Initial Report Part 11: Kaspi.kz (NASDAQ: KSPI), 117%% 5-yr Potential Upside (EIP, Dean Tay)

Response

Kaspi.kz replied shortly on the same day after the report with a statement: "In our view, the report is misleading, inaccurate and misrepresents our business. Being the first company from Kazakhstan to successfully list on Nasdaq has obviously raised our profile amongst short sellers. For those investors who have known us over the years, our reputation speaks for itself."

They later released a more detailed explanation about the arguments brought by Culpers:

-

The company emphasized that 99.6% of its 2023 revenue was generated in Kazakhstan, with the remainder coming from operations in Azerbaijan and Ukraine. This information is clearly disclosed in their US IPO prospectus and 20F filings.

-

The company operates under strict regulatory supervision, implementing comprehensive policies to avoid working with sanctioned entities. Kaspi Bank, a subsidiary, is a systemically important financial institution in Kazakhstan, subject to rigorous oversight by national regulatory bodies.

-

The company employs a thorough "know your customer" (KYC) process, including biometric identification for all account holders, whether they are Kazakh citizens or foreign nationals.

-

Kaspi.kz maintains international correspondent bank accounts with leading financial institutions worldwide, including those in the USA, France, Germany, Austria, and Russia. They stress their compliance with applicable laws and are not aware of any anti-money laundering investigations against them.The company reports that only 2.8% of their customer account balances come from non-residents of Kazakhstan as of Q2 2024, with non-resident accounts contributing only 4.5% to total account growth since the start of 2022. Their marketplace operations are primarily domestic, with only 0.3% of Gross Merchandise Value (GMV) coming from non-resident purchases in the first half of 2024.

-

Regarding international operations, Kaspi.kz acquired leading classified platforms in Azerbaijan in 2019 for KZT11,988 million, which generated KZT3,742 million in revenue in 2023. They also acquired Portmone Group in Ukraine in October 2021, which operates under Ukrainian regulatory licenses and serves as a platform for potential future growth in that market.In February 2023, Kaspi.kz acquired a 90.01% share in Magnum E-Commerce Kazakhstan, committing to invest KZT 70,000 million over three years to develop their e-Grocery business. This venture has shown significant growth, with GMV up 111% year-over-year to around KZT56,900 million in the first half of 2024.

-

The company clarifies that Mrs. Yulia Kim, who leads their e-grocery operations, has no family relationship to Mr. Vyacheslav Kim, despite sharing the same surname. They credit her leadership, along with the rest of their team, for the success of their e-grocery business.

Kazakhstan's financial regulatory body, the Agency for Regulation and Development of Financial Markets, has also publicly endorsed Kaspi's standing in the country's banking sector. In a statement released on September 23, the agency described Kaspi as a systemically important institution within Kazakhstan's financial landscape. The regulator highlighted Kaspi's consistent development, sustainable growth trajectory, and commitment to maintaining a high level of transparency in its operations.Furthermore, the agency addressed concerns regarding international sanctions compliance, particularly in light of the restrictions imposed on Russia following its full-scale invasion of Ukraine. The regulatory body unequivocally stated that Kaspi is in full compliance with the sanctions regimes established by the United States, the European Union, and other foreign nations. This affirmation from a key regulatory authority serves to reinforce Kaspi's reputation for adherence to international financial regulations and its importance within Kazakhstan's banking system.

Assessing the response

Comprehensiveness

Kaspi's response addresses many of the key allegations, but not all:

-

Strengths: The company provided detailed information on revenue sources, customer composition, and regulatory compliance.

-

Weaknesses: Some specific allegations, such as partnerships with Russian companies and complex ownership structures, were not directly addressed.

Transparency

Kaspi demonstrated a degree of transparency in its response:

-

They disclosed specific percentages of revenue and customer account balances.

-

The company provided details on international operations and acquisitions.

However, the response could have been more transparent by addressing all allegations point-by-point.

Credibility

Several factors contribute to the credibility of Kaspi's response:

-

The endorsement from Kazakhstan's financial regulatory body adds significant weight to their claims of compliance and importance in the domestic market.

-

Specific data points and percentages lend credibility to their statements about limited exposure to non-resident customers and Russian business.

Timeliness

Kaspi's initial response was prompt, followed by a more detailed explanation. This quick reaction demonstrates responsiveness to investor concerns.

Adequacy of Evidence

While Kaspi provided some concrete evidence to support their claims:

-

They cited specific percentages and figures from their financial reports.

-

The regulatory endorsement serves as external validation.

However, some allegations lacked detailed rebuttals or supporting evidence.

In summary, Kaspi's response can be considered adequate but not comprehensive. While it addresses many key concerns and provides valuable information to counter some of the most serious allegations, it falls short of a complete point-by-point rebuttal

Strengths:

-

Kaspi effectively countered claims about significant Russian exposure with specific data.

-

They clarified the nature of their international operations and acquisitions.

-

The response addressed concerns about regulatory compliance and sanctions adherence.

Weaknesses:

-

The company did not directly address allegations about Russian partnerships or suppliers.

-

Claims about complex ownership structures and questionable deals were not fully refuted.

-

The response did not provide a detailed rebuttal to claims about overvaluation.

Assessing the other arguments

Investors Zhou Yu (Founder, Forward Horizon Investment LLC) and Timothy Liu (Managing Partner, Meditation Capital) put forth several arguments against Culper's statements on LinkedIn and X respectively, which I find pertinent to raise.

-

Misrepresentation of Non-Resident Deposits

-

Unsupported Assumptions: Zhou Yu points out that Culper's claim about "If 50% of non-resident deposits went to Kaspi accounts, then 29% of Kaspi's deposits and nearly half of the Company's growth since the start of 2022 can be explained by non-residents" is based on an unsupported "if" statement without concrete evidence.

-

Misunderstanding of Growth Drivers: The report overlooks Kaspi's evolving business model, where Payments and Marketplace segments have grown from 61% to 68% of net income in the past three years, while Fintech has decreased 39% to 32%.

-

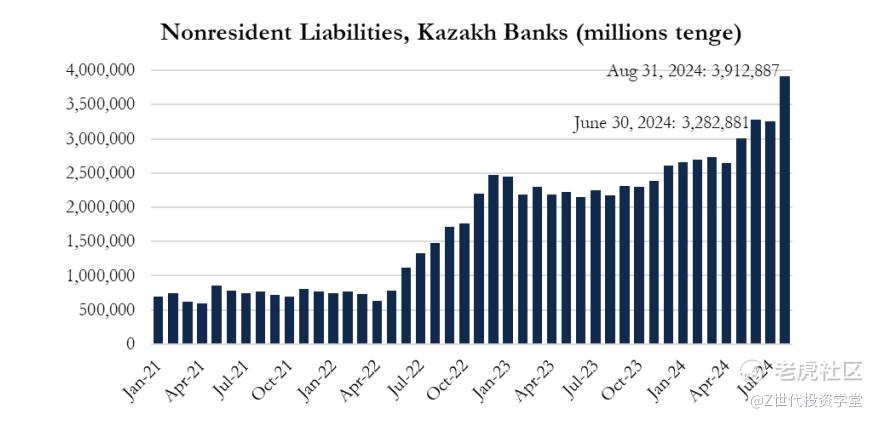

Deposit Growth Inconsistency: Timothy Liu points out that Kaspi's deposit growth doesn't match Culper's chart (as shown below) on Russians fleeing to Kazakhstan and the claim that Kazakhstan skyrocketed throughout 2022 and also continuing to grow throughout 2024:

Source: Culper Research

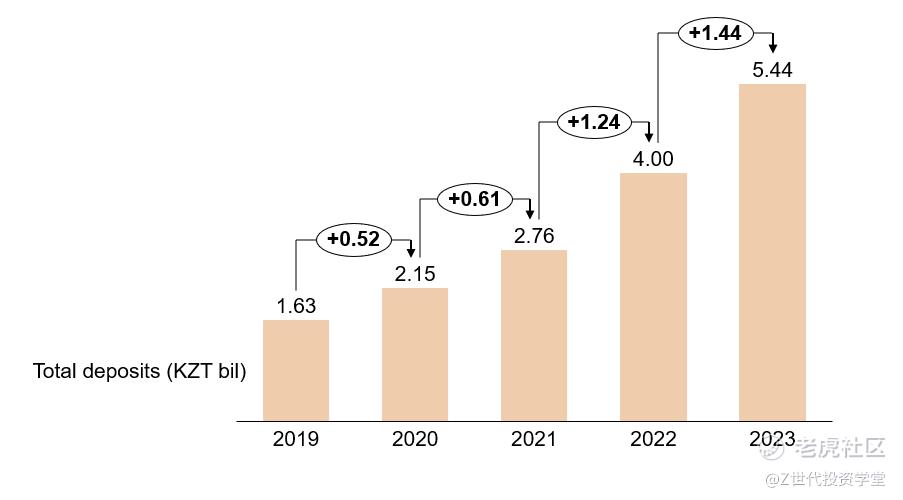

He points out that the biggest growth in Kaspi deposits occurred in 2023 when non-resident deposits were flat. It appears that Timothy's claim would be true in absolute terms, with 1.44 KZT bil increase in 2023 and 1.24 KZT bil increase in 2022.

Source: Kaspi

-

Misinterpretation of Russian Business Relationships

-

Outdated Information: Timothy also points out that some claims about Kaspi's Russian business relationships are based on information predating Russia's 2022 invasion of Ukraine.

-

Legal Business Operations: Furthermore, it is not illegal to conduct business in non-sanctioned goods with Russia. Kazakhstan has significant trade relations with Russia (13% of exports, 38% of imports).

-

Yandex Partnership Misrepresentation: The Yandex Taxi partnership is ubiquitous in the region and not unique to Kaspi.

-

Inaccuracies in Corporate Relationships

-

Misidentification of Yulia Kim: Timothy points out that Culper deliberately mistranslated Yulia Valerianovna Kim's name to falsely claim she's the daughter of Kaspi's founder, Vyacheslav Kim, which has been confirmed by Kaspi.

-

Magnum Investment Clarification: Vyacheslav Kim's stake in Magnum was a personal investment made in 2017, long before Kaspi's entry into e-grocery.

-

Azerbaijan Acquisition Valuation: The acquisition was made for approximately 10x 2020 revenue, not 84x as Culper claimed.

-

Misrepresentation of Historical Ownership

-

Outdated Claims: Timothy further points out that the allegations regarding Kairat Satybaldyuly's ownership are old and illogical, given the thorough investigation by the Kazakh government. Furthermore, even though it had not been addressed by Kaspi, the point was extensively covered by Forbes before the report and thus has been priced in into the company as a risk

-

Inconsistent with Asset Seizures: If Satybaldyuly truly had a 30% stake in Kaspi worth $7 billion, it would have been the largest asset seized by the government, which didn't occur.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。