Microsoft recently hit new all-time highs and eclipsed the $2 trillion valuation mark. Where can it go from here?

Microsoft (MSFT) -Get Report topped a $2 trillion market cap on Tuesday, joining Apple (AAPL) -Get Report as the other U.S. company to hold such a value.

Even though it’s trading better lately, Apple has been consolidating for the better part ofthree calendar quarters now, while Microsoft has slowly but surely continued to grind to new highs.

That’s been a divide in FAANG over the last six months or so.

Some FAANG components have been trading well, hitting new all-time highs in the process. On the flip side, others, like Apple and Amazon (AMZN) -Get Report havebeen biding their time.

While Microsoft may not be included in FAANG, it might as well be given its size. The question now: Where does it go from here?

After hitting its $2 trillion market cap, Microsoft received aprice target boost to $325from Wedbush analysts.

The company has its Windows event coming up on Thursday and earnings in about a month. Those may be potential catalysts. With that, let’s look at the charts.

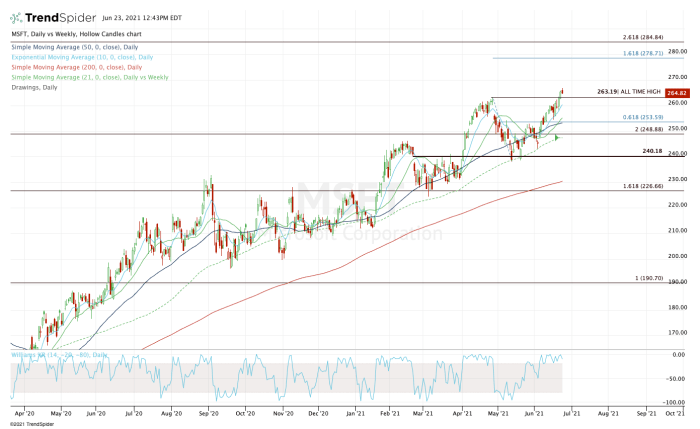

Daily chart of Microsoft stock. Chart courtesy of TrendSpider.com

I love the way Microsoft has been trading. All year long, we’ve seen these big rallies gently top out, then give us a sharp yet mild correction into support.

Those support levels have varied throughout 2021, but have generally been a combination of the 50-day and 21-week moving averages.

Most recently in May and June, the 21-week moving average was strong support, generating significant rebounds on three different occasions. The last bounce was enough to propel Microsoft to new all-time highs.

That’s after the stock cleared $263.19. From here, I would love to see Microsoft find support between $260 and $263.20, as well as from the 10-day moving average. If it does find these areas as support, dips to these measures could be short-term buying opportunities.

A break of these measures could put the 21-day moving average in play, followed by the 50-day.

Perhaps the company’s Windows event won’t be enough of a catalyst (given the leaks), but we could get a pre-earnings rally up to more news highs. For longer-term targets, I have my eye on the $278 to $285 range, which is where several key extensions come into play.