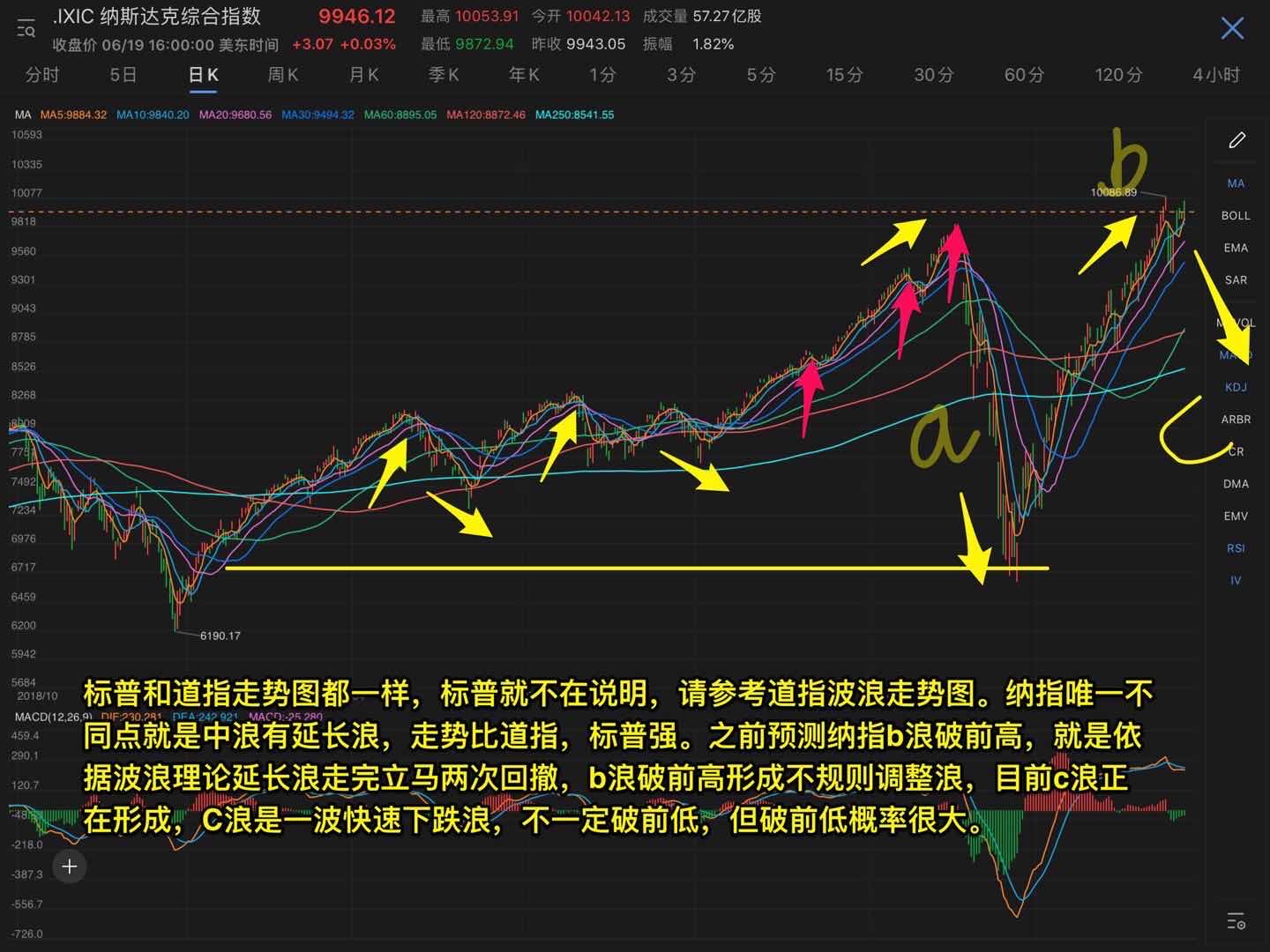

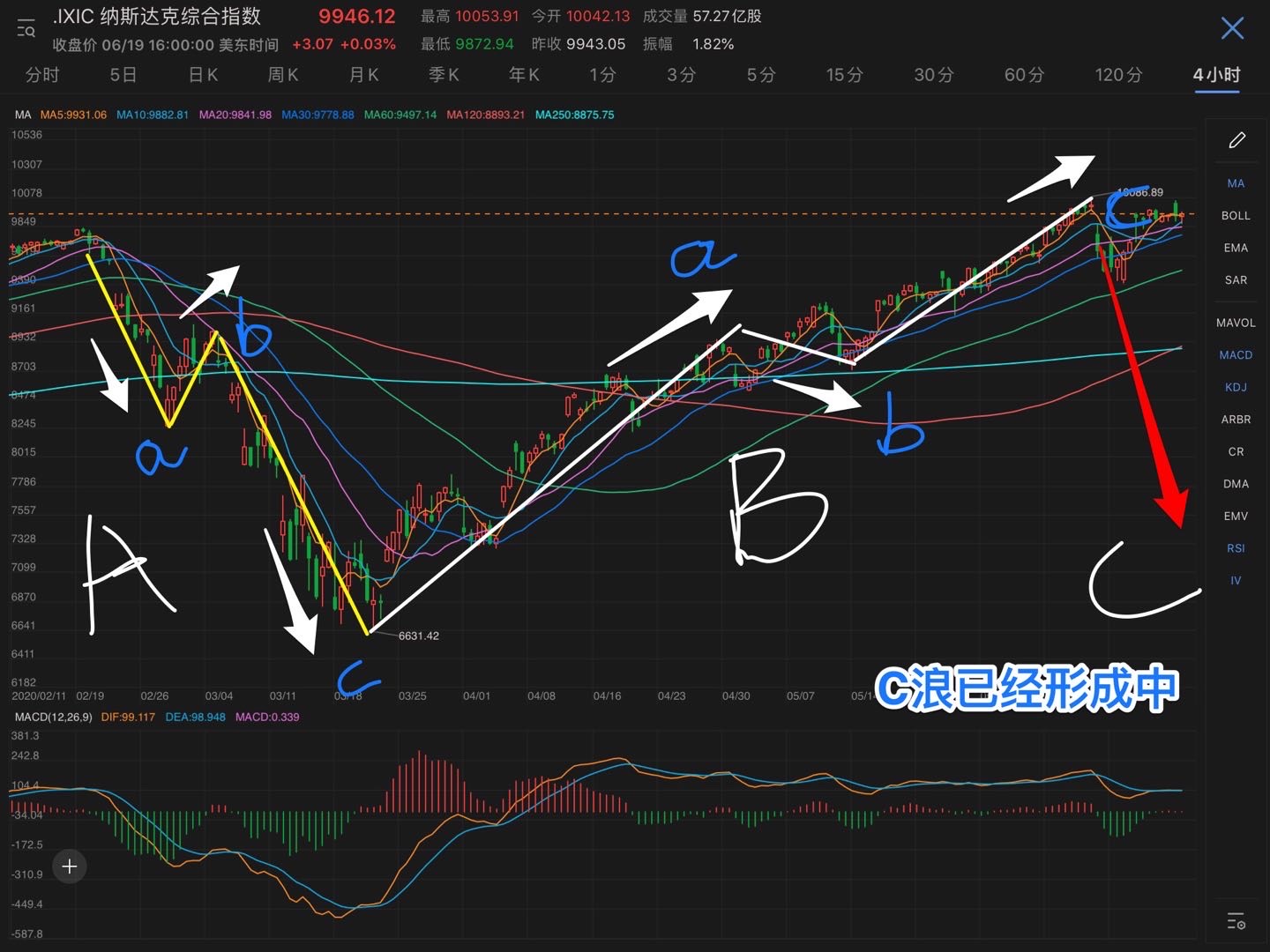

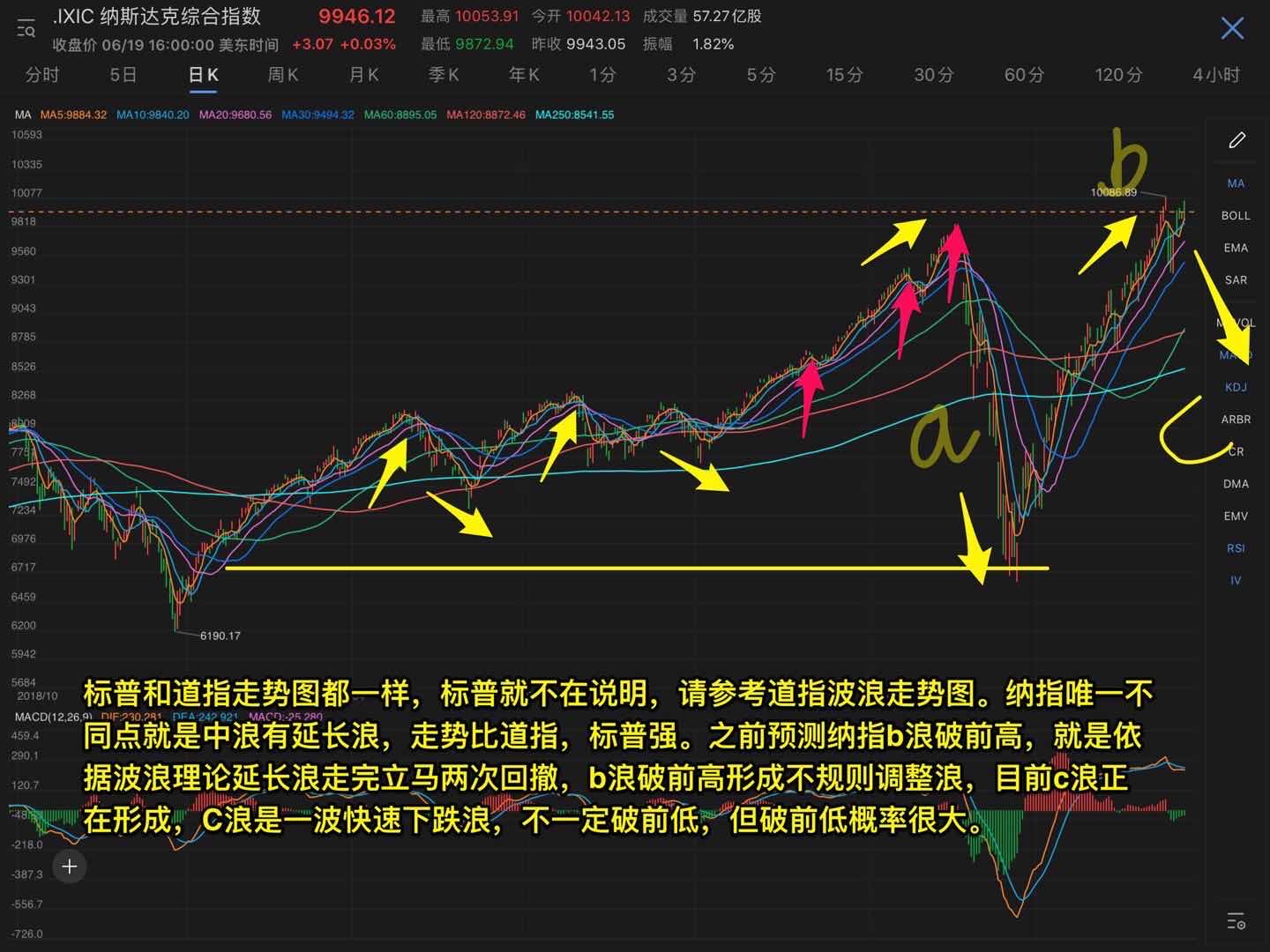

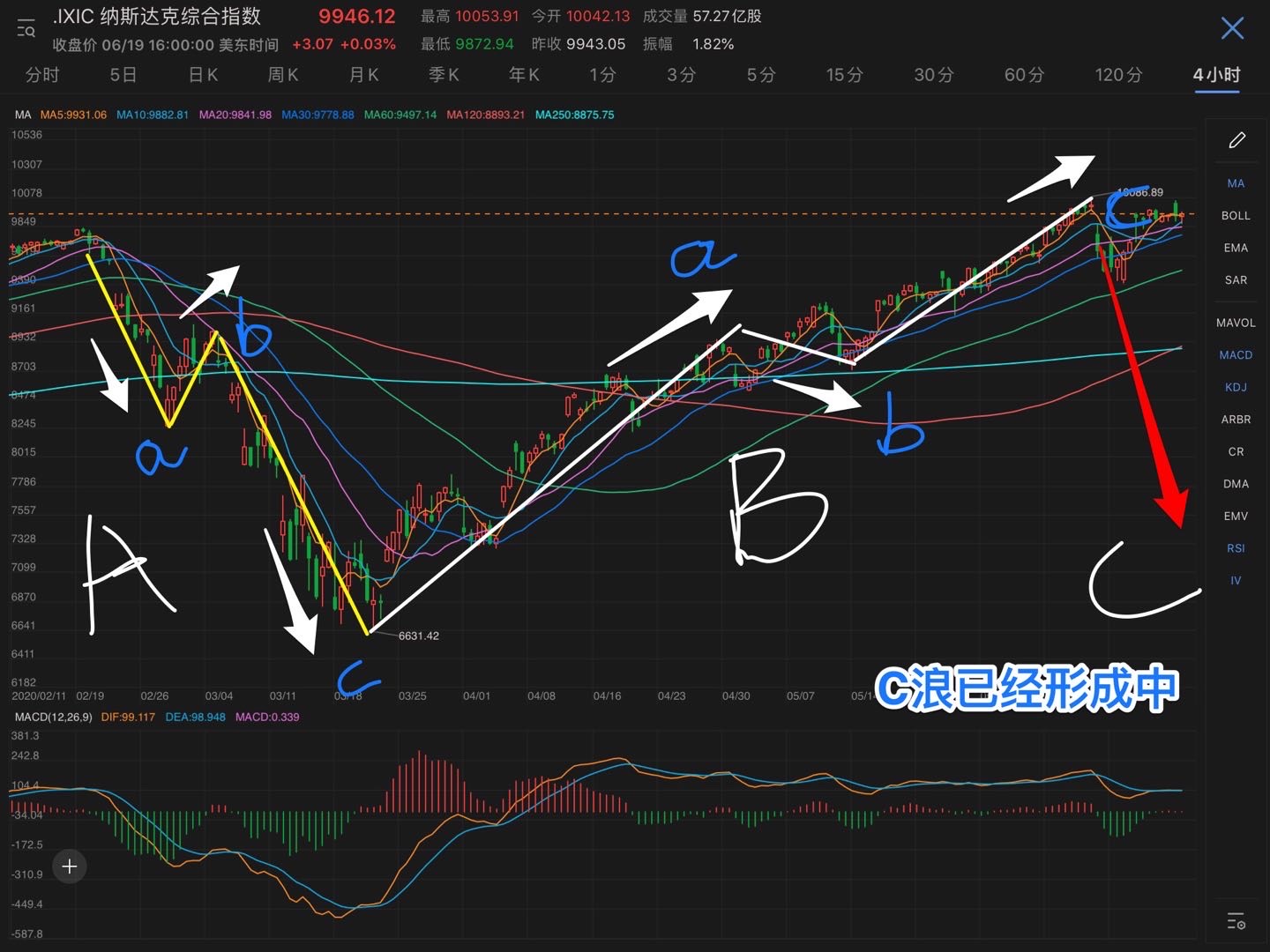

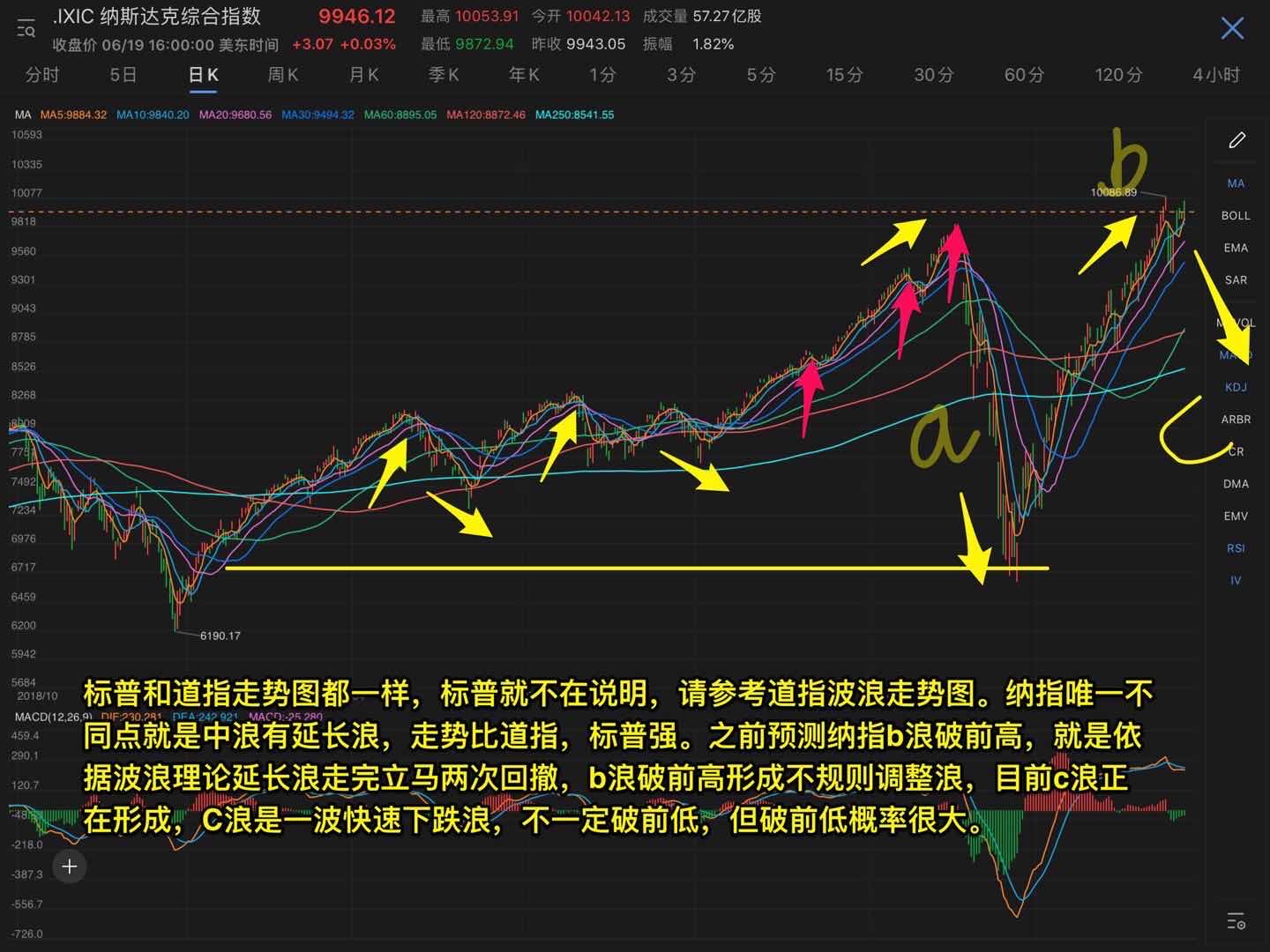

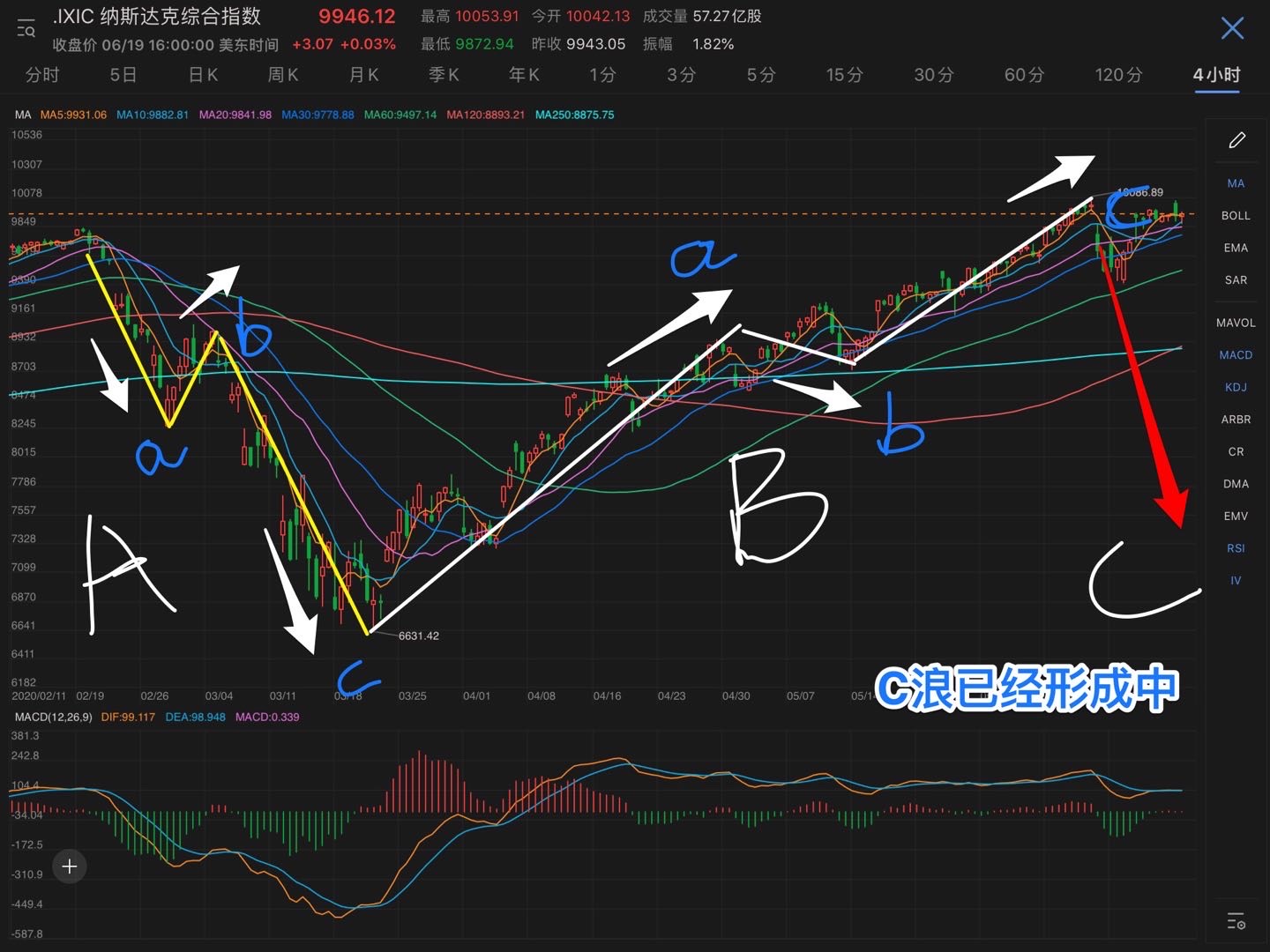

$NQ100指数主连(NQmain)$ $道琼斯(.DJI)$$纳斯达克(.IXIC)$ $道琼斯指数主连(YMmain)$ $标普500ETF(SPY)$ $SP500指数主连(ESmain)$ 这里是以波浪理论为基础解析大盘,不代表本人实际操作,具体操作还要参考均线系统,布林带指标,成交量,量价背弛,macd等一些技术指标为参考综合解析。。。。。。。。标普还有道指的月线,周线的走势图都差不多。就不另重复。纳指唯一不同的就是后面这段走势走的比较强,发展成延长浪走势。所以后面的b浪回撤会破前高。道指和标普估计年内不会再有新高了。后续会以缠论来解析大盘。炒股是个讲究综合性的技术活,靠单一理论在股市走会摔得体无完肤。请无脑黑们不要为了黑而黑。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

The theory of entanglement is a relatively scientific theory. Learning the theory well can grasp the highest point and the lowest point. There is also Gann's theory, but Gann's theory is a bit too metaphysical. However, after learning, you can roughly estimate the date and specific point. There is also chaos theory, which emphasizes the use of the right brain to speculate in stocks, that is, intuition to speculate in stocks. However, there is a saying that it is better to believe in books than to have no books. The most important thing in the stock market is to find a suitable trading strategy. No matter how good the technology is, it is useless not to earn money. Again, investment should be cautious and not mindless.