Initial Report Part 6: Kaspi.kz (NASDAQ: KSPI), 117%% 5-yr Potential Upside (EIP, Dean Tay)

Currency

The National Bank of Kazakhstan (NBK) heavily manages the Kazakh tenge, but the currency remains vulnerable to frequent devaluations during risky external conditions. The last major devaluation occurred in 2015 when the NBK abandoned its USD peg due to historically low oil prices, which depleted the Bank's foreign exchange reserves.

Source: JP Morgan

While the risk of such an event is currently low, given the tailwinds oil prices are experiencing from the Middle East geopolitical crisis, the country's rising import needs amid an infrastructure construction boom and robust demand are expected to keep the current account in deficit over the coming years, placing depreciatory pressures on the tenge.

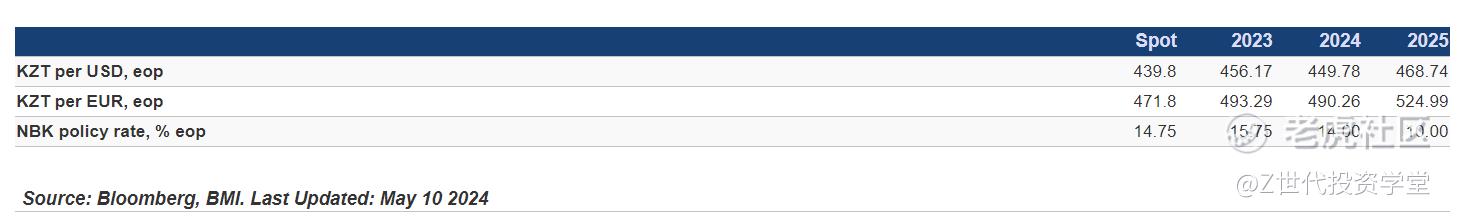

Analysts forecast the Kazakh tenge to trade within the range of KZT430-450 per USD over 2024 and 2025. The currency has appreciated modestly in the first four months of 2024, moving from KZT453.00 per USD in late December 2023 to KZT441.44 per USD by the end of April 2024, a 3.0% appreciation.

This appreciation is partly attributed to lower net-purchases and sales in USD terms in early 2024, reducing USD demand relative to KZT.The tenge's short-term outlook is closely tied to global oil prices and Kazakhstan's external trade. After declining by 6.4% on an annual average basis in 2023, Kazakh export growth has picked up modestly by 1.0% in the first two months of 2024. Oil exports, a key component of Kazakh trade, have risen by 8.1% in the same period, supported by upward pressures on global oil prices due to escalating geopolitical risks in the Middle East.

Experts expect global oil prices to remain slightly elevated in 2024 compared to 2023, supporting the view that Kazakhstan's export growth will accelerate to at least 10.0% in the year following a 7.0% decline in 2024. Firmer exports are expected to shore up demand for the KZT, anchored by the legal requirement for traders to transact solely in the local currency with Kazakh entities.

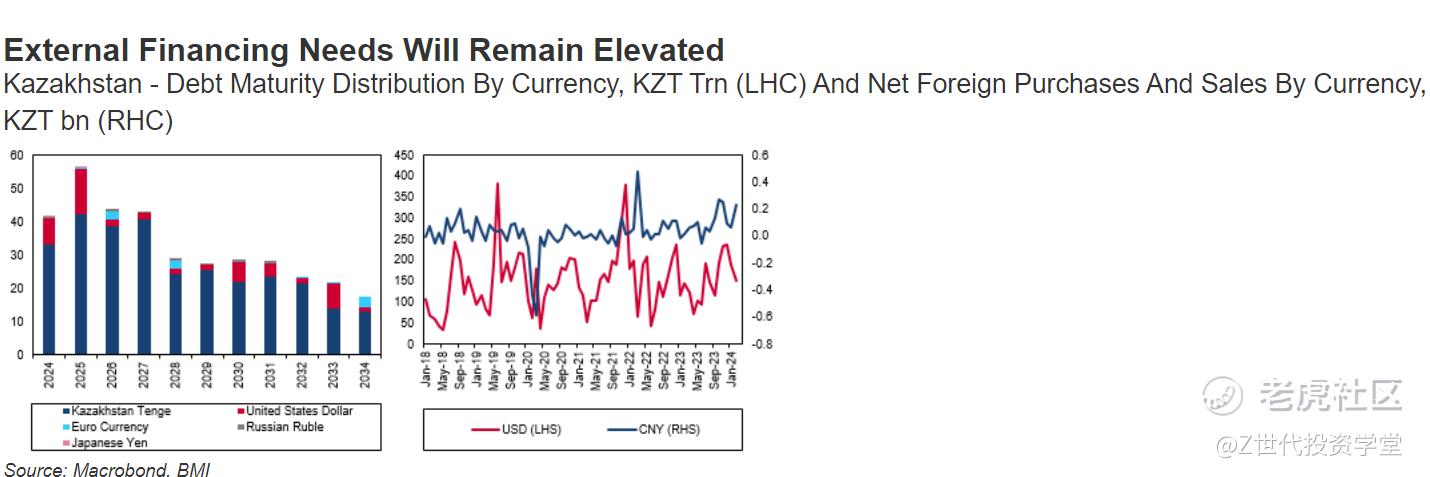

Over the medium-to-long term, depreciatory risks facing the KZT are expected to rise due to Kazakhstan's growing external financing needs. While the current account deficit is projected to narrow slightly in 2024 compared to 2023, from 3.3% to 2.7%, this shortfall is expected to persist over the coming years with modest widening likely as the country's imported capital needs increase amid infrastructure development and economic diversification goals.

Moreover, the country's substantial external debt load (72.0% of GDP as of 2023) will add pressure on the KZT amid rising debt servicing needs. In 2024 and 2025, a total of USD21.8bn worth of USD-denominated debt, which is 13.0% of the total external debt load, is due to be rolled over.

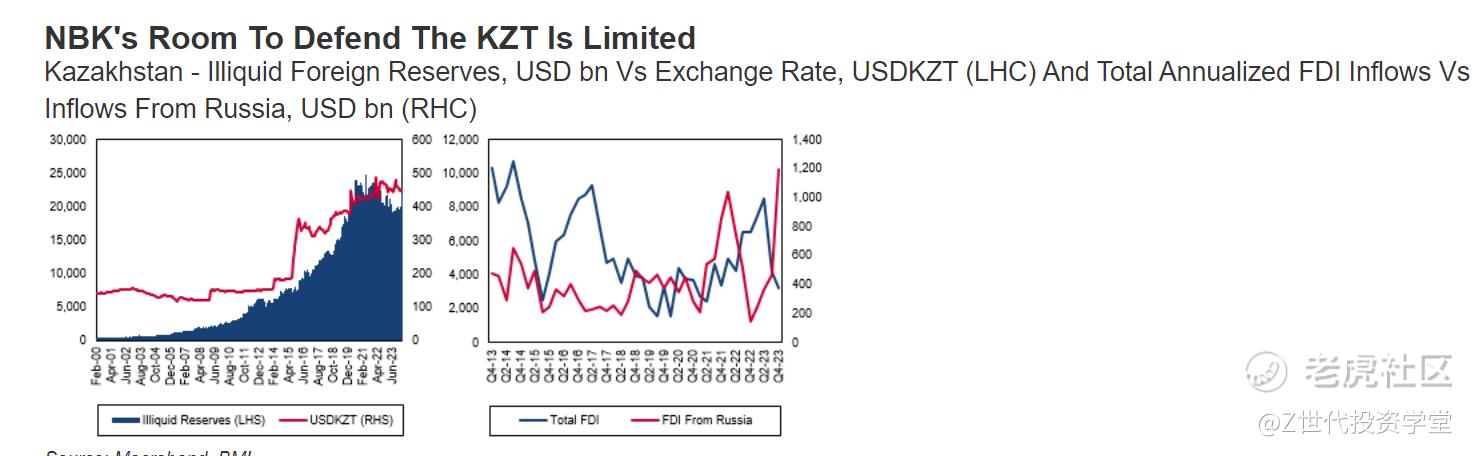

Given these increased financing needs, analysts expect the tenge to move closer to the KZT460-500 per USD range in 2025.Despite floating freely since 2015, the NBK manages the currency closely with various capital control measures and market interventions using foreign reserves. The NBK's gross international reserves stand at USD37.8bn, providing over 5.0 months of import cover. However, only 42.0% of the gross reserves are composed of readily available liquid foreign currency, reducing the cover to around 3.0 months. Liquid reserves held by the NBK have reduced materially since the 2015 currency devaluation and subsequent periods of oil price declines. While severe risks to the tenge are not immediately expected in the short-to-medium term, the NBK has less room to intervene in such an event.

An additional source of risk to Kazakhstan's external sector and the KZT is the country's continued trade and strategic dependence on Russia. Around 90% of Kazakh oil continues to be piped through the Caspian Pipeline Consortium that runs through Russia. This not only exposes it to the chances of secondary sanctions but also requires Kazakhstan to maintain a balanced and broadly positive relationship with Russia.

Industry and Competitive Analysis

Payments

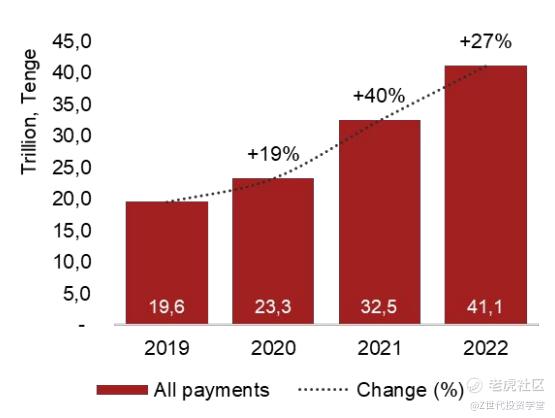

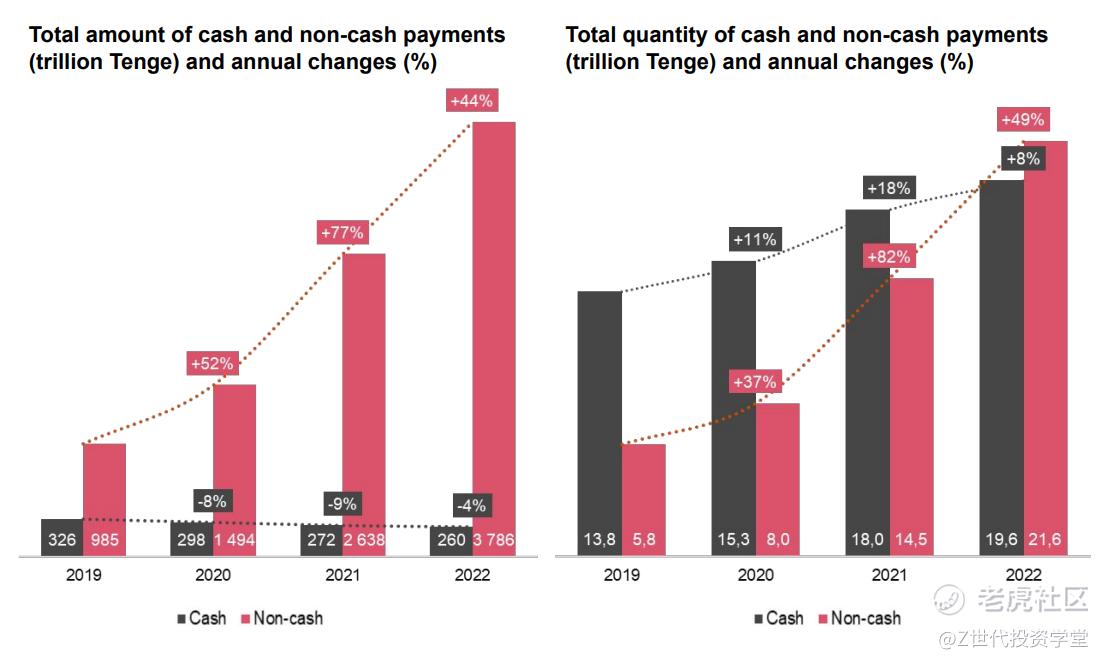

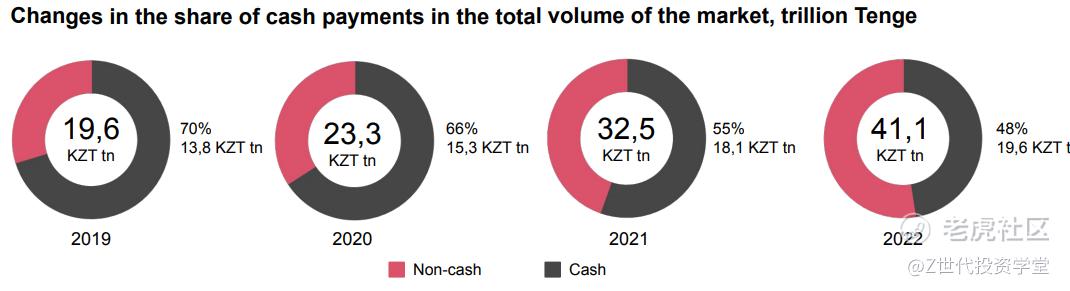

Kazakhstan's payment landscape has undergone a dramatic transformation in recent years, with digital payments rapidly displacing cash transactions. In 2022, the total payment market in Kazakhstan reached 41.1 trillion Tenge, growing by 8.6 trillion Tenge from 2021. While this represents a significant increase, the growth rate moderated to 27% in 2022, down from 40% in 2021. The shift towards digital payments has also been swift and comprehensive. In 2022, digital payments accounted for 83% of all payments in Kazakhstan's economy, with cash payments reduced to just 17%. This represents a dramatic change from 2018, when cash payments were as high as 66%.

Source: PwC

A pivotal moment occurred in 2022 when non-cash payments surpassed cash withdrawals from ATMs for the first time, reaching 21.6 trillion Tenge, a 49% increase from the previous year. This shift reflects the country's growing digitalization, the expansion of e-commerce platforms (accelerated by the pandemic), and the proliferation of diverse payment methods.

Source: PwC

As of August 2024, the National Bank of Kazakhstan reported that the majority of non-cash transactions were conducted via Internet/mobile banking, accounting for 80.3% of transactions and 90.8% of transaction volume. POS terminals followed, representing 19.6% of transactions and 8.9% of volume.

Payments players in Kazakhstan

This digital transformation has benefited various players in the Kazakh financial sector, with Kaspi.kz emerging as a standout performer. However, competitors like Halyk Bank have also experienced significant growth, albeit not to the same extent as Kaspi. According to the government, Kaspi.kz and Halyk Bank together handles around 80% of payments in Kazakhstan.

While the threat of international competition appears limited due to Kazakhstan's relatively small market size and the complexities of entering a market with established local players, some domestic competitors are worth noting. Onai, originally a national bus-card company, has begun leveraging its extensive user base to expand into the broader payments space. With millions of users already familiar with its platform through public transportation, Onai possesses a significant potential customer base and a track record of successful product implementation.

Another notable competitor is Choco, which has developed products similar to Kaspi's offerings in areas such as marketplace and payments. However, Choco's strategic approach differs from Kaspi's in that it has not integrated its various services into a unified ecosystem, a decision that may have limited its competitive impact.

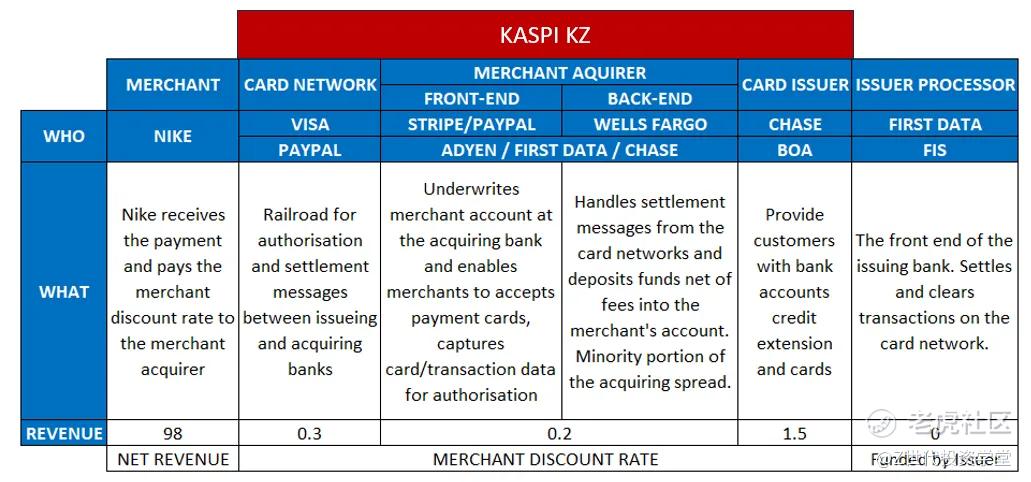

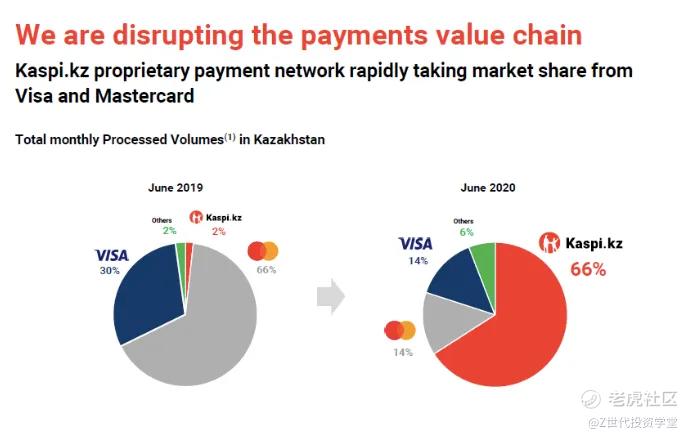

Despite these local challengers, Kaspi's position remains strong. The company's growing market share, combined with its competitive advantages and integrated ecosystem approach, provides a robust defense against current and potential competitors. The ecosystem strategy, in particular, has created significant switching costs for users, further entrenching Kaspi's market position. More importantly, Kaspi has captured a large part of the payments value chain as seen below and established almost a monopolistic position in payments.

Source: Atmos Invest on Substack

This has allowed it to displace Visa and Mastercard in Kazakhstan in its early days.

Source: Kaspi

Fintech

The overall health of Kazakhstan's banking sector appears robust, despite facing various economic challenges. Loan growth is projected to reach 17.1% in 2024, buoyed by a reduction in subsidized lending and a more relaxed monetary policy. The sector's resilience is further evidenced by the low level of non-performing loans, which stand at just 2.9%, a significant improvement from the 20% seen in the mid-2000s. This transformation is largely attributed to the National Bank of Kazakhstan's reform efforts, which have substantially enhanced regulatory practices.

Profitability in the banking sector remains strong, with a return on equity of 38.0% reported in 2023 and net interest margins of 6.4 percentage points. While the National Bank's policy easing may impact profitability to some extent, the sector is expected to maintain its stability in the coming months.

Source: BMI

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。