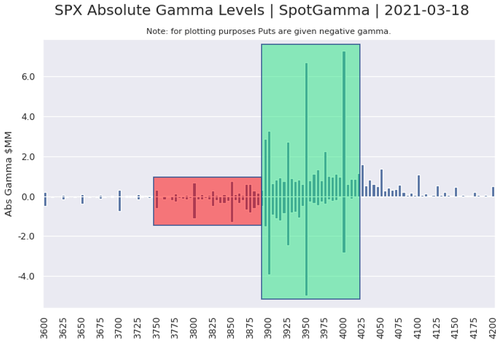

Today's quad-witching options expirations are likely to remove even more potential stabilizing flows from US equity markets as roughly25% of S&P gamma rolls off, with 40% of QQQ and 50% of single stocks. AsSpotGamma reminds us, the bulk of SPX gamma expires at 9:30AM EST, but that position is heavily outsized by SPY/QQQ which expires at the 4pm EST close. This gamma unclench and delta de-risk lower couldaccelerate any downside moves in the markets.

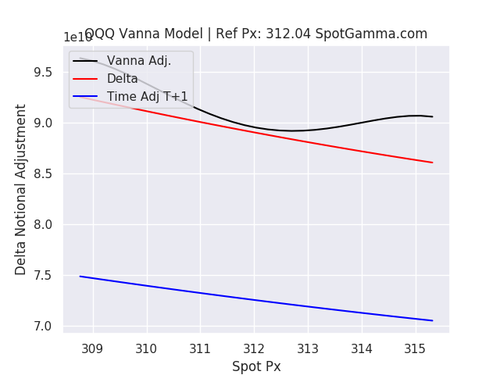

Into Monday these tech puts could provide a decent dealer short hedge (and therefore market tailwind) and reduce QQQ volatility next week. The lower QQQ closes the larger the dealer short will be that is tied to todays close. Therefore a lower close provides more “bounce fuel” into the start of next week.

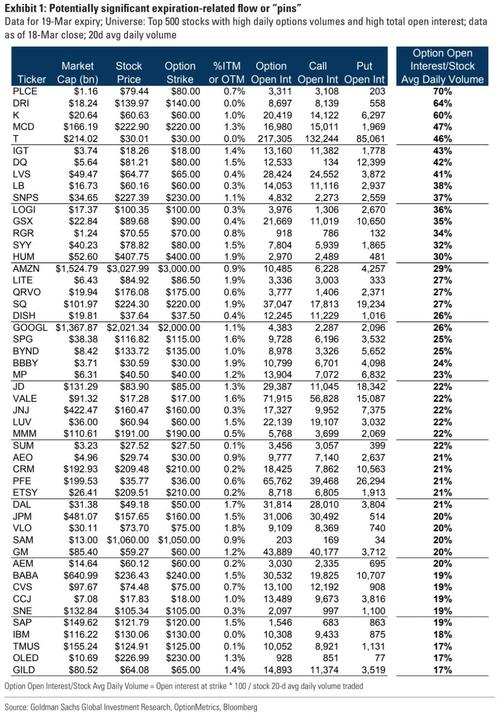

Also brace for higher single stock volatility today due to the large amount of single stock options expiring today. As Goldman notes,$655bn of options set to expire today, a record for non-January expiries and the third largest overall.Today’s expiry could be important for stocks with large open interest in at-the-money (ATM) options; market makers delta-hedging their unusually large options portfolios will be active.

Here are the stocks where option activity could have big impact