Initial Report Part 5: Kaspi.kz (NASDAQ: KSPI), 117%% 5-yr Potential Upside (EIP, Dean Tay)

Foreign Policy Dynamics and Regional Position

Kazakhstan's geopolitical landscape is undergoing significant changes, shaped by its historical ties to Russia, strategic location, and evolving multi-vector foreign policy. The country currently finds itself in a delicate position, balancing its dependence on Russia with the need to diversify its economic and diplomatic relationships.

At present, Kazakhstan's energy sector remains heavily reliant on Russia. Approximately 90% of its oil exports flow through the Caspian Pipeline Consortium (CPC), which traverses Russian territory and is partially owned by Moscow. This dependency has been highlighted by past pipeline interruptions, which have demonstrated Kazakhstan's vulnerability. A potential shutdown of this crucial export route could jeopardize up to 57% of the country's exports, significantly impacting its GDP. The ongoing Russia-Ukraine conflict has further complicated Kazakhstan's foreign policy strategy.

While maintaining cordial relations with Russia, Kazakhstan faces an urgent need to diversify its transport and infrastructure links away from Moscow, particularly in light of increasing economic sanctions against Russia. This situation has pushed Kazakhstan to seek alternative partnerships and routes for its economic activities.Interestingly, the current geopolitical shifts may present opportunities for Kazakhstan. As Russia's influence in Central Asia declines due to its military challenges in Ukraine, Kazakhstan is positioning itself to take on a more prominent leadership role in the region. This evolving dynamic is evident in Kazakhstan's recent diplomatic efforts, such as its key role in facilitating EU-mediated peace talks between Armenia and Azerbaijan.Kazakhstan's response to the Ukraine conflict further illustrates its nuanced approach to foreign relations. The government has refused to recognize Donetsk and Lugansk as independent regions and has abstained from voting on the conflict. While abstention is not outright rejection, it marks a significant departure from Kazakhstan's previous approaches to international relations.

Moreover, Kazakhstan has emerged as a crucial transit hub for Russian businesses affected by international sanctions. This role is strengthening Kazakhstan's trade ties, particularly with European nations, and provides an opportunity for the country to diversify its economy beyond its traditional reliance on oil and gas exports.

Research by Roman A. Yuneman on Kazakhstan's multi-vector foreign policy reveals some surprising insights. Contrary to expectations, China, rather than Russia, appears to be the main vector of Kazakhstan's foreign policy. The study, based on voting patterns on international resolutions, shows that Kazakhstan's positions align most closely with China.

Furthermore, Kazakhstan carefully avoids offering explicit support to Russia on initiatives related to armed conflicts, including the situation in Ukraine. This evolving geopolitical landscape presents Kazakhstan with an opportunity to reshape its relationships with major powers. By leveraging its strategic position in the Caspian region, Kazakhstan can potentially balance its interests between Russia, China, and Western partners, thereby strengthening its position on the global stage and fostering greater economic and diplomatic independence.

Economic Outlook

Economic Growth

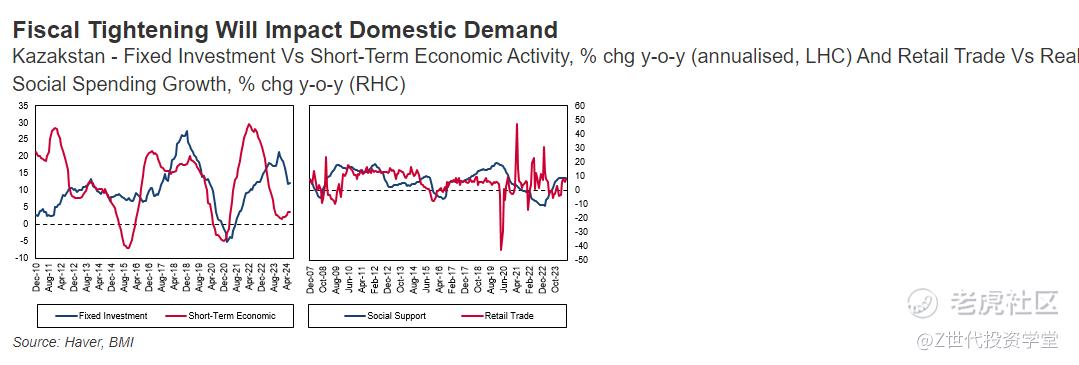

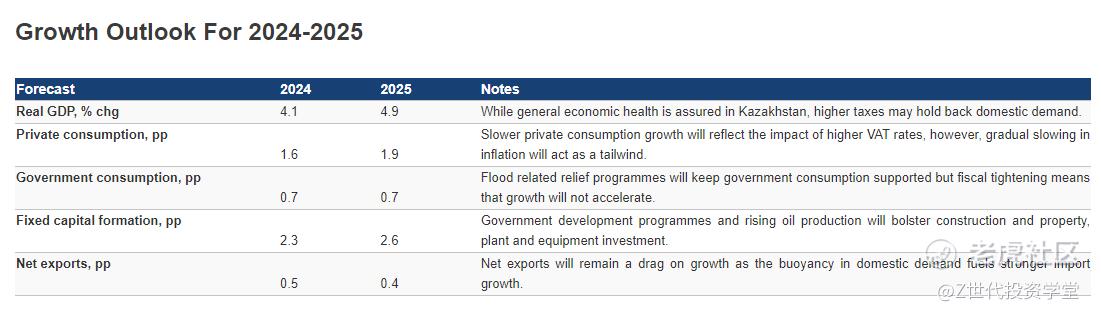

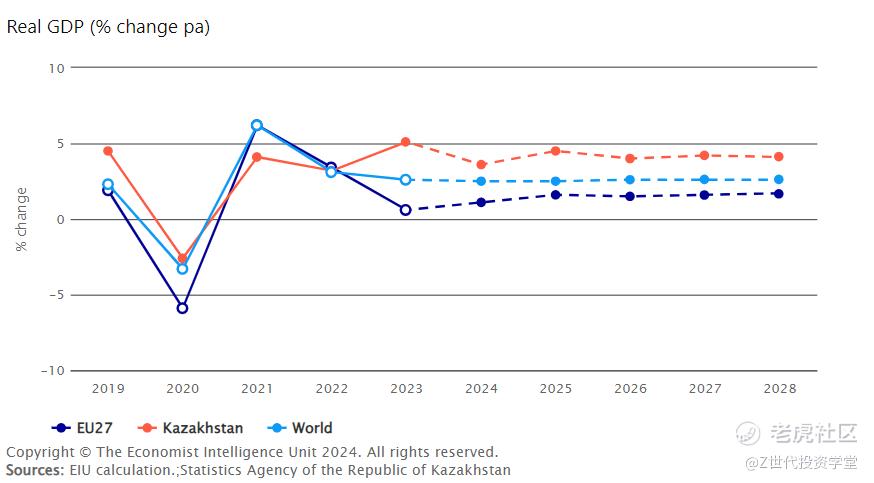

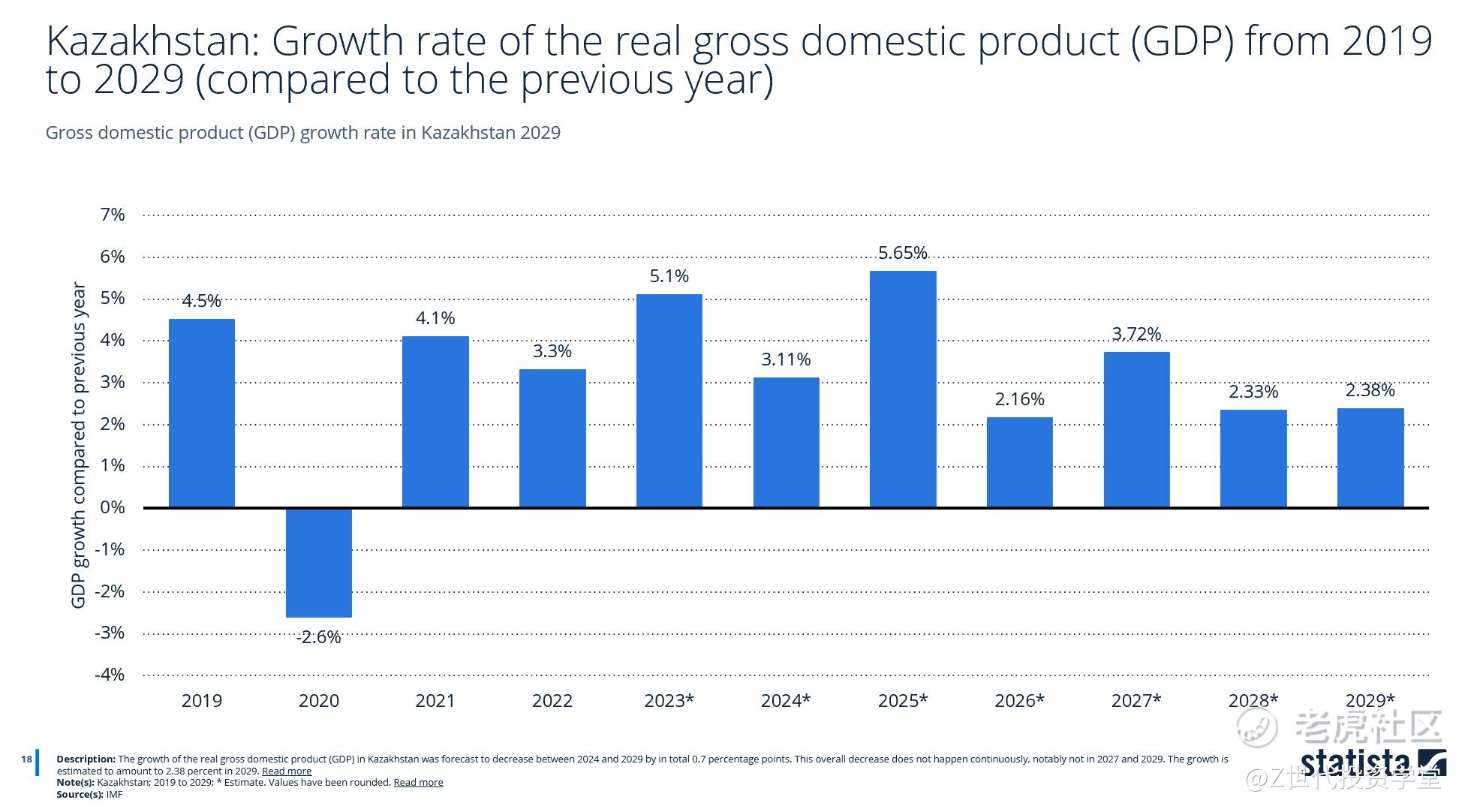

Kazakhstan's economic growth is expected to slow from 5.1% in 2023 to 4.1% in 2024, largely due to fiscal tightening. The government has reinstated fiscal rules to control spending and reduce the budget deficit over the next decade. As a result, household transfers will remain low, which will limit domestic demand growth. Although easing inflation and lower interest rates may cushion the effects of fiscal tightening, wealth inequality could restrict the benefits to a small portion of the population. This could challenge growth with social instability.

Source: BMI

Growth is expected to pick up again in 2025, with a projected rate of 5.4%, driven by the government’s continued efforts to diversify the economy. Although the contribution of fixed capital formation to growth will decrease as state-backed projects dominate investments, capital formation is expected to remain robust.

Source: BMI

In the medium term, economic growth is expected to average 4% from 2025 to 2028, driven by increased oil production, strong exports, and favorable trade relations with China and the EU.

Note: Projections differ based on source

Source: EIU, IMF, Statista

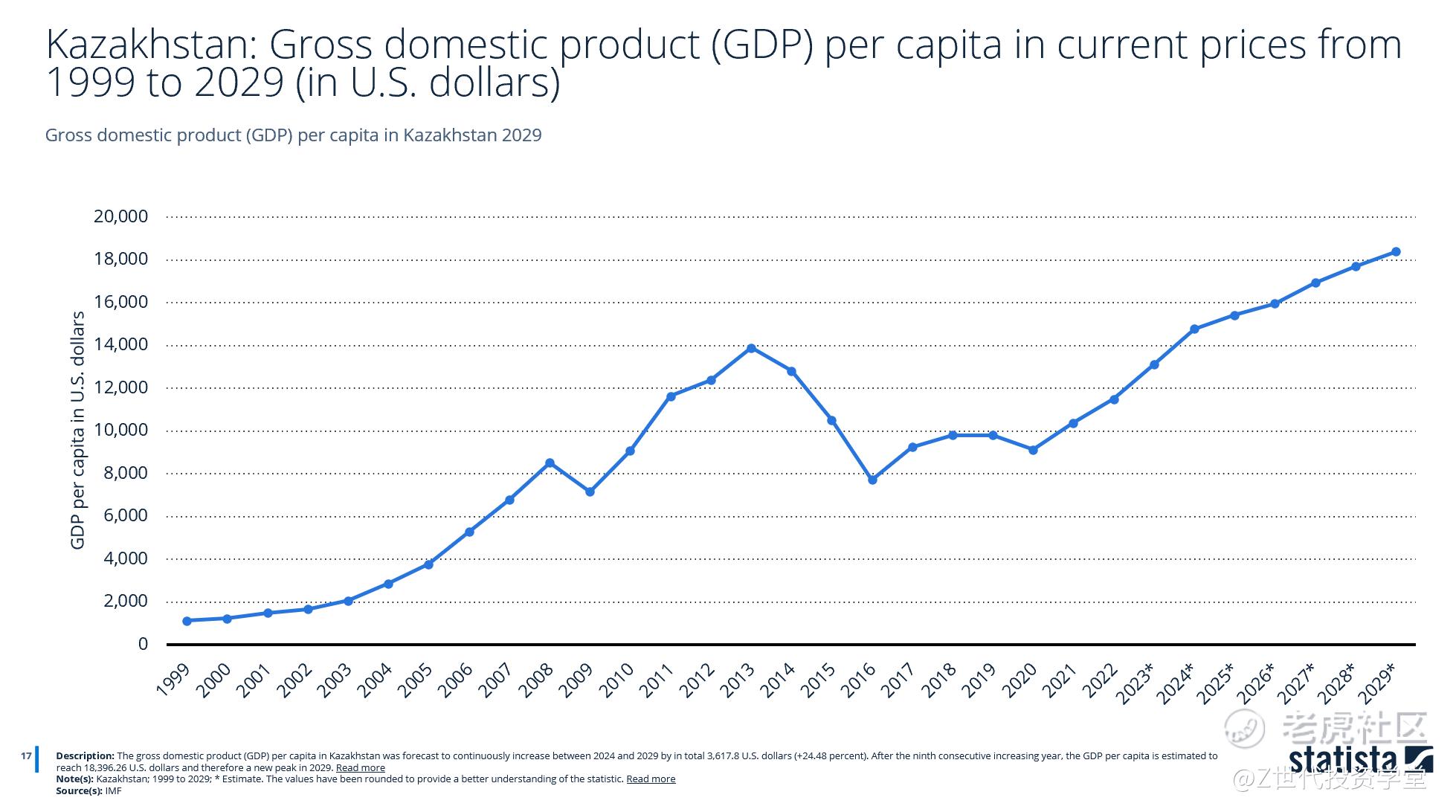

Kazakhstan’s GDP per capita was estimated at $12,993 in 2023, supported by the recovery in global oil prices. GDP per capita is expected to exceed its previous peak of $13,000 by 2024, as economic growth and rising household incomes continue. Urbanization and higher income levels in major cities will create expanded market opportunities, especially in non-food sectors.

Inflation

-

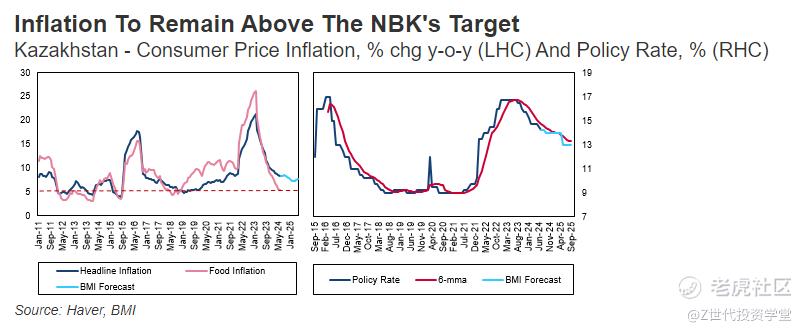

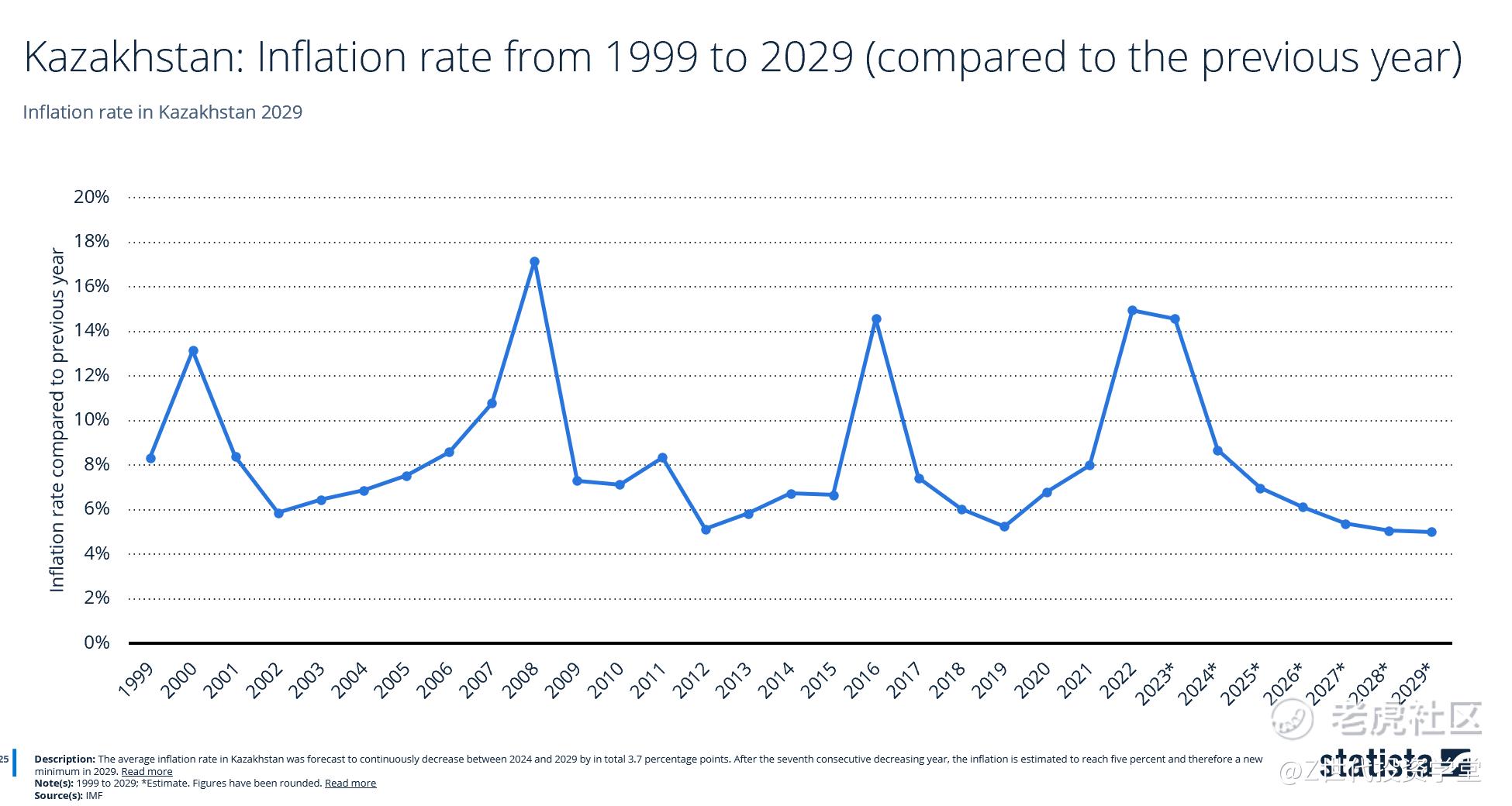

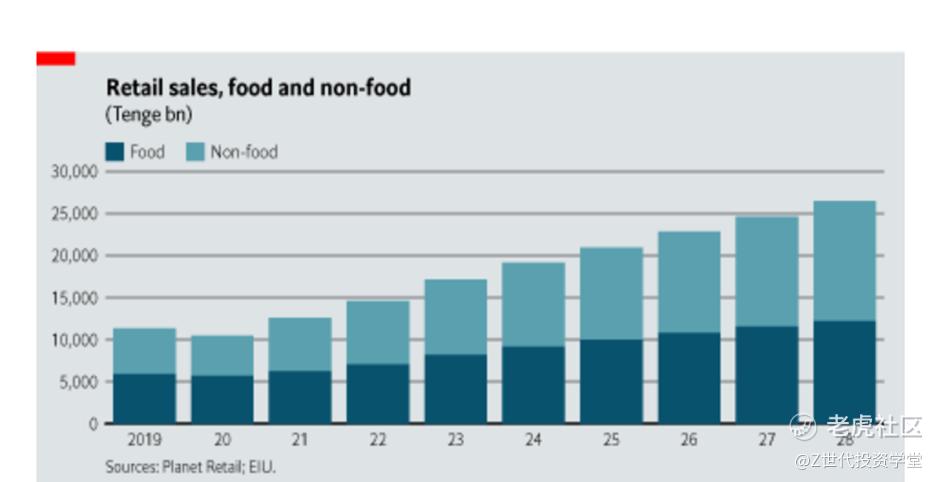

Inflation, which averaged 14.5% in 2023, is expected to decline to 8.7% in 2024 and further moderate to around 5%. Persistent inflationary pressures is driven by strong consumer demand and ongoing reforms in energy pricing. High prices, especially for food and fuel, will continue to affect consumer sentiment and increase demand for lower-cost goods. Real retail sales are forecasted to grow by 2.5% annually, while nominal sales in local currency are expected to increase at a compound annual growth rate (CAGR) of 9.1% through 2028.

Source: Statista, IMF

This of course impacts the results for Kaspi. For example, the marketplace GMV will increase by increased volume and increased prices which are partially related to inflation. We need to take this into account when assessing future growth prospects for the company, especially when looking at the performance of the year 2022 and this year.

Disposable Incomes

-

Kazakhstan's economic landscape is poised for significant growth in the coming years, presenting a promising outlook for Kaspi's expansion. From 2024 to 2028, real personal disposable income is projected to increase by 1.4% annually, while the proportion of households earning over $25,000 per year is expected to nearly double from 23% in 2023 to 42.2% by 2028. This economic uplift is likely to fuel increased spending on discretionary and luxury items, with non-food retail sales projected to rise from 52% of total sales in 2023 to 54% by 2028.

Source: EIU

-

In this thriving economic environment, Arthur D. Little, a renowned international management consulting firm, forecasts Kazakhstan's nominal retail and servicing spend to grow at mid-teens rates, reaching an impressive KZT 77 trillion (approximately $170 billion) by 2027. This robust market growth sets the stage for Kaspi's continued expansion.

-

As Kazakhstan's economy continues to develop and consumer spending patterns evolve towards discretionary and luxury items, Kaspi stands to benefit significantly from these trends, particularly in the rapidly growing e-commerce sector and related services such as B2B payment solutions and merchant financing.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。