Initial Report Part 8: Kaspi.kz (NASDAQ: KSPI), 117%% 5-yr Potential Upside (EIP, Dean Tay)

Moat and Competitive Advantage

Network Effects

Across segments

The largest moat that Kaspi.kz has is the network effects of its super app.

Source: Kaspi

Kaspi’s payment, marketplace, and finance platforms are highly interrelated. The growth and development of one platform naturally support and accelerate the growth of the others, reinforcing a virtuous cycle. For example, a consumer using Kaspi for managing finances can seamlessly browse the Marketplace for products. Once a purchase decision is made, the user can easily complete the transaction through Kaspi’s integrated payment system, given that their financial information is already stored in the app.

The interactions between Kaspi's various platforms create a self-reinforcing flywheel that drives profitable growth and provides significant competitive advantages, such as lower costs. Here's how the flywheel turns:

-

The large base of active consumers, combined with a variety of convenient payment and financing options, drives higher consumer spending on the Marketplace.

-

This increased spending on the Marketplace Platform boosts transaction volumes across the Payments Platform and increases demand for financing through the Fintech Platform.

-

The growing consumer activity attracts more merchants to the Marketplace, expanding product selection and enhancing price competitiveness. As more merchants join, the platform becomes even more attractive to consumers, creating a positive feedback loop. Merchants recognize the value of Kaspi’s extensive user base and are often willing to pay higher commissions for access to it.

These synergies encourage consumers to transact and interact more frequently with Kaspi.kz, increasing the average number of monthly transactions per user. Frequent consumer engagement is key to the effective cross-selling and upselling of products.

This seamless integration fuels a self-perpetuating cycle: the more a user engages with one service, the more they are likely to explore and use others. For instance, a user who starts with peer-to-peer (P2P) payments might soon begin shopping on the marketplace or utilizing Kaspi’s "Buy Now, Pay Later" (BNPL) services.

This all-encompassing ecosystem also reduces the likelihood of users seeking alternatives, as Kaspi fulfills a wide array of daily needs while offering unmatched convenience. Standalone competitors struggle to replicate this breadth of services.

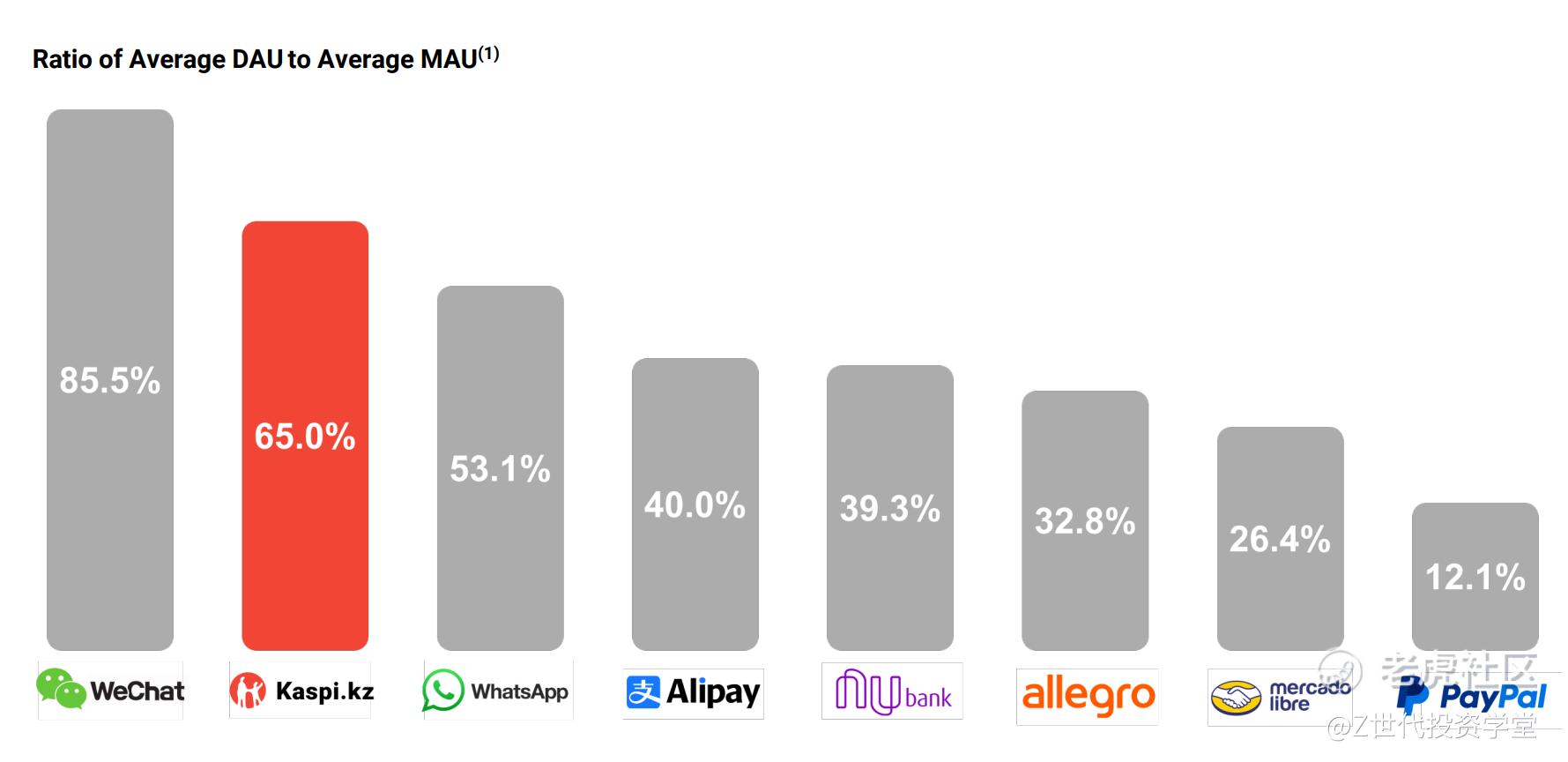

The customer stickiness that Kaspi possess and increasing engagement can be seen with the ratio of Daily Active Users (DAU) and Monthly Active Users (MAU) of 65%, which only trails behind WeChat.

Source: Kaspi 2023 Annual Report

There are benefits to such network effects:

-

Kaspi’s fintech products, such as BNPL and consumer loans, benefit from the company's cross-selling strategy. Once consumers are using Kaspi’s payments or marketplace services, they are targeted with relevant fintech offerings, allowing Kaspi to grow its fintech segment with minimal customer acquisition costs. By leveraging consumer data gathered from payments and marketplace transactions, Kaspi can price risk more effectively than competitors, further driving adoption of its financial products. o, Kaspi knows how much money you're making on revenue line. Now you are starting to work with Kaspi to pay for your goods that you are getting either from manufacturer or distributor. You might have working capital needs. Kaspi may extend you a loan because they see everything and then they will just subtract it from your revenue coming in when you make those sales. Kaspi is learning right now about that product line, so, in the next couple year, maybe two years, we will learn a lot more, maybe even faster. But that is another way to increase your stickiness of a customer from business-to-business perspective.

-

, having a large customers base makes it very easy for new services to scale rapidly and be used by consumers quickly. Kaspi Travel is a good example. After two years after launching, they managed to sell over 11 million tickets annually.

-

Exceptional scalability and near-zero marginal cost structure. At the core of this advantage is Kaspi's ability to serve additional customers and introduce new services with minimal incremental costs, allowing the company to rapidly deploy and integrate new offerings across its large, established network. New customers and services contribute significantly to revenue without proportional increases in costs, resulting in high contribution margins. This dynamic sets the stage for exponential growth potential, as the combination of an expanding user base and growing service offerings can lead to multiplicative revenue increases. Moreover, the low-cost structure allows Kaspi to offer competitive pricing while maintaining profitability, further strengthening its market position.This scalability and cost efficiency further create a virtuous cycle for Kaspi. As the company grows its user base and expands its service offerings, its competitive advantage strengthens, solidifying its market position and erecting formidable barriers to entry for potential competitors

Silos in each business segment

Payments Segment: Two-Sided Network Effect

Kaspi's payment network is the cornerstone of its ecosystem. It has created a two-sided network effect where both consumers and merchants drive each other’s adoption:

-

Consumers use Kaspi Pay for the convenience and ubiquity of its payment solutions, such as in-store QR payments, P2P transfers, and bill payments, which are often commission-free and deeply integrated into daily life.

-

Merchants are incentivized to adopt Kaspi Pay because of the sheer number of consumers using it, especially since Kaspi controls both sides of the transaction with its POS terminals.

As more merchants accept Kaspi Pay, it becomes even more convenient for consumers to use the platform, which in turn attracts more merchants. This self-reinforcing cycle creates a high barrier for other payment services to compete, especially given Kaspi’s wide reach and track record of innovation.

Additionally, Kaspi’s closed-loop payment system (where most transactions happen within its ecosystem) further strengthens these network effects. Consumers using Kaspi's Buy Now Pay Later (BNPL) or Kaspi Gold products must transact through Kaspi’s platform, which increases the volume of transactions and deepens the integration between Kaspi’s payments, marketplace, and fintech segments.

Marketplace Segment: Pseudo-Exclusivity and Economies of Scale

Kaspi’s marketplace benefits from its vast consumer base, particularly because many users are acquired through the payments segment at minimal cost. This creates organic traffic for the marketplace, giving it a significant advantage over competitors. Merchants, who typically list on multiple platforms, prioritize Kaspi due to its high order volume and extensive customer base. In fact, 33% of merchants’ revenues come through Kaspi’s platform, leading to high retention rates of 99%.

Although merchants are not contractually exclusive to Kaspi, the platform creates pseudo-exclusivity by generating a disproportionate share of their sales. This leads merchants to invest more time, inventory, and marketing into Kaspi's marketplace, reinforcing the platform's dominance. The more merchants invest in Kaspi, the more selection and convenience consumers enjoy, creating a virtuous cycle of user and merchant growth.

Furthermore, Kaspi’s logistics infrastructure—including fast and free delivery—enhances the user experience and keeps consumers loyal. Similar to Amazon’s model, Kaspi’s scale allows it to offer competitive shipping solutions that are difficult for smaller platforms to replicate.

The closed-loop nature of Kaspi’s ecosystem is critical here. For example, customers using Kaspi's marketplace must use its fintech or payment products, which ensures high usage of these services. The more customers engage with Kaspi’s fintech offerings, the more valuable the entire ecosystem becomes, as it reduces friction for transactions across the platform.

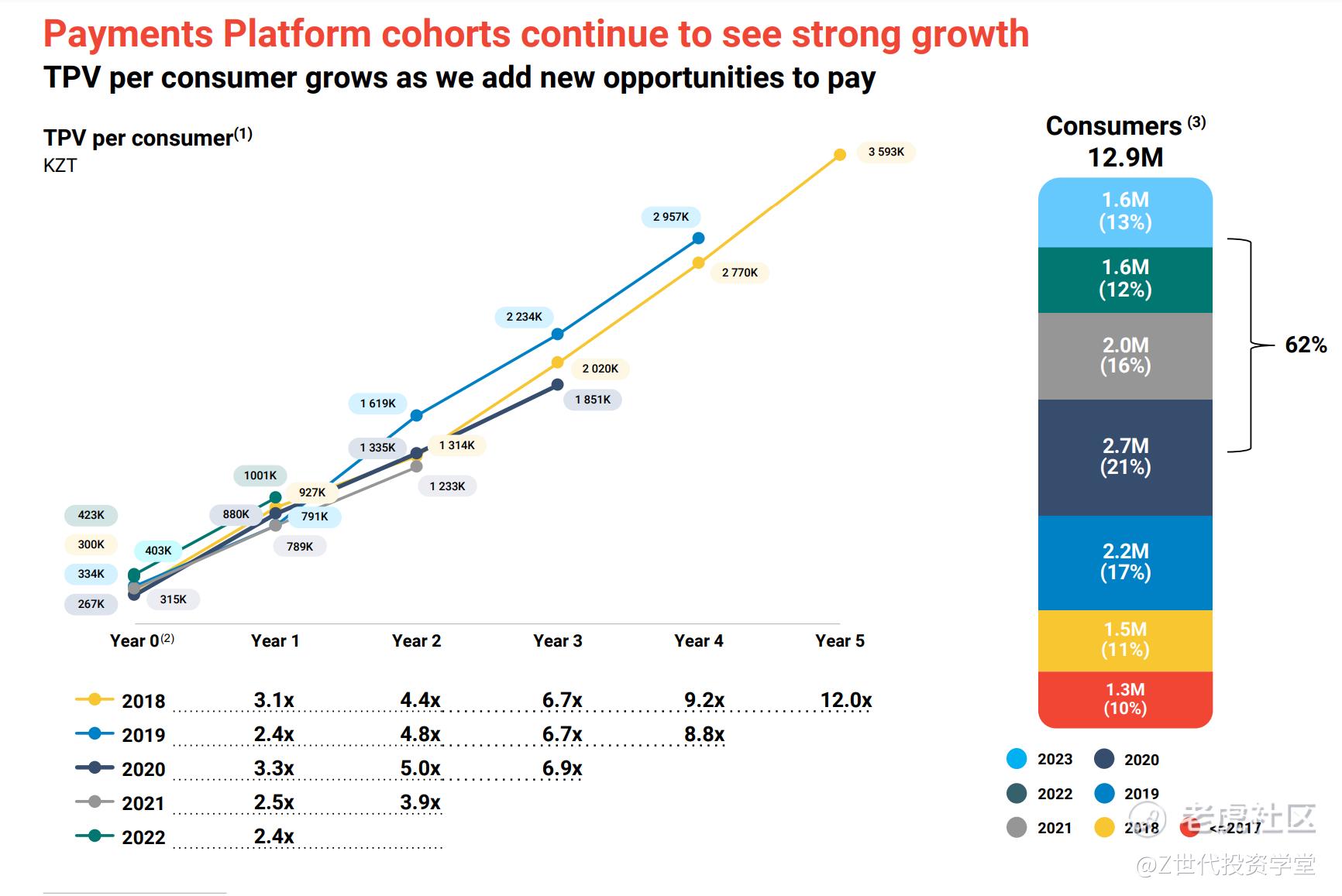

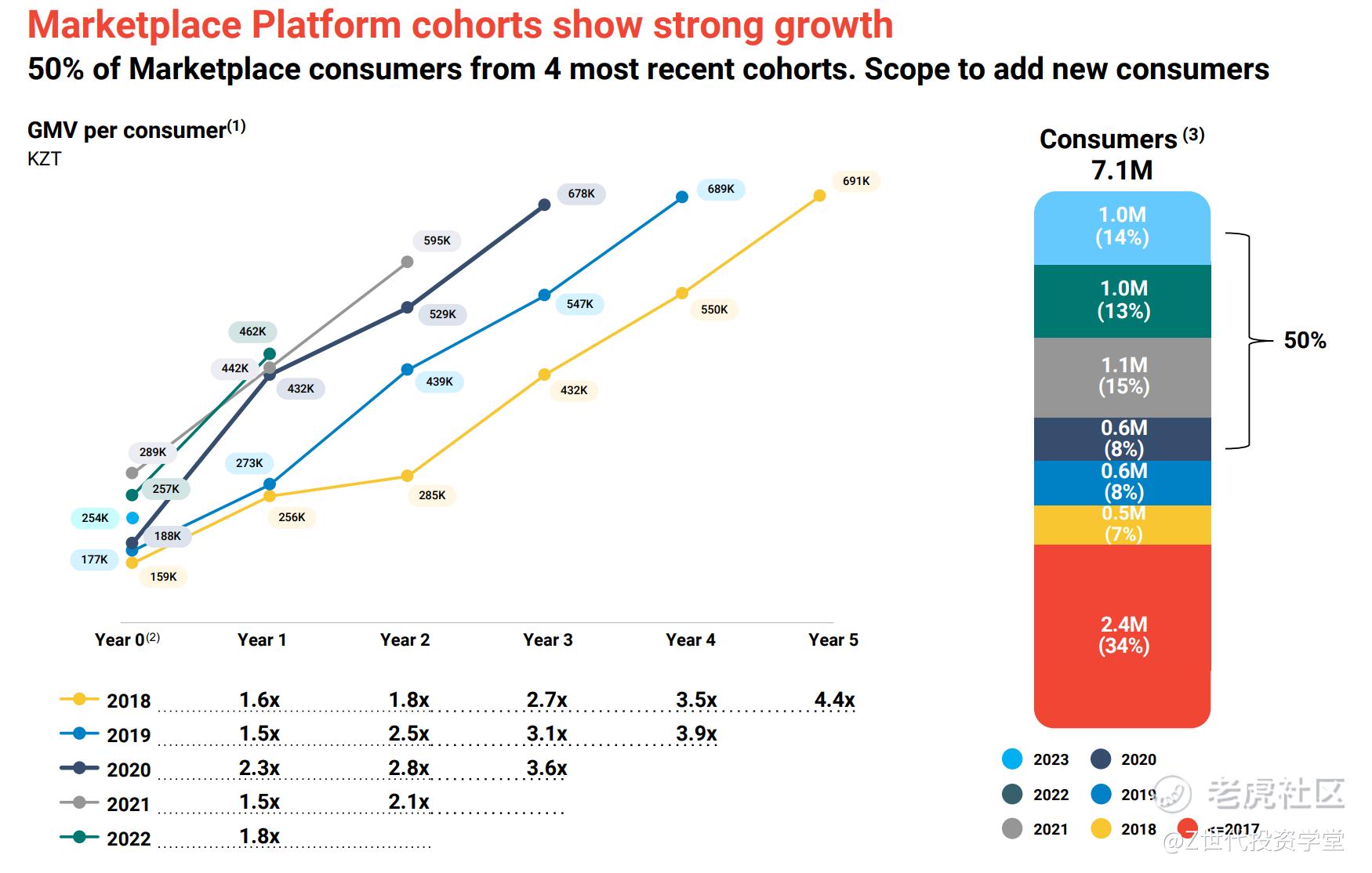

Kaspi's cohort analysis indicates strong and sustained growth across consumer cohorts for both their Payments and Marketplace platforms:

For the Payments Platform:

-

TPV per consumer grows significantly as cohorts mature, showing increasing usage over time.

-

The 2018 cohort, for example, increased TPV per consumer by 12x by Year 5.

-

Even older cohorts like 2017 and earlier continue to show growth in TPV per consumer year-over-year.

-

Newer cohorts are starting at higher TPV levels and growing faster than older cohorts did at the same stage.

Source: Kaspi

For the Marketplace Platform:

-

GMV per consumer also shows strong growth as cohorts mature over time.

-

The 2018 cohort increased GMV per consumer by 4.4x by Year 5.

-

Newer cohorts are starting at higher GMV levels compared to older cohorts at the same stage.

-

50% of Marketplace consumers are from the 4 most recent cohorts, indicating significant room to grow as these cohorts mature.

Source: Kaspi

Overall, the cohort analysis demonstrates:

-

Increasing engagement and spend from existing customers over time

-

Faster growth trajectories for newer cohorts

-

Continued growth potential as newer, larger cohorts mature

-

Strong retention and increasing value of customer relationships over multiple years

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。