Initial Report Part 3: Kaspi.kz (NASDAQ: KSPI), 117%% 5-yr Potential Upside (EIP, Dean Tay)

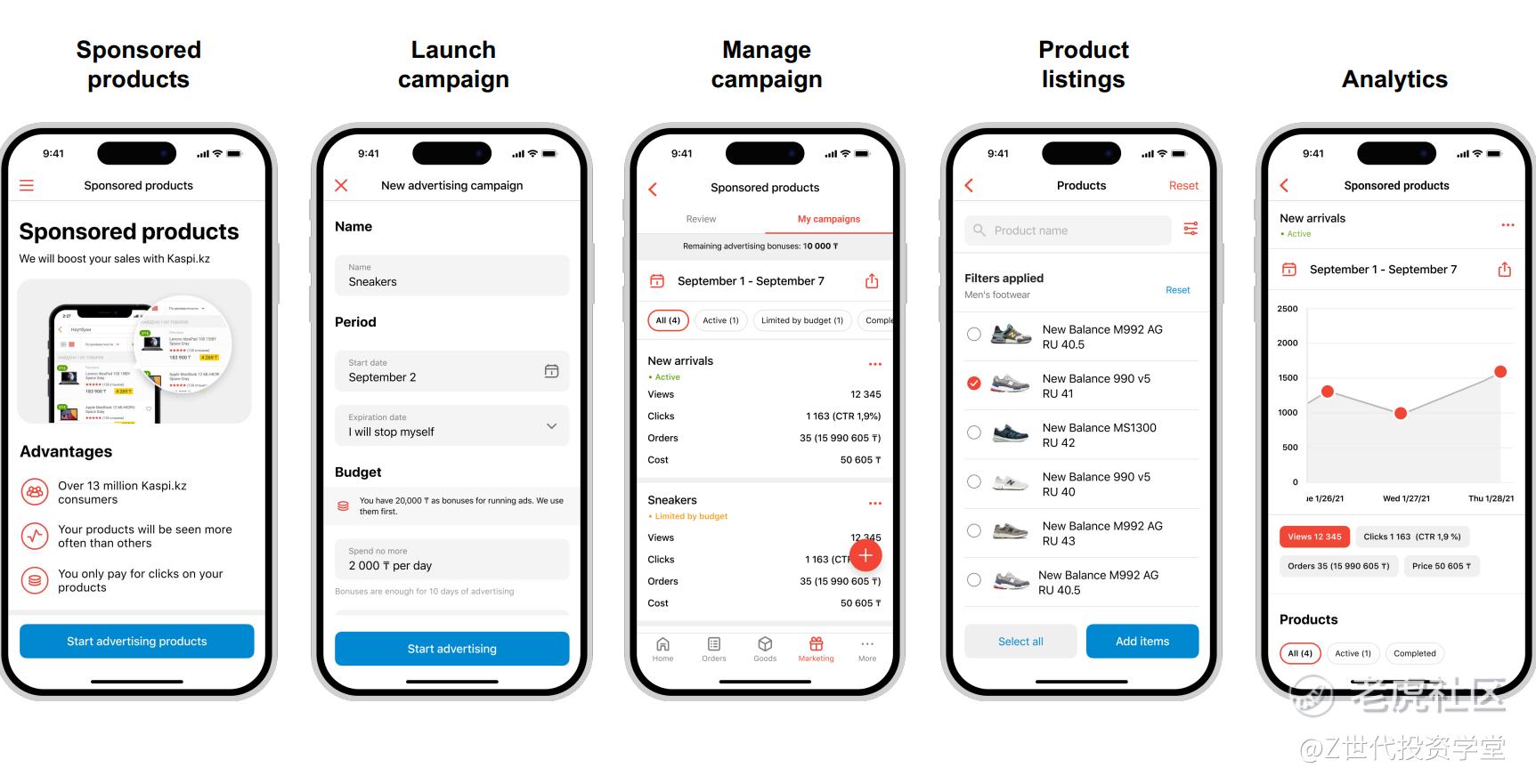

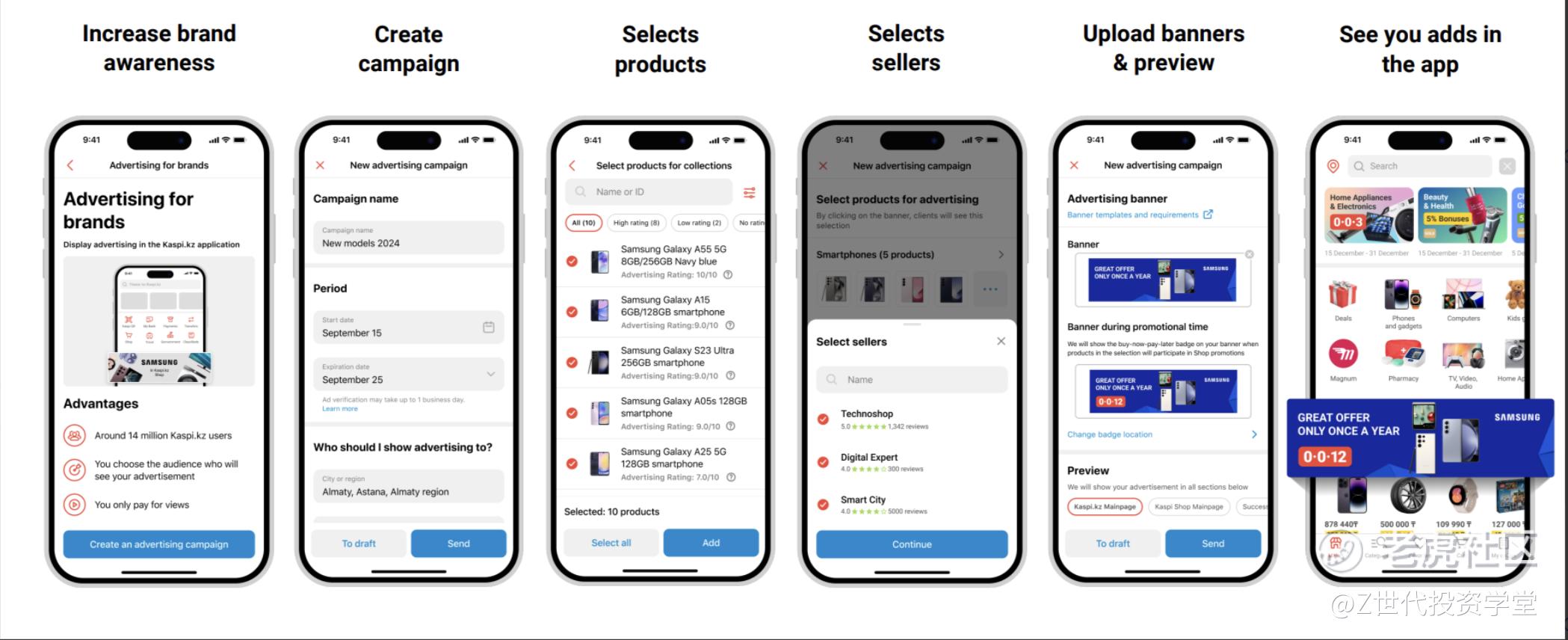

5.Advertising services - advertising campaigns on the platforms, which may display ads on the Kaspi.kz Super App to users through product searches, suggested products and banner ads.

Two forms of ads - product ads and brand ads

Product ads

Brand ads

Source: Kaspi Q2 2024 Report

Promotional periods such as Kaspi Juma, a 3 day national shopping festival (Kaspi's version of 9.9 / 10.10 / 11.11 in the context of Shopee or USA's Black Friday or China's Single Day)

Kaspi Juma usually takes place twice a year, in the summer and the autumn, and allows consumers to purchase any goods from participating merchants via a buy-now-pay-later consumer finance product with interest-free instalments for up to 24 months. This will be changed to thrice a year from 2024 onwards to cater to the different seasonalities in the year as mentioned in its earnings call.

Kaspi Juma contributes to a significant amount of GMV in a year (with 14% GMV contribution in 2019 and 14.2% GMV contribution in 2023)

As Kazakhstan's largest shopping festival, merchants pay on average double the seller fees to participate in Kaspi Juma.

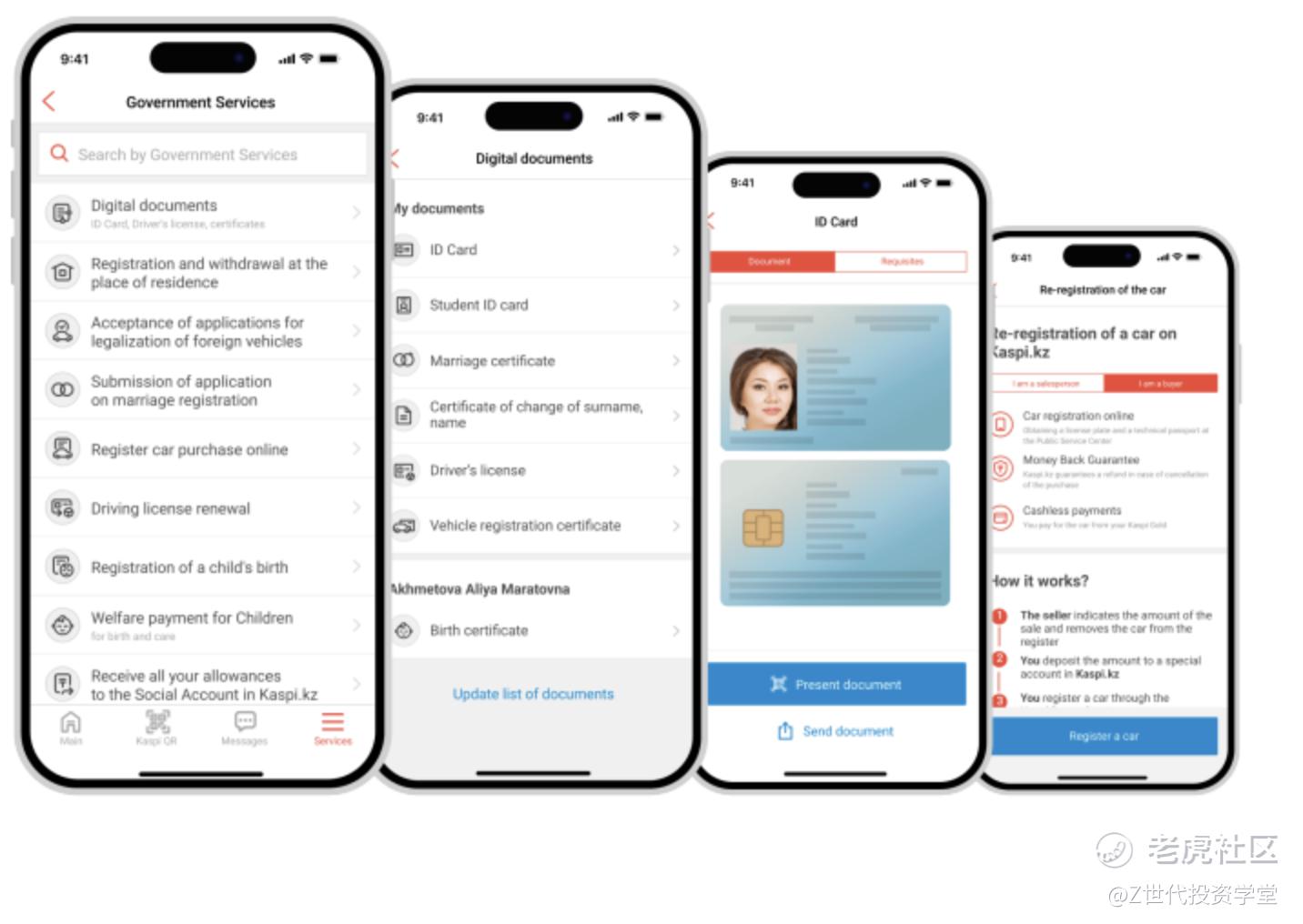

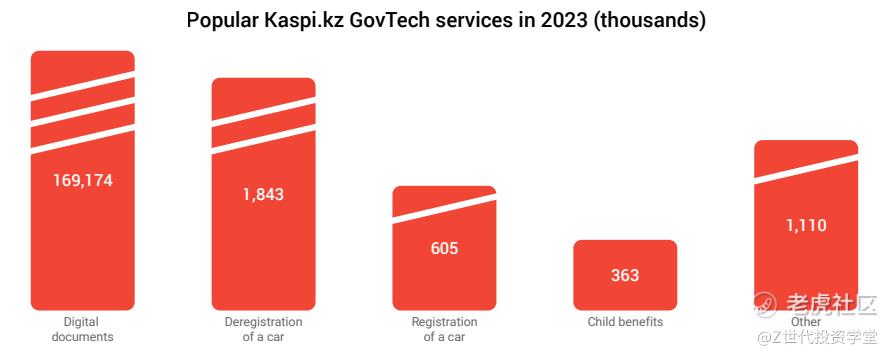

Government Services

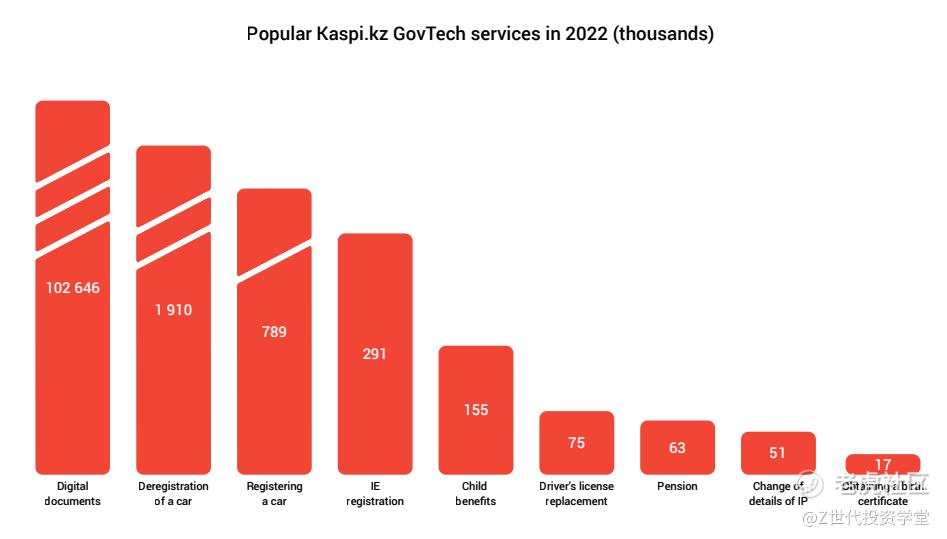

Kaspi's GovTech platform, while not directly contributing to the company's revenues, plays a crucial role in enhancing user engagement and solidifying Kaspi's position as an indispensable part of Kazakhstan's digital infrastructure.

This innovative platform seamlessly integrates a wide array of government services into the Kaspi.kz Super App, offering users unprecedented convenience in accessing essential public services.The platform's functionality is extensive and user-centric.

For individual consumers, it serves as a digital hub for storing and accessing ID documents, renewing driving licenses, transferring car ownership, registering marriages, and obtaining birth certificates. Entrepreneurs benefit from streamlined processes for business registration, tax calculations, payments, and report filings.Kaspi's close collaboration with government agencies, particularly the Ministry of Digitalisation, ensures the continuous expansion of high-frequency GovTech services within the Kaspi.kz and Kaspi Pay Super Apps.

Source: Kaspi

In 2023, the most widely utilized services included digital document management, car ownership registration, driver's license issuance, and new business registration.

Source: Kaspi

Kaspi's integral role in Kazakhstan's economy cannot be overstated. Its deep integration into both the private and public sectors positions the company as a vital component of the nation's digital ecosystem. This strategic importance suggests that, if ever necessary, Kaspi could potentially rely on support from the Kazakh government, further underlining its stability and long-term prospects.

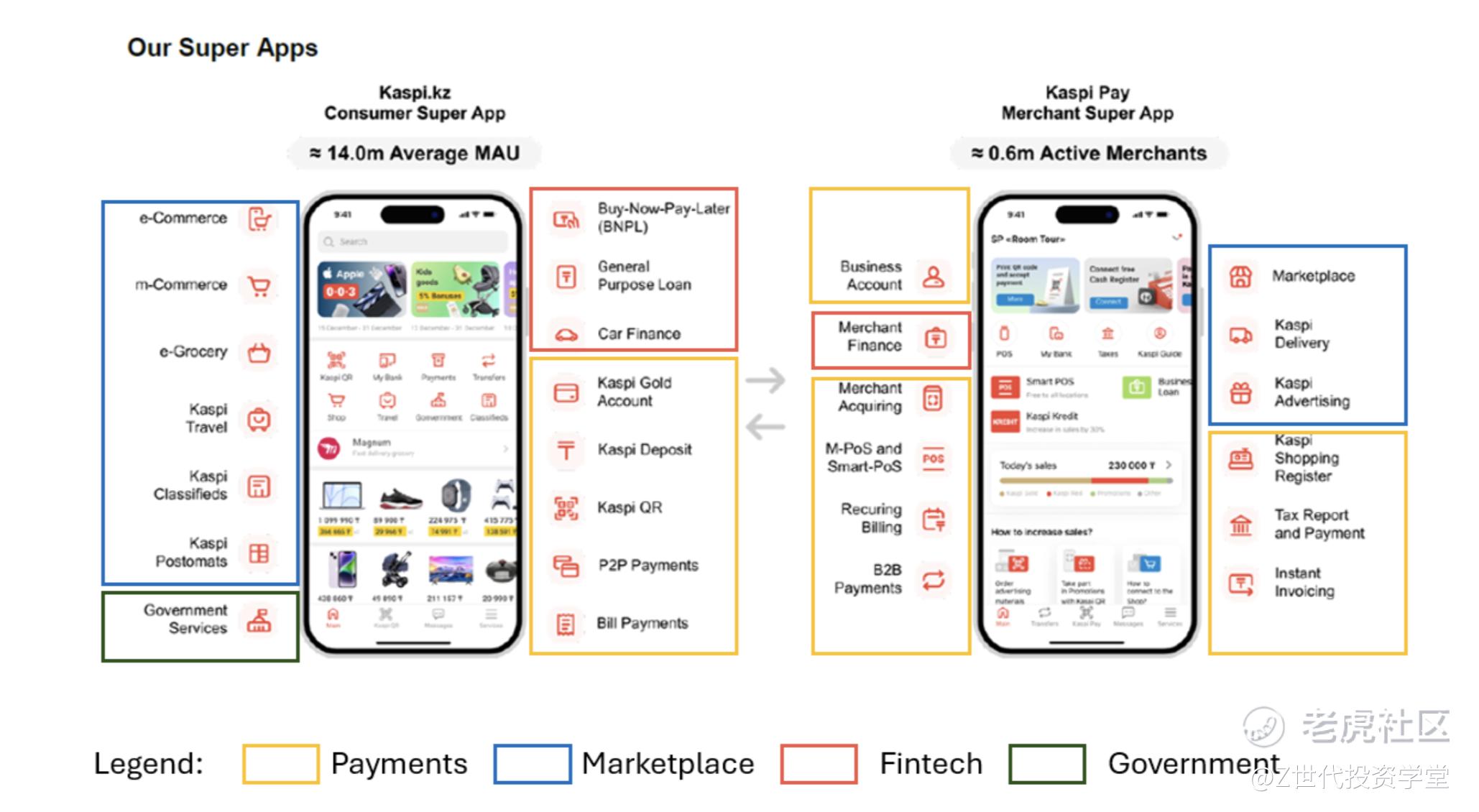

Kaspi˖s two-sided network consists of Kaspi.kz Super App (for consumers) and Kaspi Pay Super App (for merchants). The following image summarises the different offerings for both consumers and merchants, in the 4 segments as mentioned above.

Source: Kaspi, author's illustration

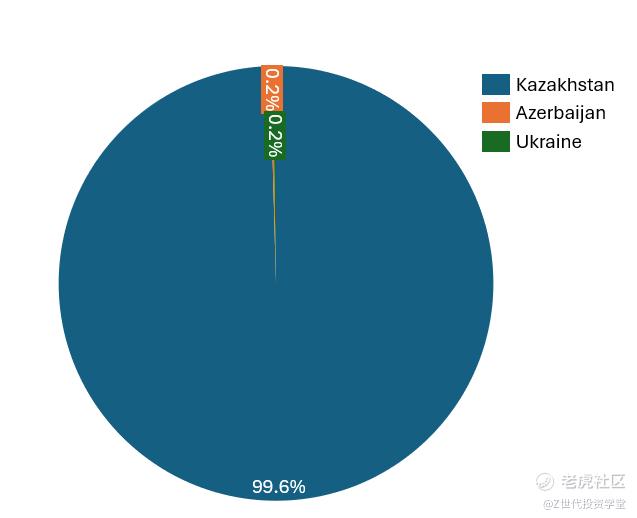

Revenue Split by Geography

Kaspi operates in 3 countries: Kazakhstan, Azerbaijan and Ukraine.

-

Kaspi entered Azerbaijan in September 2019 through the acquisition of three leading marketplace platforms (Turbo.az (a car marketplace), Tap.az (a used and new items marketplace) and Bina.az (a real estate marketplace)). This expanded their addressable market by 10 million people

-

Kaspi entered Ukraine in October 2021 when it acquired 100% of Portmone Group, a payments company operating in Ukraine.

Kazakhstan remains the largest contributor to Kaspi's revenues at 99.6%, with Azerbaijan and Ukraine both taking up 0.2% of total revenues.

Below is the revenue split by countries in Dec 2023:

Source: Kaspi 2023 Annual Report, author's illustration

Country Analysis: Kazakhstan

Located in Central Asia, Kazakhstan is a land-locked country bordering Russia, China, Kyrgyzstan, Uzbekistan and Turkmenistan.

Population and Demographics

Kazakhstan boasts a population of approximately 20 million as of 2024. The country's largest urban centers are:

-

Almaty: 2.16 million

-

Astana (the capital): 1.35 million

-

Shymkent: 1.19 million

These cities also serve as the primary operational hubs for Kaspi.

Source: Kazakhstan Discovery, author

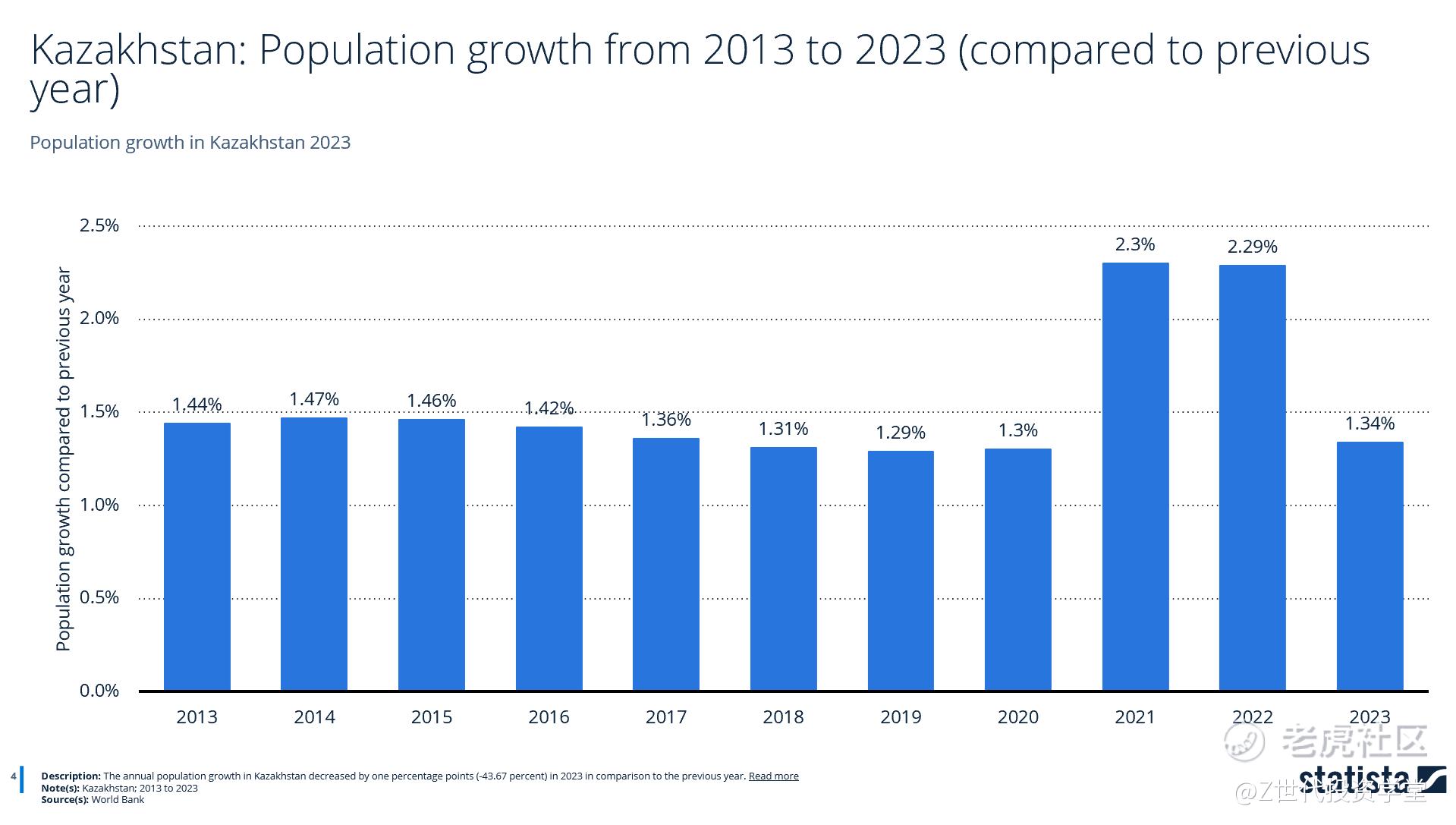

Population Numbers

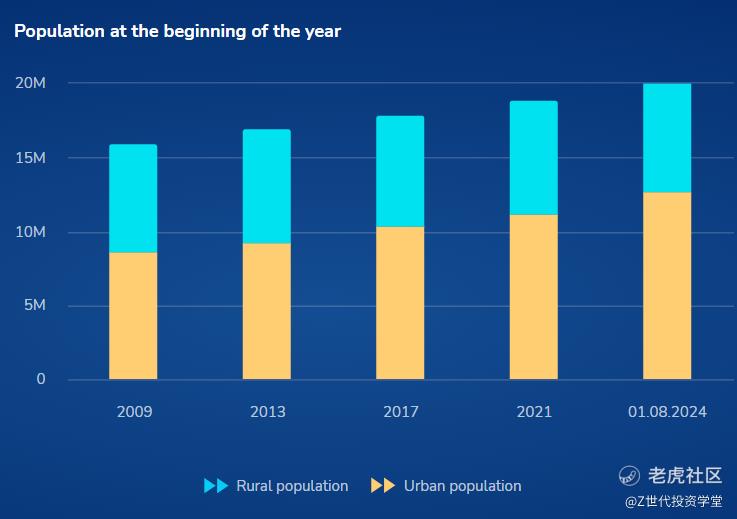

Kazakhstan's population is projected to increase from 18.51 million in 2019 to 21.12 million by 2029. The country has maintained a relatively stable population growth rate of around 1.5% from 2013 to 2023. As of 2024, the population stands at 20.59 million, with a 1.29% annual growth rate.

Source: IMF, Statista

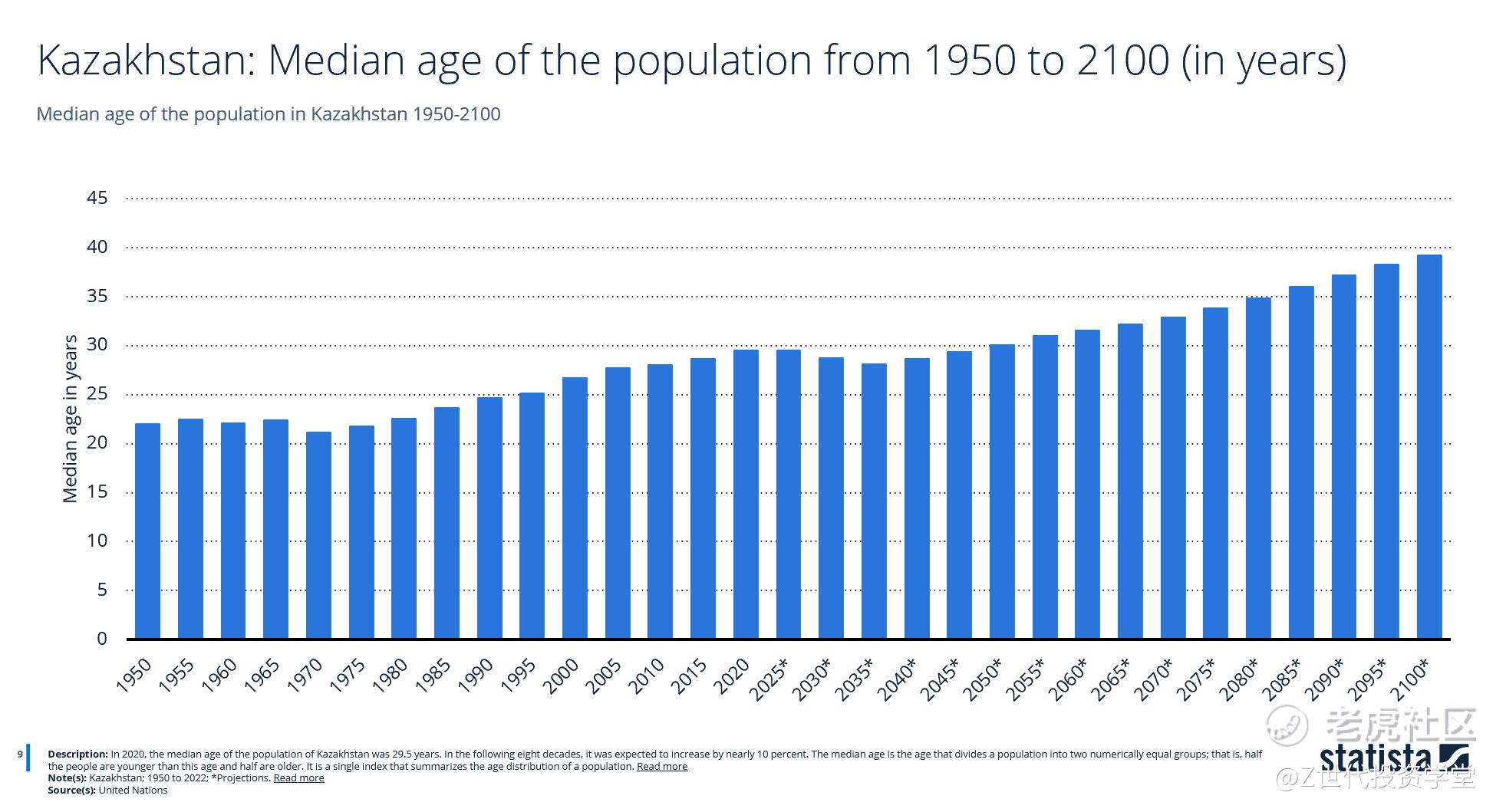

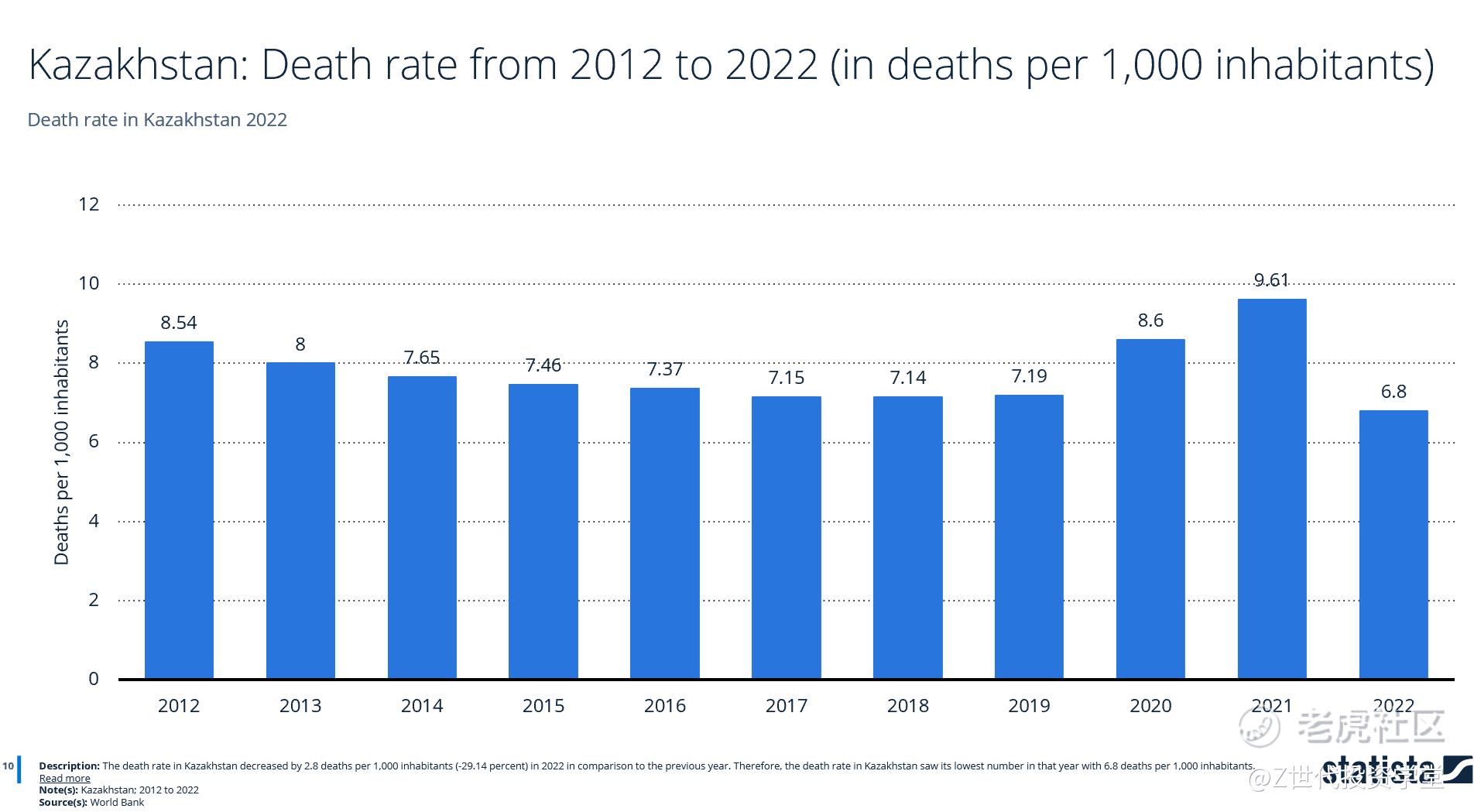

Life expectancy in Kazakhstan has been on an upward trajectory and is expected to continue rising until 2100. Death rates have been steadily decreasing, with the exception of a temporary increase during the COVID-19 pandemic in 2020 and 2021. The long-term demographic outlook appears favorable, with working-age population growth aligning closely with overall population growth.

Source: IMF, Statista

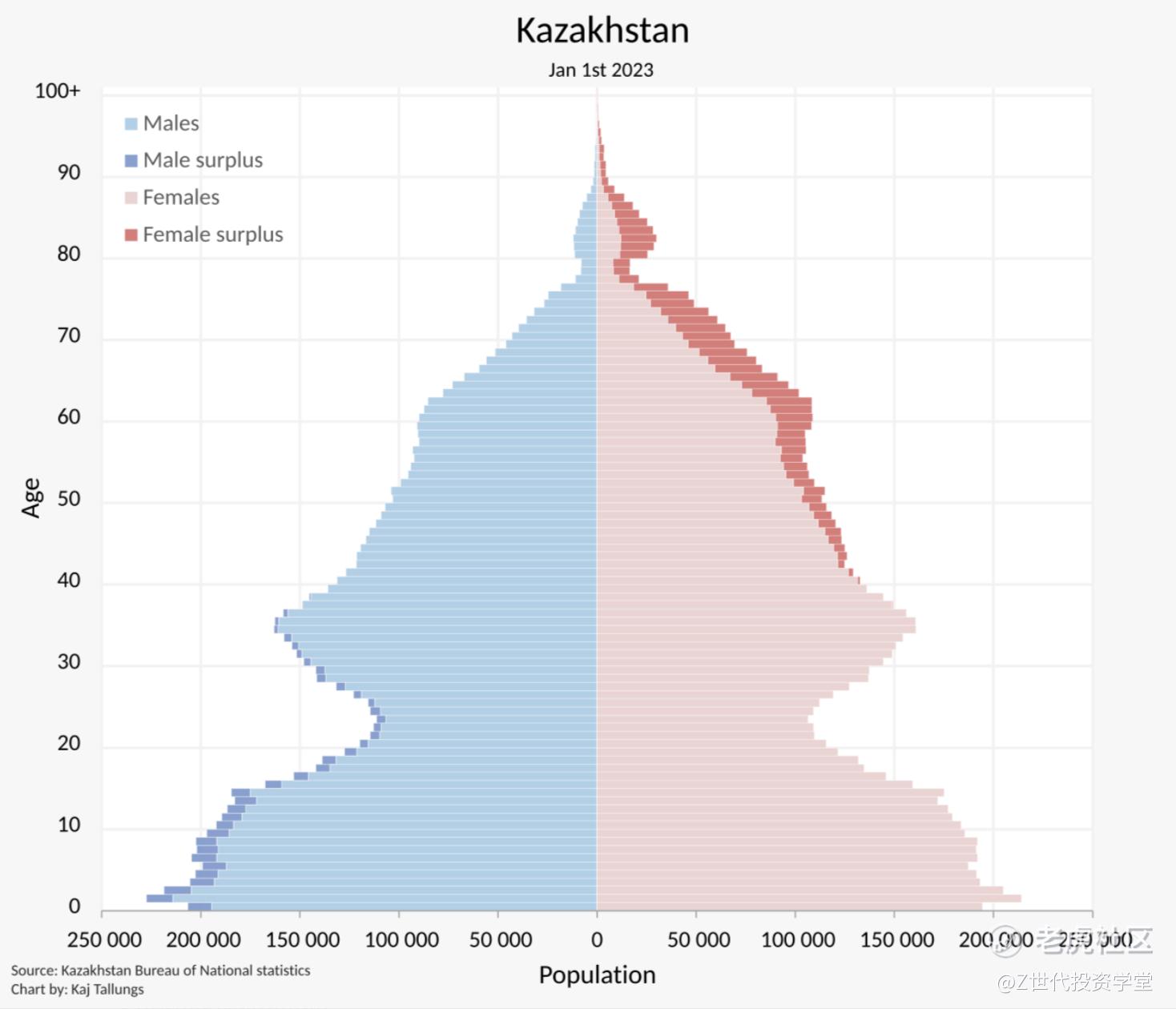

Age Structure

As of January 2023, Kazakhstan's age structure is as follows:

-

0-14 years: 29.5%

-

15-64 years: 62%

-

65 years and above: 8.5%

The median age of the population is 30 years.

Source: Wikipedia

This demographic profile presents a favorable environment for Kaspi, offering:

-

A stable consumer base

-

A young population likely to embrace digital adoption

-

Increased demand for innovative financial and non-financial products and services

-

A tech-savvy younger demographic more open to digital financial services and mobile apps

The projected increase in life expectancy suggests a potentially high lifetime value (LTV) for customers.

Population distribution

As of August 1, 2024, Kazakhstan's population distribution is:

-

Urban: 62.7%

-

Rural: 37.3%

Projections estimate that the urban population will reach approximately 69.1% by 2050.

Source: Bureau of National Statistics

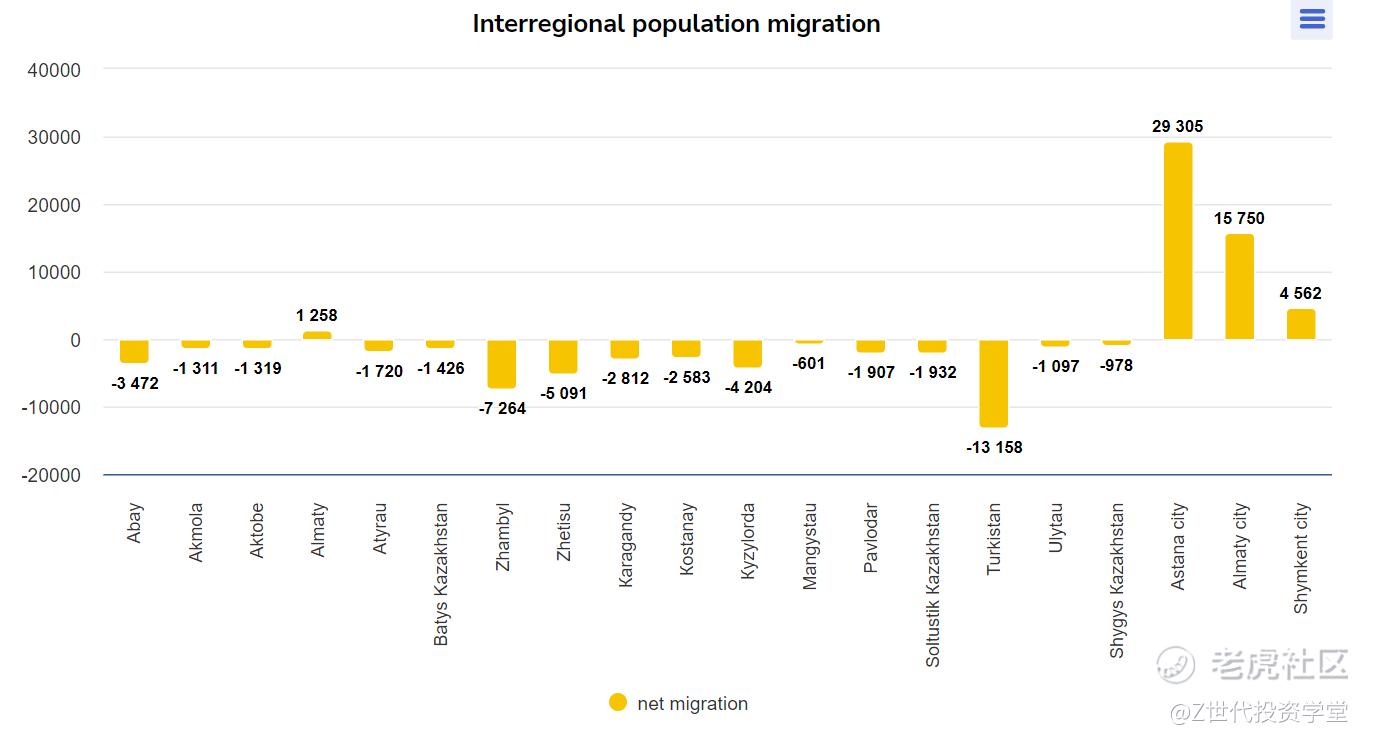

Internal migration has seen a significant uptick, with the number of people moving within the country increasing by 1.7 times compared to the same period in 2023. Four regions have experienced positive net population migration:

-

Astana: 29,305 people

-

Almaty: 15,750 people

-

Shymkent: 4,562 people

-

Almaty region: 1,258 people

Notably, these regions align with Kaspi's primary service areas.

Source: Bureau of National Statistics: the migration of the population of the Republic of Kazakhstan (January-June 2024)

The ongoing urbanization trend in Kazakhstan creates a favorable environment for digital-first companies like Kaspi, positioning them to capitalize on the changing needs and behaviors of Kazakhstan's growing urban population.

-

Digital Service Adoption

Urban populations typically demonstrate higher rates of smartphone ownership and digital service usage.

This trend aligns well with Kaspi's digital-first business model, potentially expanding their user base in urban centers.

-

Changing Consumer Behavior

The shift towards urban living is primarily driven by a quest for efficiency and convenience, rather than laziness.

Urban lifestyles, characterized by longer working hours and faster pace, are creating new consumer needs and preferences.

E-commerce and digital services are increasingly seen as time-saving solutions for busy urban dwellers.

As the e-commerce director of retail store "Kerege" notes:

"In Astana, the busy lifestyle has fueled the growth of e-commerce. With people constantly working, shopping online has become a convenient way to unwind. It's no longer just women; even men find relaxation in browsing online marketplaces from the comfort of their homes. This shift reflects a broader trend of convenience driving e-commerce growth in Kazakhstan."

-

Market Opportunities

The concentration of population in urban areas creates dense markets, beneficial for businesses like Kaspi.

Urban consumers are more likely to embrace new technologies and services, providing a fertile testing ground for innovative products

Other Factors

Beyond the growing young population and increasing urbanization, several factors contribute to the strong growth potential for consumer-based internet businesses like Kaspi:

-

Increasing data availability (4G and 5G)

-

Rising banking penetration

-

Growing debit and credit card adoption

-

Overall consumption growth

Internet and Mobile Usage

Kazakhstan demonstrates impressive internet and mobile usage statistics:

-

Internet penetration: 92.3% as of early 2024 (18.19 million users) - this is the largest in Central Asia

-

Mobile internet usage: 71.5% as of January 2024 (14.10 million social media users)

-

Smartphone adoption: 83% as of 2023 and expected to increase to 86% in 2025

-

Average daily time spent using the internet and mobile phones in Kazakhstan: 3.4h and 6h respectively

These high penetration rates provide a substantial potential user base for Kaspi.kz's digital services and align well with their mobile-only super app strategy. Furthermore, the rapid rollout of 5G is expected to significantly increase mobile internet speeds. It also provides a good backdrop for companies like Kaspi to capture significant portion of time spent online.

It is also pertinent to note that Kaspi is mobile only, and the above trends are tailwinds for Kaspi's continued adoption.

Consumer Expenditure

The average annual wage was approximately KZT 3.7 million, or approximately $8,000, in 2022. Annual wages in Kazakhstan increased at a 15% CAGR from 2017 to 2022 – see Figure 6,a v e r a g e An n u a l g e AW below. Interestingly, most families own their homes outright (i.e., no mortgage or rent payments), and it is common for children to live with their parents through their late 20s (until they marry). As such, a relatively large proportion of income is available for consumption spend.

In summary, Kazakhstan's demographics provide several favorable factors that support Kaspi.kz's growth potential. These demographic factors contribute to a favorable environment for Kaspi.kz's super app model, supporting its potential for continued user acquisition, engagement, and revenue growth in the Kazakhstan market.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。