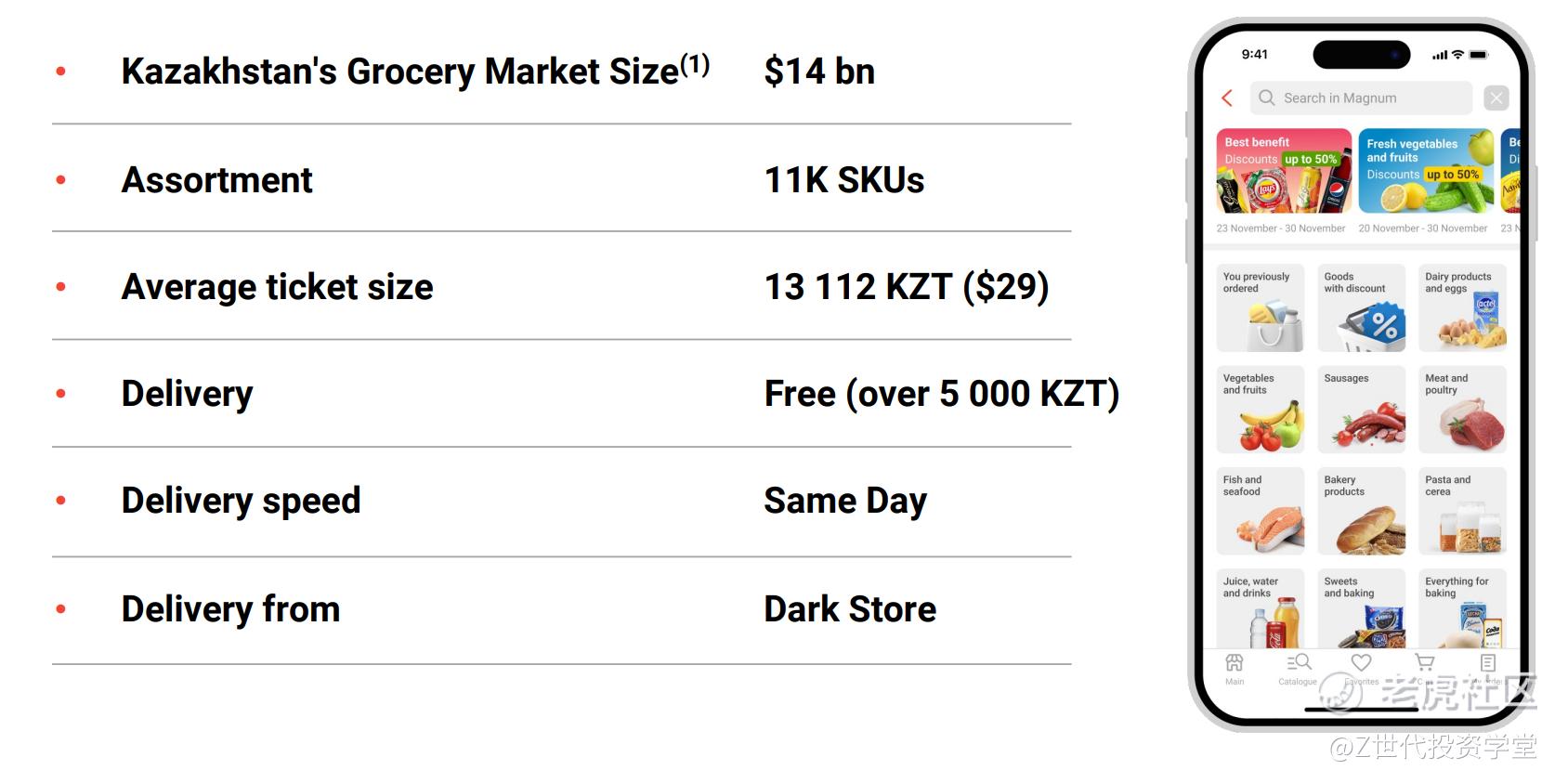

Kaspi operates an e-Grocery platform that allows consumers to order groceries through the app with free home delivery within 24h.

This was after an acquisition of an 51% stake in Magnum E-commerce Kazakhstan from Magnum Cash & Carry LLP for KZT 5000 million on February 24, 2023.

Kaspi is responsible for the frontend user experience, product assortment, and pricing, while Magnum provides grocery expertise and leading purchasing terms. Magnum owns a 10% equity stake in Kaspi˖s eGrocery segment.

Source: Kaspi

2.3P marketplace

e-Commerce - consumers are able to select, purchase and receive products through the Kaspi app, powered by fintech and payments platform

The take rate depends on the specific vertical; it ranges from 5.0% (for electronics) to a percentage level in the mid-teens (for jewellery).

A variety of fulfilment options, including in-store pick-up or delivery by merchant or by Kaspi Delivery (to be elaborated below)

Source: Kaspi

m-Commerce - consumers are able to research goods and merchants in the app and complete purchases at the merchant's physical location with Kaspi QR and BNPL products

Mobile Commerce is done through the Kaspi Red Shopping Club (a subscription-based service), which has a dedicated section for merchants and consumers in the Super App and is organised around popular shopping and lifestyle categories, which are not necessarily listed on the e-Commerce platform.

Such categories include, among others, supermarkets, restaurants, petrol stations, medical services and beauty salons.

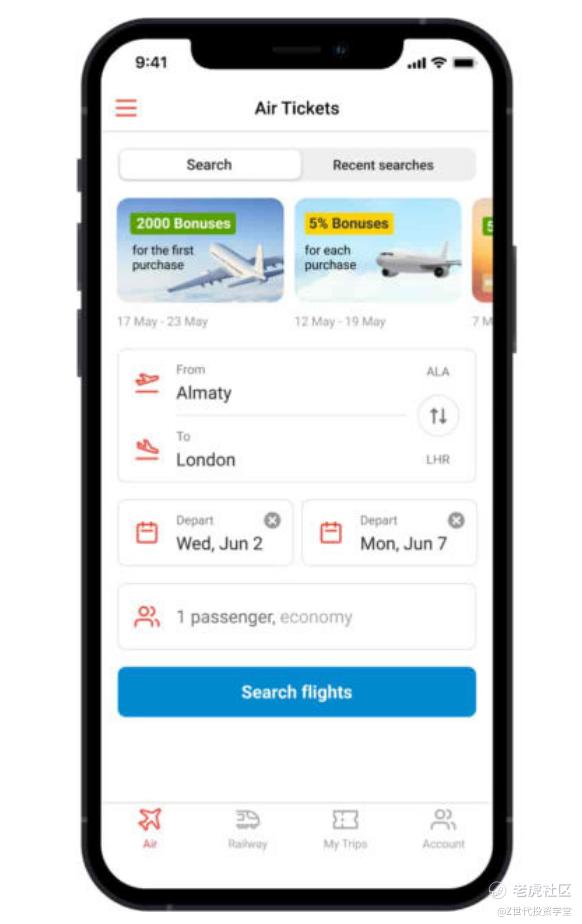

Kaspi Travel - consumers are able to purchase rail and air tickets, as well as international package holidays within the Kaspi.kz Super App, with payments fully integrated with Kaspi Gold and BNPL products.

Included in July 2020 when Kaspi.kz acquired a 100% share of LLC Traveleasy, whose primary business is selling online airline and railway tickets. Thereafter, the company started expanding into rail and more robust vacation packages. Most rail and airline tickets sold facilitate domestic travel, though anecdotally, Turkey, Egypt and Dubai are popular vacation destinations for Kazakhstanis Kaspi entered the sector via acquisition, picking up Santufei, a Kazak player in the space.

Kaspi processed KZT 231 billion in travel volume in ˖22, accounting for roughly 25% of all travel spend in Kazakhstan, and KZT 353 billion in travel volume in ˖23, up 57% from the previous year

Take rate for travel: 7.9% (according to Q2 2024 earnings call)

Source: Kaspi

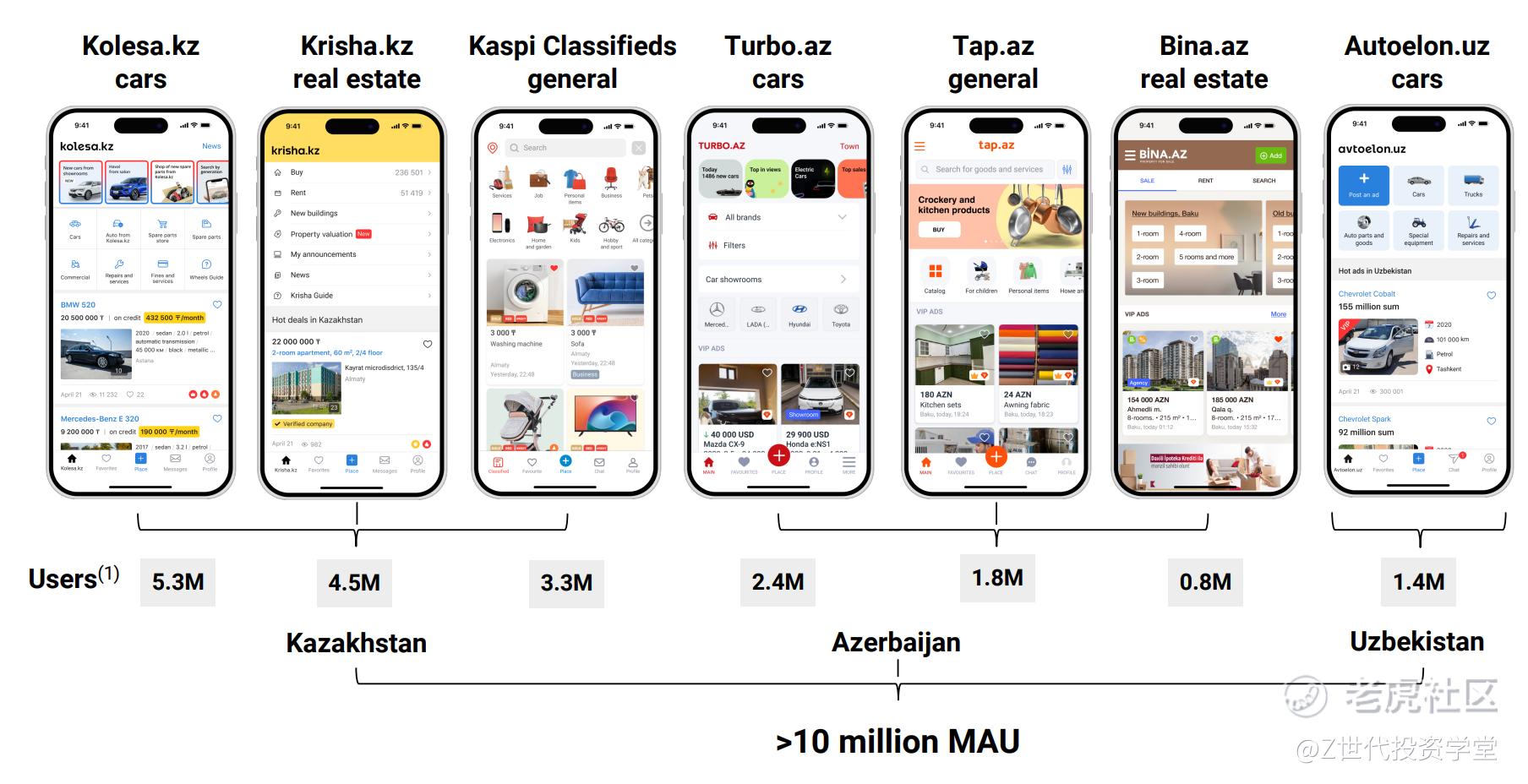

Kaspi Classifieds - consumers and businesses can advertise their used and new goods, services and jobs to consumers, including car and real estate with the Kolesa.kz and Krisha.kz acquisitions

This process began in 2019 with the acquisitions of three classifieds companies in Azerbaijan - turbo.az (cars), bina.az (real estate) and tap.az (general). Then in late 2022, Kaspi Classifieds (general) was launched in partnership with Kolesa, a leading classifieds in Kazakhstan which Kaspi’s CEO, Mikhail Lomtadze, already had an 11% interest in. Roughly a year later in the fourth quarter of 2023, Kaspi acquired a 40% stake in Kolesa, effectively giving them a controlling interest when considering Lomtadze’s stake.

Kolesa owns Kazakhstan’s no. 1 car classifieds site, kolesa.kz (13x better known than the next biggest) and Kazakhstan’s no. 1 real estate classifieds site, krisha.kz (4.6x better known than the next biggest). They also own the leading car classifieds in Uzbekistan, avtoelon.uz, which will provide a nice foothold for Kaspi.

Source: Kaspi

3.Car e-commerce

Facilitates buying and selling used cars by integrating the search, selection and legal registration steps required

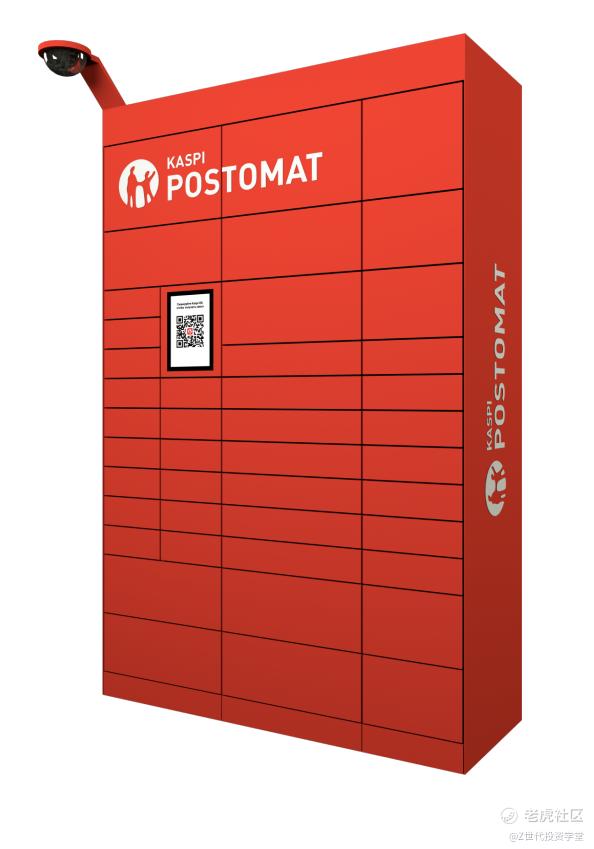

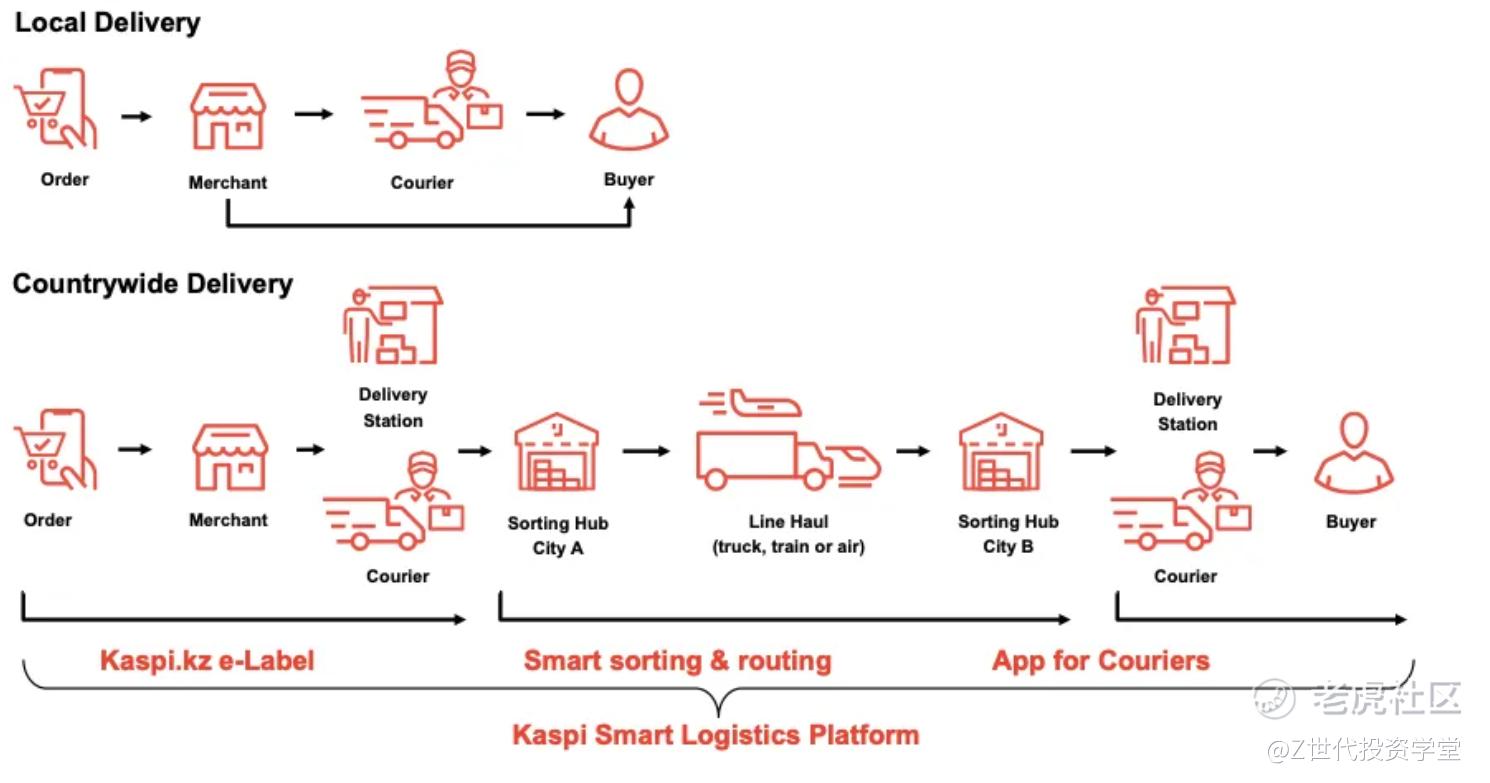

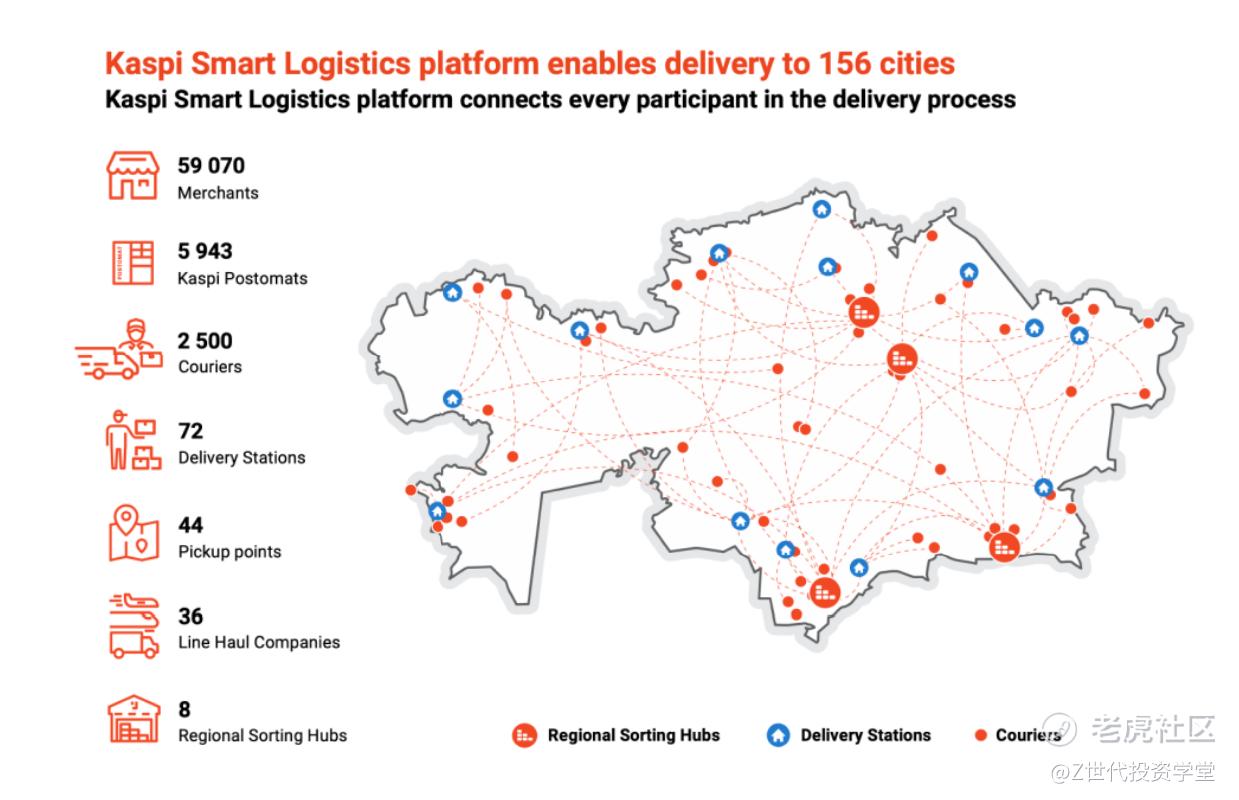

4.Delivery services - Kaspi Delivery is a service that allows the reliable delivery of any product on the Marketplace to more than 150 towns and cities in Kazakhstan.

Kaspi collaborates with more than 60 local logistics companies, including well-known names like DHL, DPD, KazPost, and Pony Express. This network employs around 2,500 couriers and 5,000 delivery personnel, primarily from small and medium-sized businesses.

Two delivery options: Delivers straight to door or to Kaspi's own postomats (automated parcel machines) that improve courier efficiency, reduce last-mile delivery costs and improve consumer convenience.

Source: Kaspi

Some performance metrics include: 96% of e-Commerce orders were delivered through Kaspi Delivery, 51% of orders were delivered within 48 hours, 88% of orders were delivered free of charge for the consumer.

It is important to note that the delivery times are impressive, considering the size of Kazakhstan (below picture for reference)

Source: Very Good Value on Substack

Source: Kaspi 2023 ESG Report

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。